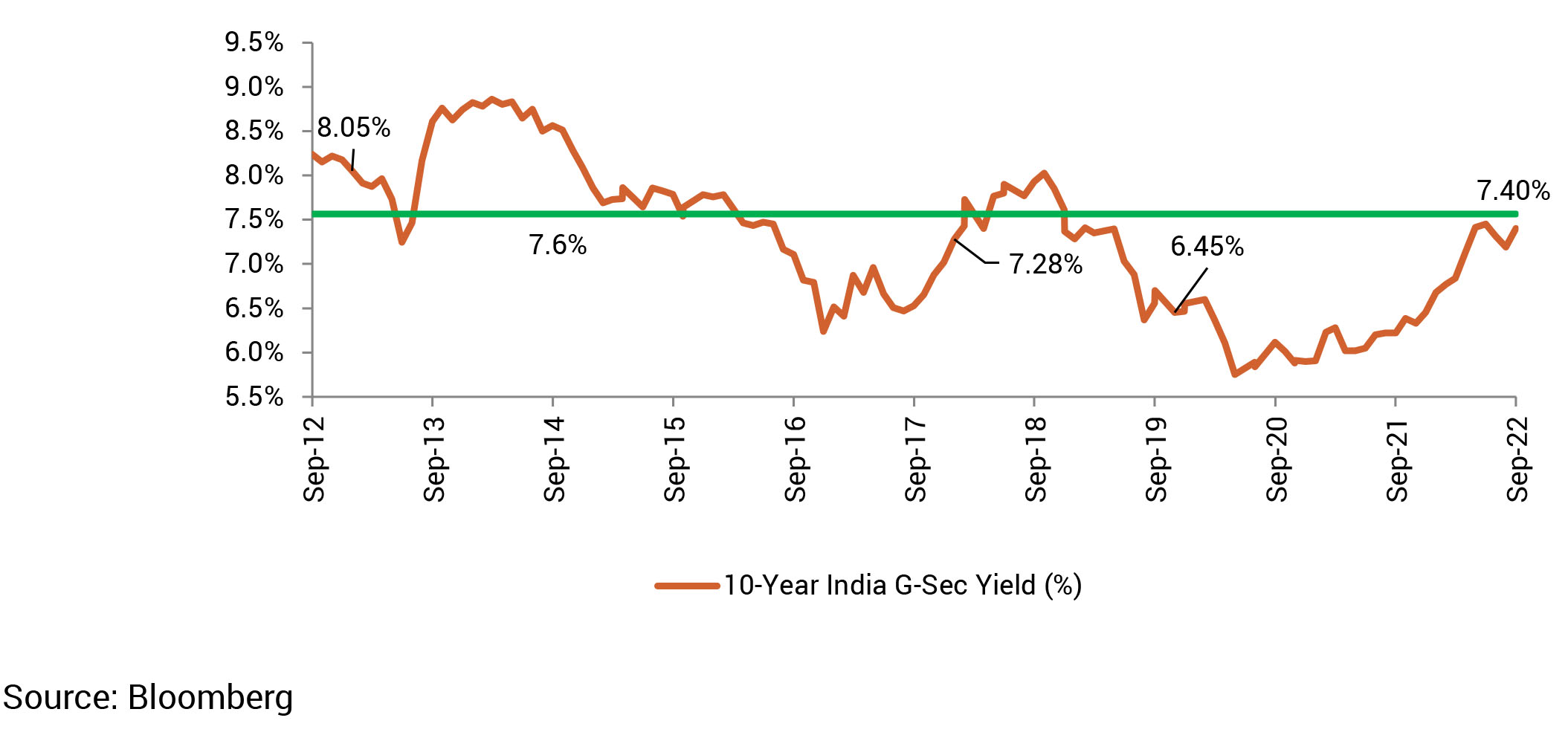

Movement in domestic market yields has been largely influenced by the seasonal flavour of index inclusion. The prospect of possible index inclusion provided strong support to domestic yields and to a large extent insulated them from the global volatilities. However, hopeful market participants have been left disappointed till now and the prospect of inclusion in this year appears incrementally fainter. This uncertainty has been weighing on yields.

On the global front, central banks continued with the hawkish rhetoric led by the US Fed. The Fed hiked policy rates by 75bps as it clearly spelt out that it is squarely focussed on bringing down inflation on a durable basis even if it means sacrificing growth and cooling the labour market. The firmly hawkish stance of the Fed has put immense pressure on global yields and currencies including the INR.

On the domestic front too, the RBI hiked policy rates by 50bps as it kept up its vigil on inflation and also help prop up the INR. The action of the RBI had been broadly anticipated by the market. Going forward, yields can be expected to trend lower as global narrative may turn soft with incremental macroeconomic data weakening. Sources of upside risks emanate from prolonged hawkish stance of Fed, adverse action of the OPEC+, and escalation of geopolitical conflicts.