Month Gone By – Markets (period ended September 30, 2022)

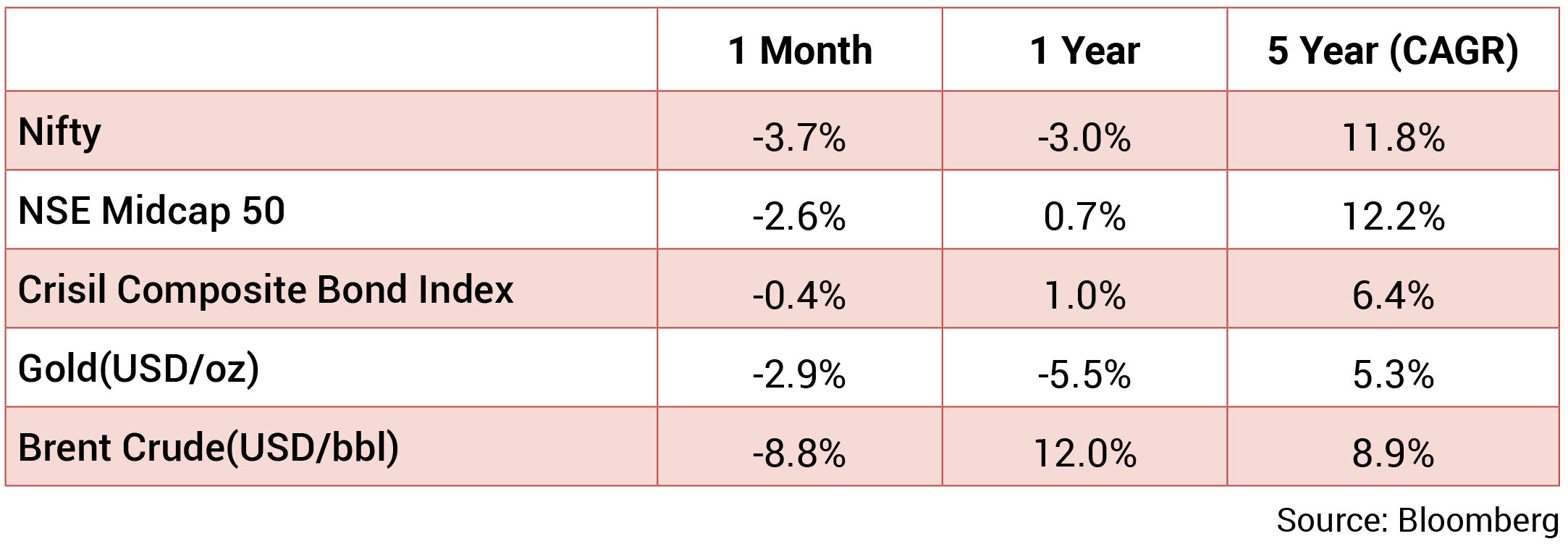

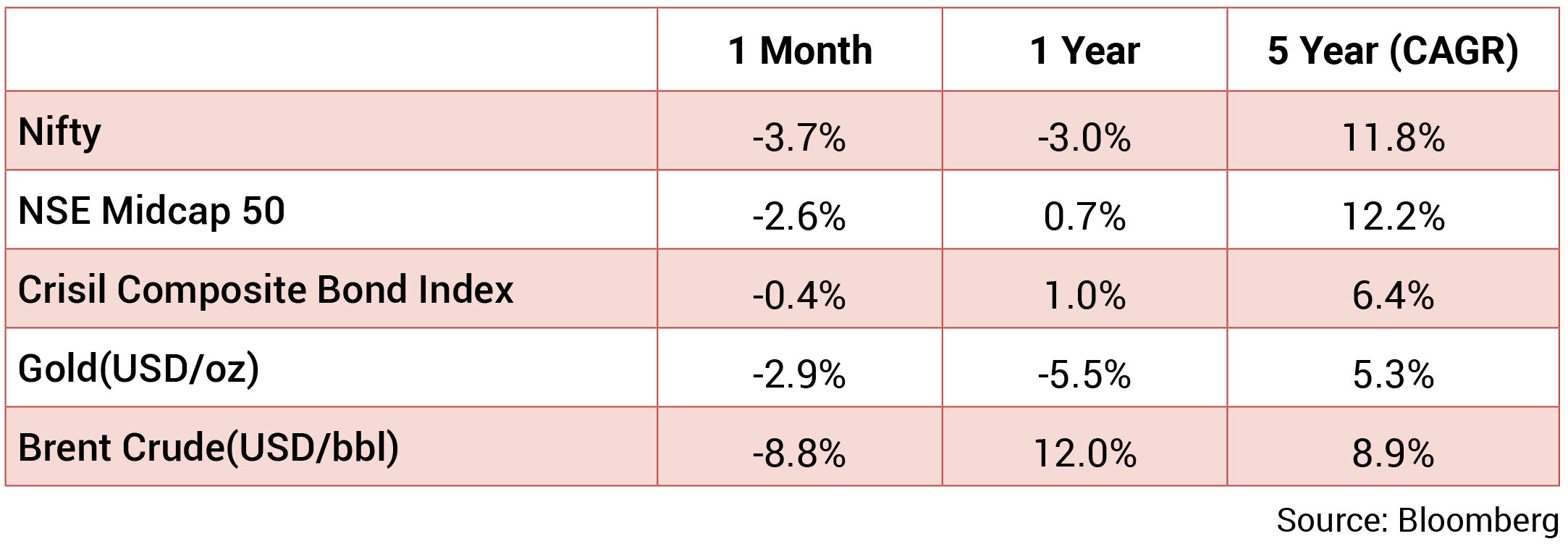

Indian markets corrected by 3.7% m-o-m tracking global cues but remain the best performer

globally. All sectors barring Pharma and FMCG ended the month in the red. O&G and Real Estate

were the worst-performing sectors. The INR continued to depreciate against the USD due to

aggressive rate hikes in the US. INR depreciated by 2.5% m-o-m, reaching 81.76/USD in September.

The 10y benchmark traded in a range of 7.1%-7.4% and eventually ending the month 22ps higher

m-o-m at 7.4%. The 10y benchmark averaged 7.23% in August.

Inflation in US and UK remained elevated at 8.3% and 9.9% respectively in August, while EU registered 10% inflation in September. The US Fed undertook another 75bps rate hike as fed fund rate ranges between 3-3.25% currently. This was the third consecutive 75bps rate hike and 5th rate increase in 2022. US economy is now technically in recession with two consecutive quarters of contraction in GDP growth. However, labour market continues to remain tight with lowest unemployment in 50 years. Hence the Fed would continue to prioritize price stability- “Our overarching focus is using our tools to bring inflation back down to our 2 percent goal and to keep longer-term inflation expectations well anchored. Reducing inflation is likely to require a sustained period of below-trend growth, and there will very likely be some softening of labor market conditions”.

On the domestic front, the RBI raised rates by 50bps at its September meeting, with the repo rate now at 5.9%. GDP forecast has been revised downwards by 30bps to 7% for FY23 while the MPC retained its average FY2023 headline projection at 6.7%.

Fear of recession in developed markets put downward pressure on crude oil prices as it touched USD 86/bbl as on end of September vs USD 93/bbl in August end. Tight supply conditions due to the on-going war and shift among European countries from gas to crude oil provides floor for oil prices. Gold ended September lower at USD 1,671/oz compared to USD 1,730/oz at the end of August.

Inflation in US and UK remained elevated at 8.3% and 9.9% respectively in August, while EU registered 10% inflation in September. The US Fed undertook another 75bps rate hike as fed fund rate ranges between 3-3.25% currently. This was the third consecutive 75bps rate hike and 5th rate increase in 2022. US economy is now technically in recession with two consecutive quarters of contraction in GDP growth. However, labour market continues to remain tight with lowest unemployment in 50 years. Hence the Fed would continue to prioritize price stability- “Our overarching focus is using our tools to bring inflation back down to our 2 percent goal and to keep longer-term inflation expectations well anchored. Reducing inflation is likely to require a sustained period of below-trend growth, and there will very likely be some softening of labor market conditions”.

On the domestic front, the RBI raised rates by 50bps at its September meeting, with the repo rate now at 5.9%. GDP forecast has been revised downwards by 30bps to 7% for FY23 while the MPC retained its average FY2023 headline projection at 6.7%.

Fear of recession in developed markets put downward pressure on crude oil prices as it touched USD 86/bbl as on end of September vs USD 93/bbl in August end. Tight supply conditions due to the on-going war and shift among European countries from gas to crude oil provides floor for oil prices. Gold ended September lower at USD 1,671/oz compared to USD 1,730/oz at the end of August.

Source: Bloomberg

Source: Bloomberg

Monetary Policy: The MPC voted with a 5-1 majority (Dr. Goyal voted for a 35 bps hike) to

raise the repo rate by 50 bps to 5.9% while continuing to remain focused on the withdrawal of

accommodation (Prof. Varma voted against this stance). Consequently, SDF and MSF rates

increased to 5.65% and 6.15%, respectively. The MPC continued to express comfort with domestic

growth while highlighting downside risks emanating from global factors, such as (1) the ongoing

geopolitical tensions; (2) tightening global financial conditions; and (3) slowing external demand.

Accordingly, the MPC revised down FY2023 real GDP growth to 7% (7.2% earlier). The MPC alluded

to risks to inflation from the ongoing geopolitical tensions, but also expressed comfort with the

recent moderation in commodity prices amid increasing recession risks. Taking into account the

positive outlook for kharif output given the recent recovery in sowing, the risk of crop damage

from excessive/unseasonal rains, uncertain outlook for crude oil prices and the incomplete passthrough

of input costs to prices, the MPC retained its average FY2023 headline projection at 6.7%.

Borrowing Calendar: The central government has decided to borrow Rs 5.92tn (including Rs160 bn of sovereign green bonds) in H2FY23, marginally lower than the expected Rs 6.02 tn (H1FY23 gross borrowing was at Rs 8.29tn compared with the indicated amount of Rs 8.45tn). The net issuance for H2FY23 is expected to be around Rs 4.9tn versus Rs 3tn in H2FY22. The weekly dated securities auction size will be in the tranches of Rs 280-300bn (Rs 320-330bn in H1FY23), distributed across 20 weeks. The supply in the 10-year and 14-year segments, combined, is at 40% of the total H2FY23 compared with 37% in H1FY23.

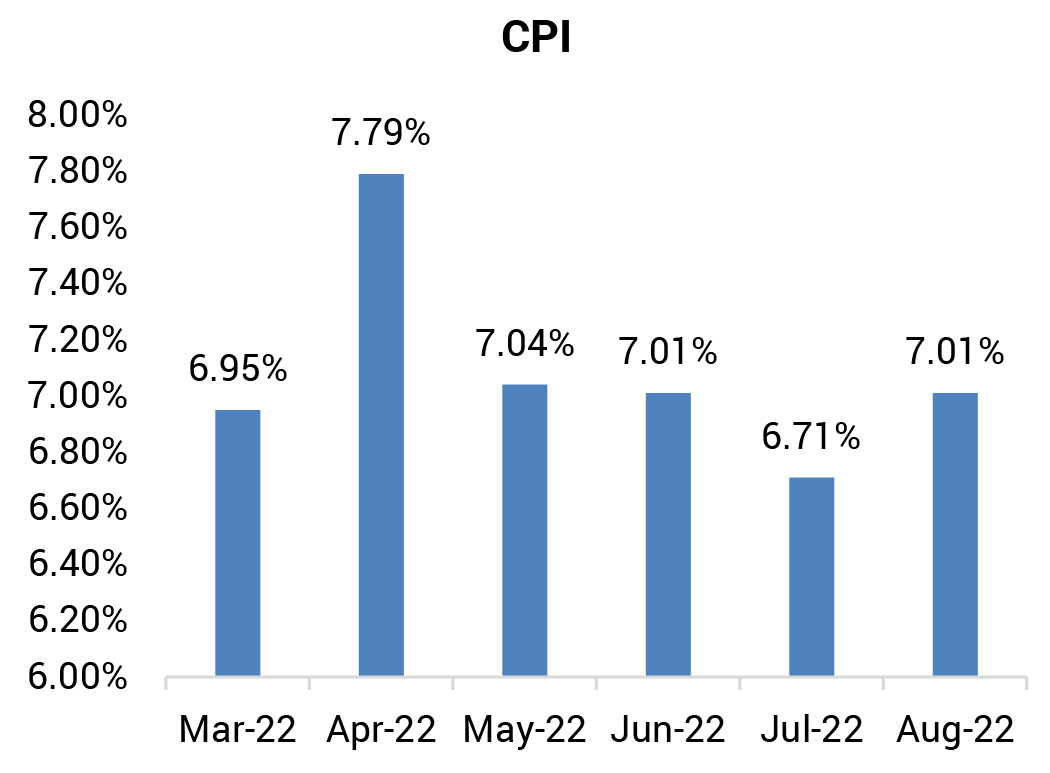

CPI: August CPI inflation rose to 7.01% (July: 6.71%) led mainly by rising food prices. Sequentially, headline inflation increased by 0.5% (broadly at the same pace as July). Food and beverages inflation increased by 7.6% (July: 6.7%) led by vegetable prices, milk, cereals, fruits, and spices. Meanwhile, fuel and light inflation moderated to 10.8% (July: 11.8%) while it declined sequentially by 0.4% (July: +2% mom). August core inflation (CPI excluding food, fuel, pan, and tobacco) moderated marginally by 8 bps to 6.17% while increasing sequentially by 0.5% (July: 0.7% mom). Clothing and footwear remained broadly sticky at 9.91% (July: 9.85%) followed by household goods and services also broadly sticky at 7.53% (7.45%), and personal care and effects category increasing by 7% (6%).

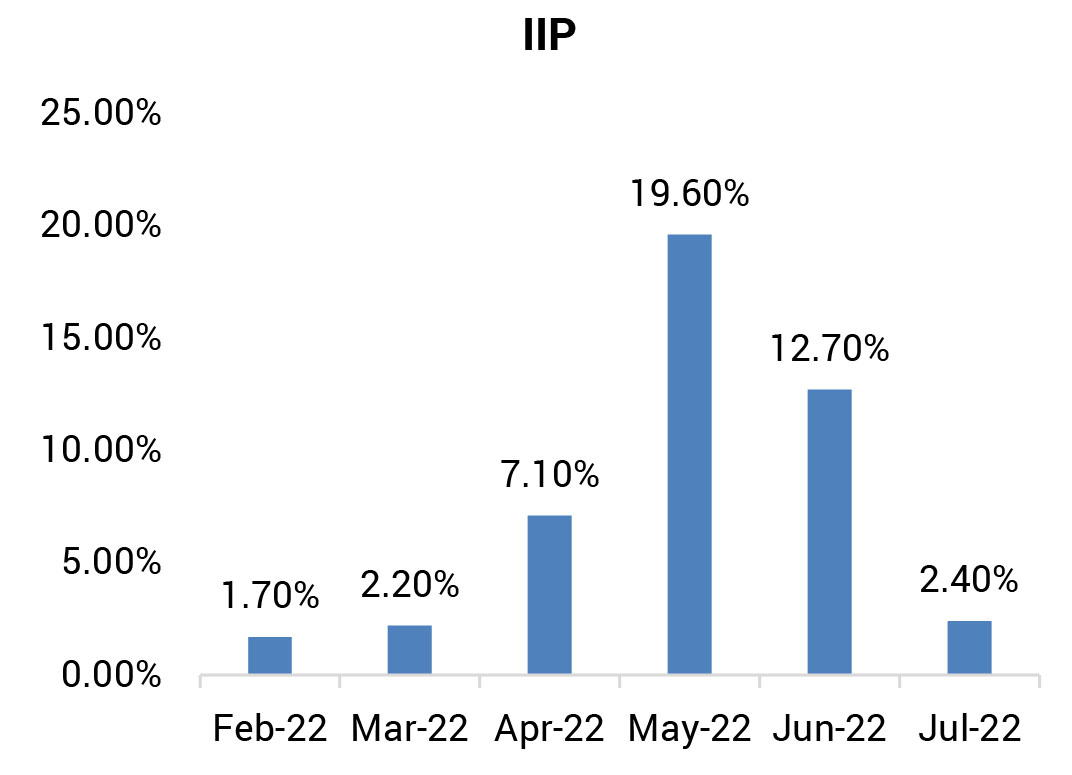

IIP: July IIP growth moderated sharply by 2.4% (June: 12.7%) while declining sequentially by 2.7% (June: +0.5% mom). On a sectoral basis, manufacturing activity increased by 3.2% (June: 13%), and electricity production by 2.3% (16.4%), while mining activity fell by 3.3% (+7.8%). As per the use-based classification, most categories registered positive growths led by capital goods increasing by 5.8%, infrastructure goods by 3.9%, and intermediate goods by 3.6%. Only consumer non-durables segment declined by 2%.

CAD/BoP: CAD in Q1FY23 widened to US$ 23.9bn (2.8% of GDP) (Q4FY22: US$ 13.4bn), mainly due to the widening of the trade deficit to US $68.6bn (Q4FY22: US$ 54.5bn). However, CAD came in better than expected due to the upside surprise in services at US$ 31bn. Net invisible inflows, accordingly, increased to a record quarterly high of US$ 45bn (Q4FY22: US$ 41bn). Capital account in Q1FY23 registered a surplus of US$ 28bn (Q4FY22: (-) US$ 2bn), mainly due to a sharp increase in banking capital to US$ 19bn (Q4FY22: (-) US$ 6bn), while ECBs flows turned negative. Consequently, BOP in Q1FY23 saw a surplus of US$ 4.6bn (4QFY22: (-) US$ 16bn).

Borrowing Calendar: The central government has decided to borrow Rs 5.92tn (including Rs160 bn of sovereign green bonds) in H2FY23, marginally lower than the expected Rs 6.02 tn (H1FY23 gross borrowing was at Rs 8.29tn compared with the indicated amount of Rs 8.45tn). The net issuance for H2FY23 is expected to be around Rs 4.9tn versus Rs 3tn in H2FY22. The weekly dated securities auction size will be in the tranches of Rs 280-300bn (Rs 320-330bn in H1FY23), distributed across 20 weeks. The supply in the 10-year and 14-year segments, combined, is at 40% of the total H2FY23 compared with 37% in H1FY23.

CPI: August CPI inflation rose to 7.01% (July: 6.71%) led mainly by rising food prices. Sequentially, headline inflation increased by 0.5% (broadly at the same pace as July). Food and beverages inflation increased by 7.6% (July: 6.7%) led by vegetable prices, milk, cereals, fruits, and spices. Meanwhile, fuel and light inflation moderated to 10.8% (July: 11.8%) while it declined sequentially by 0.4% (July: +2% mom). August core inflation (CPI excluding food, fuel, pan, and tobacco) moderated marginally by 8 bps to 6.17% while increasing sequentially by 0.5% (July: 0.7% mom). Clothing and footwear remained broadly sticky at 9.91% (July: 9.85%) followed by household goods and services also broadly sticky at 7.53% (7.45%), and personal care and effects category increasing by 7% (6%).

IIP: July IIP growth moderated sharply by 2.4% (June: 12.7%) while declining sequentially by 2.7% (June: +0.5% mom). On a sectoral basis, manufacturing activity increased by 3.2% (June: 13%), and electricity production by 2.3% (16.4%), while mining activity fell by 3.3% (+7.8%). As per the use-based classification, most categories registered positive growths led by capital goods increasing by 5.8%, infrastructure goods by 3.9%, and intermediate goods by 3.6%. Only consumer non-durables segment declined by 2%.

CAD/BoP: CAD in Q1FY23 widened to US$ 23.9bn (2.8% of GDP) (Q4FY22: US$ 13.4bn), mainly due to the widening of the trade deficit to US $68.6bn (Q4FY22: US$ 54.5bn). However, CAD came in better than expected due to the upside surprise in services at US$ 31bn. Net invisible inflows, accordingly, increased to a record quarterly high of US$ 45bn (Q4FY22: US$ 41bn). Capital account in Q1FY23 registered a surplus of US$ 28bn (Q4FY22: (-) US$ 2bn), mainly due to a sharp increase in banking capital to US$ 19bn (Q4FY22: (-) US$ 6bn), while ECBs flows turned negative. Consequently, BOP in Q1FY23 saw a surplus of US$ 4.6bn (4QFY22: (-) US$ 16bn).

Deal flow picked up in September with 33 deals worth ~$1.7bn executed. Key deals included

Embassy Office Parks REIT ($325mn) and HDFC Life Insurance ($311mn).

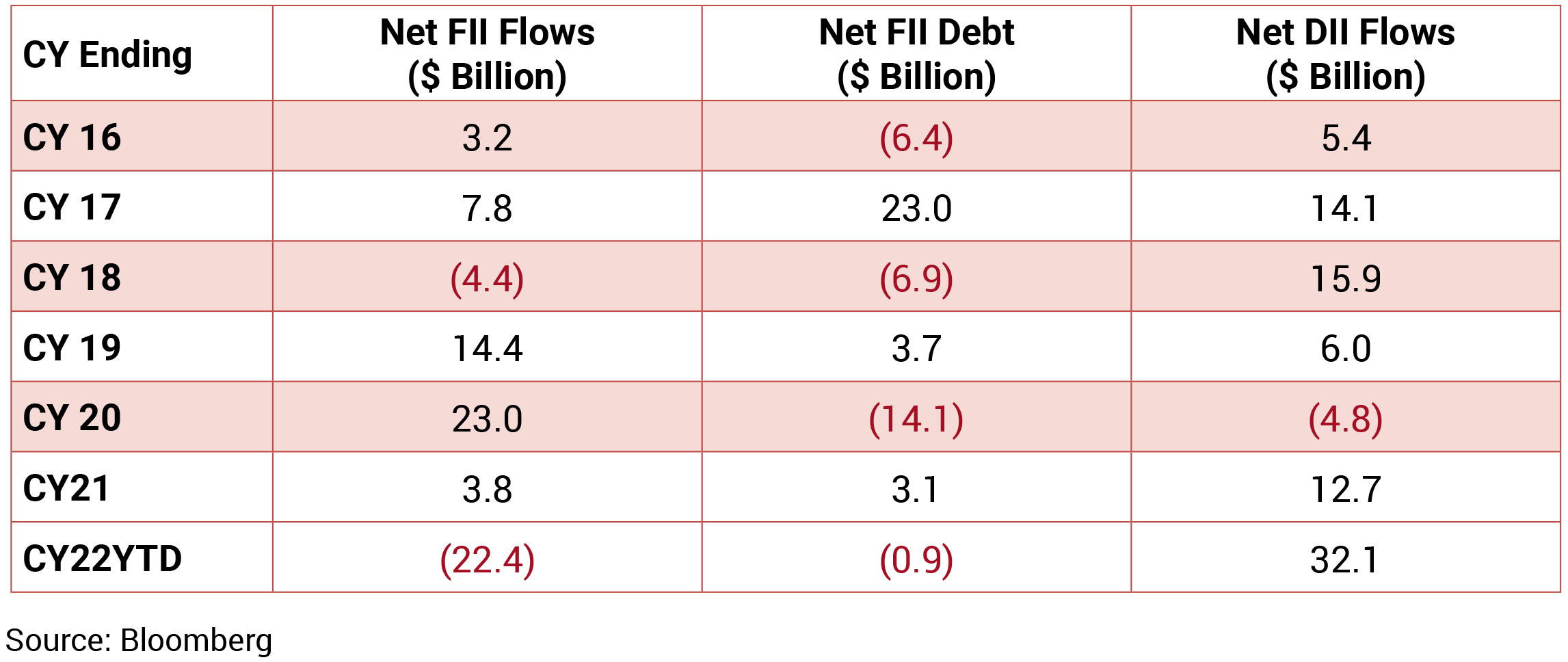

FIIs were net sellers in the month of September 2022 to the tune of $1.6bn while DIIs turned buyers at $1.7bn. MFs have bought $847mn till 23rd September 2022.

FIIs were net sellers in the month of September 2022 to the tune of $1.6bn while DIIs turned buyers at $1.7bn. MFs have bought $847mn till 23rd September 2022.