Investing wisely is crucial to protect yourself financially and accomplish long-term goals. However, there are two essential components to remember when things are constantly changing: protection and timely savings. When planning your finances, you can find a lot of choices on the market that focus on these two parts of your finances separately.

Key takeaways

- ULIPs are financial products that combine life insurance coverage with investment opportunities.

- They offer a range of benefits, including life insurance protection, potential market-linked returns, flexibility in fund choices, tax benefits, goal-based savings, and partial withdrawal options.

- When choosing a ULIP, it is essential to consider factors such as financial goals, risk appetite, charges, and the insurance provider’s reputation.

- ULIPs allocate a portion of the premium toward insurance coverage and the remaining amount towards investment funds. The returns are linked to the performance of the underlying investments.

- It is crucial to consider your investment goals and risk tolerance to find the right fund and maximize returns on ULIPs.

Fortunately, there is a savings opportunity that comes with the added benefit of life insurance protection and capital growth: ULIP. Unit Linked Insurance Plans (ULIPs) offer a unique combination of insurance and investment that enables people to benefit from both.

Read on to learn more about ULIPs, understand their benefits, debunk common myths, explore ways to maximize returns, learn tips for choosing the best ULIP, and unravel the workings of a ULIP.

ULIP Meaning and Need

ULIP full form stands for Unit Linked Insurance Plan, with “Unit” referring to the individual units or shares and “Linked” indicating the association of these units with various investment options. As the name suggests, a ULIP is an insurance-cum-investment plan that provides policyholders with the dual benefits of life insurance coverage and investment opportunities. A ULIP is designed to offer investors the flexibility to choose from a range of investment funds, such as equity, debt, or balanced funds, based on their risk desire and financial goals.

In simpler terms, a ULIP policy means a life insurance plan that invests your money over a longer period to build wealth for the future. ULIPs are becoming increasingly popular due to fund options that allow consistent returns, considerably low levels of risks, or both.

Promising insurance providers, banks, and financial institutions in India offer these plans, giving policy buyers a range of options to choose from. As a result, your money is guaranteed to earn good returns during the entire vesting time, along with life insurance protection for your near and dear ones.

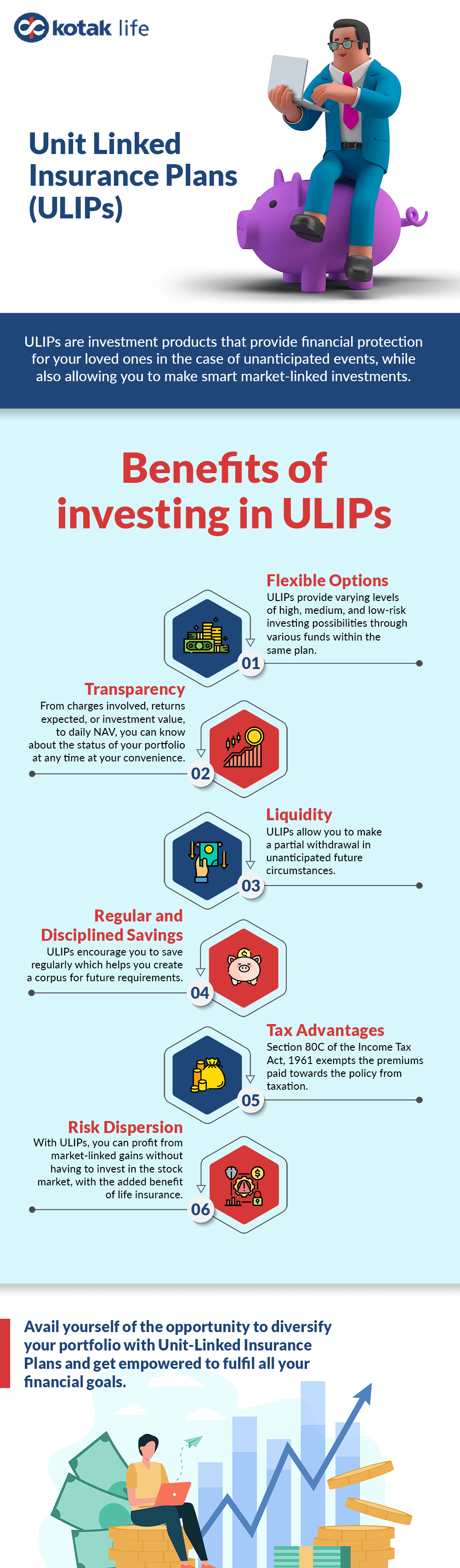

Benefits of Investing in ULIPs

ULIP plan is a one-time investment plan with tax benefits. But, in addition to tax benefits, it also has several other benefits that make the idea of investing in ULIPs a lucrative option. Let us look into some key advantages of this plan:

Flexibility and Customization

ULIPs provide investors with the freedom to switch between different investment funds based on their changing financial needs and market conditions. This flexibility lets investors align their investment plans with their risk tolerance and investment horizon.

Tax Benefits

ULIPs offer tax benefits under the provisions of the Income Tax Act 1961. The premiums paid towards the plan are eligible for tax deductions under Section 80C, subject to certain limits. Additionally, the maturity proceeds and death benefits received from are exempt from tax under Section 10(10D) of the Income Tax Act.

Market-Linked Returns

ULIPs offer the potential for market-linked returns. The investment component lets you invest in different funds. These funds invest in a diversified portfolio of stocks, bonds, or other market tools, providing a chance to earn returns based on the performance of the underlying assets.

Life Insurance Coverage

Along with the investment benefits, ULIPs also offer life insurance coverage. This ensures that in the unfortunate event of the policyholder’s demise during the policy term, the nominee receives the sum assured, providing financial security to the family.

Goal-Based Savings

ULIPs are a valuable tool for saving with goals in mind. Whether you are planning for your child’s education, buying a house, or building a retirement corpus, ULIPs provide a disciplined approach to saving and investing. They promote consistent savings and potential long-term wealth accumulation.

Partial Withdrawals

ULIPs offer the flexibility of partial withdrawals after the completion of the lock-in period, typically five years. This feature allows you to access funds in case of financial emergencies or to meet specific financial goals. Making partial withdrawals provides liquidity and offers greater control over your investments.

How to Maximize Returns from a ULIP?

Maximizing returns is essential, but it should be balanced with your risk tolerance and financial goals. It is vital to consider the charges, terms and conditions, and investment horizon of the ULIP before implementing any strategies. You can aim to maximize the potential returns from your investment by following the given strategies:

Start Early and Choose the Right Fund

Start investing early to allow your money to grow and provide enhanced returns. Assess your risk tolerance and goals to determine the right fund for your ULIP. Generally, equity funds have higher growth potential but come with higher risk, while debt funds offer stability but lower returns. Consider diversifying your investments across funds to balance risk and returns.

Stay Invested for the Long Term

ULIPs work best when held for the long term. Investors can profit from the power of compounding and sustain short-term market fluctuations by staying invested throughout the policy tenure.

Regularly Monitor and Review

It is essential to regularly monitor the performance of the chosen investment funds within ULIPs. Keep track of market trends and fund performance, and make informed decisions regarding fund switches based on the market conditions and your investment goals.

Optimize Asset Allocation

To minimize risk and maximize rewards, diversification is essential. Choose a plan for balancing your assets by investing in various equities, debt, and other funds. This strategy can maximize returns while reducing the effects of market volatility.

Seek Professional Consultation

Consulting a financial advisor or insurance expert can provide valuable insights and guidance in maximizing returns on your ULIP. They can assess your risk profile and investment goals and provide personalized recommendations based on their expertise.

Debunking Common ULIP Myths

ULIPs, like any other investment option, have their fair share of myths and misconceptions. It is vital to separate fact from fiction to make informed decisions. This can be done by conducting thorough research, seeking professional advice, and carefully reading policy papers. Individuals can make well-informed decisions regarding their investment and insurance needs by dispelling such myths. Let us debunk some common ULIP myths:

Myth 1: ULIPs are Expensive

One of the prevalent misconceptions about ULIPs is that they are expensive because of the various charges that accompany them. While it is true that ULIPs have fees such as premium allocation fees, policy administration charges, mortality fees, and fund management costs, it is important to realize that these fees are required to cover the costs associated with managing investment funds and providing insurance coverage. However, over time, these fees tend to have less effect and may even be outweighed by the possible profits from the investment component.

Myth 2: ULIP Returns are Low

Another misconception about ULIPs is that they offer a lesser return on investment than other investment options like mutual funds. The returns from ULIPs are market-linked and subject to market fluctuations. They are based on how well the policyholder’s chosen underlying investment funds perform. If the funds perform well, ULIPs have the potential to generate significant returns over the long term.

Myth 3: ULIPs Offer No Liquidity

Some people believe that ULIPs lack liquidity and have a lock-in period. Although ULIPs do have a five-year lock-in term as required by Insurance Regulatory and Development Authority of India (IRDAI) regulations, they provide partial withdrawal possibilities once the lock-in time ends. Policyholders can use the money they receive from these partial withdrawals to cover any unforeseen costs or financial difficulties. Additionally, the lock-in period promotes long-term investing, which may result in higher returns.

Myth 4: ULIPs Do Not Provide Transparency

It is widely believed that ULIPs are secretive and that investors have no idea where their money is being put. However, ULIP providers are obligated to disclose details regarding the investment funds, their goals, past performance, and asset allocation strategy. Furthermore, policyholders often receive statements and updates on the fund’s performance, fees, and investment value. It is essential to read and understand the policy documents to gain complete clarity about the ULIP and its workings.

Myth 5: ULIPs are Only for Insurance Purposes

Another myth is that ULIPs are primarily meant for insurance coverage and not as investment vehicles. While ULIPs do provide life insurance coverage, they also offer investment opportunities. The investment component of ULIPs allows individuals to allocate their premiums to different funds. The policyholder has the flexibility to switch funds and manage their investment portfolio to maximize returns. ULIPs provide a combination of insurance and investment, making them suitable for individuals looking for both financial protection and wealth creation.

How to Choose the Best ULIP?

Choosing the best ULIP requires thorough research, understanding financial goals, and considering various factors. By selecting a ULIP that aligns with your investment objectives, risk tolerance, and insurance needs, you can make the most of this hybrid product and work towards achieving your financial aspirations. Here are some key points to keep in mind when selecting a ULIP:

Research and Compare

Start by researching different ULIP providers in the market. Look for reputable insurance companies with a strong track record and good customer reviews. Compare the features, benefits, charges, and performance of different ULIP plans these providers offer. This will help you shortlist the options that align with your investment and insurance needs.

Financial Goals and Risk Appetite

Identify your financial goals and risk appetite before choosing a ULIP. Determine whether you are looking for long-term wealth output, retirement planning, or specific financial goals. Assess your risk tolerance and choose an investment fund that matches your risk profile. A ULIP should align with your investment objectives and time horizon.

Fund Performance

Evaluate the historical performance of the investment funds offered within the ULIP. Look for consistent and competitive returns over different time periods. Choosing ULIPs that have consistently performed well across various market cycles is advisable.

Associated Charges

Understand the various charges or fees associated with the ULIP. These charges include premium allocation charges, policy administration charges, mortality charges, fund management charges, and surrender charges. Compare the costs across different ULIP plans and choose the one that offers a reasonable balance between expenses and benefits.

Flexibility and Options

Consider ULIP’s flexibility regarding premium payment options, top-up facilities, and switching between funds. Look for ULIPs that allow you to customize your investment strategy per your changing needs. Switching between funds should be available at reasonable intervals without excessive charges.

Insurance Coverage

Evaluate the insurance coverage provided by the ULIP. Check the sum assured and the types of insurance riders available, such as critical illness or accidental death benefit riders. Ensure that the insurance coverage adequately meets your family’s financial needs in case of unfortunate events.

Transparency and Disclosures

Choose a ULIP provider that offers transparency in terms of disclosing all the relevant information. Read the policy documents carefully to understand the terms and conditions, charges, exclusions, and claim settlement process. Look for ULIP providers who provide regular updates and statements about the fund’s performance and the value of your investment.

How Does a ULIP Work?

ULIPs (Unit Linked Insurance Plans) work by combining insurance and investment components. Since life insurers are the ones who provide ULIPs, the payments you make to them when you purchase a ULIP are referred to as “premiums,” as ULIPs are primarily more akin to insurance plans.

When you pay premiums, it gets divided into an investment component and a mutual fund component, depending on the funds you choose, such as equity, debt, hybrid, or another type of fund. Your investments are looked after by fund managers. Additionally, you are permitted to alter between various fund types to create the ideal ULIP for you. At maturity, the accumulated investment value is returned.

Summed Up

ULIPs are a powerful financial tool that offers the dual advantage of insurance coverage and investment growth. The various benefits of ULIP mentioned in the blog showcase how ULIPs allow you to diversify your portfolio and offer a reliable opportunity to build wealth and attain financial stability at the same time. By harnessing the benefits of ULIPs and adopting sound investment strategies, investors can confidently navigate their financial journey and achieve their desired milestones.

Individuals have different financial objectives and risk tolerances; therefore, it is crucial to remember that before making investment decisions, one must consider their situation and consult financial counselors. With the right approach and a clear understanding of ULIPs, individuals can embark on a path toward economic prosperity and peace of mind.