Group Fund

Kotak Group Prudent Fund

(ULGF-019-04/07/17-KGPFFND-107)

MONTHLY UPDATE DECEMBER 2023

|

AS ON 30th November 2023 |

Aims to provide enhanced long term returns by taking a moderate exposure to equity and equity related securities and active management of a

fixed income portfolio.

Date of Inception

01st June 2018

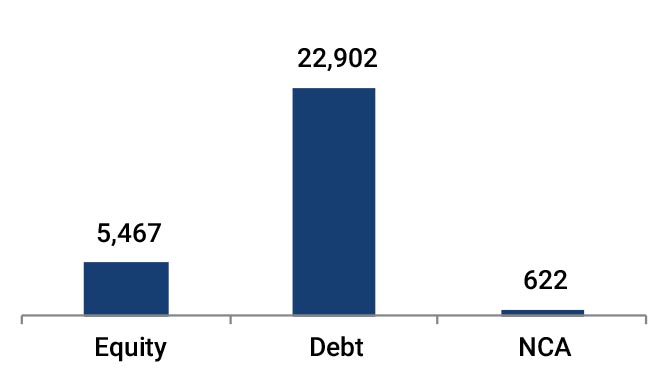

AUM (in Lakhs)

28,991.02

NAV

15.8622

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

20% BSE 100 & 80% Crisil Composite Bond

Modified Duration

Debt & Money

Market Instruments : 5.60

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 20 | 19 |

| Gsec / Debt | 40 - 100 | 71 |

| MMI / Others | 00 - 40 | 10 |

Performance Meter

| Kotak Group Prudent Fund (%) | Benchmark (%) | |

| 1 month | 1.8 | 1.8 |

| 3 months | 1.5 | 1.8 |

| 6 months | 3.5 | 3.5 |

| 1 year | 7.2 | 7.2 |

| 2 years | 5.1 | 5.4 |

| 3 years | 6.2 | 6.7 |

| 4 years | 7.4 | 8.0 |

| 5 years | 8.6 | 8.8 |

| 6 years | n.a. | n.a. |

| 7 years | n.a. | n.a. |

| 10 years | n.a. | n.a. |

| Inception | 8.7 | 8.7 |

| Holdings | % to Fund |

| Equity | 18.86 |

| ICICI Bank Ltd. | 1.17 |

| Infosys Ltd. | 1.10 |

| HDFC Bank Ltd. | 1.03 |

| Reliance Industries Ltd | 0.92 |

| I T C Ltd. | 0.74 |

| Larsen And Toubro Ltd. | 0.67 |

| Axis Bank Ltd. | 0.61 |

| Maruti Suzuki India Ltd | 0.54 |

| Hindustan Unilever Ltd | 0.48 |

| Bharti Airtel Ltd. | 0.48 |

| Sun Pharmaceuticals Ltd | 0.46 |

| UltraTech Cement Ltd. | 0.40 |

| Bajaj Finance Ltd | 0.36 |

| Venus Pipes and Tubes Ltd | 0.34 |

| Tata Consultancy Services Ltd. | 0.33 |

| Tata Motors Ltd. | 0.33 |

| Tech Mahindra Ltd. | 0.32 |

| Zomato Ltd | 0.31 |

| Bharat Electronics Ltd. | 0.30 |

| SBI Life Insurance Company Ltd. | 0.29 |

| Others | 7.69 |

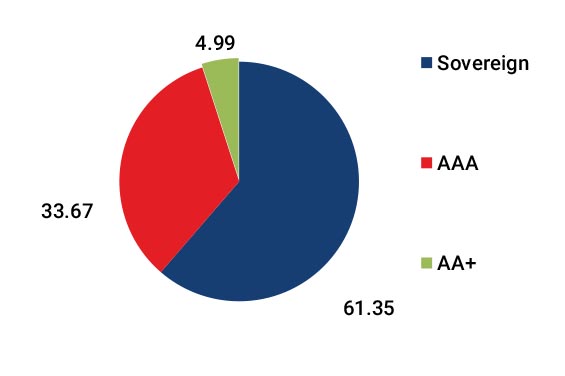

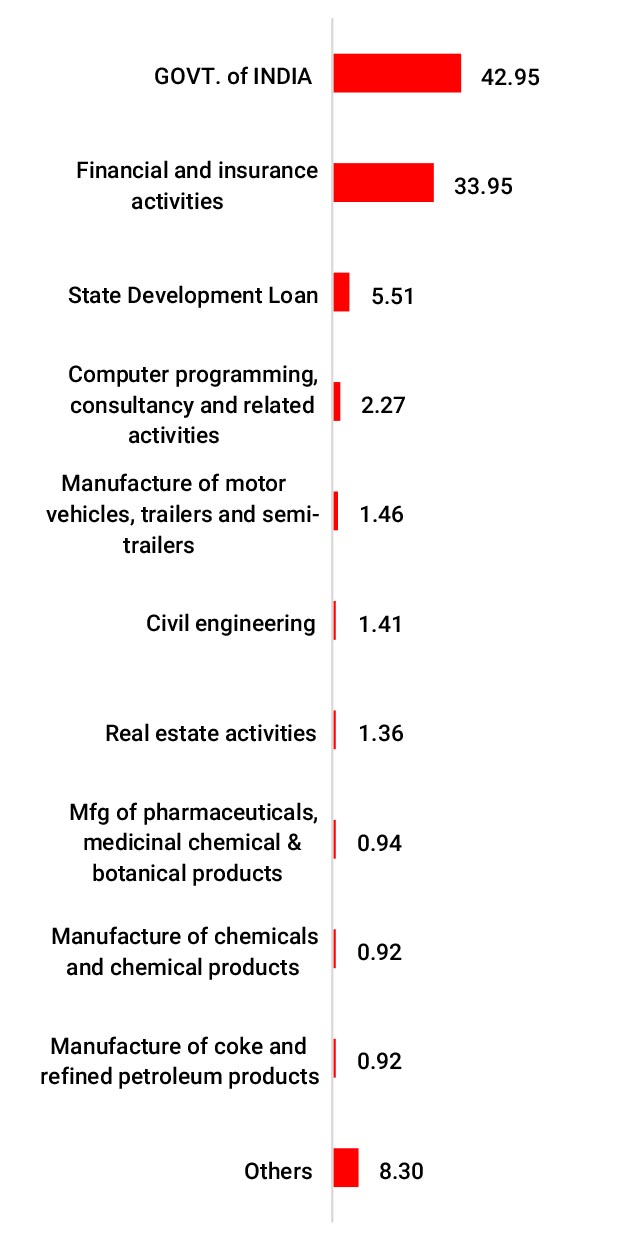

| G-Sec | 49.11 |

| 7.18% GOI - 24.07.2037 | 11.44 |

| 7.18% GOI - 14.08.2033 | 10.15 |

| 7.26% GOI - 06.02.2033 | 7.29 |

| 7.25% GOI - 12.06.2063 | 3.31 |

| 7.30% GOI - 19.06.2053 | 2.43 |

| 7.36% GOI - 12.09.2052 | 2.36 |

| 7.17% GOI - 17.04.2030 | 1.47 |

| 7.38% GJ SDL - 28.06.2030 | 1.09 |

| 7.17% GOI - 08.01.2028 | 0.91 |

| 7.40% GOI - 19.09.2062 | 0.82 |

| Others | 7.83 |

| Corporate Debt | 21.49 |

| 6.99% IRFC - 04.06.2041 | 2.60 |

| 7.80% HDFC BANK - 03.05.2033 | 1.80 |

| 8.60% Bharti Telecom Limited Series XIV - 12.12.2025 | 1.72 |

| 5.44% NABARD - 05.02.2024 | 1.55 |

| 6.25% Cholamandalam Invest and Fin co ltd - 21.02.2024 | 1.10 |

| 7.85% PFC - 03.04.2028 | 1.04 |

| 8.03% Sundaram Home Finance Ltd -22.11.2024 | 1.03 |

| 7.58% PFC - 15.01.2026 | 1.03 |

| 7.38% Cholamandalam Invest and Fin co Ltd - 31.07.2024 | 0.89 |

| 7.05% Embassy Office Parks REIT - 18.10.2026 | 0.84 |

| Others | 7.90 |

| MMI | 8.40 |

| NCA | 2.14 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.