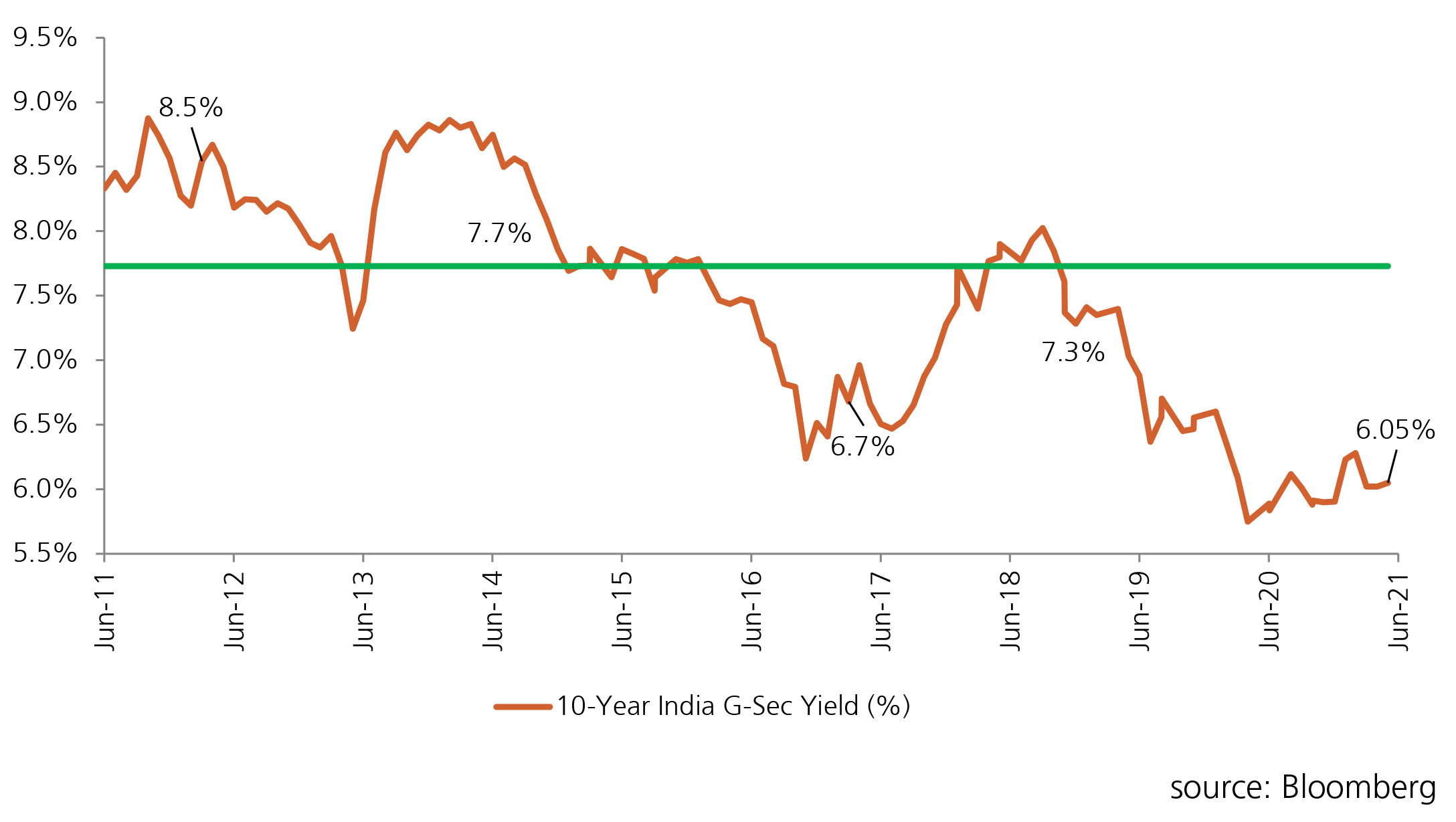

The 10Y Benchmark closed at 6.05% on June 30th vs 6.00% on May 31st and traded in a close range of 6.00% to 6.06% during the month. Though, thw MPC on June 4th was on expected line with Rs1.20Tn announced in OT for Q2 2021-22 and lowering the GDP forecast by 100 bps while maintaining status quo on rates; it failed to spur any demand from investors in the government securities. The auctions saw a muted demand in 5Y and 10Y Bonds as the heightened CPI expectations for the near future, aggressive cornering of the 10Y Bond by RBI for yield curve control and tapering fears lead to spike in yields across the curve. The 10Y Benchmark is expected to trade in the range 6.00 – 6.10, while the 5Y is expected to trade between 5.72 – 5.80.