Month Gone By – Markets (period ended April 30, 2021)

US Markets witnessed dizzying heights, reaching all time high of 4219 on April 29th,

overcoming the crisis created by the collapse of Archegos Capital. The recovery in equity

markets reflected the broad based recovery in the US economy at 6.4% lead by consumption

and the Fed’s commitment to a low rate environment and continuing the purchase of assets

and thereby signalling the delay which global markets were expecting related to tapering

of the asset purchase program. The US Yields traded in a narrow range mostly 1.60 centric

shedding the volatility experienced in the prior month.

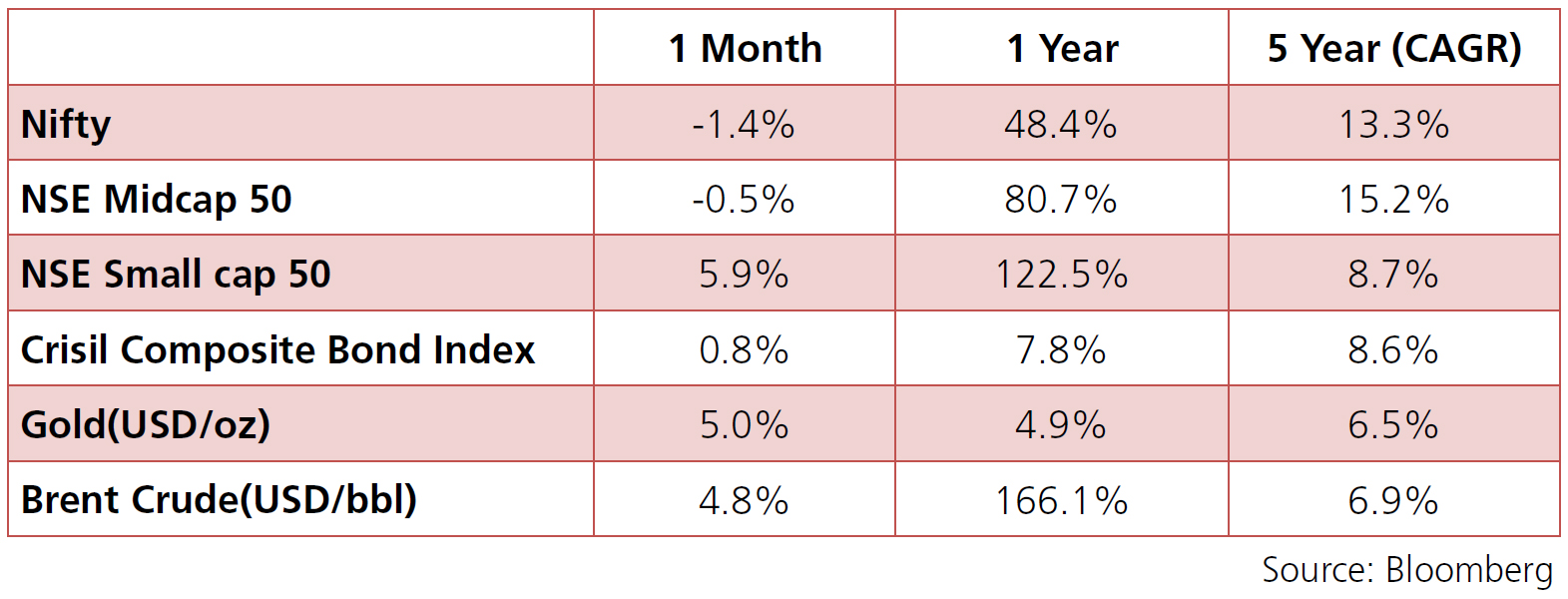

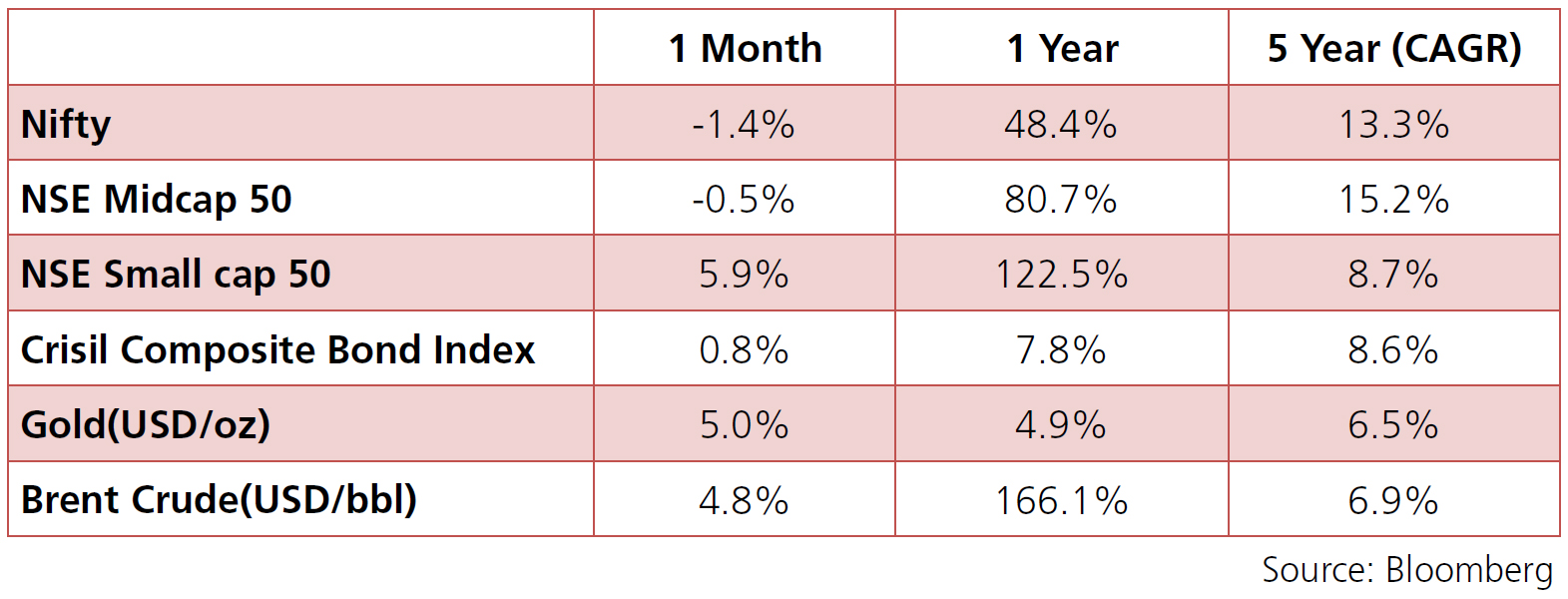

Nifty, which started the year on a positive note at 14,870 saw a deep plunge to 14296 by mid-April owing to a deadlier second wave gripping the country. The resurgent virus and its deadlier mutants saw a severe localised lockdown leading to expectations of a slow-down in the economy and downside risks to economic projections.

The INR also remained under pressure amid the resurgence of Covid cases through out the country. The INR collapsed from 73.13 at the beginning of the month to highs of 75.42 on April 21st, before closing the month at 74.05.

Nifty, which started the year on a positive note at 14,870 saw a deep plunge to 14296 by mid-April owing to a deadlier second wave gripping the country. The resurgent virus and its deadlier mutants saw a severe localised lockdown leading to expectations of a slow-down in the economy and downside risks to economic projections.

The INR also remained under pressure amid the resurgence of Covid cases through out the country. The INR collapsed from 73.13 at the beginning of the month to highs of 75.42 on April 21st, before closing the month at 74.05.

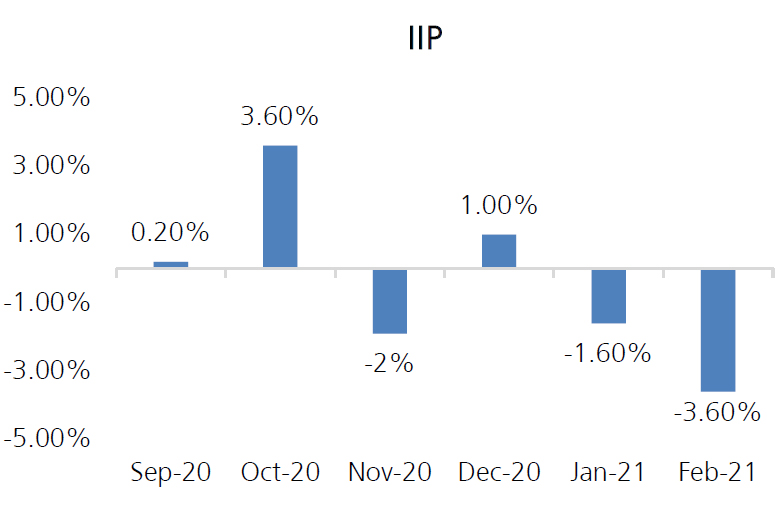

IIP: IIP, reflecting the sluggishness in the economy contracted for a straight second

month by 3.60% (vs -1.60% previous month). The manufacturing sector—which

constitutes 77.6% of the index - declined by 3.7% in February 2021 whereas mining

sector contracted by 5.5%.

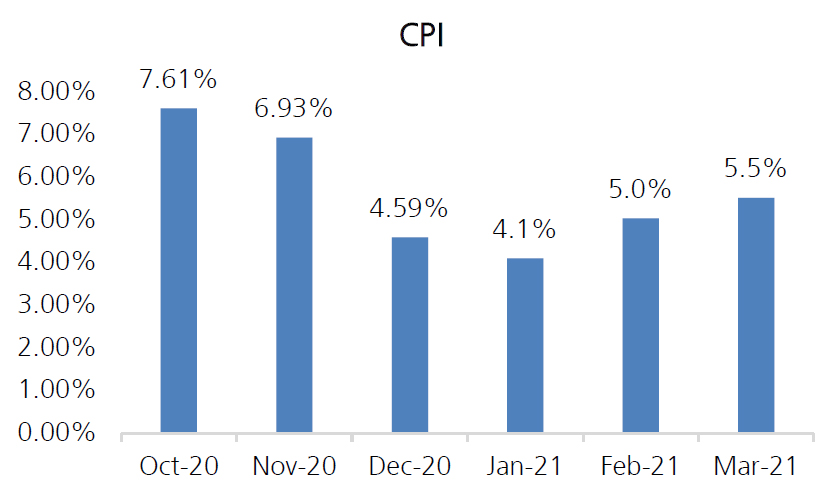

CPI: India witnessed a resurgence of inflation in March 2021 at 5.6% (vs 4.5% previous month). The main contributors to the basket were Consumer Food Price Inflation (CFPI) which saw a jump of 5.36% vs previous month 4.64% and Fuel & Light which contributed 40bps to the base line.

Trade Deficit: India witnessed a trade deficit of $15.2 Billion, which is up from $13.9 Billion in the previous month. Exports witnessed a three-fold increase y-o-y at $30 Billion on the back of a low base effect as economic activity was disrupted in April 2020 due to covid-induced lockdowns. Imports were recorded at $45.5 Billion vs $17.1 Billion recorded in April 2020.

Fiscal Deficit: India recorded a fiscal deficit of Rs. 14.05 Trillion against a revised budgeted figure of Rs. 18.48 Trillion. The fiscal deficit has been contained so far bolstered by direct tax collections for the year beating estimates by 5% (Rs. 9.45 Trillion collected vs Rs 9 Trillion budgeted) and indirect tax collections by roughly 8% (Rs. 10.71 Trillion collected vs Rs. 10 Trillion budgeted)

CPI: India witnessed a resurgence of inflation in March 2021 at 5.6% (vs 4.5% previous month). The main contributors to the basket were Consumer Food Price Inflation (CFPI) which saw a jump of 5.36% vs previous month 4.64% and Fuel & Light which contributed 40bps to the base line.

Trade Deficit: India witnessed a trade deficit of $15.2 Billion, which is up from $13.9 Billion in the previous month. Exports witnessed a three-fold increase y-o-y at $30 Billion on the back of a low base effect as economic activity was disrupted in April 2020 due to covid-induced lockdowns. Imports were recorded at $45.5 Billion vs $17.1 Billion recorded in April 2020.

Fiscal Deficit: India recorded a fiscal deficit of Rs. 14.05 Trillion against a revised budgeted figure of Rs. 18.48 Trillion. The fiscal deficit has been contained so far bolstered by direct tax collections for the year beating estimates by 5% (Rs. 9.45 Trillion collected vs Rs 9 Trillion budgeted) and indirect tax collections by roughly 8% (Rs. 10.71 Trillion collected vs Rs. 10 Trillion budgeted)

Deal activity moderated in April with 12 deals worth ~$2.8 Billion (vs 27 deals worth

~$4.9 Billion in March) key deals being IDFC First Bank’s QIP (~$0.4 Billion), Macrotech

Developers’ IPO (~$0.3 Billion) and Indigrid’s Rights Issue (~$0.2 Billion).

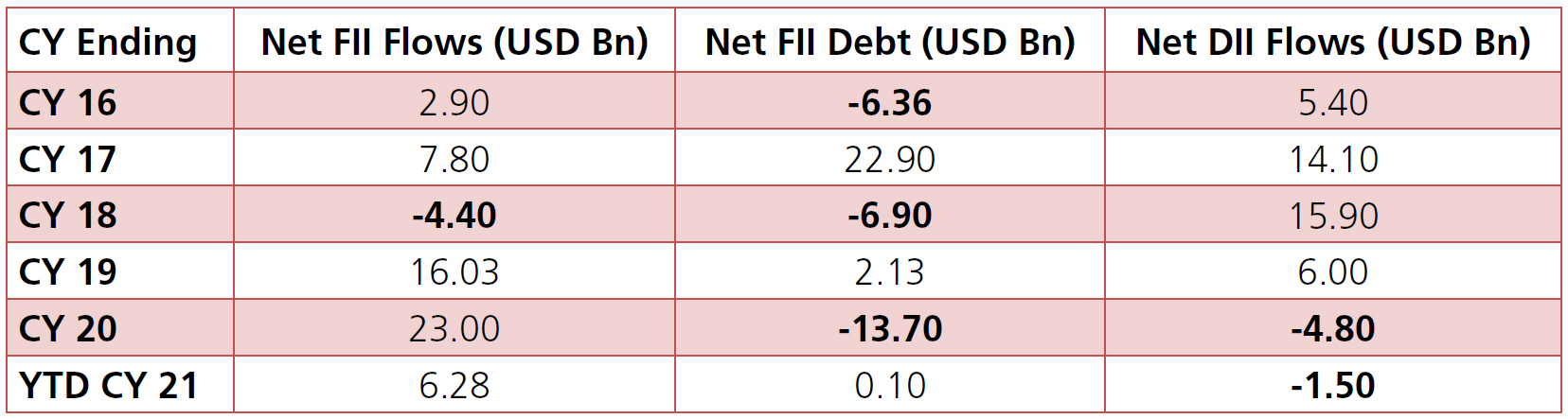

FIIs turned net sellers for the first time in 2021, recording outflows of ~$1.5 Billion in April (YTD +$5.7 Billion) vs net inflows of $2.2 Billion in March. DIIs on the other hand, ramped up buying to +$1.5 Billion (YTD -$1.7 Billion) and absorbed FII selling entirely. DII buying was on the back of buying by both Domestic MF (~$0.8 Billion, YTD -$2.9 Billion) and Insurance (~$0.7 Billion, YTD +$1.2bn).

FIIs turned net sellers for the first time in 2021, recording outflows of ~$1.5 Billion in April (YTD +$5.7 Billion) vs net inflows of $2.2 Billion in March. DIIs on the other hand, ramped up buying to +$1.5 Billion (YTD -$1.7 Billion) and absorbed FII selling entirely. DII buying was on the back of buying by both Domestic MF (~$0.8 Billion, YTD -$2.9 Billion) and Insurance (~$0.7 Billion, YTD +$1.2bn).