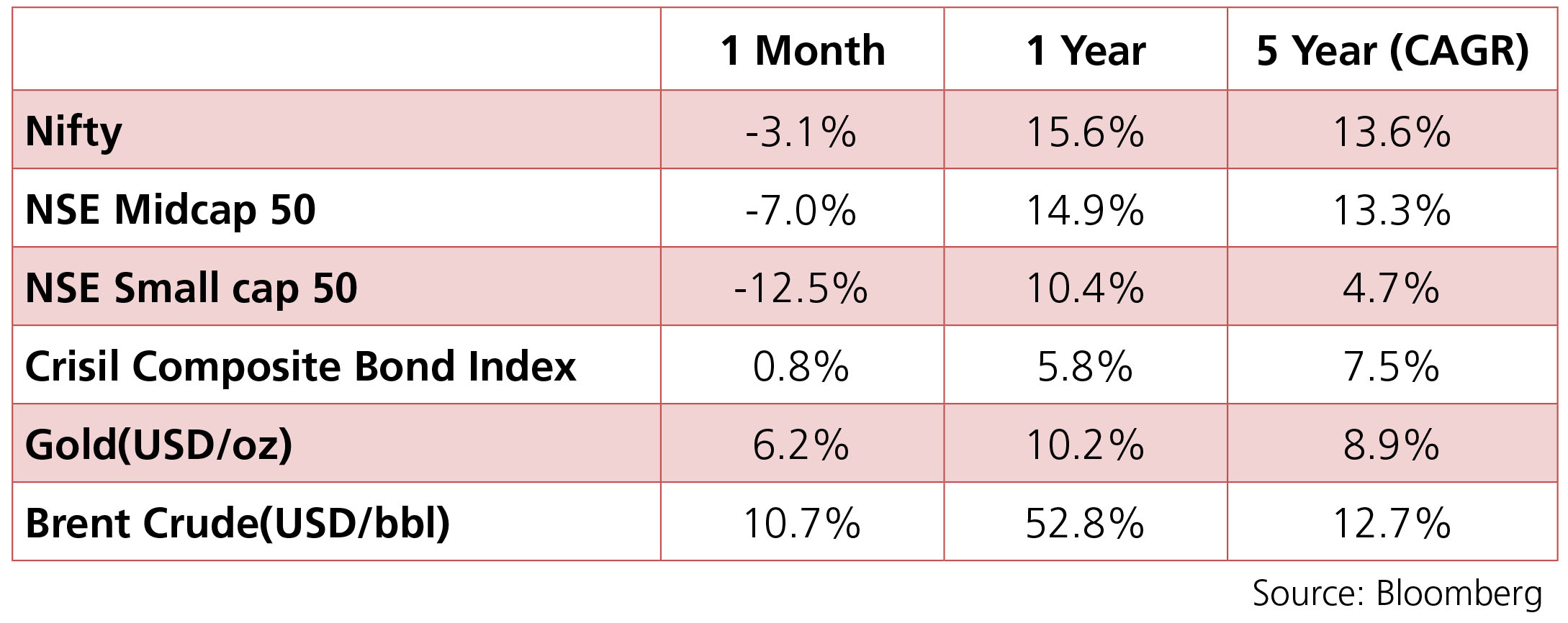

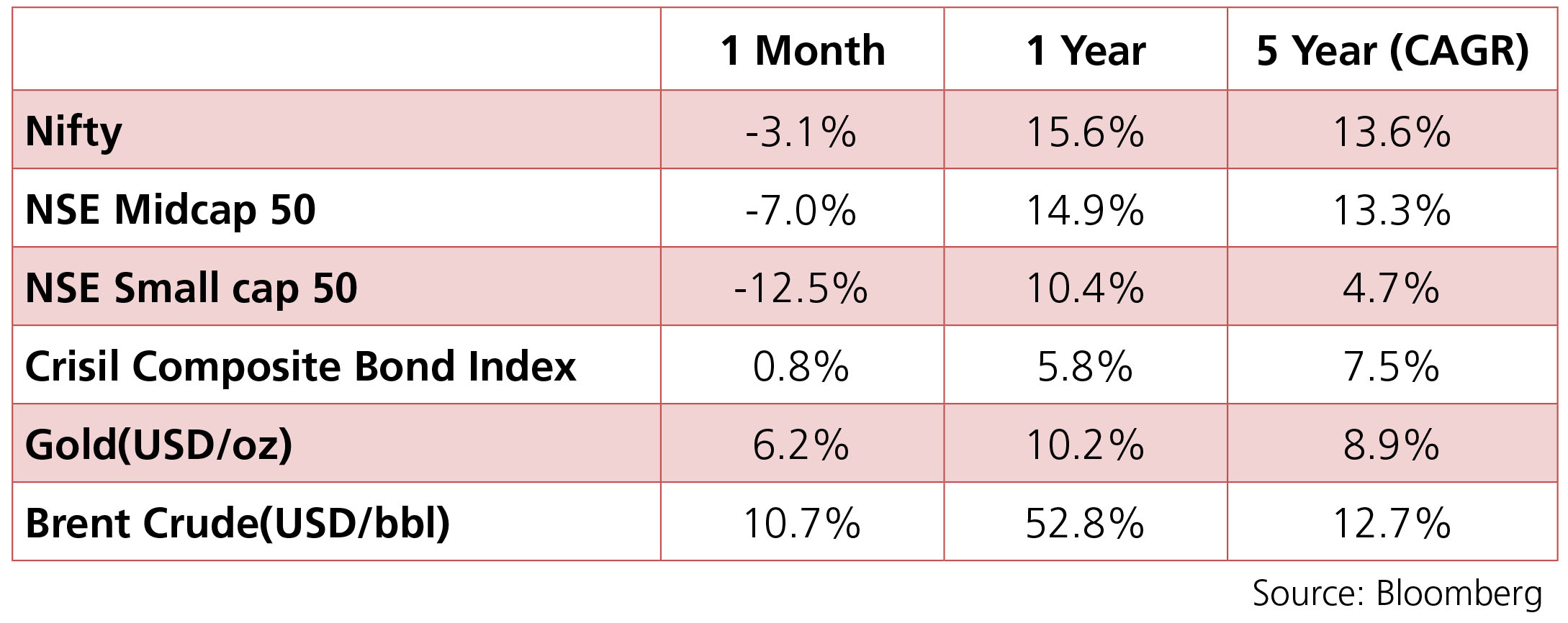

Month Gone By – Markets (period ended February 28, 2022)

February was an eventful month starting with the Union Budget, followed by MPC meet and then

the focus shifting to geo-politics with the conflict between Russia and Ukraine. The Nifty index closed

3.0% lower for the month as Metals turned out to be the only sector in the green while Realty and

Cement were the key laggards. The INR averaged about 75 against the USD over the month holding

up well amidst global volatility to trade in a tight range. Yields on the 10y benchmark traded in a

range of 6.66%-6.89% and eventually ended the month 9bps higher at 6.77%. The 10y benchmark

averaged 6.75% over the month of February.

The Union Budget surprised markets as Govt. of India printed a fiscal deficit of 6.9% (vs expectation of 6.5%) for FY22 and 6.4% for FY23 (vs expectation of 6%). The fiscal deficit numbers translate into massive borrowing numbers for the upcoming fiscal FY23 as net borrowing stands at INR 11.18tn (vs exp of INR 9-9.25tn) while gross borrowing amounts to a massive INR 14.95tn (vs exp of INR 12- 12.25tn). On the monetary policy front. the RBI MPC’s decision too came as a surprise to markets as the commitee decided to keep key rates unchanged for now, citing concerns on growth, and emphasizing the need to keep monetary policy accommodative for as long as necessary, to support growth. The decision was contrary to market expectations which were bent towards a hike of at least 20 bps in the Reverse Repo rate to effectively signal that the RBI had embarked on the path of policy normalisation. The RBI Governor went on to acknowledge that the future course of economic parameters is unpredictable due to the unknown elements related to the mutations of the virus.

The European Central Bank (ECB) looks set to raise rates for the first time since 2011 later this year. At the February press conference, ECB President Lagarde threw into doubt the extended tapering timetable that had been outlined in December and refused to repeat her assertion that a 2022 rate hike was “extremely unlikely”. Over to the the Bank of England (BoE), the BoE Monetary Policy Committee (MPC) raised the base rate (Bank Rate) 25bps to 0.50% at its February meeting, and committed to the start of effective quantitative tightening (QT) via ending reinvestments of maturing bonds (the BoE also intends to unwind its corporate bond sales by end-2023).

In commodities, oil prices continued their momentum from previous month, gaining 10.7% in February. Brent crude averaged USD 96/bbl over the month. Gold prices ended the month 6.2% higher m-o-m benefitting from safe have demand

The Union Budget surprised markets as Govt. of India printed a fiscal deficit of 6.9% (vs expectation of 6.5%) for FY22 and 6.4% for FY23 (vs expectation of 6%). The fiscal deficit numbers translate into massive borrowing numbers for the upcoming fiscal FY23 as net borrowing stands at INR 11.18tn (vs exp of INR 9-9.25tn) while gross borrowing amounts to a massive INR 14.95tn (vs exp of INR 12- 12.25tn). On the monetary policy front. the RBI MPC’s decision too came as a surprise to markets as the commitee decided to keep key rates unchanged for now, citing concerns on growth, and emphasizing the need to keep monetary policy accommodative for as long as necessary, to support growth. The decision was contrary to market expectations which were bent towards a hike of at least 20 bps in the Reverse Repo rate to effectively signal that the RBI had embarked on the path of policy normalisation. The RBI Governor went on to acknowledge that the future course of economic parameters is unpredictable due to the unknown elements related to the mutations of the virus.

The European Central Bank (ECB) looks set to raise rates for the first time since 2011 later this year. At the February press conference, ECB President Lagarde threw into doubt the extended tapering timetable that had been outlined in December and refused to repeat her assertion that a 2022 rate hike was “extremely unlikely”. Over to the the Bank of England (BoE), the BoE Monetary Policy Committee (MPC) raised the base rate (Bank Rate) 25bps to 0.50% at its February meeting, and committed to the start of effective quantitative tightening (QT) via ending reinvestments of maturing bonds (the BoE also intends to unwind its corporate bond sales by end-2023).

In commodities, oil prices continued their momentum from previous month, gaining 10.7% in February. Brent crude averaged USD 96/bbl over the month. Gold prices ended the month 6.2% higher m-o-m benefitting from safe have demand

Source: Bloomberg

Source: Bloomberg

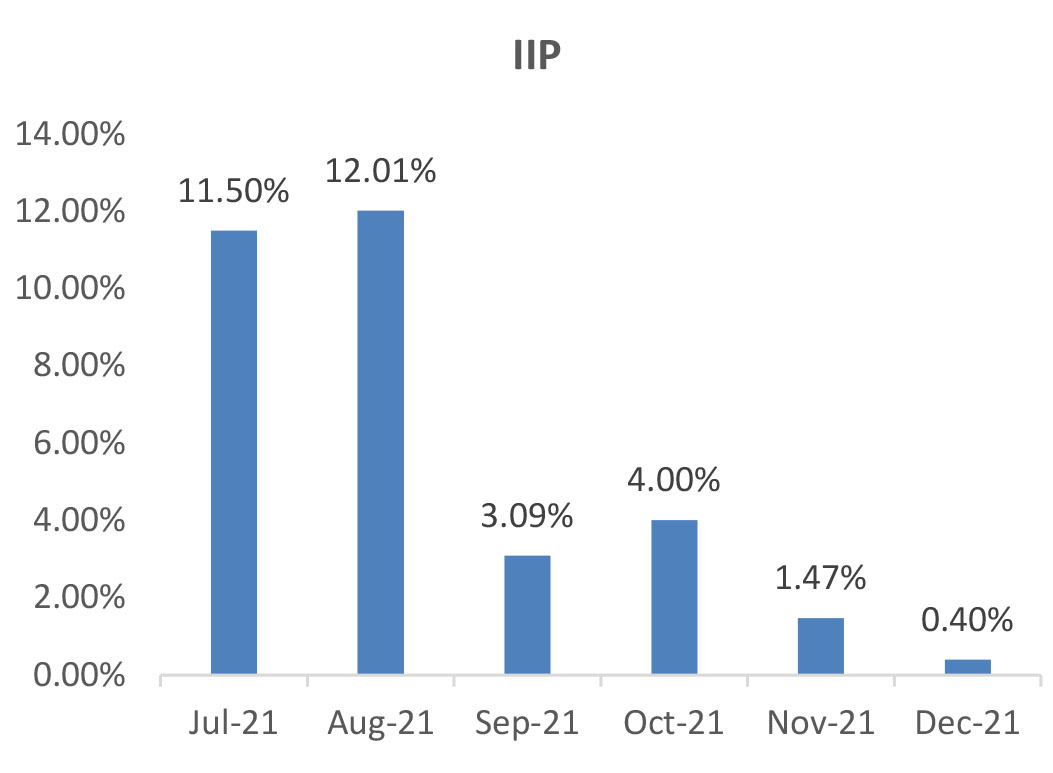

IIP: December IIP registered a growth of 0.4% yoy (November: 1.4%) led by a pickup in sequential

momentum of 7.5%. On a sectoral basis, manufacturing activity fell by 0.1% (November: 0.8%) while

electricity production increased 2.8% yoy (2.1%) and mining production increased 2.6% (4.9%). As

per the use-based classification, production of consumer durables, consumer non-durables, and capital

goods contracted over December 2020. When compared to December 2019, all categories registered

a positive growth except for capital goods. On a sequential basis, all segments registered positive

growth after declining last month, with consumer durables and capital goods production leading the

way with a 13.7% (November: (-)17.1%) and 10.7% (November: (-)8.1%) growth, respectively.

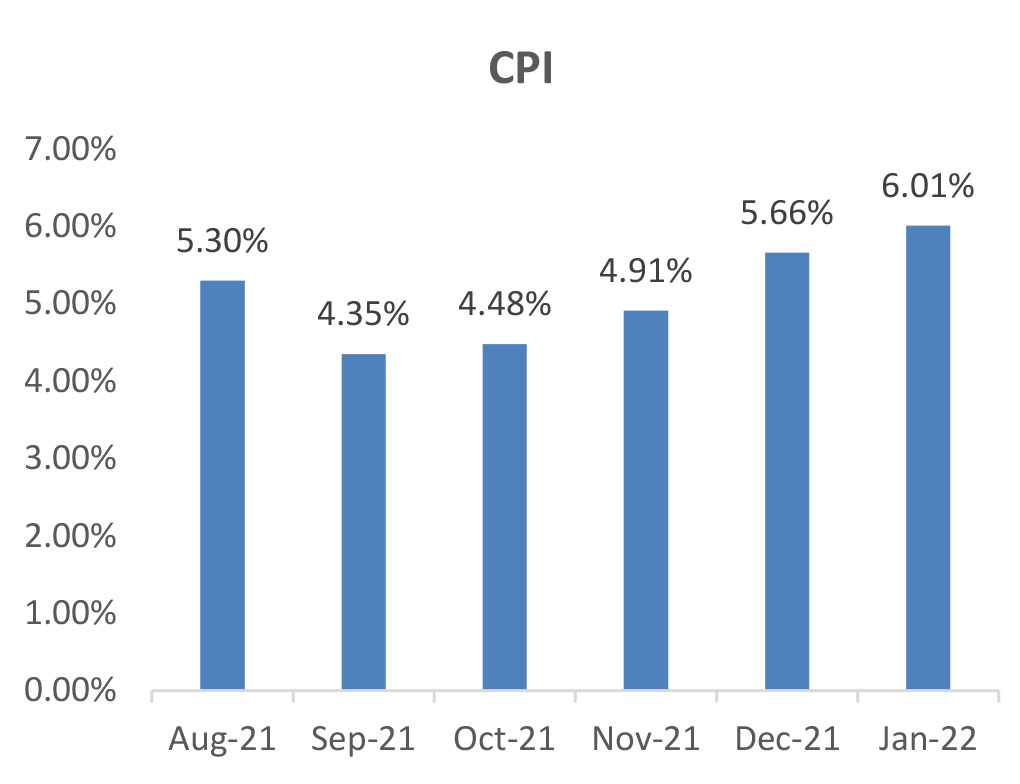

CPI: January CPI inflation rose to 6.01% (December: 5.66%) even as CPI fell by 0.3% mom led by 1.3% mom decline in food prices. Food inflation increased to 5.4% yoy (December: 4%) due to adverse base effects, though on a sequential basis prices of vegetables, oils and fats, fruits, and meat and fish declined. Core inflation (CPI excluding food, fuel, pan and tobacco) moderated by 10 bps to 6.2% but increased 0.4% mom (0.3% mom in December). A broad-based increase in prices continued across all categories primarily led by transport, clothing and footwear, and household goods. Additionally, there was a sequential increase of 1.6% in mobile charges on account of telecom tariff hikes.

Trade Deficit: Trade deficit continued to narrow gradually with January trade deficit at USD 17.4bn. However, trade deficit is likely to remain wide over next few quarters as crude prices remain elevated. Exports in January fell by 8.7% mom (25.3% growth yoy) to USD 34.5bn (December: USD 37.8bn). Non-oil exports also fell by 5% mom (19% growth yoy) at USD 30.3bn. However, exports remained above its pre-pandemic levels in January 2020, increasing by 34% with non-oil exports increasing by 34%; continuing their robust performance in FY2022. Imports in January declined by 12.7% mom to USD 51.9bn (December: USD 59.5bn). Oil imports declined by 29% mom to USD 11.4bn (December: USD 16.2bn). Non-oil imports decreased to USD 40.5bn (December: USD 43.3bn). Trade deficit is at USD 155bn in 10MFY22 (USD 74bn in 10MFY21 and USD 141bn in 10MFY20).

GDP: Real GDP in 3QFY22 grew 5.4% (Consensus: 5.9%) led by private consumption growth of 7% (10.2% in 2QFY22). Government consumption grew 3.4% (9.3% in 2QFY22), and investments (GFCF) grew 2% (14.6% in 2QFY22). The NSO revised FY2022E GDP growth estimate to 8.9% compared to 9.2% in first advance estimate, mostly due to changes in base. Real GVA in 3QFY22 grew 4.7% (Consensus: 5.7%). GVA growth was supported by services sector growth at 8.2% (2QFY22: 10.2%) led by growth of 16.8% in public admin, defense, etc. and growth of 6.1% in trade, hotel, transport, etc. segments. Agriculture and allied sectors’ growth was at 2.6% (2QFY22: 3.7%) while industry segment’s growth dropped sharply to 0.2% (2QFY22: 7%). The NSO revised FY2022E GVA growth estimate to 8.3% (8.6% in first advance estimate).

Fiscal deficit: The fiscal deficit stood at 58.9% of the Revised Estimates, as compared to 66.8% in the same period last year. In absolute terms, the fiscal deficit was at INR 9,37,868crore at the end of January. The main contributors to the lower fiscal deficit were higher net tax revenues at 87.7% of RE vs 82% in the corresponding period previous year and non-tax revenues at 92.9% vs 67% in the same period last year. At the same time, total expenditure was marginally lower at 74.5% for the period vs 73% in the same period last year.

CPI: January CPI inflation rose to 6.01% (December: 5.66%) even as CPI fell by 0.3% mom led by 1.3% mom decline in food prices. Food inflation increased to 5.4% yoy (December: 4%) due to adverse base effects, though on a sequential basis prices of vegetables, oils and fats, fruits, and meat and fish declined. Core inflation (CPI excluding food, fuel, pan and tobacco) moderated by 10 bps to 6.2% but increased 0.4% mom (0.3% mom in December). A broad-based increase in prices continued across all categories primarily led by transport, clothing and footwear, and household goods. Additionally, there was a sequential increase of 1.6% in mobile charges on account of telecom tariff hikes.

Trade Deficit: Trade deficit continued to narrow gradually with January trade deficit at USD 17.4bn. However, trade deficit is likely to remain wide over next few quarters as crude prices remain elevated. Exports in January fell by 8.7% mom (25.3% growth yoy) to USD 34.5bn (December: USD 37.8bn). Non-oil exports also fell by 5% mom (19% growth yoy) at USD 30.3bn. However, exports remained above its pre-pandemic levels in January 2020, increasing by 34% with non-oil exports increasing by 34%; continuing their robust performance in FY2022. Imports in January declined by 12.7% mom to USD 51.9bn (December: USD 59.5bn). Oil imports declined by 29% mom to USD 11.4bn (December: USD 16.2bn). Non-oil imports decreased to USD 40.5bn (December: USD 43.3bn). Trade deficit is at USD 155bn in 10MFY22 (USD 74bn in 10MFY21 and USD 141bn in 10MFY20).

GDP: Real GDP in 3QFY22 grew 5.4% (Consensus: 5.9%) led by private consumption growth of 7% (10.2% in 2QFY22). Government consumption grew 3.4% (9.3% in 2QFY22), and investments (GFCF) grew 2% (14.6% in 2QFY22). The NSO revised FY2022E GDP growth estimate to 8.9% compared to 9.2% in first advance estimate, mostly due to changes in base. Real GVA in 3QFY22 grew 4.7% (Consensus: 5.7%). GVA growth was supported by services sector growth at 8.2% (2QFY22: 10.2%) led by growth of 16.8% in public admin, defense, etc. and growth of 6.1% in trade, hotel, transport, etc. segments. Agriculture and allied sectors’ growth was at 2.6% (2QFY22: 3.7%) while industry segment’s growth dropped sharply to 0.2% (2QFY22: 7%). The NSO revised FY2022E GVA growth estimate to 8.3% (8.6% in first advance estimate).

Fiscal deficit: The fiscal deficit stood at 58.9% of the Revised Estimates, as compared to 66.8% in the same period last year. In absolute terms, the fiscal deficit was at INR 9,37,868crore at the end of January. The main contributors to the lower fiscal deficit were higher net tax revenues at 87.7% of RE vs 82% in the corresponding period previous year and non-tax revenues at 92.9% vs 67% in the same period last year. At the same time, total expenditure was marginally lower at 74.5% for the period vs 73% in the same period last year.

Deal flow picked up in February with 12 deals worth ~USD1.48bn executed (vs 13 deals worth ~USD

0.54bn in Jan). Key deals included IPO of Vedant Fashions (USD 419mn), Adani Wilmar (USD 483mn).

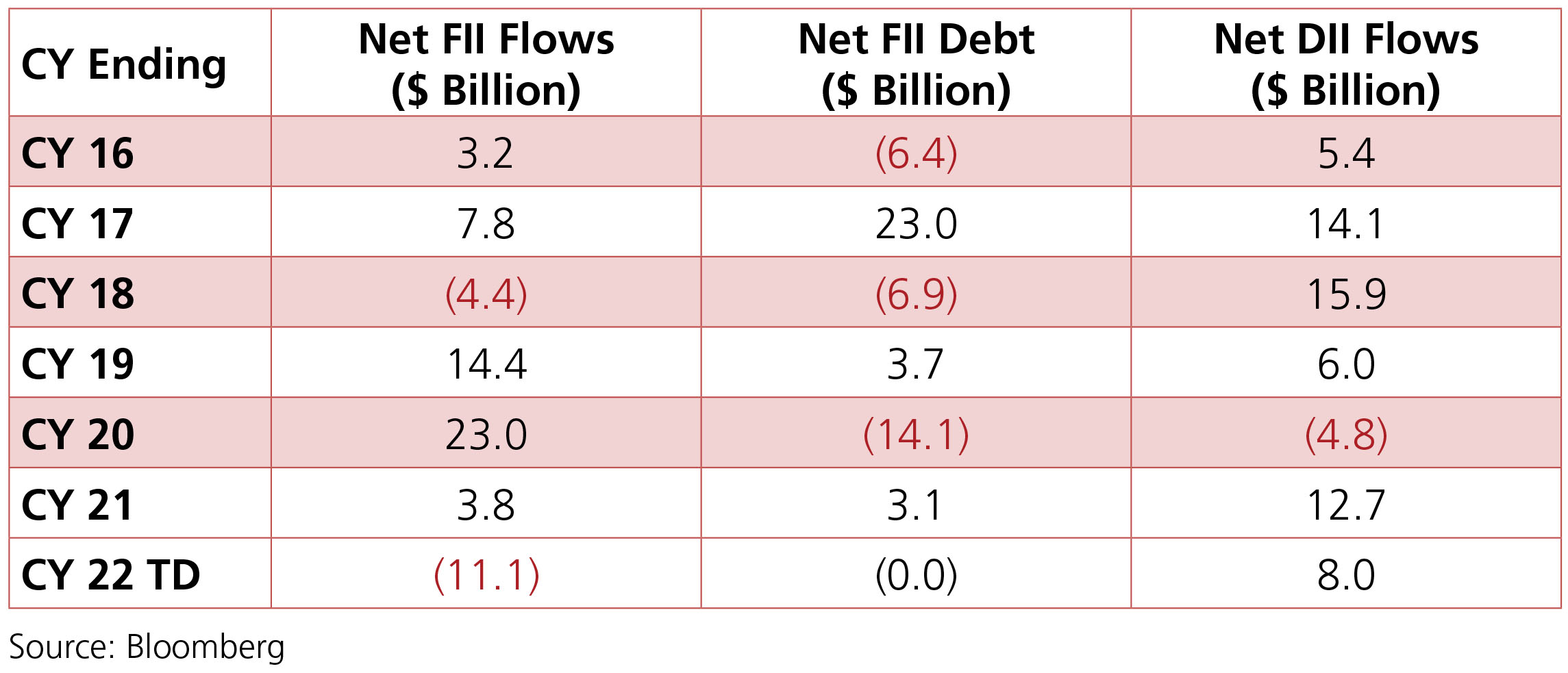

FIIs continued being net sellers in the month of February 2022 and were net sellers to the tune of –USD 5.0bn even as DII buying continued +USD 5.6bn, driven by both MFs +USD 1.4bn and Insurance +USD 4.2bn

FIIs continued being net sellers in the month of February 2022 and were net sellers to the tune of –USD 5.0bn even as DII buying continued +USD 5.6bn, driven by both MFs +USD 1.4bn and Insurance +USD 4.2bn