Unit Linked Insurance Plans (ULIPs) have gained significant popularity in recent years as one of the best tax-saving instruments in India. ULIPs not only provide a dual benefit of insurance coverage and investment returns but also offer ULIP tax benefits to the policyholders.

ULIPs are structured in a way that allows investors to invest in a combination of equity and debt funds while also providing life insurance coverage. ULIPs have become a preferred investment option for individuals looking to save taxes and maximize returns on their investments. In this article, we will explore why ULIPs are considered one of the best tax-saving instruments and how they can help individuals achieve their long-term financial goals.

What is ULIP?

A Unit Linked Insurance Plan, more commonly known as a ULIP, is a life insurance product. Compared to traditional life insurance tools, such as term insurance plans that offer only life insurance protection, or high-risk investment avenues like mutual funds that provide only the opportunity to create wealth, ULIP is a market-linked plan that offers the opportunity for wealth creation along with insurance and superior tax-benefits.

Moreover, ULIP is a life insurance product that can be considered more reliable. It is one of the best wealth-creation tools for long-term investment, given the benefits of ULIP taxation, protection & security, and the returns all in one insurance product. Not only that, it gives you options to invest while offering the benefit of life insurance. But, the ULIP tax benefits are a key feature, which makes it a special one.

Among various investor-friendly features that ULIPs offer, a very interesting and unique proposition is the ability to invest a portion of the policy premium in a debt-equity mix that, too, in varying amounts. This enables the policyholder to make inter-fund transfers through the ULIPs fund switching capability without additional ULIP tax liabilities. This means that you can invest your money into debts or equities in any proportion you wish to and then manipulate the investment amount using the ULIPs switch feature.

Also Read: What is ULIP?

How Does ULIP Work?

When an individual purchases a ULIP, they need to choose the amount of premium they wish to pay and the type of fund they want to invest in. The premium paid towards a ULIP is divided into two parts- one part goes towards providing life insurance coverage, and the other part goes towards investment. The investment component of the premium is invested in the chosen fund(s) as per the policyholder’s investment objective.

Choose a suitable fund type

- In ULIPs, the policyholder has the option to choose from different types of funds, such as equity, debt, and hybrid funds.

- The investment objective of each fund differs, and therefore, the returns also vary. Equity funds invest primarily in stocks and have a high-risk, high-return profile, while debt funds invest in fixed-income instruments and have a lower risk and lower returns. Hybrid funds, on the other hand, invest in a mix of equity and debt instruments and offer a balanced risk-return profile.

Calculate the unit of the fund

- The investment returns earned by the fund(s) are credited to the policyholder’s account, which is linked to the value of the investment. This is known as the unit of the fund.

- The value of the units is calculated based on the Net Asset Value (NAV) of the fund. The NAV is the value of the total assets of the fund divided by the total number of units. As the value of the units changes, the value of the policyholder’s investment also changes.

Also Read: What is NAV in ULIP?

Avail Insurance Benefits

- In addition to the investment component, a ULIP also provides life insurance coverage.

- The life insurance coverage amount is determined based on the premium paid and the age and health condition of the policyholder.

- In case of the policyholder’s untimely death, the insurance coverage amount is paid out to the nominee.

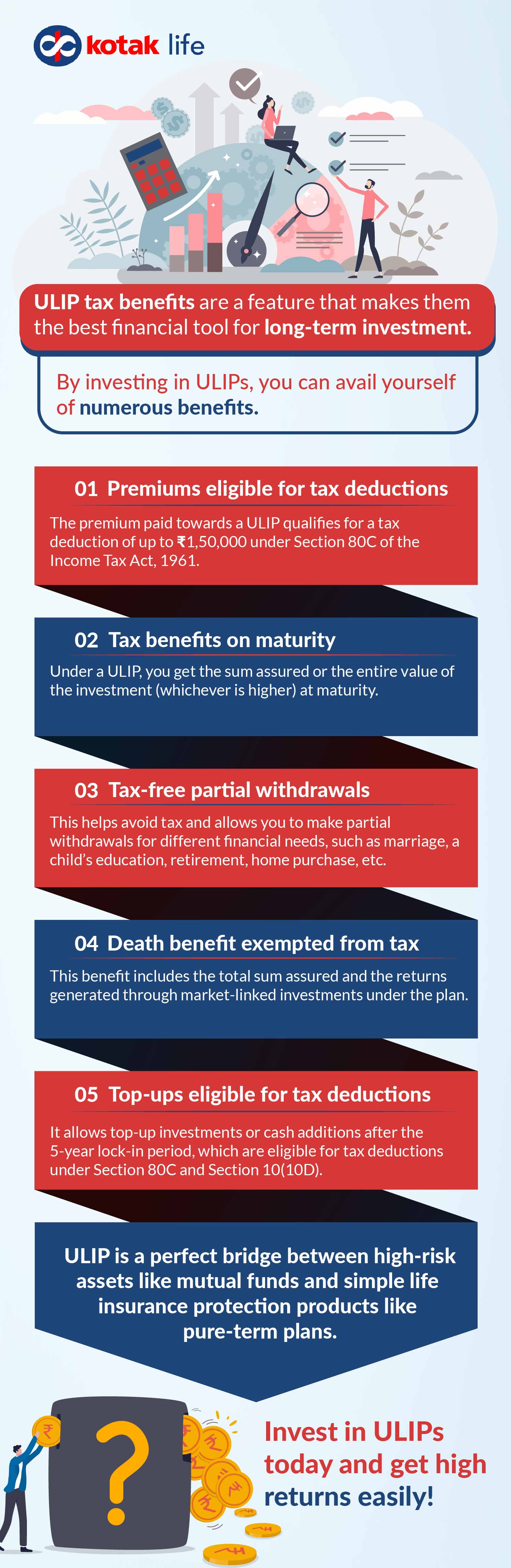

9 Tax Benefits of ULIPs

ULIP benefits range from deductions on premium payments to tax-free withdrawals at maturity. Understanding these benefits can help investors make informed decisions about their investment choices and maximize their tax savings. Whether you are a first-time investor or a seasoned one, the tax advantages of ULIPs are valuable insights and can help you achieve your financial goals.

The Premiums Paid Towards a ULIP Are Eligible for Tax Deductions

The premium paid towards a ULIP qualifies for a tax deduction of up to ₹1,50,000 under Section 80C of the Income Tax Act, 1961. However, this deduction is applicable only if the premium is less than 10% of the sum assured of the plan. For premiums beyond 10%, the deduction amount is still capped at 10%.

So, for instance, if the premium you pay under a policy is ₹3,00,000 for a sum assured of ₹15,00,000, the deduction amount will be limited to ₹1,50,000. Additionally, you must note that, as there is a lock-in period of 5 years on ULIP policies, you will be directly saving taxes through ULIP tax exemption benefits.

ULIP Offers Tax Benefits on Maturity

Maturity refers to completing your policy. Under a ULIP, you get the sum assured or the entire value of the unit-linked investments (whichever is higher) at maturity. This payout is exempted from tax under Section 10(10D) of the Income Tax Act, 1961. The premium amount must be limited to 10% of the sum assured value.

You Can Make Tax-Free Partial Withdrawals Under a ULIP

You can make tax-free partial withdrawals after completing the mandatory lock-in period of 5 years of your ULIP. However, the withdrawal amount cannot exceed 20% of the total sum assured value. This helps avoid tax and allows you to make partial withdrawals for different financial needs, such as marriage, a child’s education, retirement, home purchase, etc. Hence, you have the freedom to withdraw funds from time to time.

The Death Benefit Payable Under a ULIP is Exempt from Tax

The death benefit of a ULIP that is payable to your nominee/family members is not taxable. This benefit includes the total sum assured and the returns generated through market-linked investments under the plan.

Any Top-Ups Made Under an Existing ULIP Plan are Eligible for Tax Deductions

With a ULIP, you can make top-up investments or cash additions after the 5-year lock-in period. These top-ups are eligible for tax deductions under Section 80C and Section 10(10) D of the Income Tax Act, 1961. However, the premium amount must not exceed 10% of the sum assured.

Long-Term Tax Benefits

The management of traditional fleets is changing due to the science and study of fleet management. The influence of fleet management is being increased by the convergence of networks, connected devices, and big data that results from this process.

ULIP Offers Investment, Life Cover and Other Tax Benefits Under a Single Plan

Compared to mutual funds, PPFs, and other standard insurance plans, unit-linked insurance plans provide several advantages. Although it provides life insurance, it does not assist in wealth creation. Mutual funds, on the other hand, give you good returns but no insurance. ULIP plans, however, provide a bridge and an additional benefit of tax savings.

Tax Benefits on Switching Between Funds

ULIPs offer the option to switch between different funds based on market conditions or the policyholder’s investment goals. The switching between funds in ULIPs is tax-free and does not attract any tax liability.

Tax Benefits for NRI Investors

Non-Resident Indians (NRIs) can also avail of the ULIP tax benefits. The premium paid by NRIs towards ULIPs is eligible for tax deduction under Section 80C of the Income Tax Act, 1961. The maturity proceeds of ULIPs are also tax-free for NRIs.

Conclusion

ULIP is a perfect bridge between high-risk assets like mutual funds and simple life insurance protection products like pure-term plans. It gives you high returns, life coverage, and the ULIP tax benefit. Moreover, ULIP is a highly flexible modern insurance plan where you control your investment and funds. You are free to invest in the market as per your risk appetite and, at the same time, have insurance security. Additionally, the ULIPs tax benefits are something that, as an investor, you cannot ignore.

However, you must ensure that you have analyzed your long-term financial goals and invested accordingly into ULIP. Also, you must understand that the longer you stay invested in ULIP, the higher returns you get. So if you are planning to save for a house, say 15 years from now, you must start investing in ULIP now.

Key takeaways

- The premium paid towards a ULIP qualifies for a tax deduction of up to ₹1,50,000 under Section 80C of the Income Tax Act, 1961.

- You can make tax-free partial withdrawals after completing the mandatory lock-in period of 5 years of your ULIP.

- The death benefit of a ULIP that is payable to your nominee/family members is not taxable.

- ULIPs offer the option to switch between different funds based on market conditions or the policyholder’s investment goals.

FAQs

1

What is a ULIP, and how does it help in tax-saving?

A ULIP (Unit Linked Insurance Plan) is a type of insurance policy that offers both insurance coverage and investment opportunities. It allows investors to invest in various fund options while also providing life insurance coverage. ULIPs help in tax-saving as the premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act, up to a limit of ₹ 1.5 lakh per year.

2

How do ULIPs compare to other tax-saving instruments like PPF, NSC, and ELSS?

ULIPs have an advantage over other tax-saving instruments like PPF (Public Provident Fund), NSC (National Savings Certificate), and ELSS (Equity-Linked Savings Scheme) as they offer both life insurance coverage and investment opportunities. Additionally, ULIPs have the potential to generate higher returns than other instruments over the long-term, depending on the market conditions and the fund option chosen by the investor.

3

Are ULIPs a risky investment?

Like any investment, ULIPs carry a certain amount of risk. However, ULIPs offer investors the flexibility to switch between different fund options depending on their risk appetite and market conditions. Also, ULIPs typically have a lock-in period of 5 years, which helps in achieving long-term financial goals.

4

How do ULIPs provide tax benefits?

ULIPs provide tax benefits in two ways: (i) the premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act, and (ii) the maturity proceeds or death benefits received from the policy are tax-free under Section 10(10D) of the Income Tax Act, subject to certain conditions.

5

Can I withdraw my investment in ULIPs before the maturity period?

Yes, ULIPs offer partial withdrawal options after the completion of the lock-in period of 5 years. However, premature withdrawal before the completion of the lock-in period attracts penalties and may result in the loss of benefits. It is important to understand the terms and conditions of the policy before investing in a ULIP.