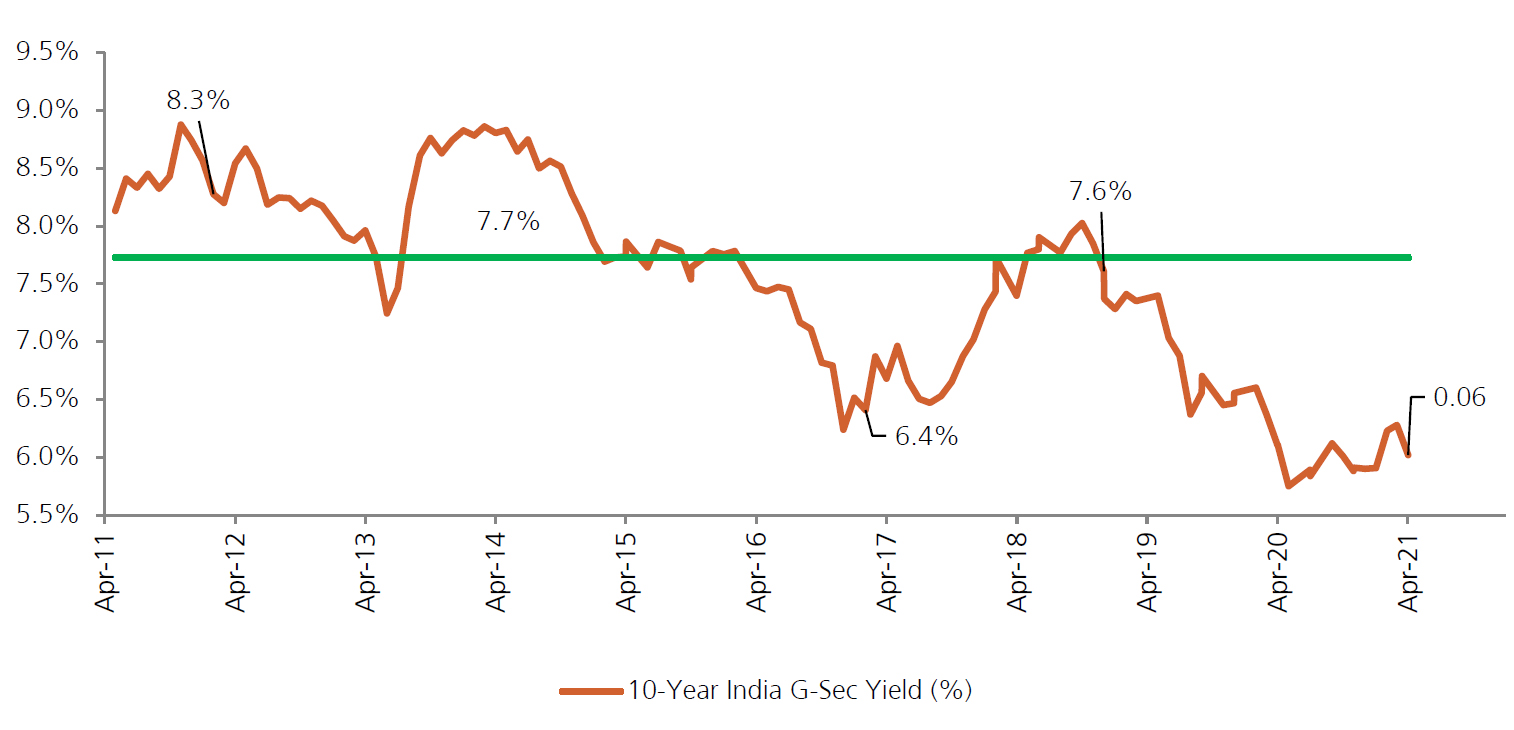

The 10Y Benchmark closed at 6.18% on March 31st finally rallying to 6.02% on the close of April. The yields fell as the RBI’s Monetary Policy Committee though broadly retained its inflation and growth projections, pledged liquidity to support growth and also announced the much touted G-Sec Acquisition Programme (GSAP) wherein it commited to purchase Rs. 1 Trillion in Q1 2021-22 in secondary markets over and above the OMO/ Operation Twists expected around Rs. 3 Trillion.

The resurgent wave which has clamped down the nation’s economic activity and poses a risk to various growth projections will compel the central bank to continue with a softened approach for much longer than expected to in a bid to support the economy. Hence, the yields are expected to trade in the range of 5.95 – 6.10 for the month of May 2021.