June saw a reversal of some of the rally in India rates in the previous couple of months. A strong nonfarm payroll number to start the month followed by hawkish hikes by both Canada and Australia caused a reversal in global rates which sold off. The RBI policy that followed immediately after also seemed to surprise the market on the hawkish side with a consensus change in stance not delivered, causing the momentum to decisively shift. Going into the MPC, traders’ expectations seemed to hover around a change in stance which the MPC did not deliver. Separately, the Governor also suggested that a cut would not be on the table unless a consistent 4% CPI Inflation is observed.

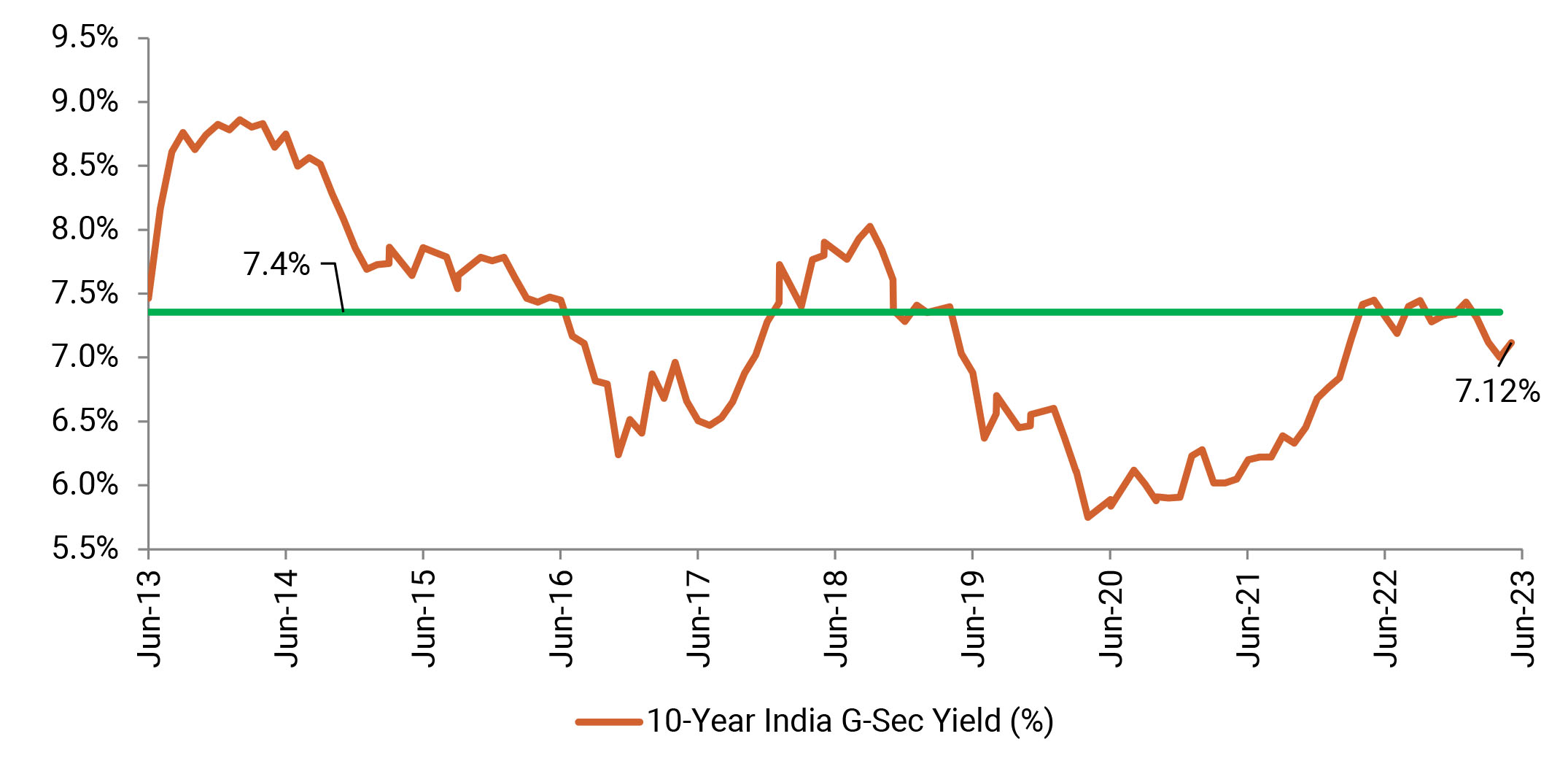

After a low of 6.96% on the 10y bond during May, the selloff in US rates coupled with weak auction demand sparked a selloff, especially in the last couple of sessions, taking the 10y back to over 7.10%