The month of January is when the budget starts entering the discussions and conversations of market participants. Typically, there is some apprehension on taking a significant short or long position with respect to duration ahead of the budget due to the possible volatility on budget day.

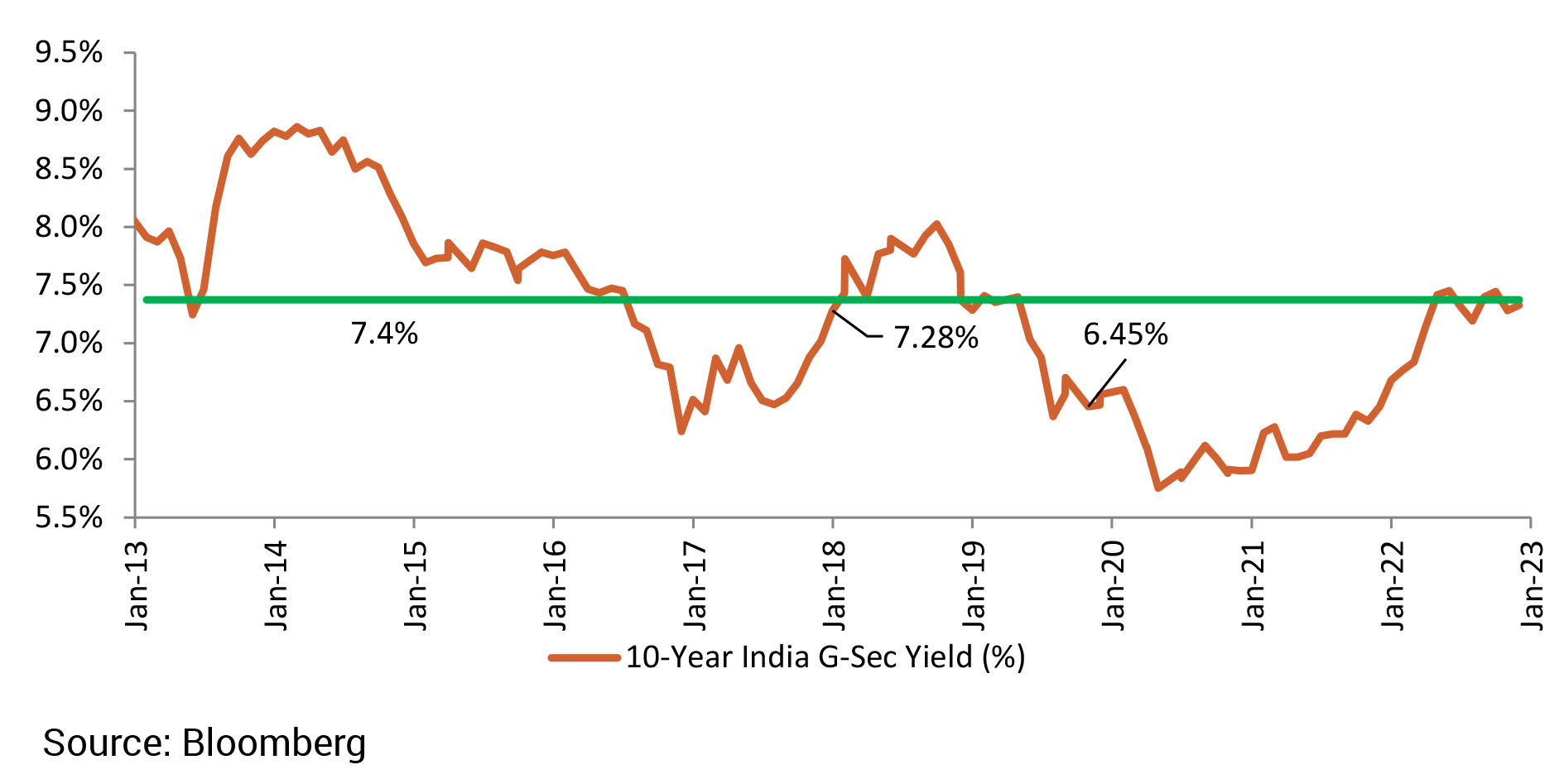

As such, we saw yields in the month of January largely range-bound with the yield moving up by only 1bp m-o-m from 7.33% to 7.34%. The numbers in the budget with respect to fiscal deficit and borrowing are slightly better than expectations and this has led to a softening of yields post-Budget.

In the events to watch out for, the actions of major global central banks such as US Fed, BoE and ECB will have some bearing on global yields with some spillover impact on domestic yields as well.