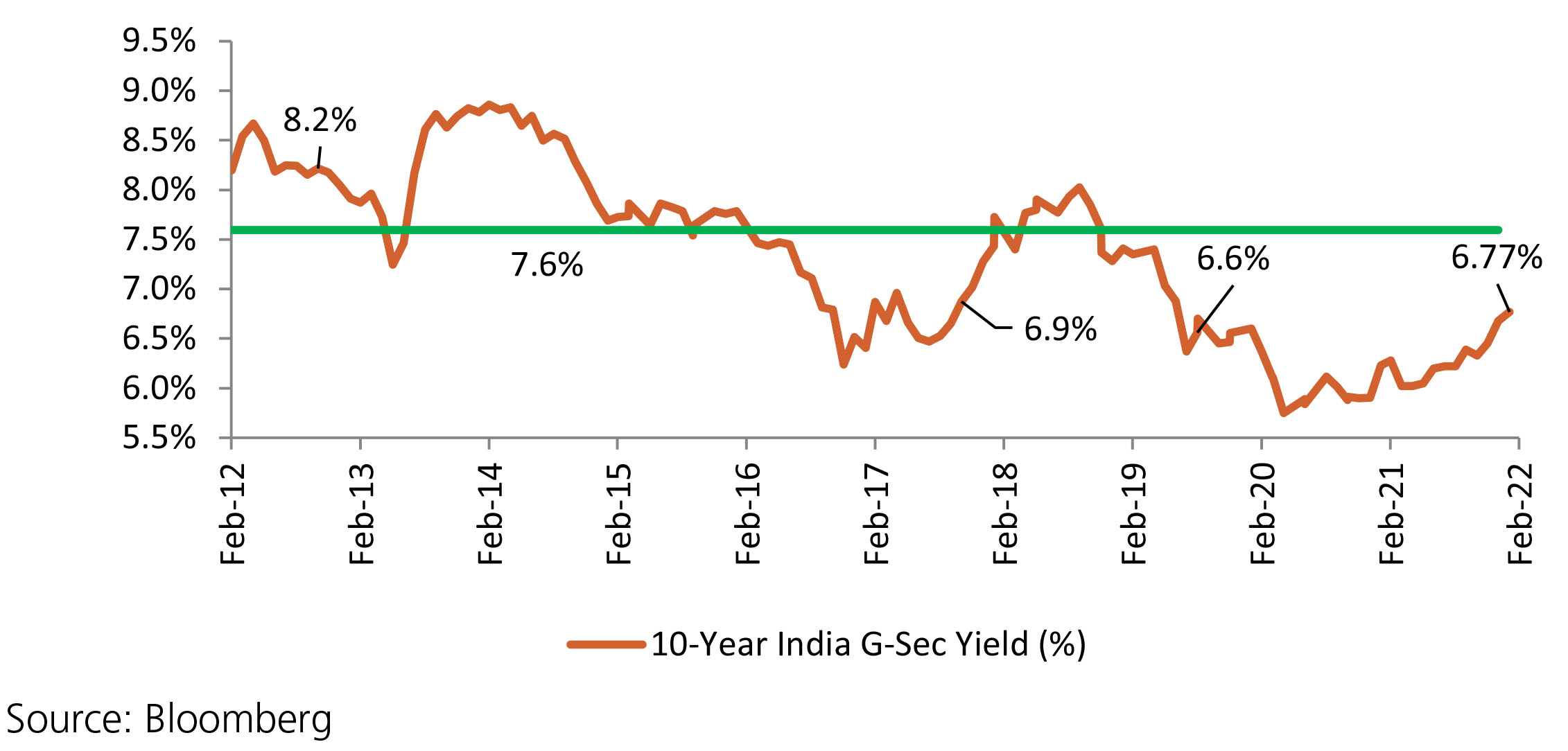

Beginning of the month witnessed sharp surge of nearly 20-25 bps from 6.68% in end-Jan to 6.81%- 6.87% in mid-February largely due to the announcements made in the Union Budget which turned out to be unfavorable for the bond market. The Union Budget brought in a heavy shock for the bond market as the market borrowing announced for FY23, was significantly higher than the market expectations. Thus, following the budget announcements, yields hardened and the 10Y benchmark paper traded at a high of 6.87% during the intra-day trades. Later on, bonds traded on a bullish note largely due to two main factors, first, cancellation of weekly G-Sec auction and second, RBI’s decision to keep the Reverse Repo rate unchanged at 3.35%. The decision to cancel the weekly G-Sec auction was taken after assessing the Government’s cash balance position, which has been in huge surplus for the entire year. The decision came in as a pleasant surprise for the market after the massive borrowing programme for FY23 that was announced in the Union Budget. Post MPC, markets rallied up to 8bps and yield were trading at 6.71%. Towards the end of the month, yields remained under pressure throughout the week as geo-political tensions mounted on the global front. Crude oil prices traded within the range of ~$100-105/bbl weighing on the market sentiment. In addition to these global headwinds, the government also revised the T-bill calendar up by ~ INR 600bn which should affect short-term yields negatively. Sentiment continued to remain weak as after two successive cancellations the markets were expecting the government to cancel remaining G-sec auctions for FY22. Yields closed the month of February at 6.77%. Going ahead yields are likely to remain under pressure due to geo-political tension, global interest rate hike scenario, higher crude oil prices and inflation.