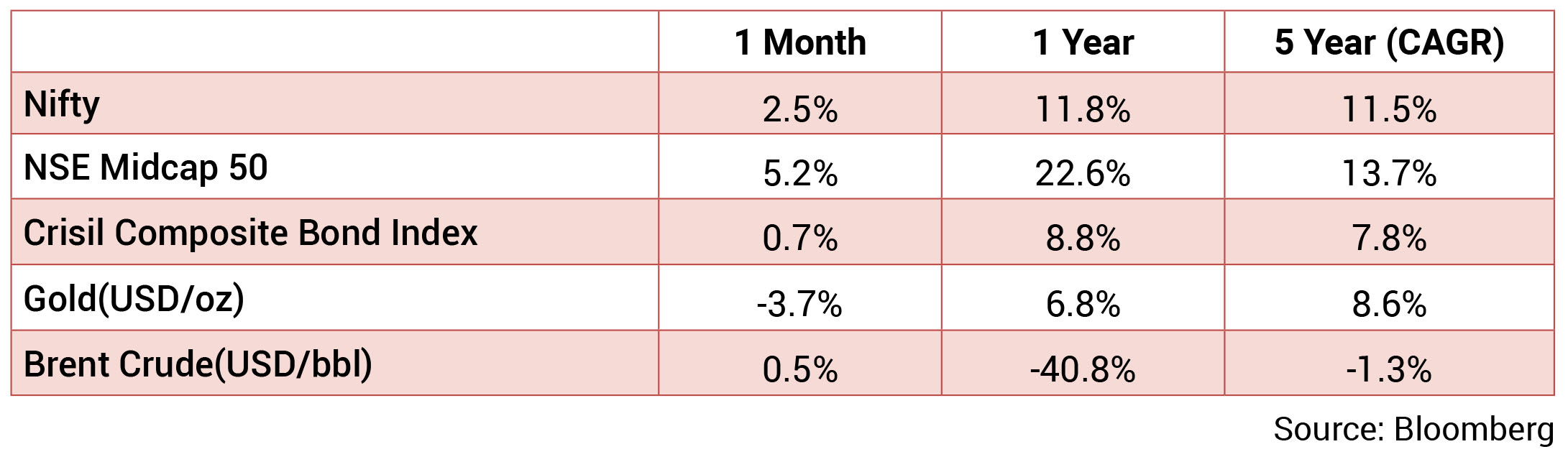

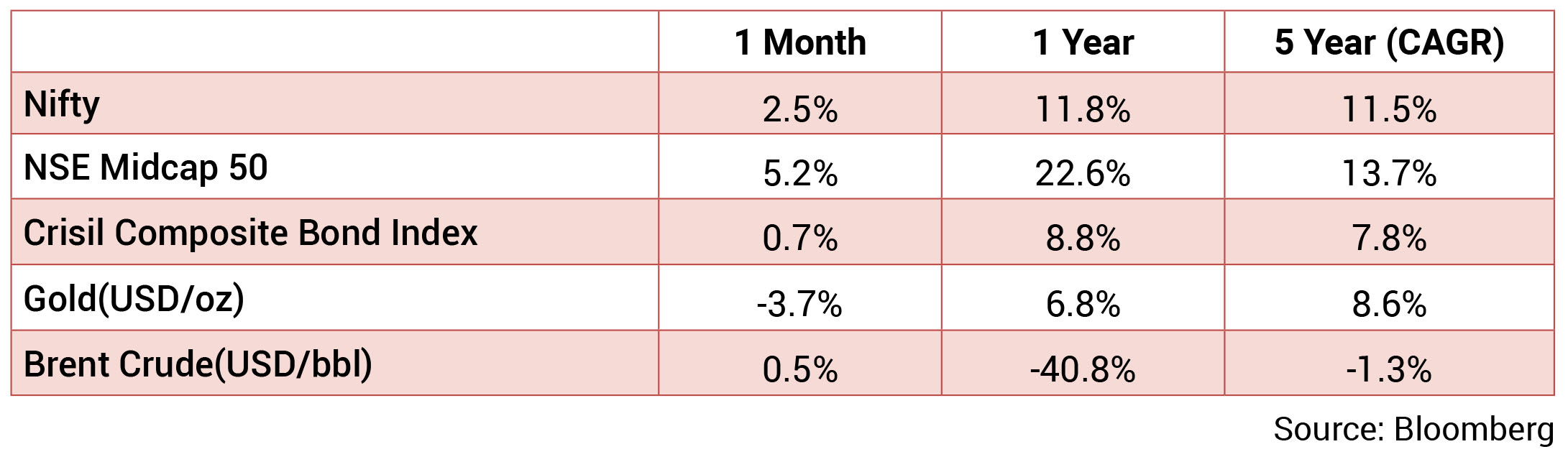

Market was up 2.6% primarily driven by FIIs buying (highest flows since Nov-22), favorable macros,

reasonable stock valuations and resilient earnings. Auto, Consumer (FMCG) and IT have been the

frontrunner sectors while PSU banks and O&G have been the laggards. The INR depreciated against

the USD by 1.1% in May’23 due to the uncertainties caused by US Debt ceiling negotiations. It averaged

around 82.4 with a monthly best and worst of 81.8 and 82.8 respectively. 10yr benchmark yields traded

in the range of 6.96%-7.04% and eventually ended the month 13bps lower sequentially at 7%. The 10y

benchmark averaged 7.01% in May.

US Debt ceiling negotiations came to an end as both the parties agreed to a bipartisan deal. If passed by both the houses, it would suspend US31trn debt limit and prevent a default. On expected lines, Fed undertook a 25bps rate hike in May’23 and has now cumulatively increased the policy rate by 500bps. The minutes from the meeting suggested that there is scope for the Fed to take a pause in rate hike and take further decisions based on the incoming data as tight financial conditions would lead to a recession in the current year followed by moderately paced recovery.US to witness tighter credit conditions due to rising interest rates and impact of banking turmoil. Recent data though, suggests that rate hike cycle is far from over.US inflation rate remained stubbornly high at 4.9% in Apr’23. US core PCE price index (Federal Reserve’s preferred gauge of inflation) increased to 4.7%YoY in April compared to 4.6% in the previous month. Looking at the employment scenario, US economy created 250k jobs in April, which beat market expectations of 180k jobs, indicating a tight labor market. Central banks across AEs increased policy rates in May. ECB and Bank of England, both increased policy rate by 25bps. While Eurozone inflation grew to 7% in April, UK saw inflation moderate to 8.7%.

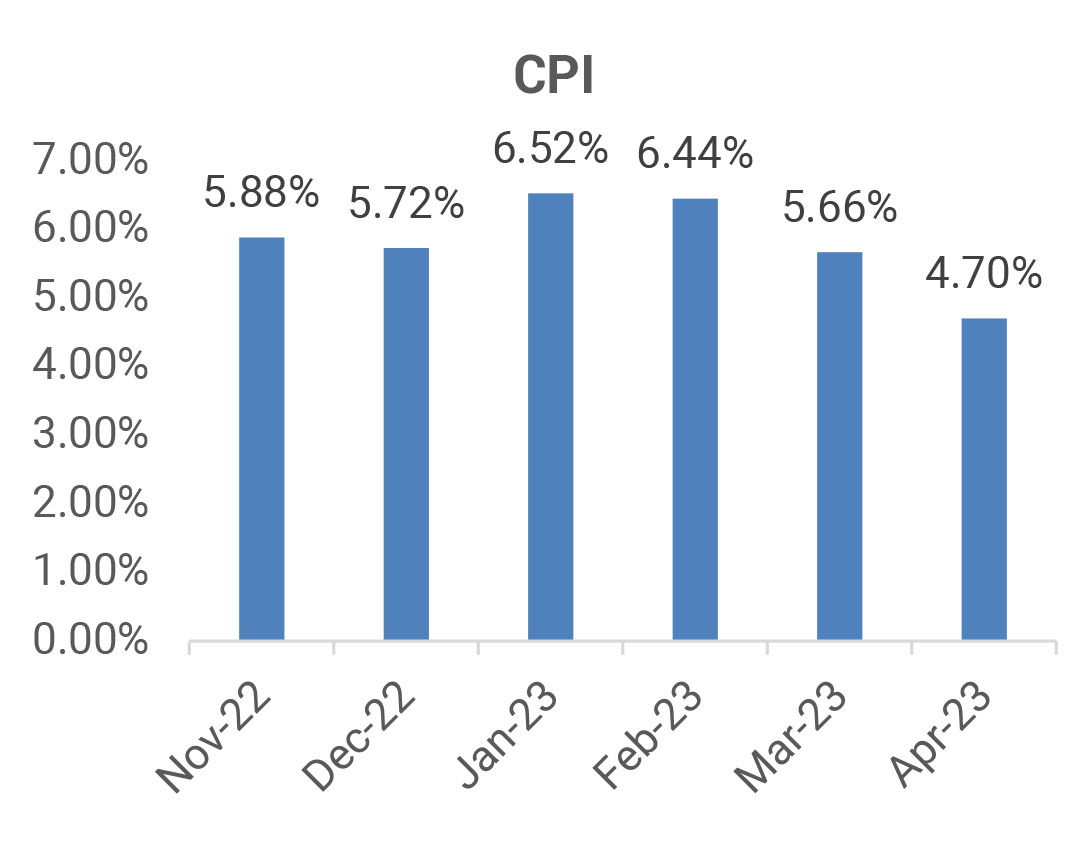

GDP growth in Q4FY23 was 6.1% YoY. This led to FY23 GDP grow at 7.2%YoY, beating government’s estimates by 20 bps. The beat was driven by agricultural sector, which witnessed its highest growth since Q4FY20. Similarly, services sector continues to grow at a high rate of 6.9% while double digit growth in construction drove industry sector growth. Investments was the silver lining as it grew by 8.9% in Q4FY23. Centre was able to limit its fiscal deficit to the budgeted 6.4% (of the GDP). Government’s capex grew by 24% YoY in FY23 and was higher than the revised estimates. The absolute fiscal deficit was lower than the revised estimates as government reined in its revenue expenditure. Owing to favorable base and moderation in price rise, India CPI dipped to 4.7% YoY in April vs. 5.7% in the last month with core CPI slowing to 35-month low of 5.2% YoY. April inflation print also saw softening in sequential inflation for food, fuel & light, clothing & footwear, services and housing. Such a positive inflation print has firmed street’s expectations of the MPC holding the policy rates in the June’23 meet. High frequency indicators suggest resilience in domestic demand with highest ever GST collections and significantly strong PMI. Both manufacturing and services PMI registered higher activity with service sector leading the growth.

Brent crude prices decreased from an average of USD83.4/bbl in April to USD75.7/bbl in May as it ranged between USD72-USD79/bbl. The fall in prices was a reaction to data suggesting tepid recovery of Chinese manufacturing and uncertainties caused due to USA’s debt ceiling negotiations. Gold prices fell marginally as it ended at USD 1,964/oz in May from USD 1,983/oz in April. Steel price trended lower as HRC prices ended the month at USD934/ton compared to USD 1,069/ton in April.

US Debt ceiling negotiations came to an end as both the parties agreed to a bipartisan deal. If passed by both the houses, it would suspend US31trn debt limit and prevent a default. On expected lines, Fed undertook a 25bps rate hike in May’23 and has now cumulatively increased the policy rate by 500bps. The minutes from the meeting suggested that there is scope for the Fed to take a pause in rate hike and take further decisions based on the incoming data as tight financial conditions would lead to a recession in the current year followed by moderately paced recovery.US to witness tighter credit conditions due to rising interest rates and impact of banking turmoil. Recent data though, suggests that rate hike cycle is far from over.US inflation rate remained stubbornly high at 4.9% in Apr’23. US core PCE price index (Federal Reserve’s preferred gauge of inflation) increased to 4.7%YoY in April compared to 4.6% in the previous month. Looking at the employment scenario, US economy created 250k jobs in April, which beat market expectations of 180k jobs, indicating a tight labor market. Central banks across AEs increased policy rates in May. ECB and Bank of England, both increased policy rate by 25bps. While Eurozone inflation grew to 7% in April, UK saw inflation moderate to 8.7%.

GDP growth in Q4FY23 was 6.1% YoY. This led to FY23 GDP grow at 7.2%YoY, beating government’s estimates by 20 bps. The beat was driven by agricultural sector, which witnessed its highest growth since Q4FY20. Similarly, services sector continues to grow at a high rate of 6.9% while double digit growth in construction drove industry sector growth. Investments was the silver lining as it grew by 8.9% in Q4FY23. Centre was able to limit its fiscal deficit to the budgeted 6.4% (of the GDP). Government’s capex grew by 24% YoY in FY23 and was higher than the revised estimates. The absolute fiscal deficit was lower than the revised estimates as government reined in its revenue expenditure. Owing to favorable base and moderation in price rise, India CPI dipped to 4.7% YoY in April vs. 5.7% in the last month with core CPI slowing to 35-month low of 5.2% YoY. April inflation print also saw softening in sequential inflation for food, fuel & light, clothing & footwear, services and housing. Such a positive inflation print has firmed street’s expectations of the MPC holding the policy rates in the June’23 meet. High frequency indicators suggest resilience in domestic demand with highest ever GST collections and significantly strong PMI. Both manufacturing and services PMI registered higher activity with service sector leading the growth.

Brent crude prices decreased from an average of USD83.4/bbl in April to USD75.7/bbl in May as it ranged between USD72-USD79/bbl. The fall in prices was a reaction to data suggesting tepid recovery of Chinese manufacturing and uncertainties caused due to USA’s debt ceiling negotiations. Gold prices fell marginally as it ended at USD 1,964/oz in May from USD 1,983/oz in April. Steel price trended lower as HRC prices ended the month at USD934/ton compared to USD 1,069/ton in April.

Source: Bloomberg

Source: Bloomberg

CPI: CPI slowed to 4.7% in April vs. 5.7% in the previous month and 7.8% a year ago. Sequentially, CPI

registered 51bps increase vs. 23bps in the last month. Core CPI eased further to 5.2% yoy vs. 5.9% in the

last month with sequential pace of 54bps vs. 28bps in the last month. Food inflation was up by 56 bps

mom vs. 23bps in the last month led by higher price for fruits (4%) and vegetables (2%). Housing prices

was up by 1% after remaining unchanged in the last month while pan/tobacco and clothing was up by

0.6/0.3%. Fuel prices fell by 11bps as in the previous month. Services inflation pace was higher at 0.5%

vs. 0.3% in the last month with price pressure from personal care (1.7%), education (0.8%), medical care

(0.3%), recreation (0.2%), transport & communication (0.2%) and household requisites (0.2%).

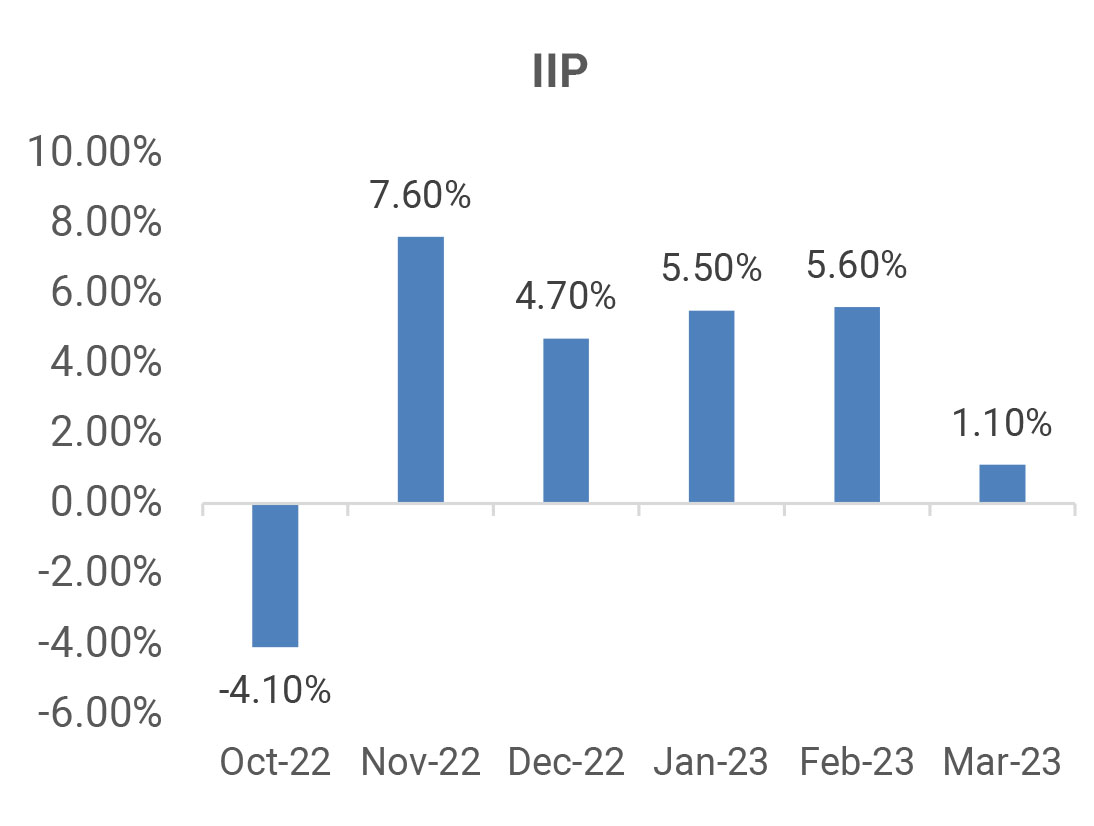

IIP: March IIP registered 1.1% yoy growth vs. 5.8% in the last month and 2% a year ago. Mining/ Manufacturing saw 7%/0.5% yoy growth vs. 5%/6% yoy in the last month while electricity contracted by 1.6% yoy vs 8% yoy growth in the last month.

GDP: Real GDP accelerated to 6.1% yoy growth in Q4FY23, taking growth for FY23 to 7.2% (above the RBI’s 7% and IMF’s 6.8% estimates). The rebound in Q4 was spurred by a turnaround in net exports, as exports of goods and services grew 11.9% yoy while imports decelerated to 4.9% yoy growth. Investment spending grew 8.9% yoy in Q4FY23, and its 11.4% growth in FY23 remained the key contributor to the robust GDP print for the second consecutive year.

Trade: Exports in April fell by 13% yoy to USD 34.7bn (March: USD 41.4bn) with non-oil exports at USD 28.2bn (USD 33bn). April imports fell by 14.1% yoy to USD 49.9bn (March: USD 60bn) with oil imports at USD 15.2bn (USD 18bn) and non-oil imports at USD 34.7bn (USD 42bn). Trade deficit narrowed to USD 15.2bn (March: USD 18.6bn). Services trade surplus moderated marginally to USD 13.9bn in April (March: USD 14.2bn) with exports at USD 30.4bn and imports at USD 16.5bn.

IIP: March IIP registered 1.1% yoy growth vs. 5.8% in the last month and 2% a year ago. Mining/ Manufacturing saw 7%/0.5% yoy growth vs. 5%/6% yoy in the last month while electricity contracted by 1.6% yoy vs 8% yoy growth in the last month.

GDP: Real GDP accelerated to 6.1% yoy growth in Q4FY23, taking growth for FY23 to 7.2% (above the RBI’s 7% and IMF’s 6.8% estimates). The rebound in Q4 was spurred by a turnaround in net exports, as exports of goods and services grew 11.9% yoy while imports decelerated to 4.9% yoy growth. Investment spending grew 8.9% yoy in Q4FY23, and its 11.4% growth in FY23 remained the key contributor to the robust GDP print for the second consecutive year.

Trade: Exports in April fell by 13% yoy to USD 34.7bn (March: USD 41.4bn) with non-oil exports at USD 28.2bn (USD 33bn). April imports fell by 14.1% yoy to USD 49.9bn (March: USD 60bn) with oil imports at USD 15.2bn (USD 18bn) and non-oil imports at USD 34.7bn (USD 42bn). Trade deficit narrowed to USD 15.2bn (March: USD 18.6bn). Services trade surplus moderated marginally to USD 13.9bn in April (March: USD 14.2bn) with exports at USD 30.4bn and imports at USD 16.5bn.

Deal flow picked in May 2023 with 25 deals worth USD 2.34bn executed. Key deals included Mankind

Pharma (USD 527.2mn) and Krishna Institute of Medical Sciences Ltd (USD 449mn).

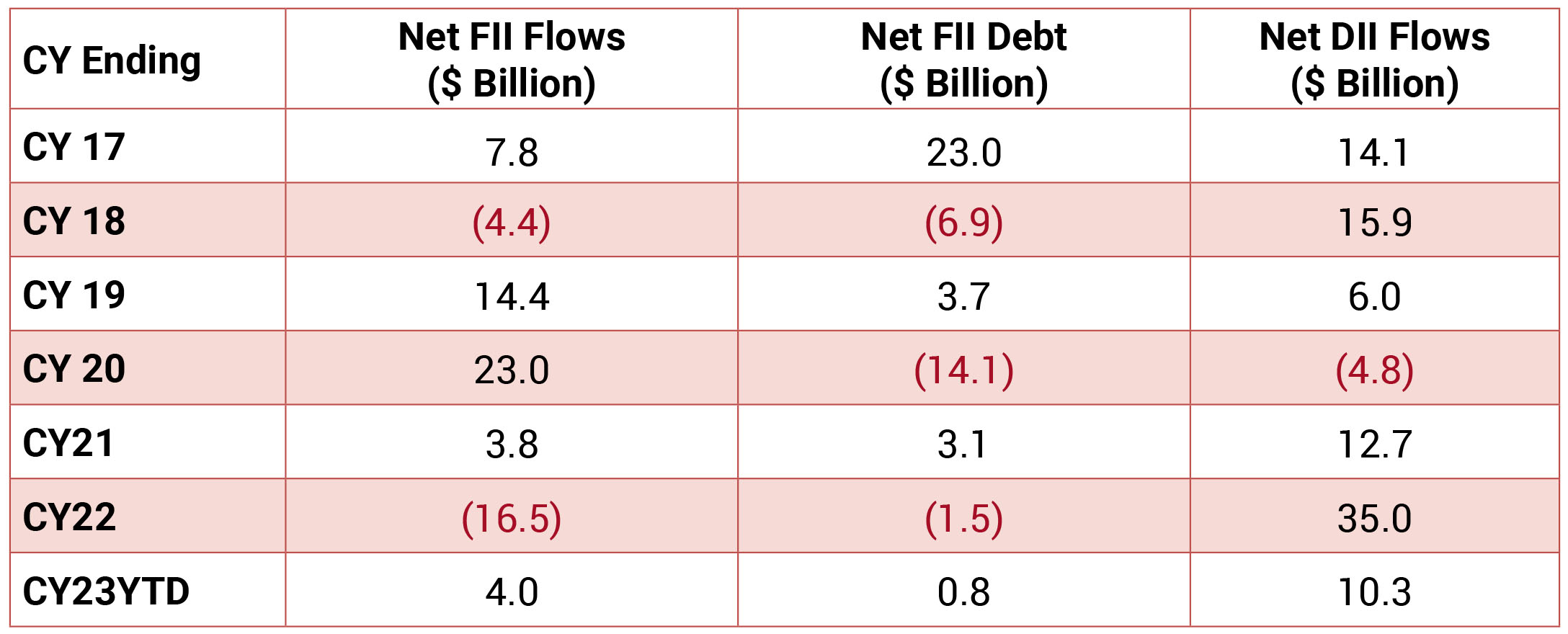

FIIs were net buyers in the month of May 2023 to the tune of USD 4.9bn and DIIs sold to the tune of USD 406mn.

FIIs were net buyers in the month of May 2023 to the tune of USD 4.9bn and DIIs sold to the tune of USD 406mn.