Kotak Fortune Maximiser

A Participating Non-Linked Life Insurance Individual Savings Product

When it is about your dreams and aspirations, there shouldn’t be any compromise. To realize your dreams, you ensure your money is invested in a disciplined manner which gives higher return towards building a corpus to meet your important milestones.

Kotak Fortune Maximiser is A Participating Non-Linked Life Insurance Individual Savings Product,which can be customized as per your requirement to help you achieve your life goals through multiple plan, payout & rider options. Your dreams are important and deserves to be fulfilled, therefore, life mein sirf #BadaSocho.

How it works

-

Mr. Verma 35-year-old, decides to invest in the plan. He chooses Life Goal Maximiser and Bonus Option as Paid-Up Addition.

-

He pays premium of Rs. 1,00,000^ p.a. for 12 years with policy term of 50 years. The Sum Assured is Rs. 11,09,647.

-

From the end of the first policy year, Paid-Up Addition gets accumulated till end of the Policy Term.

-

He also has an option to withdraw Cash Value of accrued Paid-Up Additions during the policy term to meet his important life goals.

-

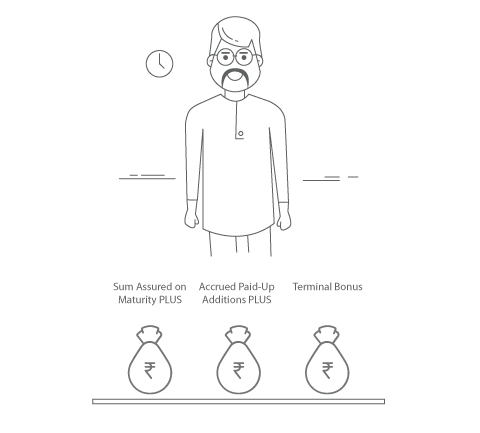

On maturity, Mr. Verma will receive @8%# Rs.15,705,408 & @4%# Rs. 3,315,126.

-

In case of death, his nominee will receive the death benefit as per the policy condition.

Key Features

-

Multiple Plan Options

Flexibility to choose from 3 Plan Options to fulfil your goal: - Life Goal Maximiser - Bright Future Maximiser - Golden Years Maximiser

-

Multiple Bonus Payout Options

Flexibility to choose from 3 Bonus Payout Options as per your convenience: - Cash Bonus (Immediate Payout) - Cash Bonus (Deferred Payout)* - Paid-Up Additions

-

Long Life Cover

Secure your life & provide financial protection to your loved ones till 85 years.

-

Multiple Riders

Comprehensive coverage for yourself & loved ones through 6 Riders.

-

Enhanced Sum Assured for Female Life

Avail High Sum Assured with the same premium for Female Life.

-

Spouse Cover

Flexibility to secure your spouse’s life under the same plan.

Eligibility

-

Entry Age of Life Insured (as on last birthday) Min: 0 years (90 days)

In case Spouse Cover is availed:

Min: 18 years (Primary Life Insured & Spouse)Max: 50 years – 6 & 15 pay

55 years – 8 / 10 & 12 pay

In case Spouse Cover is availed:

Max: 60 years (Spouse)Maturity Age of Life Insured (as on last birthday) 85 years for Primary Life Insured

In case Spouse Cover is availed: 85 years or Age at Maturity whichever is lower (for Spouse). -

Policy Term

85 years less Entry Age of Life Insured (Primary Life Insured in case Spouse Cover option is chosen)

-

Basic Sum Assured

Basic Sum Assured shall depend upon the Age, Gender, Policy Term, Premium Payment Term, Premium Amount & Bonus Payout Options chosen.

Basic Sum Assured is the Guaranteed Maturity Benefit to be payable on death or maturity.

Sum Assured on Death for Spouse shall be 50% - 100% of the Basic Sum Assured applicable for Primary Life Insured.

-

Premium Levels (Annual)

Min: 6 & 8 Pay: Rs. 48,000 | 10 /12 & 15 Pay: Rs. 36,000

Max: No Limits, subject to Board Approved Underwriting Policy

Premium Payment Term

6 /8 / 10 / 12 & 15 years

Premium Payment Mode

Yearly, Half yearly, Quarterly and Monthly

Premium Modal Factor

Premium Modal Factor Yearly – 100% | Half yearly – 51% | Quarterly – 26% | Monthly – 8.8%