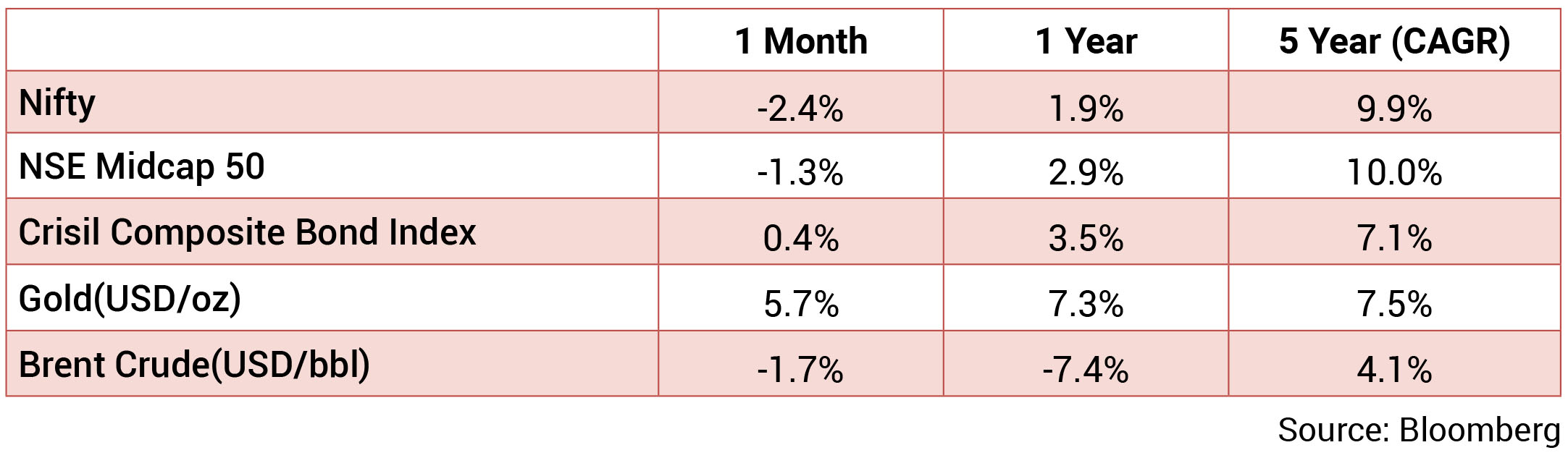

Markets declined by 2.4% amidst anaemic domestic flows with redemptions picking up & FII outflows.

Oil & Gas, Banks and Media have been the laggards while Auto & IT have been the frontrunner sectors.

The INR appreciated against USD in January after slight depreciation in the previous month. It averaged

around 81.9 with a monthly best and worst of 81.1 and 82.9 respectively. 10y benchmark yields traded

in the range of 7.29%-7.40% and eventually ended the month 1bp higher sequentially at 7.34%. The 10y

benchmark averaged 7.33% in January.

At 6.5% yoy, US recorded its lowest inflation in 13 months, while prices contracted sequentially for the first time since May’20 due to falling fuel prices. Core inflation moderated further from 6% in November to 5.7% in December. Services-ex shelter, a leading indicator of US inflation as it represents services wage growth, increased by 0.4% sequentially after remaining flat for 2 months. It remains a major upside risk to inflation as it indicates that high wage growth continues to persist. In line with consensus, the Fed slowed down its policy rate hike to 50bps in early February. FOMC continued to remain hawkish as they have suggested further rate hikes. EU and UK witnessed their inflation fall for the second month in a row but it remains at 9.2% & 10.5% respectively. In line with expectations, ECB and Bank of England have undertaken a 50bps rate hike in early February. While ECB has stated that another 50bps hike would be under undertaken in March, BOE may now undertake smaller rate hikes in the near term. Only clear indication of inflation moving towards mandated target will allow central banks to slow down on their policy rate hikes or pivot. IMF has increased USA’s GDP projections for 2023 by 40bps but has slashed it for other advanced economies such as Eurozone and UK, with the latter projected to undergo a recession during the current year.

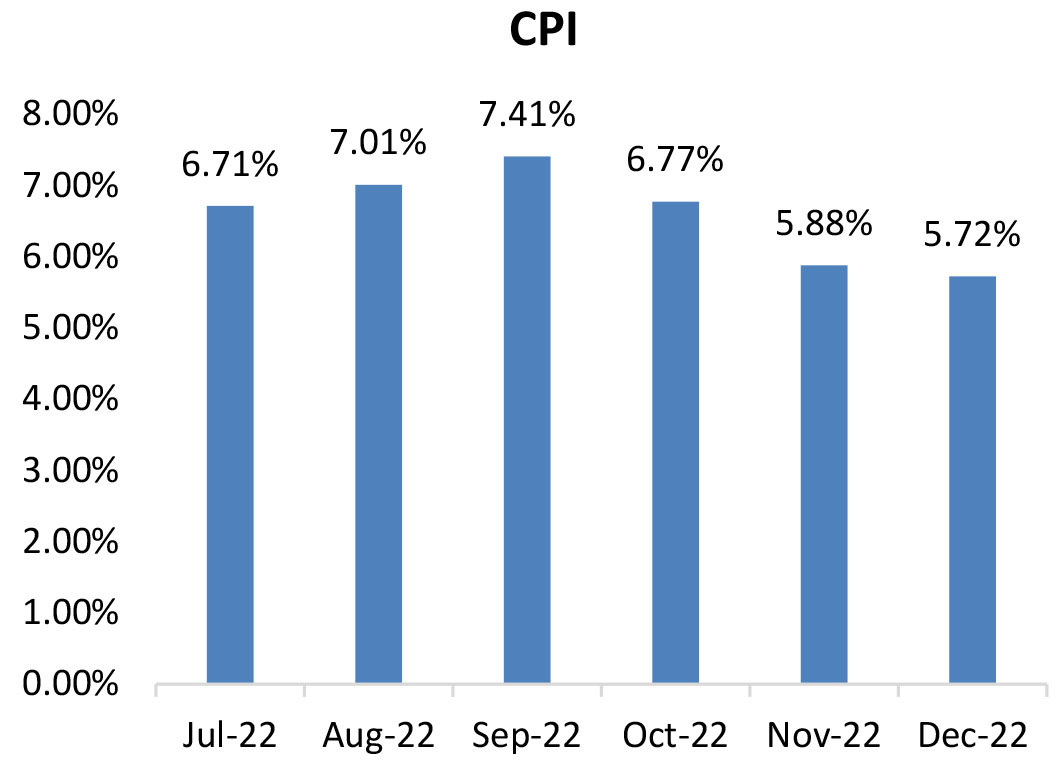

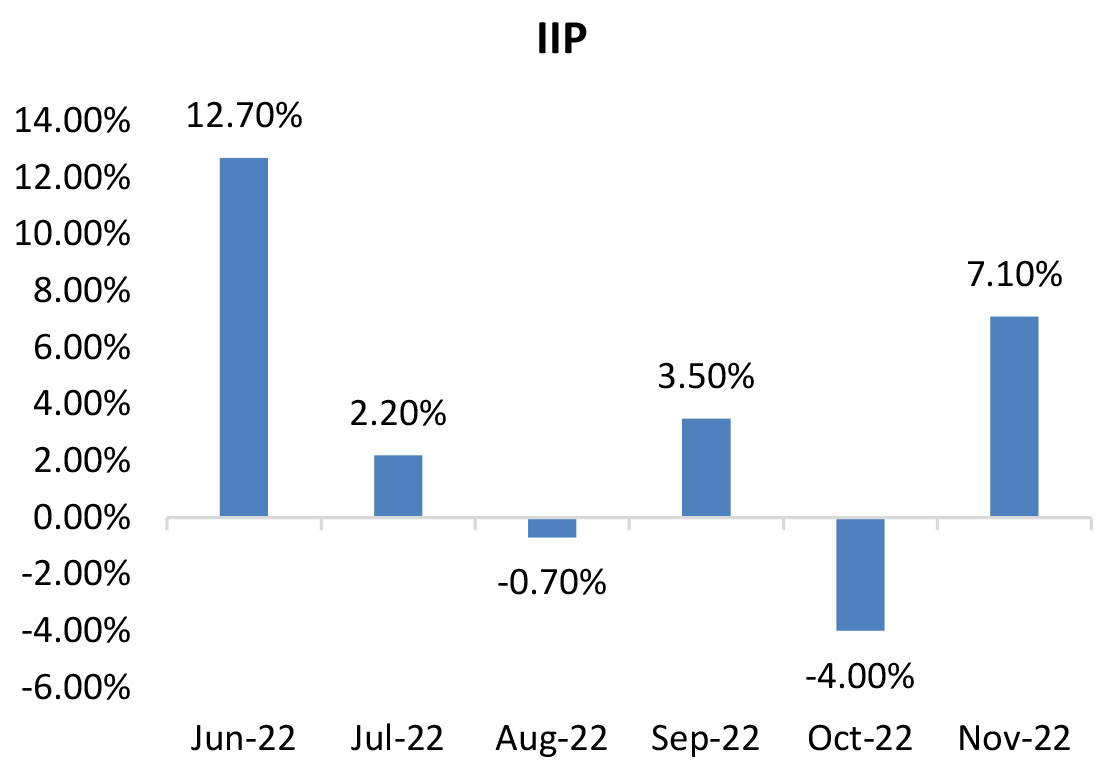

High frequency indicators suggests domestic consumption continues to remain resilient as represented by GST collections, which was recorded at a 9 month high. PMI data indicates a slowdown in production due to moderating exports but strong domestic demand continues to help manufacturing sector stay resilient and in the expansion zone. In its economic survey, government has projected a 6-6.8% GDP growth in FY24. CPI inflation further eased to 5.7% in December’22 as food prices contracted by 1.2% sequentially. While vegetable prices has been driving the food prices down, cereal & milk inflation continue to inch upward. Similarly, core inflation at 6.1%, remains sticky and trends above the MPC’s inflation targeting upper tolerance limit of 6%. With the MPC set to meet in early February, consensus expects a repo rate hike of 25bps taking the policy rate to 6.5%. Government continues to rein in the fiscal deficit whilst it maintains strong capex numbers. By end of December, government had already achieved 65% of its budgeted capex driven by railways and roads as both sectors have achieved 90% & 80% respectively of their BE. With 80% of tax revenues achieved, government’s fiscal deficit has been just 59% of the BE. In the recently presented Union budget, government has announced a 37% increase in capex driven by road & railway sector. It is continuing on its fiscal consolidation path as Fiscal deficit is projected to fall from 6.4% in FY23 to 5.9% in FY24.

Brent crude prices increased from an average of USD 81.6/bbl in December to USD 83.9 in January as demand expectations have increased, given that China, the second largest crude oil consumer has bid farewell to its zero – covid policy. Gold prices ended higher at USD 1,924/oz in December from USD 1,814/ oz in November.

At 6.5% yoy, US recorded its lowest inflation in 13 months, while prices contracted sequentially for the first time since May’20 due to falling fuel prices. Core inflation moderated further from 6% in November to 5.7% in December. Services-ex shelter, a leading indicator of US inflation as it represents services wage growth, increased by 0.4% sequentially after remaining flat for 2 months. It remains a major upside risk to inflation as it indicates that high wage growth continues to persist. In line with consensus, the Fed slowed down its policy rate hike to 50bps in early February. FOMC continued to remain hawkish as they have suggested further rate hikes. EU and UK witnessed their inflation fall for the second month in a row but it remains at 9.2% & 10.5% respectively. In line with expectations, ECB and Bank of England have undertaken a 50bps rate hike in early February. While ECB has stated that another 50bps hike would be under undertaken in March, BOE may now undertake smaller rate hikes in the near term. Only clear indication of inflation moving towards mandated target will allow central banks to slow down on their policy rate hikes or pivot. IMF has increased USA’s GDP projections for 2023 by 40bps but has slashed it for other advanced economies such as Eurozone and UK, with the latter projected to undergo a recession during the current year.

High frequency indicators suggests domestic consumption continues to remain resilient as represented by GST collections, which was recorded at a 9 month high. PMI data indicates a slowdown in production due to moderating exports but strong domestic demand continues to help manufacturing sector stay resilient and in the expansion zone. In its economic survey, government has projected a 6-6.8% GDP growth in FY24. CPI inflation further eased to 5.7% in December’22 as food prices contracted by 1.2% sequentially. While vegetable prices has been driving the food prices down, cereal & milk inflation continue to inch upward. Similarly, core inflation at 6.1%, remains sticky and trends above the MPC’s inflation targeting upper tolerance limit of 6%. With the MPC set to meet in early February, consensus expects a repo rate hike of 25bps taking the policy rate to 6.5%. Government continues to rein in the fiscal deficit whilst it maintains strong capex numbers. By end of December, government had already achieved 65% of its budgeted capex driven by railways and roads as both sectors have achieved 90% & 80% respectively of their BE. With 80% of tax revenues achieved, government’s fiscal deficit has been just 59% of the BE. In the recently presented Union budget, government has announced a 37% increase in capex driven by road & railway sector. It is continuing on its fiscal consolidation path as Fiscal deficit is projected to fall from 6.4% in FY23 to 5.9% in FY24.

Brent crude prices increased from an average of USD 81.6/bbl in December to USD 83.9 in January as demand expectations have increased, given that China, the second largest crude oil consumer has bid farewell to its zero – covid policy. Gold prices ended higher at USD 1,924/oz in December from USD 1,814/ oz in November.

Source: Bloomberg

Source: Bloomberg

Union Budget: The government in its FY24 union budget (1) prioritized fiscal consolidation and (2) focused

on capital expenditure to achieve higher medium-term GDP growth. It has targeted central GFD/GDP

at 5.9% in FY24BE (6.4% in FY2023RE), staying on course to reach the targeted 4.5% by FY2026. The

‘growth’ focus of the budget was visible in (1) high capital expenditure growth and (2) targeted increase

in allocations to affordable housing, rural employment, rural roads and drinking water. The government

has budgeted (1) 37% increase in direct capital expenditure to Rs 10tn (with Rs 1.3tn support to states

and 32% including spending of PSUs) and (2) 13% contraction in rural development. The budget has

targeted (1) tax revenues growth of 10% (10% for both direct and indirect taxes) and (2) overall expenditure

growth of 7.5% (1.2% for revenue expenditure). It has pegged divestment target at Rs 610bn (Rs 510bn of

divestment receipts and Rs 100bn as other receipts). Nominal GDP growth has been assumed at 10.5%

for FY24. The government has also rejigged the tax structures for personal income taxes and made them

increasingly attractive versus the old regime.

CPI: December CPI inflation at 5.72% (November: 5.88%) surprised marginally on the downside led mainly by a sequential fall in food prices. Sequentially, headline inflation contracted by 0.5% (November: (-)0.1% mom) led by a sharp fall in prices of vegetable ((-)12.7% mom versus (-)8.3% mom in November), and fruits ((-)1.7% mom vs (-)1.9% mom in November). On the other hand, cereal prices along with prices of milk and spices continued to push up food inflation. December core inflation (CPI excluding food, fuel, pan, and tobacco) remained sticky at 6.3% while increasing sequentially by 0.3% (November: +0.42% mom). Clothing and footwear while remaining elevated moderated marginally to 9.6% (November: 9.8%) while personal care and effects inflation was at 8.1% (7%) and household goods and services inflation was at 7.4% (7.6%). Personal care and effects inflation was mainly led by rise in prices of gold and silver (three consecutive months of increase).

IIP: November IIP grew by 7.1% (October: (-)4.3%) with sequential growth at 6% (October: (-)3.5% mom). Manufacturing sector growth was at 6.1% while mining sector growth was at 9.7%. As per the use-based classification, all categories registered positive growths led by capital goods (20.7% yoy) and infrastructure goods (12.8% yoy).

GDP: The NSO estimates FY23 real GDP growth at 7% against 8.7% in FY2022. With 1HFY23 GDP growth at 9.7%, the implied 2HFY23 GDP growth is at 4.5%. The key driver of 2HFY23 growth is expected to be investments (GFCF) at 8.4% growth (15% in 1HFY23) and government expenditure growth at 7.2% ((- )1.3% in 1HFY23). Private consumption is expected to contract by 0.2% (+17.2% in 1HFY23). Exports are expected to grow by 11.9% in 2HFY23 (13% in 1HFY23) while import growth is expected to moderate sharply to 12.2% (30.9%). The NSO estimates FY23 real GVA growth at 6.7% against 8.1% in FY2022. With 1HFY23 GVA growth at 9%, the implied 2HFY23 growth is at 4.7%. Nominal GDP growth has been pegged at 15.4% implying a GDP deflator of around 7.9%.

Trade: December exports at USD 34.5bn (November: USD 34.8bn) fell by 12.2% yoy. Non-oil export was at USD 29.5bn (November: USD 26.7bn) while oil exports fell sharply to USD 4.9bn (November: USD 8.1bn). Engineering goods increased to USD 9.1bn (November: USD 8.1bn). December imports at USD 58.2bn (November: USD 58.2bn) fell by 3.5% yoy with oil imports at USD 17.5bn (November: USD 18.1bn) and nonoil imports at USD 40.8bn (November: USD 40.2bn). Non-oil import was driven by electronics, machinery, and transport equipment. Trade deficit in December remained steady at USD 23.8bn (November: USD 23.4bn) and was at USD 219bn in 9MFY23 (9MFY22: USD 137 bn)

CPI: December CPI inflation at 5.72% (November: 5.88%) surprised marginally on the downside led mainly by a sequential fall in food prices. Sequentially, headline inflation contracted by 0.5% (November: (-)0.1% mom) led by a sharp fall in prices of vegetable ((-)12.7% mom versus (-)8.3% mom in November), and fruits ((-)1.7% mom vs (-)1.9% mom in November). On the other hand, cereal prices along with prices of milk and spices continued to push up food inflation. December core inflation (CPI excluding food, fuel, pan, and tobacco) remained sticky at 6.3% while increasing sequentially by 0.3% (November: +0.42% mom). Clothing and footwear while remaining elevated moderated marginally to 9.6% (November: 9.8%) while personal care and effects inflation was at 8.1% (7%) and household goods and services inflation was at 7.4% (7.6%). Personal care and effects inflation was mainly led by rise in prices of gold and silver (three consecutive months of increase).

IIP: November IIP grew by 7.1% (October: (-)4.3%) with sequential growth at 6% (October: (-)3.5% mom). Manufacturing sector growth was at 6.1% while mining sector growth was at 9.7%. As per the use-based classification, all categories registered positive growths led by capital goods (20.7% yoy) and infrastructure goods (12.8% yoy).

GDP: The NSO estimates FY23 real GDP growth at 7% against 8.7% in FY2022. With 1HFY23 GDP growth at 9.7%, the implied 2HFY23 GDP growth is at 4.5%. The key driver of 2HFY23 growth is expected to be investments (GFCF) at 8.4% growth (15% in 1HFY23) and government expenditure growth at 7.2% ((- )1.3% in 1HFY23). Private consumption is expected to contract by 0.2% (+17.2% in 1HFY23). Exports are expected to grow by 11.9% in 2HFY23 (13% in 1HFY23) while import growth is expected to moderate sharply to 12.2% (30.9%). The NSO estimates FY23 real GVA growth at 6.7% against 8.1% in FY2022. With 1HFY23 GVA growth at 9%, the implied 2HFY23 growth is at 4.7%. Nominal GDP growth has been pegged at 15.4% implying a GDP deflator of around 7.9%.

Trade: December exports at USD 34.5bn (November: USD 34.8bn) fell by 12.2% yoy. Non-oil export was at USD 29.5bn (November: USD 26.7bn) while oil exports fell sharply to USD 4.9bn (November: USD 8.1bn). Engineering goods increased to USD 9.1bn (November: USD 8.1bn). December imports at USD 58.2bn (November: USD 58.2bn) fell by 3.5% yoy with oil imports at USD 17.5bn (November: USD 18.1bn) and nonoil imports at USD 40.8bn (November: USD 40.2bn). Non-oil import was driven by electronics, machinery, and transport equipment. Trade deficit in December remained steady at USD 23.8bn (November: USD 23.4bn) and was at USD 219bn in 9MFY23 (9MFY22: USD 137 bn)

Deal flow slowed in January with 20 deals worth ~USD 757mn executed. Key deals included Paytm (USD

126mn) and FSN E-Commerce Venture (USD 26mn).

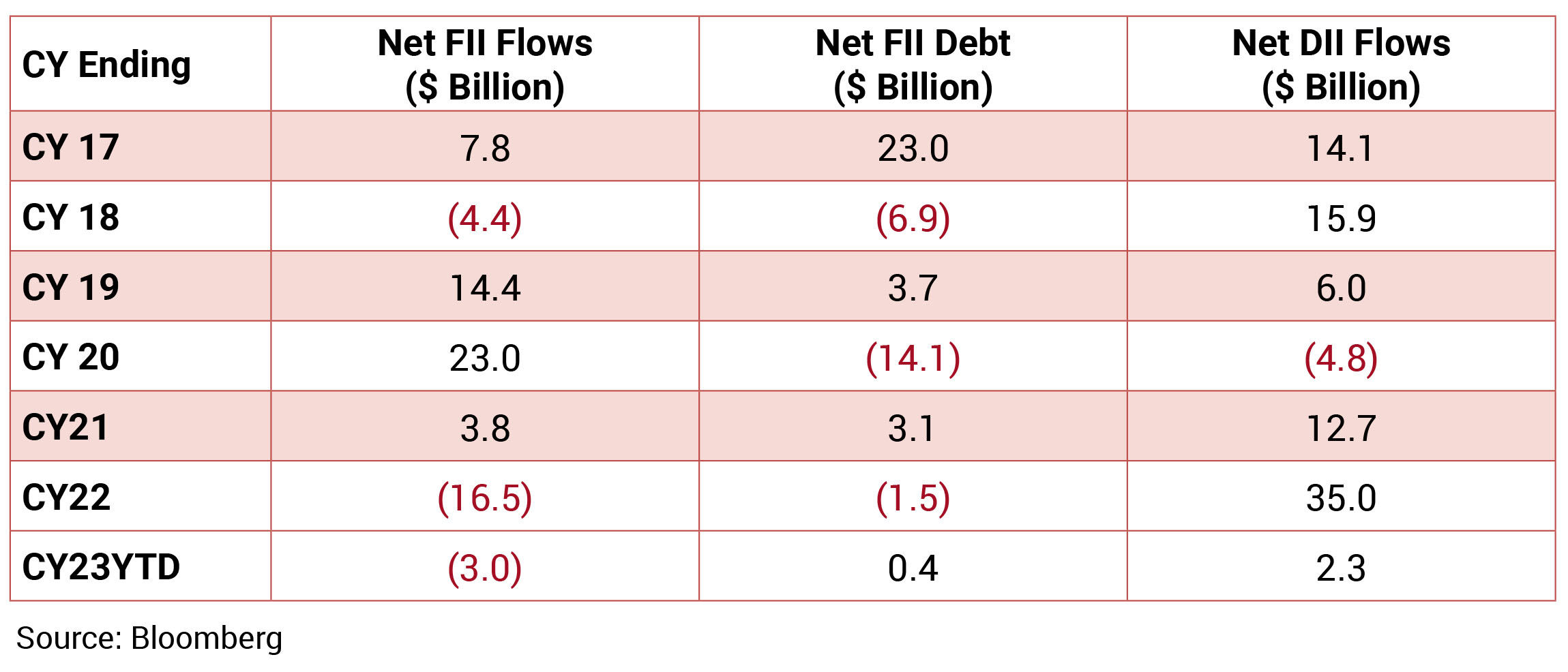

FIIs were net sellers in the month of January 2023 to the tune of USD 3.7bn and DIIs bought to the tune of USD 4.0bn.

FIIs were net sellers in the month of January 2023 to the tune of USD 3.7bn and DIIs bought to the tune of USD 4.0bn.