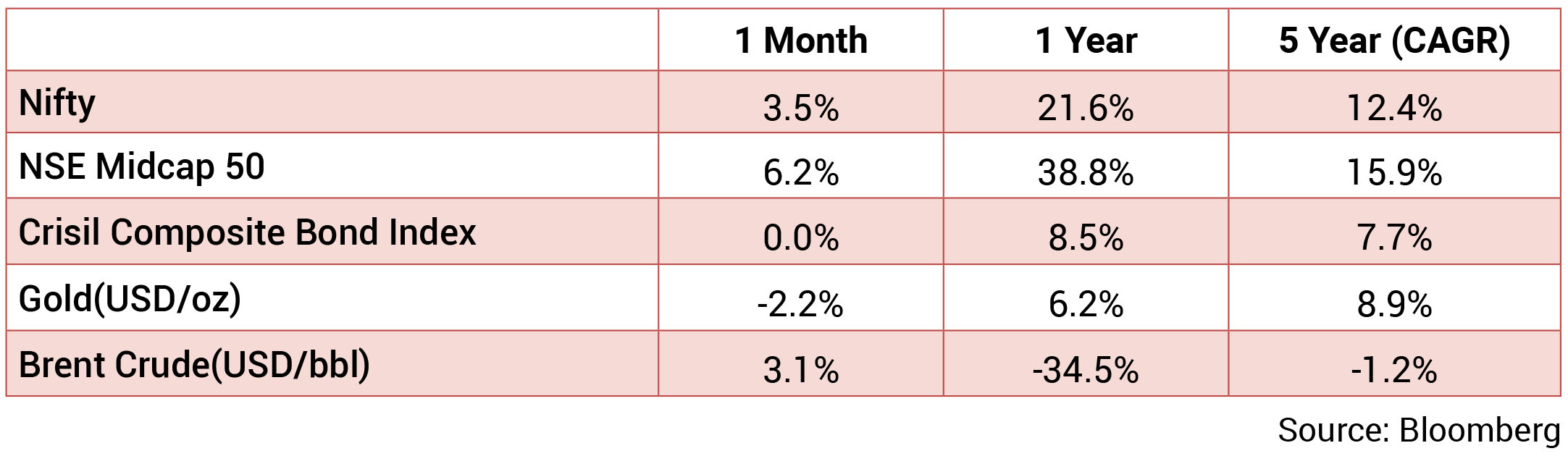

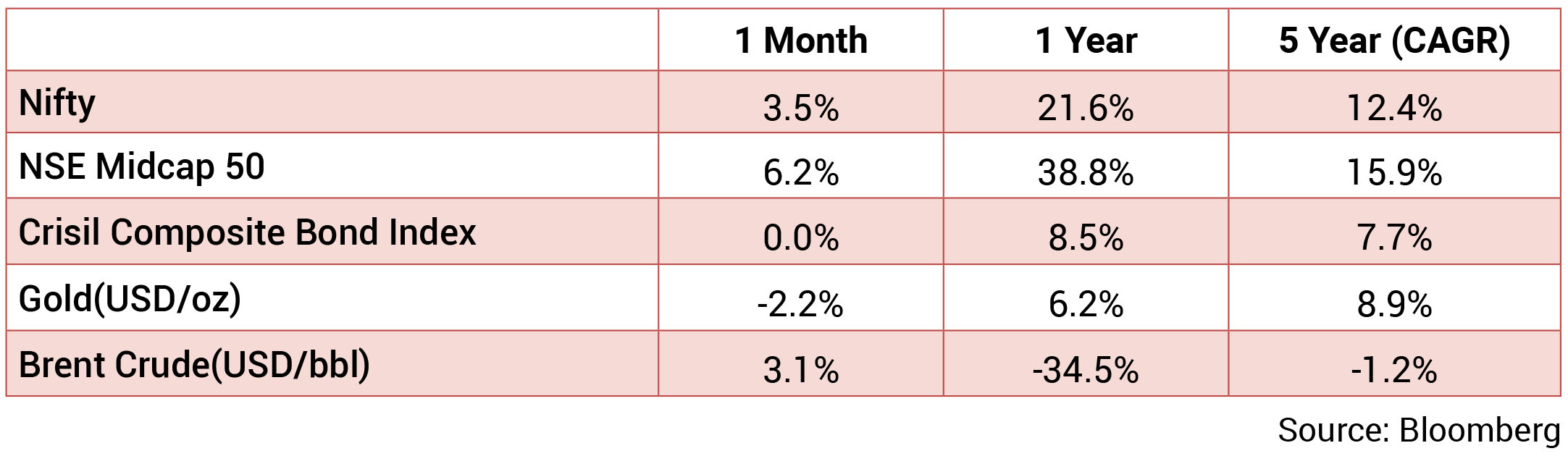

Market was up 3.5% primarily driven by strong institutional flows, favorable macros and robust earnings

growth. Financials, Discretionary, and Industrials have been the frontrunner sectors. The INR saw

slight appreciation against USD and averaged at 82.23 with a monthly best and worst of 81.9 and 82.7

respectively in June. 10yr benchmark yields traded in the range of 6.98%-7.12% and eventually ended the

month 13bps higher sequentially at 7.12%. The 10y benchmark averaged 7.03% in June.

As widely expected, Fed opted for a pause in the June meeting after a cumulative 500bps hike seen over the past year. However, hawkishness persisted as Fed’s projection of fed funds rate indicated another 50bps of additional tightening. Resilient economic activity led to revision in GDP growth to 1% in 2023 from 0.4% projected earlier. Fed chair also hinted that nearly all members expected to raise interest rates further in the year. While inflation in US has further moderated to 4% in May 2023 from as high as 9.1% in June 2022 due to the monetary policy actions, job market remained relatively robust. US economy added 339k jobs according to non-farm payrolls data in May 2023 vs. 294k jobs in April 2023. EU inflation rate also continued to ease; at 5.5% in June 2023. However, ECB opted to hike rates by 25bps and made clear that there was no decision yet on pause and terminal rate. Bank of Canada, Reserve Bank of Australia and Bank of England also chose to hike interest rates. Fed, ECB and BoE also maintained their hawkish stance at the recent ECB forum panel discussion and continued to expect rate hikes as long as inflation moderated to their target.

Meanwhile, RBI left policy rates unchanged (supported by all MPC members) on the expected lines and left the stance unchanged (dissented by 1 MPC members). Prof Jayanth Varma who dissented against the stance pointed that policy is dangerously close to levels that can inflict significant damage to economy. He also added that current level of repo rate is high enough to keep inflation below the tolerance band and also to glide towards the target. All other members remained fairly hawkish due to uncertainty in inflation outlook (concerns also on weak monsoon and El-nino impact on food inflation). RBI further lowered (marginally) FY24 inflation projection to 5.1% (-10bps, -20bps since start of FY24) and retained GDP growth projection for FY24 at 6.5%. CPI fell to a two year low of 4.25% in May 2023 supported by high base and controlled price rise. Sequential rise in inflation stood unchanged at 51bps as in the last month. Core-CPI remained sticky at 5.2% yoy with ease in sequential price rise to 40bps vs. 60bps in the previous month. High frequency indicators suggest resilience in domestic demand with GST collections improving from the previous month and 12% yoy growth while both manufacturing and services PMI continue strong in the expansionary zone. Government account for May saw fiscal deficit tamed at 12% of BE with strong capex at 17% of BE. Significant support came from RBI dividend that helped with controlling the deficit while core capex sectors like railways and road ministry witnessed strong spending.

Brent crude prices fell from an average of USD 76/bbl in May to USD 75/bbl in June as it ranged between USD 72-USD 77/bbl. Weak manufacturing activity in major economies dented outlook for energy demand along with expectation of further rate hike by major global central bank. Gold price saw dip as it ended at USD 1,929/oz in June from USD 1,964/oz in May. Steel price trended lower as HRC prices ended the month at USD 881/Tn compared to USD 934/Tn in May.

As widely expected, Fed opted for a pause in the June meeting after a cumulative 500bps hike seen over the past year. However, hawkishness persisted as Fed’s projection of fed funds rate indicated another 50bps of additional tightening. Resilient economic activity led to revision in GDP growth to 1% in 2023 from 0.4% projected earlier. Fed chair also hinted that nearly all members expected to raise interest rates further in the year. While inflation in US has further moderated to 4% in May 2023 from as high as 9.1% in June 2022 due to the monetary policy actions, job market remained relatively robust. US economy added 339k jobs according to non-farm payrolls data in May 2023 vs. 294k jobs in April 2023. EU inflation rate also continued to ease; at 5.5% in June 2023. However, ECB opted to hike rates by 25bps and made clear that there was no decision yet on pause and terminal rate. Bank of Canada, Reserve Bank of Australia and Bank of England also chose to hike interest rates. Fed, ECB and BoE also maintained their hawkish stance at the recent ECB forum panel discussion and continued to expect rate hikes as long as inflation moderated to their target.

Meanwhile, RBI left policy rates unchanged (supported by all MPC members) on the expected lines and left the stance unchanged (dissented by 1 MPC members). Prof Jayanth Varma who dissented against the stance pointed that policy is dangerously close to levels that can inflict significant damage to economy. He also added that current level of repo rate is high enough to keep inflation below the tolerance band and also to glide towards the target. All other members remained fairly hawkish due to uncertainty in inflation outlook (concerns also on weak monsoon and El-nino impact on food inflation). RBI further lowered (marginally) FY24 inflation projection to 5.1% (-10bps, -20bps since start of FY24) and retained GDP growth projection for FY24 at 6.5%. CPI fell to a two year low of 4.25% in May 2023 supported by high base and controlled price rise. Sequential rise in inflation stood unchanged at 51bps as in the last month. Core-CPI remained sticky at 5.2% yoy with ease in sequential price rise to 40bps vs. 60bps in the previous month. High frequency indicators suggest resilience in domestic demand with GST collections improving from the previous month and 12% yoy growth while both manufacturing and services PMI continue strong in the expansionary zone. Government account for May saw fiscal deficit tamed at 12% of BE with strong capex at 17% of BE. Significant support came from RBI dividend that helped with controlling the deficit while core capex sectors like railways and road ministry witnessed strong spending.

Brent crude prices fell from an average of USD 76/bbl in May to USD 75/bbl in June as it ranged between USD 72-USD 77/bbl. Weak manufacturing activity in major economies dented outlook for energy demand along with expectation of further rate hike by major global central bank. Gold price saw dip as it ended at USD 1,929/oz in June from USD 1,964/oz in May. Steel price trended lower as HRC prices ended the month at USD 881/Tn compared to USD 934/Tn in May.

Source: Bloomberg

Source: Bloomberg

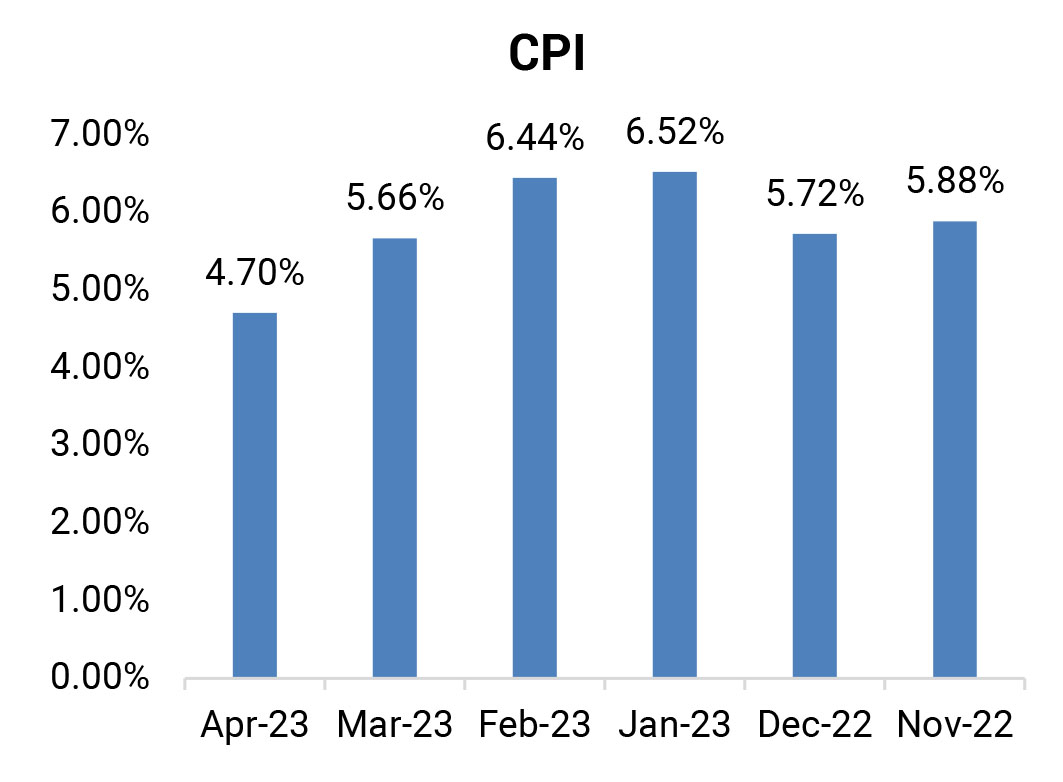

CPI: CPI inflation in May moderated to 4.25% (April: 4.7%) led by falling food inflation and favorable

base effects. Food and beverages inflation fell mainly due to sequential contraction in prices of oils and

fats, and fruits. However, prices of vegetables, meat and fish, spices and eggs continued to increase

sequentially. Core inflation (CPI, excluding food and fuel) in May remained sticky at 5.15%, with rural and

urban core inflation easing by 25 bps and 6 bps to 5.25% and 4.92%, respectively. Specifically, personal

care and effects continued to push up core inflation led mainly by gold prices.

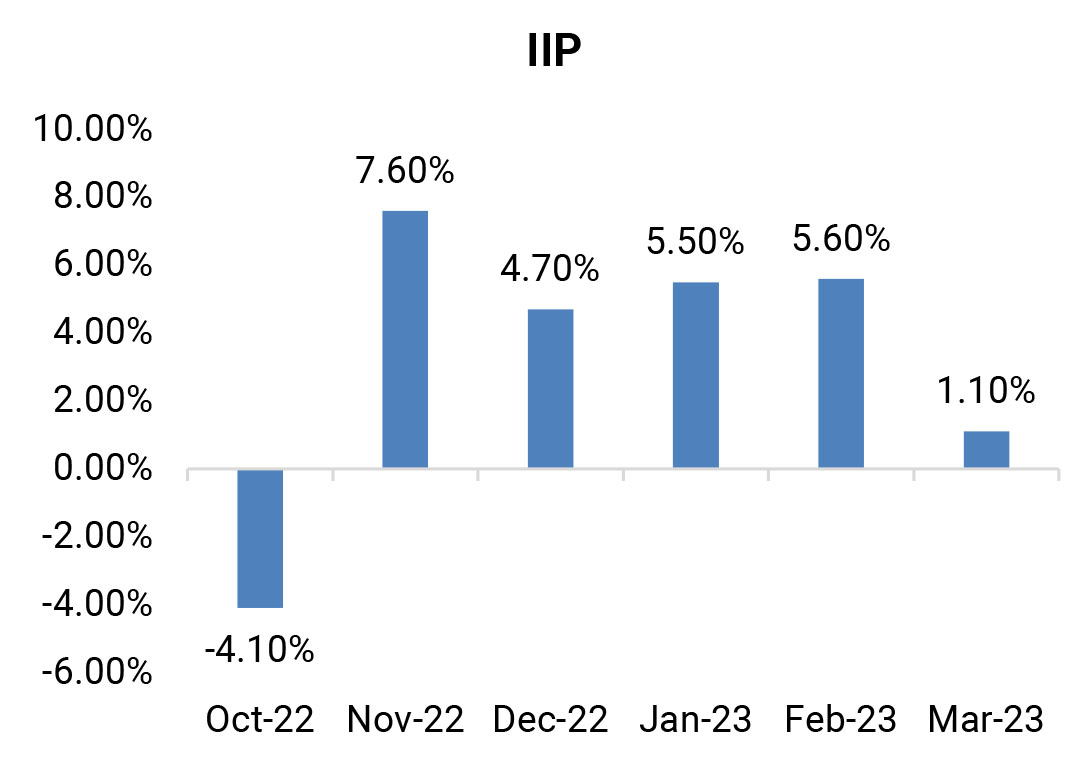

IIP: April IIP growth at 4.2% (March 1.7%) surprised on the upside led by a favorable base effect and pickup in manufacturing activity. Sequentially, IIP contracted by 7.4% (March: +8.9% mom), which was in line with the seasonal trend. Manufacturing activity grew by 4.9% (March: 1.2%) followed by mining activity at 5.1% (6.8%) while electricity production contracted by 1.1% ((-)1.6%). As per the use-based classification, all categories registered positive growths barring the consumer durables segment (which has contracted for the fifth consecutive month).

CAD: CAD in Q4FY23 narrowed to USD 1.4bn (0.2% of GDP) from USD 16.8bn in Q3FY23. This was led by goods trade deficit narrowing to USD 53bn (Q3FY23: (-)USD 71bn) with exports at USD 116bn (USD 106bn) and imports at USD 168bn (USD 177bn) due to lower non-oil imports. Services trade surplus was steady at USD 39bn aided by software exports and professional and management consulting exports. Capital account surplus in Q4FY23 moderated sharply to USD 7bn mainly due to banking capital outflows of USD 4bn (Q3FY23: +USD 14bn) and FPI outflows of USD 2bn (+USD 5bn). FDI inflows increased to USD 6bn (Q3FY23: USD 2bn) while ECB flows increased to USD 2bn ((-)USD 2bn). Due to a weaker capital account, BOP surplus moderated to USD 5.6bn (Q3FY23: USD 11.1bn).

MPC: The RBI MPC voted unanimously to hold the repo rate at 6.5%. It also voted to remain focused on the withdrawal of accommodation, with a 5-1 majority (Dr Varma continued to express reservations). The decision likely reflects the MPC’s continuing concerns about inflation amid uncertainties from monsoons while retaining its optimism on the growth front (though risks to the growth outlook are more from the global side). The MPC revised down its FY2024 inflation estimate marginally to 5.1% (from 5.2%). The MPC noted that the inflation trajectory is likely to be shaped by food price dynamics. The estimates were based on corrections in wheat prices, assumptions of a normal monsoon and easing crude oil prices. The MPC retained its FY2024 real GDP growth projection at 6.5% with some marginal revisions to the quarterly estimates.

IIP: April IIP growth at 4.2% (March 1.7%) surprised on the upside led by a favorable base effect and pickup in manufacturing activity. Sequentially, IIP contracted by 7.4% (March: +8.9% mom), which was in line with the seasonal trend. Manufacturing activity grew by 4.9% (March: 1.2%) followed by mining activity at 5.1% (6.8%) while electricity production contracted by 1.1% ((-)1.6%). As per the use-based classification, all categories registered positive growths barring the consumer durables segment (which has contracted for the fifth consecutive month).

CAD: CAD in Q4FY23 narrowed to USD 1.4bn (0.2% of GDP) from USD 16.8bn in Q3FY23. This was led by goods trade deficit narrowing to USD 53bn (Q3FY23: (-)USD 71bn) with exports at USD 116bn (USD 106bn) and imports at USD 168bn (USD 177bn) due to lower non-oil imports. Services trade surplus was steady at USD 39bn aided by software exports and professional and management consulting exports. Capital account surplus in Q4FY23 moderated sharply to USD 7bn mainly due to banking capital outflows of USD 4bn (Q3FY23: +USD 14bn) and FPI outflows of USD 2bn (+USD 5bn). FDI inflows increased to USD 6bn (Q3FY23: USD 2bn) while ECB flows increased to USD 2bn ((-)USD 2bn). Due to a weaker capital account, BOP surplus moderated to USD 5.6bn (Q3FY23: USD 11.1bn).

MPC: The RBI MPC voted unanimously to hold the repo rate at 6.5%. It also voted to remain focused on the withdrawal of accommodation, with a 5-1 majority (Dr Varma continued to express reservations). The decision likely reflects the MPC’s continuing concerns about inflation amid uncertainties from monsoons while retaining its optimism on the growth front (though risks to the growth outlook are more from the global side). The MPC revised down its FY2024 inflation estimate marginally to 5.1% (from 5.2%). The MPC noted that the inflation trajectory is likely to be shaped by food price dynamics. The estimates were based on corrections in wheat prices, assumptions of a normal monsoon and easing crude oil prices. The MPC retained its FY2024 real GDP growth projection at 6.5% with some marginal revisions to the quarterly estimates.

Deal flow spiked in June with reported 28 block deals worth USD 2.44bn executed. Key deals included

Shriram Finance (USD 588mn) and HDFC AMC (USD 497mn).

Other than reported block deals, there were several other large deals including Kotak Mahindra Bank (USD 743mn), Adani Enterprises (USD 512mn), Adani Green (USD 395mn)

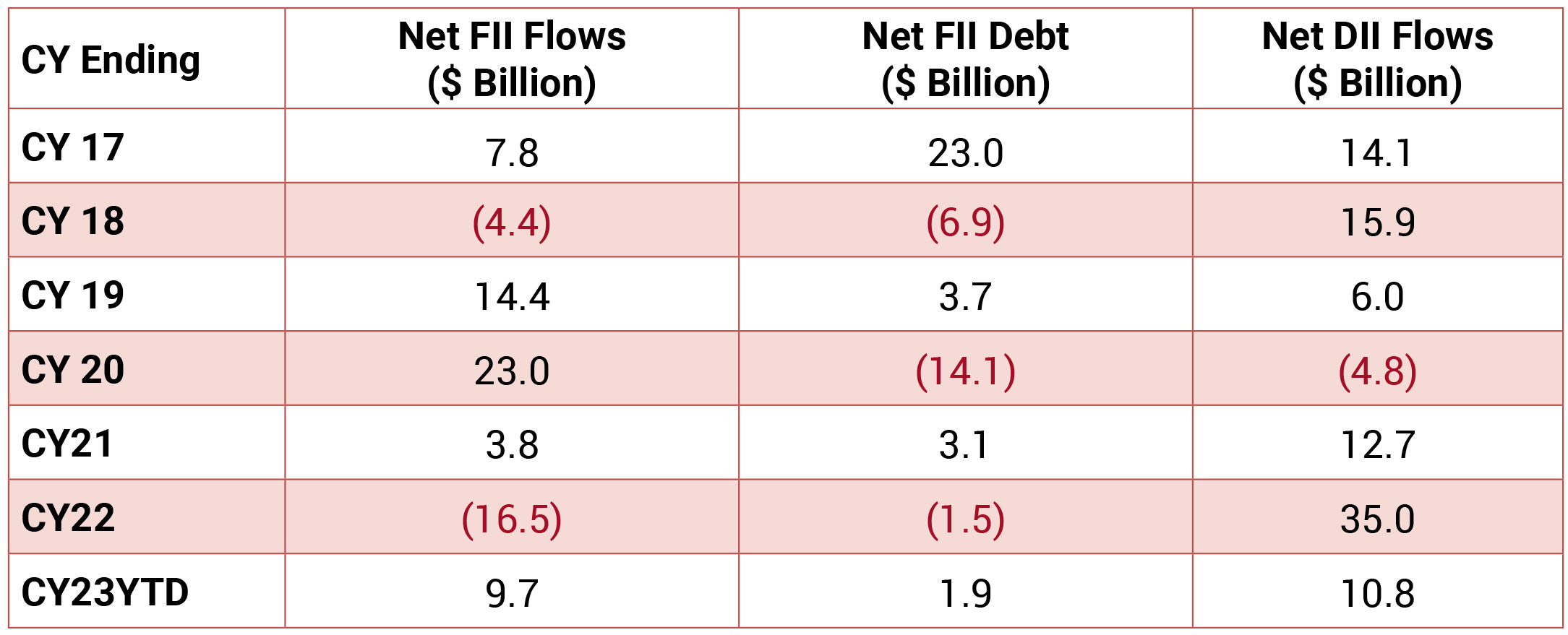

FIIs were net buyers in the month of June 2023 to the tune of USD 6.7bn and DIIs bought to the tune of USD 540mn.

Other than reported block deals, there were several other large deals including Kotak Mahindra Bank (USD 743mn), Adani Enterprises (USD 512mn), Adani Green (USD 395mn)

FIIs were net buyers in the month of June 2023 to the tune of USD 6.7bn and DIIs bought to the tune of USD 540mn.