In local currency terms, Nifty was up 7.9%, while the NSE500 was up 8.0%. The Midcap and Small cap segments continued to rally in December, with the Midcap index rising by 7.6%, while Small caps rose 6.9%. Metals was top performer with a gain of 13.7%,

while Pharma emerged as the principal underperformer for the month, still rising by 3.7%. The INR saw slight appreciation (0.2% MoM) against USD and averaged 83.3 in Dec-23, with a monthly best and worst of

83 and 83.4, respectively. The 10yr benchmark yields traded in the range of 7.16%-7.29% in Dec-23 and eventually ended the month 10.6bps lower sequentially at 7.17%. The 10y benchmark averaged 7.22% in December.

The US Fed finally moved away from its hawkish stance as it signaled 3 rate cuts in CY2024 with markets expecting the rate cut cycle to begin as early as Mar-24. US job market continued to remain tight as nonfarm payrolls increased to 199,000, which was higher than consensus while wages grew by 0.4% M-o-M. US CPI inflation declined to 3.1% YoY in Nov-23 (3.2% in oct-23), with core inflation remaining stable at 4.0% YoY (4.1% in Sep-23). EU inflation also declined to 2.4% in Nov-23 vs 2.9% in Oct-23, and with core inflation also falling to 3.6% from 4.2%. On expected lines, ECB too held its rates constant in Dec-23, unlike US Fed it is yet to signal rate cuts, but market has projected rate cuts to begin around the same time as US Fed’s. Dec’23 meet. China’s factory activity as represented by PMI has contracted for the 3rd month in a row suggesting need for further stimulus.

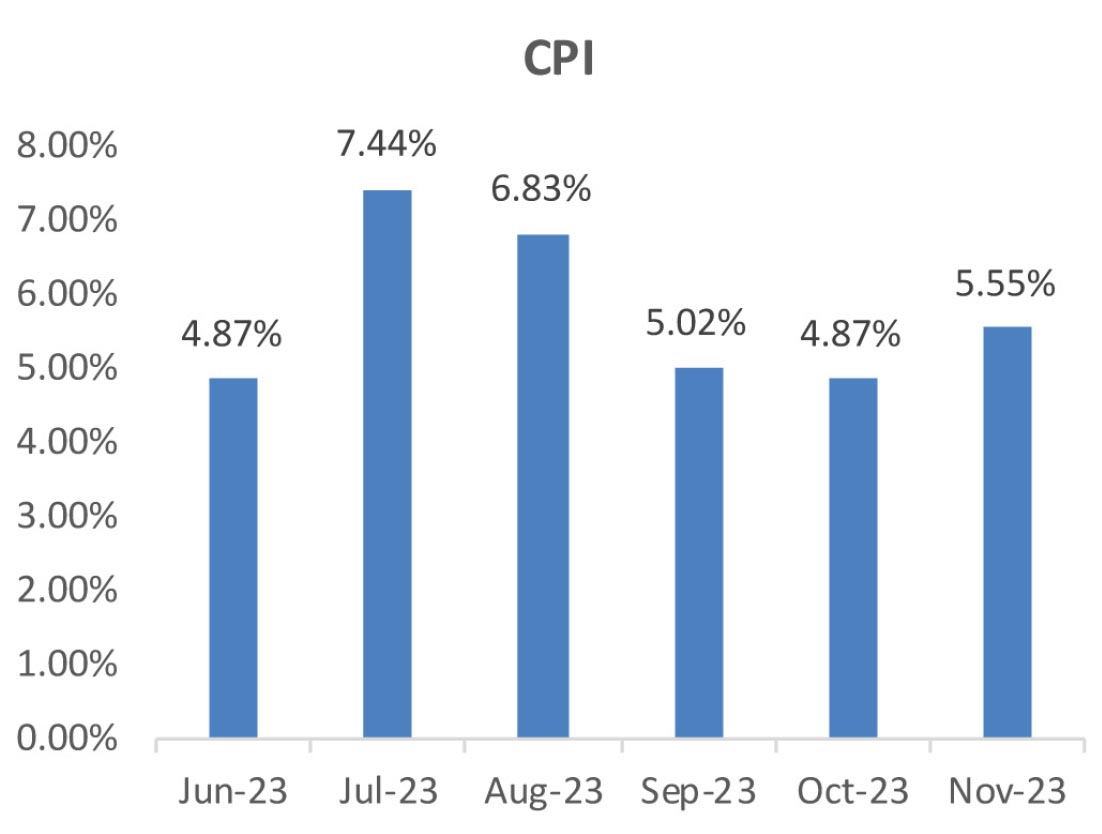

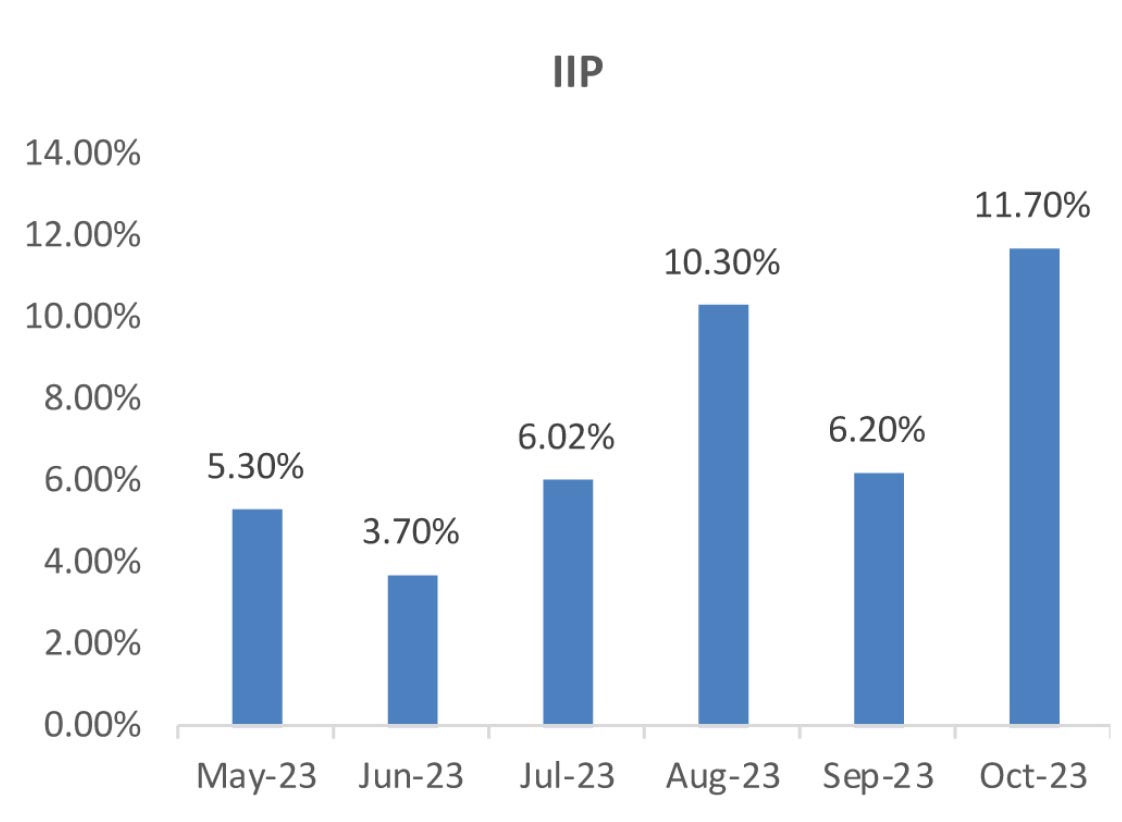

High frequency indicators suggests resilient economic activities in December. Festive season boost was visible as GST collections, retail spends and 2-W sales were impressive and drove industrial activity too as seen in the recent IIP print. On the policy front, MPC, on expected lines, held the policy rates constant. While it reiterated its objective of bringing the policy rate down to the targeted 4%, the policy address had a dovish tone as the MPC upgraded its growth projections. Festive season led cash requirements, government’s rising tax collections and RBI’s day-to-day money market operations continue to tighten liquidity conditions. November headline inflation increased to 5.55% vs 4.87% in October-23 on account of food inflation (0.9% M-o-M). Supply led issues continue to keep prices of major food items such as cereals, pulses and vegetables elevated. On the other hand, base effect and government’s LPG subsidy has significantly brought down fuel inflation while core inflation was recorded at lowest level since Sep-19. On the external front, Current account deficit was recorded at 1% of GDP in 2QFY24 (vs 1.1% in 1QFY24), the increase in trade deficit, outweighed by a rise in net services exports and foreign remittances. On the capital account front, Capital Account surplus moderated significantly to 1.2% of GDP (vs 4% in previous quarter). Major reason has been the moderation in foreign investments as both, FDI and FPI flow moderated. The fiscal situation of the Central government remains comfortable in 8MFY24, led by robust growth in tax collection, constrained revenue expenditure and healthy capital expenditure. The Centre’s fiscal deficit was at 50.7% of BE in 8MFY24 vs 58.9% of BE in 8MFY23, with capital expenditure recording growth of 31% YoY amounting to 58.5% of BE. Revenue expenditure grew 3.6% YoY in 8MFY24 as government has been able to contain fertilizer subsidy expenditure while it has been prudent with spending of several smaller ministries (~25 ministries have spent <50% of their budget). On the revenue front, there is a split between healthy growth for direct taxes (25% YoY) – which are expected to overshoot the FY24BE – and indirect taxes, which have only risen 5% YoY as lower imports continue to hurt customs and excise duty.

Brent crude prices declined by 5.7% to an average of USD77.3/bbl in Dec-23 from USD82.03/bbl in Nov- 23, and ranged between USD73.24-USD81.07/bbl in Dec-23. Continued benign demand conditions, and uncertainties related to OPEC+ agreeing upon further supply cuts led to crude oil prices moderating for the second consecutive month. Overall industrial commodity prices (Core commodity CRB Industrial Index) declined MoM by ~3.2% in Dec-23 vs a drop of 2.2% in Nov-23 due to weak demand for industrial metals as demand continues to remain tepid in major countries like China. Gold prices rose by 1.3% as of Dec-23 end vs Nov-23 end as it ended the month at USD 2,062.98/oz from USD 2,036.41/oz in Nov-23.

The US Fed finally moved away from its hawkish stance as it signaled 3 rate cuts in CY2024 with markets expecting the rate cut cycle to begin as early as Mar-24. US job market continued to remain tight as nonfarm payrolls increased to 199,000, which was higher than consensus while wages grew by 0.4% M-o-M. US CPI inflation declined to 3.1% YoY in Nov-23 (3.2% in oct-23), with core inflation remaining stable at 4.0% YoY (4.1% in Sep-23). EU inflation also declined to 2.4% in Nov-23 vs 2.9% in Oct-23, and with core inflation also falling to 3.6% from 4.2%. On expected lines, ECB too held its rates constant in Dec-23, unlike US Fed it is yet to signal rate cuts, but market has projected rate cuts to begin around the same time as US Fed’s. Dec’23 meet. China’s factory activity as represented by PMI has contracted for the 3rd month in a row suggesting need for further stimulus.

High frequency indicators suggests resilient economic activities in December. Festive season boost was visible as GST collections, retail spends and 2-W sales were impressive and drove industrial activity too as seen in the recent IIP print. On the policy front, MPC, on expected lines, held the policy rates constant. While it reiterated its objective of bringing the policy rate down to the targeted 4%, the policy address had a dovish tone as the MPC upgraded its growth projections. Festive season led cash requirements, government’s rising tax collections and RBI’s day-to-day money market operations continue to tighten liquidity conditions. November headline inflation increased to 5.55% vs 4.87% in October-23 on account of food inflation (0.9% M-o-M). Supply led issues continue to keep prices of major food items such as cereals, pulses and vegetables elevated. On the other hand, base effect and government’s LPG subsidy has significantly brought down fuel inflation while core inflation was recorded at lowest level since Sep-19. On the external front, Current account deficit was recorded at 1% of GDP in 2QFY24 (vs 1.1% in 1QFY24), the increase in trade deficit, outweighed by a rise in net services exports and foreign remittances. On the capital account front, Capital Account surplus moderated significantly to 1.2% of GDP (vs 4% in previous quarter). Major reason has been the moderation in foreign investments as both, FDI and FPI flow moderated. The fiscal situation of the Central government remains comfortable in 8MFY24, led by robust growth in tax collection, constrained revenue expenditure and healthy capital expenditure. The Centre’s fiscal deficit was at 50.7% of BE in 8MFY24 vs 58.9% of BE in 8MFY23, with capital expenditure recording growth of 31% YoY amounting to 58.5% of BE. Revenue expenditure grew 3.6% YoY in 8MFY24 as government has been able to contain fertilizer subsidy expenditure while it has been prudent with spending of several smaller ministries (~25 ministries have spent <50% of their budget). On the revenue front, there is a split between healthy growth for direct taxes (25% YoY) – which are expected to overshoot the FY24BE – and indirect taxes, which have only risen 5% YoY as lower imports continue to hurt customs and excise duty.

Brent crude prices declined by 5.7% to an average of USD77.3/bbl in Dec-23 from USD82.03/bbl in Nov- 23, and ranged between USD73.24-USD81.07/bbl in Dec-23. Continued benign demand conditions, and uncertainties related to OPEC+ agreeing upon further supply cuts led to crude oil prices moderating for the second consecutive month. Overall industrial commodity prices (Core commodity CRB Industrial Index) declined MoM by ~3.2% in Dec-23 vs a drop of 2.2% in Nov-23 due to weak demand for industrial metals as demand continues to remain tepid in major countries like China. Gold prices rose by 1.3% as of Dec-23 end vs Nov-23 end as it ended the month at USD 2,062.98/oz from USD 2,036.41/oz in Nov-23.

CPI: CPI inflation in November spiked up to 5.5% (October: 4.9%) while increasing 0.5% mom led mainly by a sequential increase in prices of vegetables, pulses, cereals, sugar and eggs. Food inflation

was at 8.7% (October: 6.6%). November core inflation moderated to 4.1% (October: 4.2%). Sequentially, the core inflation momentum moderated to 0.2% in November (compared with the downwardly revised October reading

of 0.3% mom).

IIP: Industrial production in October registered a robust growth at 11.7% compared with an upwardly revised 6.2% reading in September, aided by a favorable base effect and pre-festive sequential pick-up. Manufacturing sector grew 10.4% while consumer durables and consumer non-durables grew 15.9% and 8.6% respectively.

Trade: Goods trade deficit in November fell to US$ 20.6bn (October: US$ 29.9bn) with exports at US$ 33.9bn (October: US$ 33.5bn) and imports at US$ 54.5bn (October: US$ 63.5bn). Non-oil exports was at US$ 26.4bn (October: US$ 27.5bn) while non-oil imports was at US$ 39.6bn (October: US$ 47.3bn). Services trade surplus was at US$ 15.3 bn, with exports at US$ 28.7bn and imports at US$ 13.4bn.

CAD: 2QFY24 CAD moderated to US$8.3 bn (1% of GDP) (1QFY24: US$9.2 bn). The goods trade deficit widened marginally to US$61 bn (1QFY24: US$57 bn) while net invisibles surplus increased to US$53 bn (US$47 bn) aided by an increase in (1) personal travel services to US$0.3 bn ((-)US$1.5 bn in 1QFY24), and (2) technical, trade-related services to (-)US$5.4 bn ((-)US$6.5 bn). Software exports increased to a record high of US$35.2 bn (US$33.9 bn in 1QFY24) while professional and management consulting services remained steady from 1QFY24 at US$11.6 bn. 1HFY24 CAD/GDP came in at 1% (1HFY23: (-)2.9%). Capital account surplus in 2QFY24 fell sharply to US$10 bn (1QFY24: US$34 bn) weighed down by a fall in FPI inflows (US$5 bn from US$16 bn in 1QFY24), banking capital inflows (US$4 bn from US$13 bn), and ECBs ((-)US$3 bn from +US$6 bn). Consequently, 2QFY24 BOP moderated to US$2.5 bn (from US$24 bn in 1QFY24). FX reserves in 1HFY24 increased by US$9.3 bn, which included a valuation effect of (-)US$17.7 bn, along with a BOP surplus of US$27 bn

IIP: Industrial production in October registered a robust growth at 11.7% compared with an upwardly revised 6.2% reading in September, aided by a favorable base effect and pre-festive sequential pick-up. Manufacturing sector grew 10.4% while consumer durables and consumer non-durables grew 15.9% and 8.6% respectively.

Trade: Goods trade deficit in November fell to US$ 20.6bn (October: US$ 29.9bn) with exports at US$ 33.9bn (October: US$ 33.5bn) and imports at US$ 54.5bn (October: US$ 63.5bn). Non-oil exports was at US$ 26.4bn (October: US$ 27.5bn) while non-oil imports was at US$ 39.6bn (October: US$ 47.3bn). Services trade surplus was at US$ 15.3 bn, with exports at US$ 28.7bn and imports at US$ 13.4bn.

CAD: 2QFY24 CAD moderated to US$8.3 bn (1% of GDP) (1QFY24: US$9.2 bn). The goods trade deficit widened marginally to US$61 bn (1QFY24: US$57 bn) while net invisibles surplus increased to US$53 bn (US$47 bn) aided by an increase in (1) personal travel services to US$0.3 bn ((-)US$1.5 bn in 1QFY24), and (2) technical, trade-related services to (-)US$5.4 bn ((-)US$6.5 bn). Software exports increased to a record high of US$35.2 bn (US$33.9 bn in 1QFY24) while professional and management consulting services remained steady from 1QFY24 at US$11.6 bn. 1HFY24 CAD/GDP came in at 1% (1HFY23: (-)2.9%). Capital account surplus in 2QFY24 fell sharply to US$10 bn (1QFY24: US$34 bn) weighed down by a fall in FPI inflows (US$5 bn from US$16 bn in 1QFY24), banking capital inflows (US$4 bn from US$13 bn), and ECBs ((-)US$3 bn from +US$6 bn). Consequently, 2QFY24 BOP moderated to US$2.5 bn (from US$24 bn in 1QFY24). FX reserves in 1HFY24 increased by US$9.3 bn, which included a valuation effect of (-)US$17.7 bn, along with a BOP surplus of US$27 bn

Deal flow saw a pickup in December with reported 56 deals worth ~$6.3 billion executed. Key deals included Embassy Office Parks REITS ($850mn) and Mankind Pharma ($695mn).

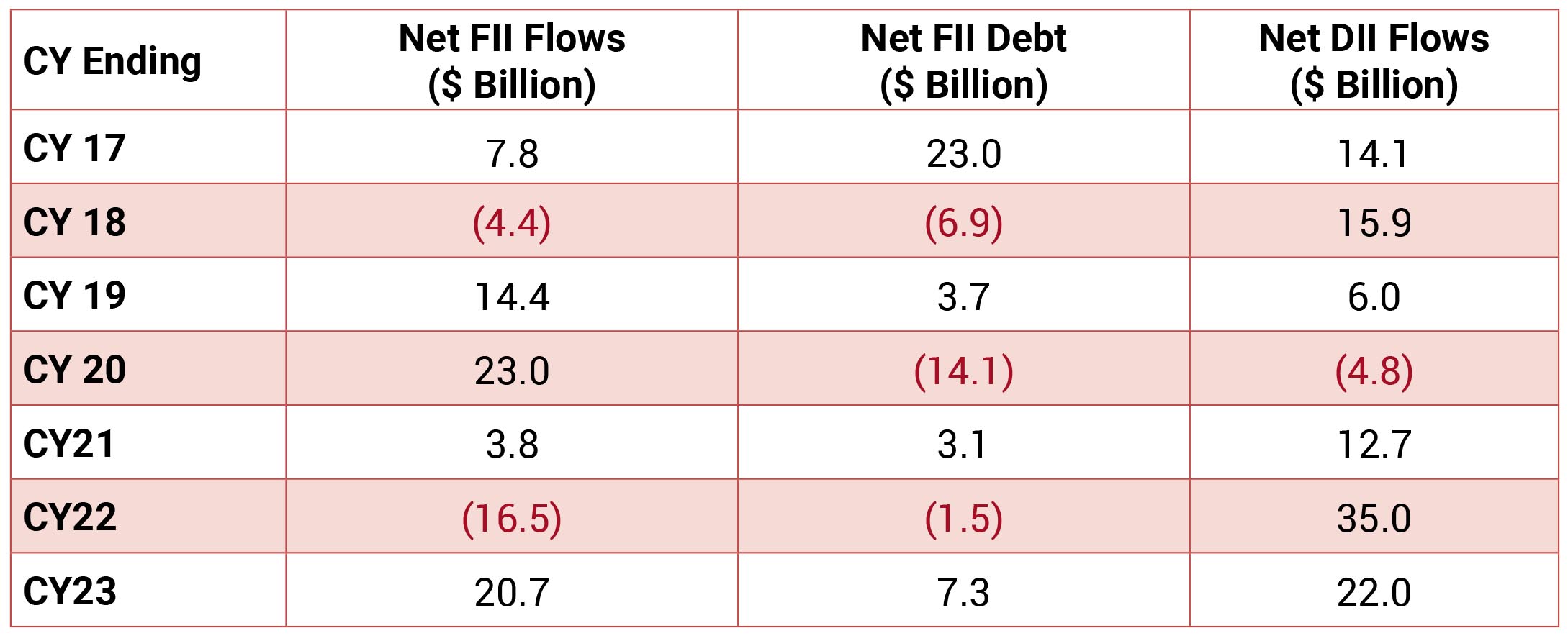

FIIs increased buying in the month of December 2023 to the tune of $7.0bn and DIIs remained net buyers to the tune of $1.55bn.

FIIs increased buying in the month of December 2023 to the tune of $7.0bn and DIIs remained net buyers to the tune of $1.55bn.