Month Gone By – Markets (period ended November 30, 2022)

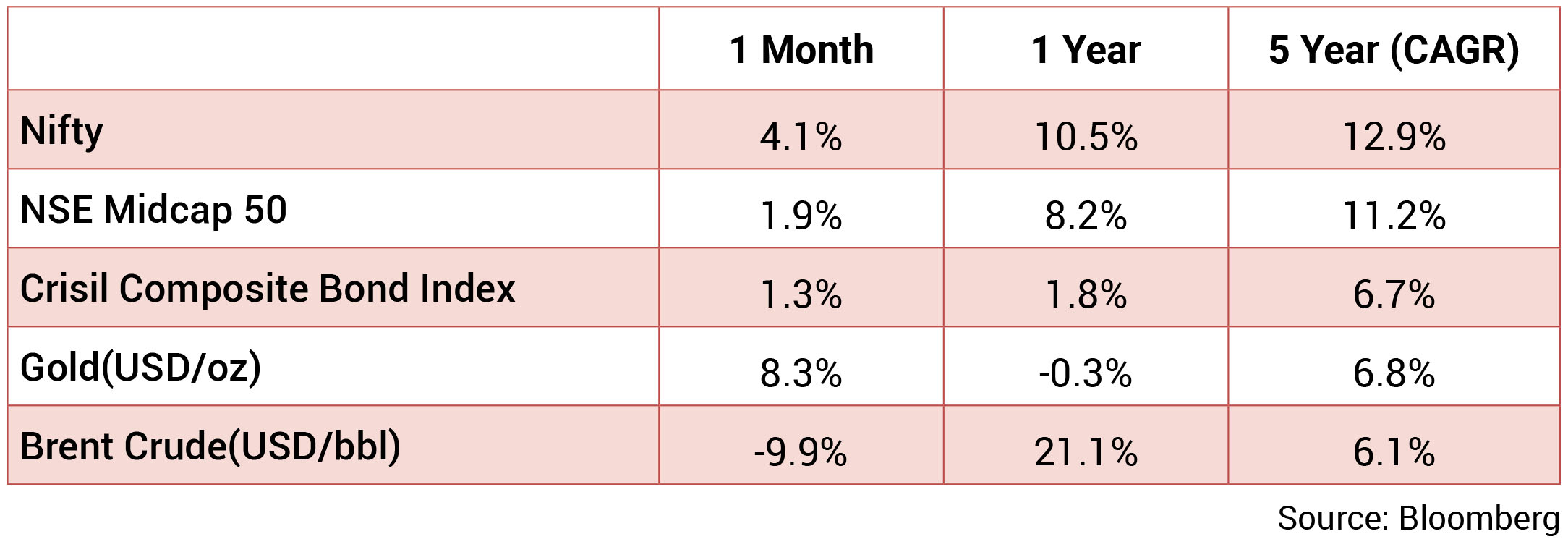

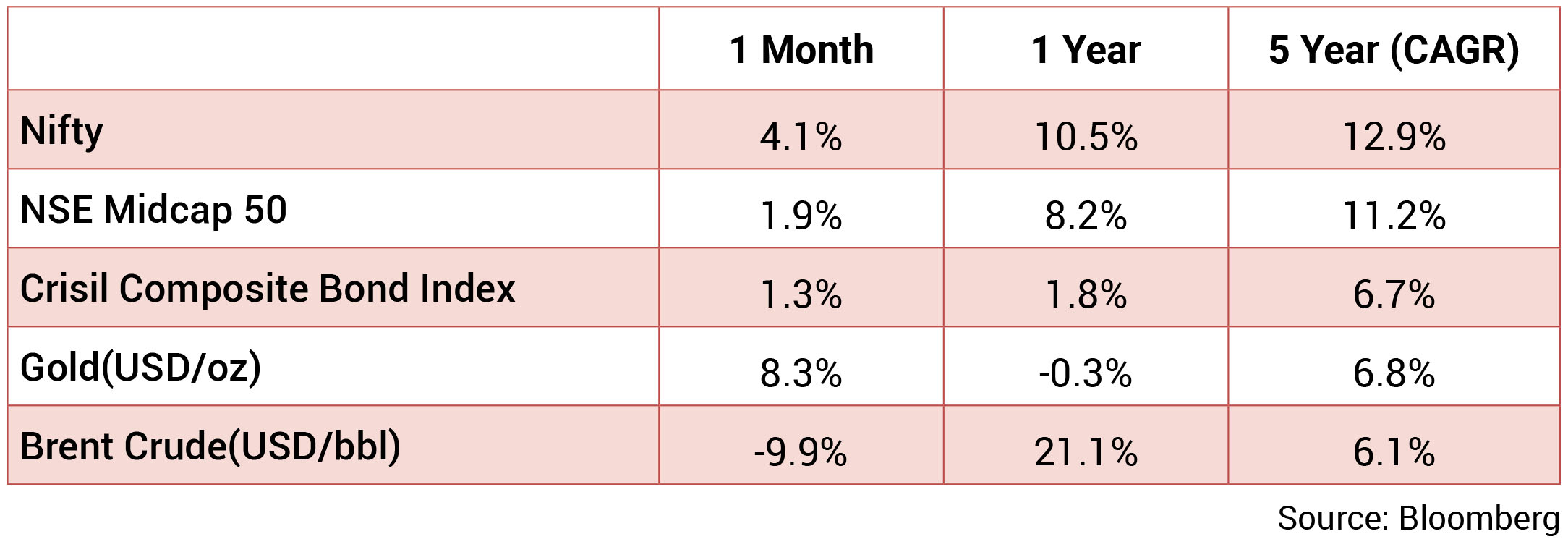

Markets improved by 4.1% primarily driven by strong FIIs buying and expectation of slower monetary

policy tightening. Financial, IT and Energy sectors have been the frontrunner sectors while Discretionary

and Utilities have been the laggards. The INR appreciated against USD marking first monthly improvement

since December 2021 supported by decline in crude prices. INR averaged around 81.78 with a monthly

best and worst of 80.82 and 82.89 respectively. Yields fell with the 10y benchmark trading in a range of

7.26%-7.48% and eventually ending the month 17bps lower m-o-m at 7.28%. The 10y benchmark averaged

7.33% in November.

Inflation in US displayed signs of easing, but remained elevated at 7.7% in October while inflation in EU was at 10% in November. To tackle price pressures, FOMC raised rates by 75bps in November, marking sixth consecutive rate hike and 375bps cumulative increase. However, there are signals on slowing the pace of rate hikes to assess the lag in impact of monetary policy on growth and inflation. Fed chair had highlighted that the terminal rate would now be higher than earlier expectation and will be held at that rate for a longer term until inflation shows clear sign of moving back towards the 2% objective. ECB raised policy rates by 75bps in October taking cumulative rate hike to 200bps while Bank of England raised rates 75bps as well with cumulative rate hike at 290bps. Monetary policy meetings of all these central banks are lined up in the first half of December. Their projections and commentary on policy rate, inflation and growth should guide market performance going ahead.

On the domestic front, Q2FY23 GDP/GVA registered 6.3%/5.6% growth nearly as expected by market and RBI with significant support from investment and private consumption. Agriculture and services growth were robust while industrial performance was disappointing. Headline inflationary pressure eased to below 7% in October. However, the pace of sequential price rise remains elevated across all segments. Some MPC members suggested at slower pace of rate hikes to gauge the impact of tightening till date. Fiscal situation is in control supported by buoyant tax revenue. Government focus on capex continue with road and railways capex spend extremely strong at around 75% of BE. High frequency data including GST collections point to resilient economic activity.

Brent crude price toned down to an average USD 91/bbl in November from USD 94/ bbl in October with recessionary concerns and covid restriction followed in China. Gold prices ended higher at USD 1,746/oz in November from USD 1,641/oz in October.

Inflation in US displayed signs of easing, but remained elevated at 7.7% in October while inflation in EU was at 10% in November. To tackle price pressures, FOMC raised rates by 75bps in November, marking sixth consecutive rate hike and 375bps cumulative increase. However, there are signals on slowing the pace of rate hikes to assess the lag in impact of monetary policy on growth and inflation. Fed chair had highlighted that the terminal rate would now be higher than earlier expectation and will be held at that rate for a longer term until inflation shows clear sign of moving back towards the 2% objective. ECB raised policy rates by 75bps in October taking cumulative rate hike to 200bps while Bank of England raised rates 75bps as well with cumulative rate hike at 290bps. Monetary policy meetings of all these central banks are lined up in the first half of December. Their projections and commentary on policy rate, inflation and growth should guide market performance going ahead.

On the domestic front, Q2FY23 GDP/GVA registered 6.3%/5.6% growth nearly as expected by market and RBI with significant support from investment and private consumption. Agriculture and services growth were robust while industrial performance was disappointing. Headline inflationary pressure eased to below 7% in October. However, the pace of sequential price rise remains elevated across all segments. Some MPC members suggested at slower pace of rate hikes to gauge the impact of tightening till date. Fiscal situation is in control supported by buoyant tax revenue. Government focus on capex continue with road and railways capex spend extremely strong at around 75% of BE. High frequency data including GST collections point to resilient economic activity.

Brent crude price toned down to an average USD 91/bbl in November from USD 94/ bbl in October with recessionary concerns and covid restriction followed in China. Gold prices ended higher at USD 1,746/oz in November from USD 1,641/oz in October.

Source: Bloomberg

Source: Bloomberg

GDP: Q2FY23 real GDP grew by 6.3% (Q1FY23: 13.5%), aided by investment (GFCF) growth of 10.4%

(Q1FY23: 20.1%) and private consumption growth of 9.7% (25.9%). Government consumption, however,

contracted by 4.4% (Q1FY23: +1.3%). On a q-o-q basis, real GDP grew by 3.6%, primarily led by investments

growth of 3.4% and private consumption growth of 1%. Nominal GDP in Q2FY23 grew by 16.2% (Q1FY23:

26.7%). On the production side, Q2FY23 real GVA grew by 5.6% (Q1FY23: 12.7%), led mainly by services

growth of 9.3% (Q1FY23: 17.6%) and agriculture growth of 4.6% (4.5%). Industrial sector contracted in

Q2FY23 by 0.8% (Q1FY23: +8.6%) led by contraction of 4.3% in manufacturing activity while construction

grew by 6.6%. Within services, contact-based services (trade, hotels, transport, etc.) led the growth at

14.7% (Q1FY23: 25.7%) followed by financial, real estate, etc. growing by 7.2% (9.2%). On a q-o-q basis, real

GVA growth was at 1.9% led again by services growth of 8.7% even as agriculture and industry contracted.

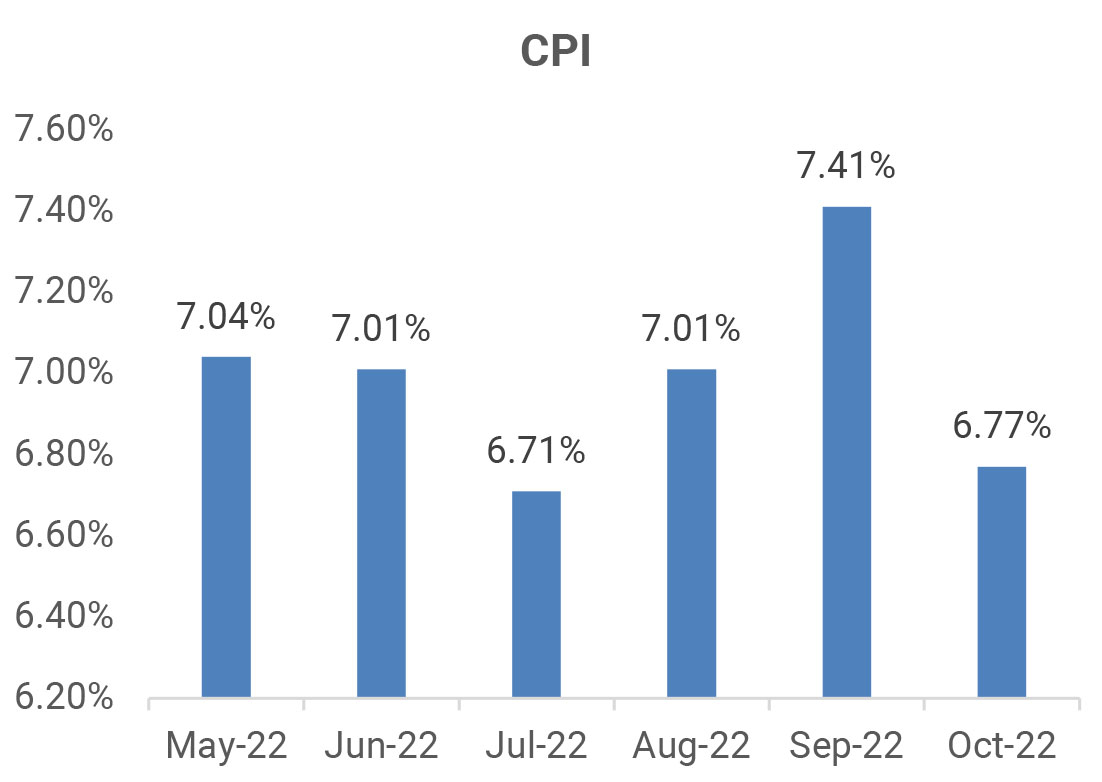

CPI: October CPI inflation fell sharply to 6.77% (September: 7.4%) led by rising food prices. Sequentially, headline inflation rose by 0.8% (September: 0.6% mom) led by food and beverages (1% mom). Food inflation has been pushing inflation higher recently with most of it being driven by cereals and vegetables. Fuel and light inflation moderated to 9.9% (September: 10.4%) but increased by 0.6% mom (September: 0.4% mom). October core inflation (CPI excluding food and fuel) remained steady at 6.3%. Sequentially, core inflation increased by 0.7% (September: 0.3%). Clothing and footwear inflation has remained quite high at 10.2% (September: 10.2%) while household goods and services remained steady at 7.6% (7.6%). Personal care and effects increased marginally to 7% (September: 6.8%) led by gold and soaps.

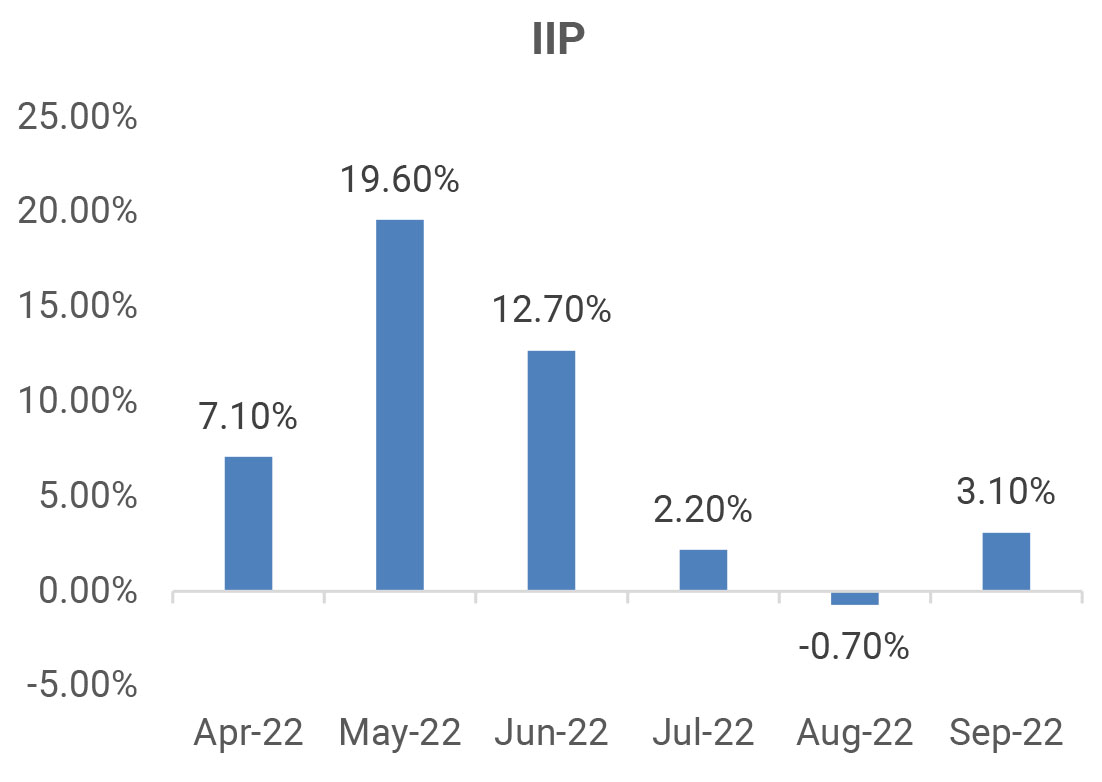

IIP: September IIP registered a growth of 3.1% yoy (August: (-)0.7%), with a favourable base. Sequentially, IIP increased 1.5%. On a sectoral basis, all components exhibited positive growth, led by electricity production, which increased 11.6% (August: 1.4%), whereas mining activity grew 4.6% ((-)3.9%) and manufacturing 1.8% ((-)0.5%). According to the use-based classification, capital goods production grew the most by 10.3% (August: 4.3%), followed by primary goods by 9.3% (1.7%), infrastructure and construction goods by 7.4% (2.1%), intermediate goods by 2% (1.2%), consumer durables by (-)4.5% ((-)2.5%), and consumer non-durables at (-)7.1% ((-)9.5%

Trade: October exports, at USD 29.8bn was lower than September exports (USD 35.4bn) and 16.7% lower than October last year. This was led mainly by a fall in petroleum products to USD 4.8bn (September: USD 7.4bn) as well as engineering goods to USD 7.4bn (USD 8.4bn). Non-oil exports at USD 25bn (September: USD 28bn), fell by 17.6% yoy while declining sequentially by 10.7%. October imports, at USD 56.7bn, increased by 5.7% yoy while declining by 7.3% mom (September: USD 61.2bn). This was mainly due to a fall in non-oil imports to USD 40.8bn (September: USD 45.3bn) even as oil imports remained around September levels at USD 15.9bn. Trade deficit in October increased to USD 26.9bn (September: USD 25.7bn) and stood at USD 175.4bn in 7MFY23 (7MFY22: USD 94.2 bn).

CPI: October CPI inflation fell sharply to 6.77% (September: 7.4%) led by rising food prices. Sequentially, headline inflation rose by 0.8% (September: 0.6% mom) led by food and beverages (1% mom). Food inflation has been pushing inflation higher recently with most of it being driven by cereals and vegetables. Fuel and light inflation moderated to 9.9% (September: 10.4%) but increased by 0.6% mom (September: 0.4% mom). October core inflation (CPI excluding food and fuel) remained steady at 6.3%. Sequentially, core inflation increased by 0.7% (September: 0.3%). Clothing and footwear inflation has remained quite high at 10.2% (September: 10.2%) while household goods and services remained steady at 7.6% (7.6%). Personal care and effects increased marginally to 7% (September: 6.8%) led by gold and soaps.

IIP: September IIP registered a growth of 3.1% yoy (August: (-)0.7%), with a favourable base. Sequentially, IIP increased 1.5%. On a sectoral basis, all components exhibited positive growth, led by electricity production, which increased 11.6% (August: 1.4%), whereas mining activity grew 4.6% ((-)3.9%) and manufacturing 1.8% ((-)0.5%). According to the use-based classification, capital goods production grew the most by 10.3% (August: 4.3%), followed by primary goods by 9.3% (1.7%), infrastructure and construction goods by 7.4% (2.1%), intermediate goods by 2% (1.2%), consumer durables by (-)4.5% ((-)2.5%), and consumer non-durables at (-)7.1% ((-)9.5%

Trade: October exports, at USD 29.8bn was lower than September exports (USD 35.4bn) and 16.7% lower than October last year. This was led mainly by a fall in petroleum products to USD 4.8bn (September: USD 7.4bn) as well as engineering goods to USD 7.4bn (USD 8.4bn). Non-oil exports at USD 25bn (September: USD 28bn), fell by 17.6% yoy while declining sequentially by 10.7%. October imports, at USD 56.7bn, increased by 5.7% yoy while declining by 7.3% mom (September: USD 61.2bn). This was mainly due to a fall in non-oil imports to USD 40.8bn (September: USD 45.3bn) even as oil imports remained around September levels at USD 15.9bn. Trade deficit in October increased to USD 26.9bn (September: USD 25.7bn) and stood at USD 175.4bn in 7MFY23 (7MFY22: USD 94.2 bn).

Deal flow picked up in November with 27 deals worth USD 2.23bn executed. Key deals included Paytm

(USD 198mn) and Global Health (USD 210mn).

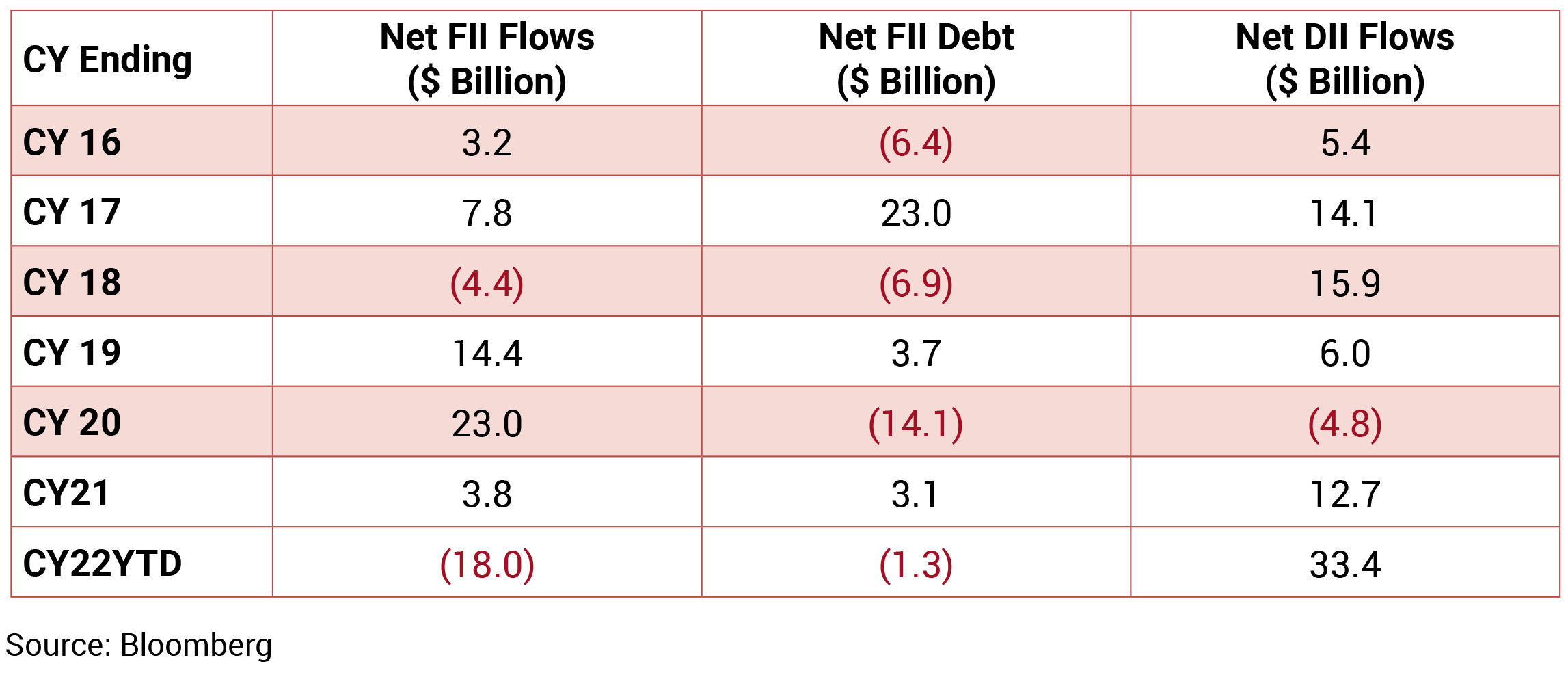

FIIs were net buyers in the month of November 2022 to the tune of USD 4.6bn and DIIs sold to the tune of USD 769mn.

FIIs were net buyers in the month of November 2022 to the tune of USD 4.6bn and DIIs sold to the tune of USD 769mn.