Kotak Assured Savings Plan

A Non-Participating Non-Linked Life Insurance Individual Savings Product

Take confident steps towards your financial goals. Life insurance policies are more than just modes of protection. They can also play an active role in helping you reach your financial goals. Kotak Assured Savings Plan enables you to accumulate wealth and strengthens your finances for the future. It not only offers you affordable protection but also helps accumulate enough wealth to help achieve your financial goals through guaranteed@ benefits.

How it works

-

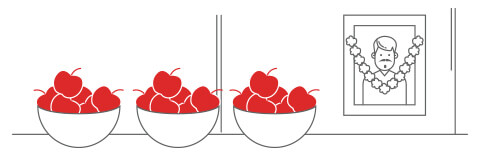

Mr. Shetty 35-year-old family man who buys Kotak Assured Savings Plan, he chooses a premium payment term of 10 years for a policy term of 15 years. He pays an annual premium of Rs. 1,00,000*

-

He determines the Basic Sum Assured as per Premium, Policy Term, Premium Payment Term and his age.

-

Premium payment term expires and the policy continues till maturity.

-

At maturity, Mr. Shetty receives Guaranteed@ Maturity Benefit of Rs. 16,39,661 which is Sum of Basic Sum Assured of Rs. 9,08,051 + Accrued Guaranteed@ Yearly Additions of Rs. 5,50,000 + Guaranteed@ Loyalty Addition of Rs. 1,81,610

-

Mr. Shetty nominates his wife. In case of an unfortunate event of Mr. Shetty’s death during the term of the plan, she would receive death benefit higher of (a) or (b) :

a) Basic Death Benefit, Plus Guaranteed Yearly Additions accrued as on the date of death.

b) 105% of all premium paid (excluding extra premium, if any) till the date of death.

* The above Premium figures are exclusive of Goods and Services Tax and Cess. Goods and Services Tax and Cess thereon, shall be charged as per the prevalent tax laws over and above the said premiums.

Key Features

-

Guaranteed@ Maturity Benefit: Payable at maturity

Get Basic Sum Assured PLUS Accrued Guaranteed@ Yearly Additions PLUS Guaranteed@ Loyalty Addition

-

Get increasing life cover

Enjoy Guaranteed@ Yearly Additions added every time you pay the premium - payable at maturity or death, whichever is earlier.

-

Enjoy higher benefits with longer premium commitment

Get increased Guaranteed@ Yearly Additions and Guaranteed@ Loyalty Addition with increase in Premium Payment Term (PPT)

-

Get more value for money

Through high premium benefit leading to higher Basic Sum Assured

-

Enhanced protection

Through a wide range of Riders

Note: Riders shall not be available for policies purchased through POS distribution channel. -

Enjoy tax benefit

as per applicable tax laws

Eligibility

-

Eligibility For All Channels (except POS) For POS Channel Entry Age (as on last birthday) Min : 3 Year

Max: 60 YearsMin : 3 Years

Max: 65 Years less Policy TermMaturity Age (as on last birthday) Min : 18 Years

Max: 75 YearsMin : 18 Years

Max: 65 Years -

Policy Term & Premium Payment Term (PPT) PPT 5 Pay 6 Pay 7 Pay 10 Pay Policy Term 10 | 15 years 12 | 18 years 14 | 20 years 15 | 20 years -

Determined on the basis of minimum premium amount, entry age, policy term and PPT

Example: For Rs. 20,000 annual premium, following shall be the Basic Sum Assured for entry ages 3 & 50 years:

Minimum Basic Sum Assured Age Policy Term Premium Payment Term Basic Sum Assured (Rs.) 3 years 15 years 5 years 1,45,758 3 years 20 years 10 years 2,72,660 50 years 15 years 10 years 1,59,222 Basic Sum Assured is calculated considering channel as Individual Agents

For details, please refer to the premium calculator on the website.

-

Eligibility For All Channels (except POS) For POS Channel Maximum Basic Sum Assured Determined on the basis of minimum premium amount, entry age, policy term and PPT subject to UW Rules Rs. 25,00,000 -

Eligibility For All Channels (except POS) For POS Channel Annualized Premium Min: Rs. 20,000 Max: No limit, subject to underwriting Min: Rs. 20,000 Max: Rs. 1,50,000 -

Premium Payment Mode Yearly, Half-yearly, Quarterly, Monthly -

Premium Payment Option Limited only -

Premium Modal Factor (% of annualized premium) Yearly - 100% , Half yearly - 51% , Quarterly - 26% , Monthly - 8.8%