The month of October started with re-constitution of Monetary Policy Committee to replace the external members whose tenures had come to a conclusion. The outgoing members were replaced by Ms. Ashima Goyal, Dr Shashanka Bhide and Prof Jayanth Verma. The MPC outcome, though expected lines with no rate cut or change in stance brought a welcome announcement to the market – an announcement to conduct bi-monthly OMOs in G-Sec and a monthly OMO in SDLs for the rest of the financial year. Though an announcement to increase the borrowings for second of the year by INR 1.1 tn through 3YR and 5YR bonds in equal measures lead to believe that it will lead to some flattening of the curve, the bull steepening continued as the minutes of monetary policy released on October 23rd lead to further bull steepening of the curve.

This was the first policy this fiscal to finally release RBI estimates for inflation and growth, a practice which was temporarily halted owing to the pandemic. The MPC has projected inflation at 6.8 per cent for Q2:2020-21, at 5.4-4.5 per cent for H2:2020-21 and 4.3 per cent for Q1:2021-22.

Also the RBI estimates the real GDP growth in 2020-21 to be negative at (-)9.5%, with risks tilted to the downside: (-)9.8 % in Q2:2020-21; (-)5.6 % in Q3; and 0.5 % in Q4. Real GDP growth for Q1:2021-22 is placed at 20.6%.

The permission to States to borrow INR 70 Bn from the open market with OMO in SDLs to support the yields has lead to softening of the belly by 8-10 basis points. Also the resolve of the MPC is quite evident that although no shift in mandate was proposed, it has made its stand very clear that growth revival continues to be pivotal point of focus.

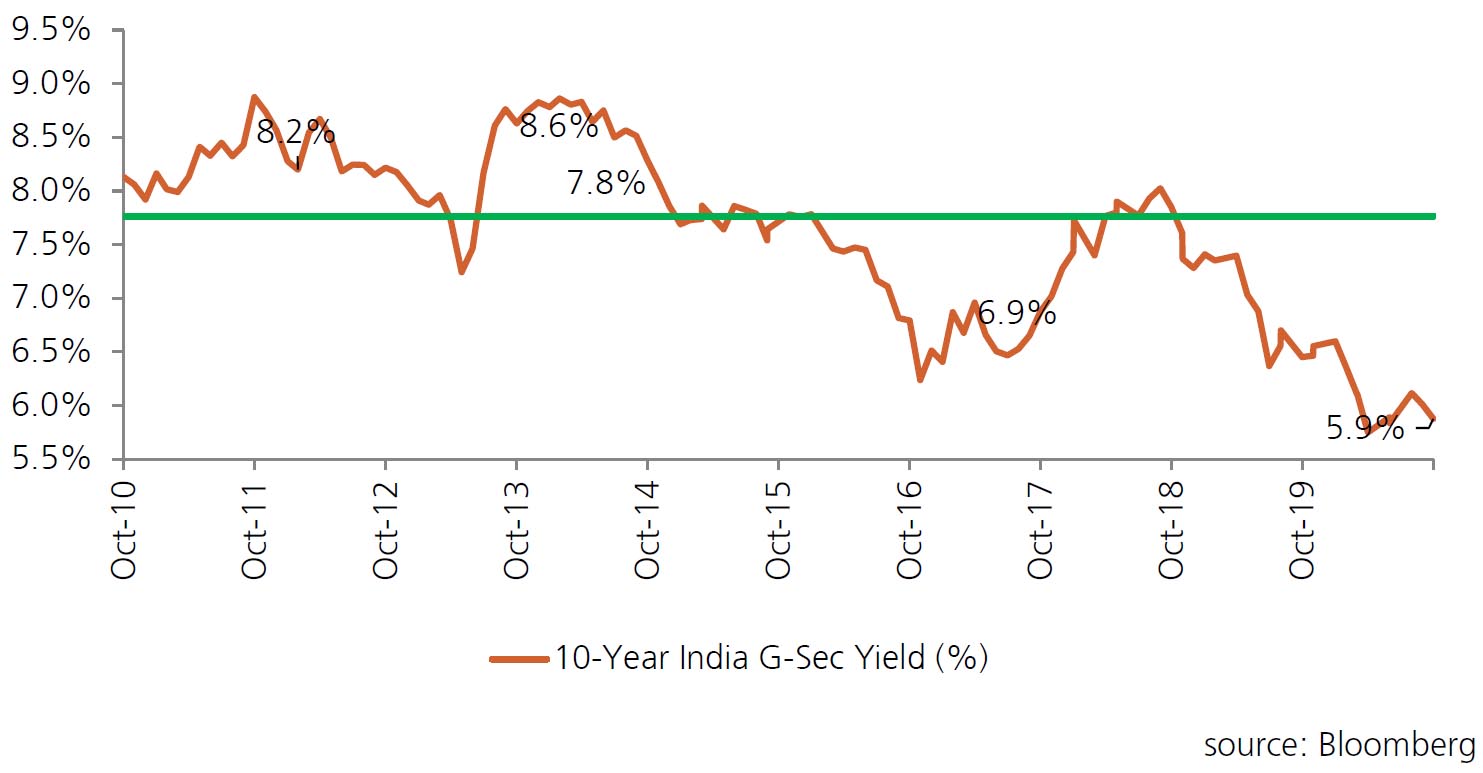

Hence, the rates will continue to be range bound from 5.80%-6.00% on the 10YR Benchmark.