In local currency terms, Nifty was up 5.5%, while the NSE500 was up 7.1%. The Midcap and Smallcap

segments also rallied, after having dipped in October. The Midcap index was up 10.4%, while Smallcaps

rose 12.0%. Real Estate continued its upward momentum, registering a gain of 18.4%, while FMCG

emerged as the principal underperformer for the month, albeit still rising by 3.5%. The INR saw slight

depreciation (0.2% MoM) against USD and averaged 83.298 in Nov-23, with a monthly best and worst of

83.145 and 83.395, respectively. The 10yr benchmark yields traded in the range of 7.22%-7.36% in Nov-23

and eventually ended the month 7bps lower sequentially at 7.28%. The 10y benchmark averaged 7.28%

in November.

Global central banks continue to stay cautious on inflation, but rate cycles have certainly peaked in most DMs, and the view is now shifting towards how long rates will stay elevated before being cut. US CPI inflation declined to 3.2% YoY in Oct-23 (3.7% in Sep-23), with core inflation also falling to 4.0% YoY (4.1% in Sep-23). The US labor market saw non-farm payroll additions of 150,000 in October, almost half the additions seen in September (297,000), indicating that while the labor market is tight, there are strong signs that it is slowly weakening. All of these point towards the Fed holding rates in December. EU inflation also declined to 2.4% in Oct-23 vs 2.9% in Sep-23, and with core inflation also falling to 3.6% from 4.2%, the ECB is expected to continue holding rates steady at its December meeting.

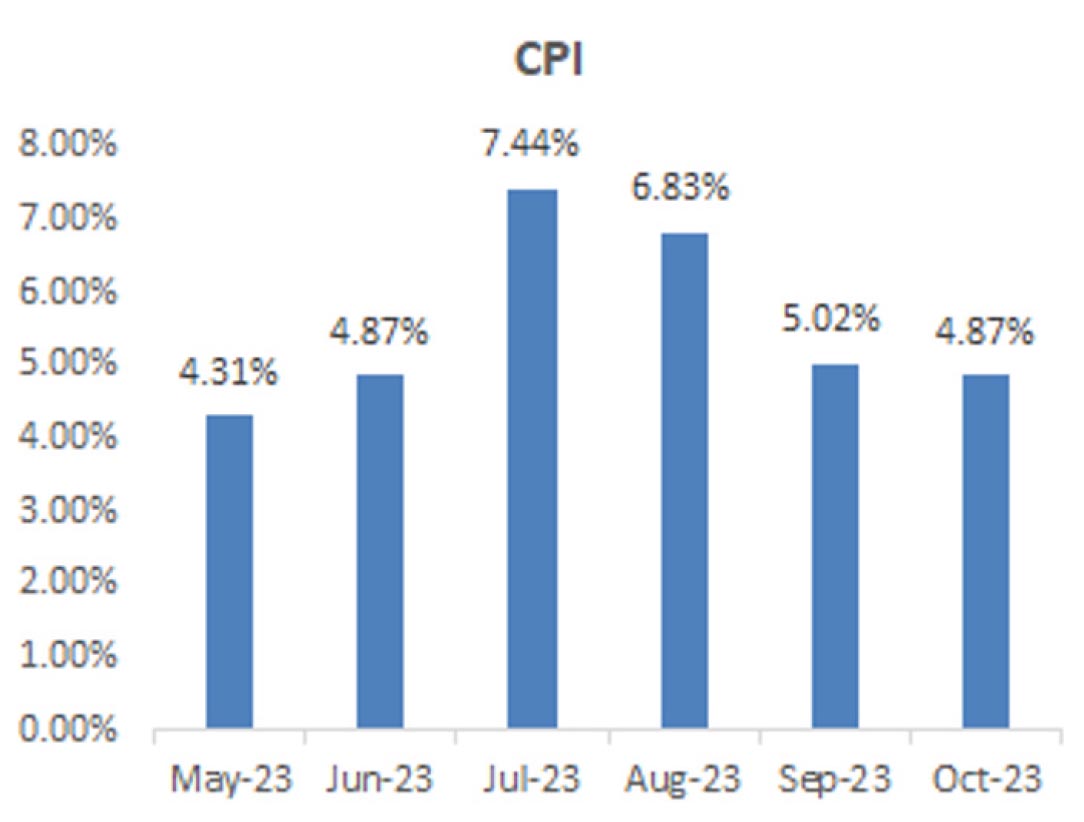

Domestically, the RBI expectedly kept the repo rate unchanged at 6.50% in its October meeting. It reiterated caution and vigilance on inflation amidst recurring food price shocks, and struck a hawkish tone on liquidity. The RBI’s preference seems to be for tighter liquidity and financial conditions in general, with the Governor Dr. Das citing the possibility of OMO sales to manage liquidity if required. October CPI inflation fell to a six-month low of 4.87% YoY, lower than the September print of 5.02%. The decline was led by a favourable base effect and falling core inflation, but there was a sequential increase in headline inflation (0.7% MoM) for the first time in three months. Food inflation rose 1.1% MoM, led by vegetables (3.4% MoM), pulses (2.5% MoM) and spices (1.0% MoM), among others. Core inflation declined to 4.3% YoY (4.6% in Oct), with the lagged effect of lower commodity prices and a favourable base effect as the key factors. Q2FY24 GDP growth was much higher than expected, at 7.6% YoY, led by a boom in Manufacturing (13.9% YoY) and Construction (13.3% YoY). However, services growth moderated to 5.8% YoY, with a sharp decline in growth for Trade, Hotels, Transport and Communication (4.3% YoY vs 9.2% prior), while Agriculture growth weakened further to 1.2% YoY. The expenditure side showed government consumption leading the way (12.4% YoY), along with GFCF (11.0% YoY), while private consumption slowed to 3.0% YoY.

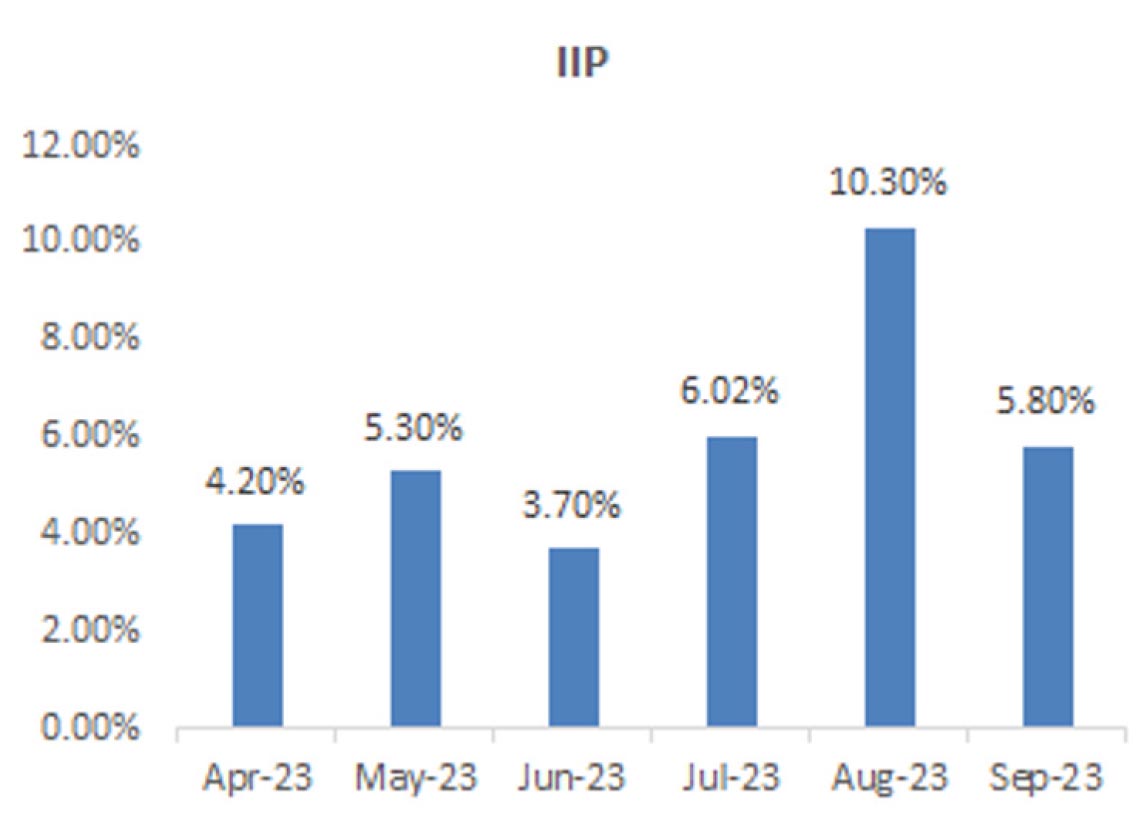

Other high frequency indicators continue to suggest strong macroeconomic activity. Recent prints of IIP, credit growth, and GST collections all point to continued robust growth. The fiscal situation of the Central government remains comfortable in 7MFY24, led by robust growth in tax collection, constrained revenue expenditure and healthy capital expenditure. The Centre’s fiscal deficit was at 45% of BE in 7MFY24 vs 46% of BE in 7MFY23, with capital expenditure recording growth of 34% YoY amounting to 55% of BE. Revenue expenditure grew 7% in 7MFY24, and the high run-rate so far implies that revenue expenditure can actually decline ~4% during Nov-23 to Mar-24 over the same period last year and still meet the FY24BE target. On the revenue front, there is a split between healthy growth for direct taxes (24% YoY) – which are expected to overshoot the FY24BE – and indirect taxes, which have only risen 3% YoY so far. Strong direct tax growth has led to net taxes rising 16% YoY so far. Among key ministries, the Ministry of Road Transport & Highways and the Ministry of Railways have already spent 66% and 65% of their annual allocation for capex by 7MFY24, respectively.

Brent crude prices declined by 7.5% to an average of USD82.03/bbl in Nov-23 from USD88.70/bbl in Oct-23, and ranged between USD86.85-USD77.42/bbl in Nov-23. Continued benign demand conditions, and a weaker-than-expected OPEC+ supply cut, led to crude declining sharply during the month. Overall industrial commodity prices (CRB Industrial Index) declined MoM by ~0.2% in Nov-23 vs a drop of 3.2% in Oct-23. Gold prices rose by 2.6% as of Nov-23 end vs Oct-23 end as it ended the month at USD 2036.41/ oz from USD 1983.88/oz in Oct-23.

Global central banks continue to stay cautious on inflation, but rate cycles have certainly peaked in most DMs, and the view is now shifting towards how long rates will stay elevated before being cut. US CPI inflation declined to 3.2% YoY in Oct-23 (3.7% in Sep-23), with core inflation also falling to 4.0% YoY (4.1% in Sep-23). The US labor market saw non-farm payroll additions of 150,000 in October, almost half the additions seen in September (297,000), indicating that while the labor market is tight, there are strong signs that it is slowly weakening. All of these point towards the Fed holding rates in December. EU inflation also declined to 2.4% in Oct-23 vs 2.9% in Sep-23, and with core inflation also falling to 3.6% from 4.2%, the ECB is expected to continue holding rates steady at its December meeting.

Domestically, the RBI expectedly kept the repo rate unchanged at 6.50% in its October meeting. It reiterated caution and vigilance on inflation amidst recurring food price shocks, and struck a hawkish tone on liquidity. The RBI’s preference seems to be for tighter liquidity and financial conditions in general, with the Governor Dr. Das citing the possibility of OMO sales to manage liquidity if required. October CPI inflation fell to a six-month low of 4.87% YoY, lower than the September print of 5.02%. The decline was led by a favourable base effect and falling core inflation, but there was a sequential increase in headline inflation (0.7% MoM) for the first time in three months. Food inflation rose 1.1% MoM, led by vegetables (3.4% MoM), pulses (2.5% MoM) and spices (1.0% MoM), among others. Core inflation declined to 4.3% YoY (4.6% in Oct), with the lagged effect of lower commodity prices and a favourable base effect as the key factors. Q2FY24 GDP growth was much higher than expected, at 7.6% YoY, led by a boom in Manufacturing (13.9% YoY) and Construction (13.3% YoY). However, services growth moderated to 5.8% YoY, with a sharp decline in growth for Trade, Hotels, Transport and Communication (4.3% YoY vs 9.2% prior), while Agriculture growth weakened further to 1.2% YoY. The expenditure side showed government consumption leading the way (12.4% YoY), along with GFCF (11.0% YoY), while private consumption slowed to 3.0% YoY.

Other high frequency indicators continue to suggest strong macroeconomic activity. Recent prints of IIP, credit growth, and GST collections all point to continued robust growth. The fiscal situation of the Central government remains comfortable in 7MFY24, led by robust growth in tax collection, constrained revenue expenditure and healthy capital expenditure. The Centre’s fiscal deficit was at 45% of BE in 7MFY24 vs 46% of BE in 7MFY23, with capital expenditure recording growth of 34% YoY amounting to 55% of BE. Revenue expenditure grew 7% in 7MFY24, and the high run-rate so far implies that revenue expenditure can actually decline ~4% during Nov-23 to Mar-24 over the same period last year and still meet the FY24BE target. On the revenue front, there is a split between healthy growth for direct taxes (24% YoY) – which are expected to overshoot the FY24BE – and indirect taxes, which have only risen 3% YoY so far. Strong direct tax growth has led to net taxes rising 16% YoY so far. Among key ministries, the Ministry of Road Transport & Highways and the Ministry of Railways have already spent 66% and 65% of their annual allocation for capex by 7MFY24, respectively.

Brent crude prices declined by 7.5% to an average of USD82.03/bbl in Nov-23 from USD88.70/bbl in Oct-23, and ranged between USD86.85-USD77.42/bbl in Nov-23. Continued benign demand conditions, and a weaker-than-expected OPEC+ supply cut, led to crude declining sharply during the month. Overall industrial commodity prices (CRB Industrial Index) declined MoM by ~0.2% in Nov-23 vs a drop of 3.2% in Oct-23. Gold prices rose by 2.6% as of Nov-23 end vs Oct-23 end as it ended the month at USD 2036.41/ oz from USD 1983.88/oz in Oct-23.

CPI: October CPI inflation moderated marginally to 4.9% (September: 5%) mainly due to a favorable base.

Sequentially, headline CPI increased by 0.7% (Sep: (-)1.1% mom) led by a spike in vegetable prices (mainly

onions, spinach, and brinjal). Core inflation moderated to 4.3% (Sep: 4.5%) while increasing sequentially

by 0.4% (Sep: 0% mom).

IIP: IIP growth in September moderated to 5.8% (August: 10.3%) while contracting sequentially by 2.4% (August: +1.8%). As per the sectoral classification, manufacturing sector growth was at 4.5% (August: 9.3%), mining activity growth was at 11.5% (12.3%), and electricity production growth was at 9.9% (15.3%). As per the use-based classification, all categories registered robust growths. However, consumer durables and non-durables growth was muted at 1% and 2.7%, respectively.

Trade: Exports in October moderated marginally to US$33.6 bn (September: US$34.5 bn; 6.2% yoy) with non-oil exports at US$27.6 bn (Sep: US$28 bn). Imports surged to US$65 bn (Sep: US$53.8 bn; 12.3% yoy). Of the US$11.2 bn rise in imports from Sep levels, US$9.7 bn was due to (1) crude oil (US$3.7 bn higher than in September), (2) gold (US$3.1 bn), (3) silver (US$1.2 bn), (4) coal, coke, and briquettes (US$1 bn) and (5) fertilizers (US$ 0.7 bn). October trade deficit widened to US$31.5 bn (Sep: US$19.4 bn). Services surplus in October increased to US$14.4 bn with exports at US$28.7 bn and imports at US$14.3 bn.

Fiscal Deficit: The Center’s fiscal deficit in 1HFY24 remained in check at 39% of FY2024BE, aided by an improvement in direct tax collections. The pace of expenditure remained steady and buoyed by capex on roads and railways. We expect the Center to adhere to its FY2024BE GFD/GDP target of 5.9%, given robust tax collections, the RBI’s surplus transfer and manageable expenditure, so far.

IIP: IIP growth in September moderated to 5.8% (August: 10.3%) while contracting sequentially by 2.4% (August: +1.8%). As per the sectoral classification, manufacturing sector growth was at 4.5% (August: 9.3%), mining activity growth was at 11.5% (12.3%), and electricity production growth was at 9.9% (15.3%). As per the use-based classification, all categories registered robust growths. However, consumer durables and non-durables growth was muted at 1% and 2.7%, respectively.

Trade: Exports in October moderated marginally to US$33.6 bn (September: US$34.5 bn; 6.2% yoy) with non-oil exports at US$27.6 bn (Sep: US$28 bn). Imports surged to US$65 bn (Sep: US$53.8 bn; 12.3% yoy). Of the US$11.2 bn rise in imports from Sep levels, US$9.7 bn was due to (1) crude oil (US$3.7 bn higher than in September), (2) gold (US$3.1 bn), (3) silver (US$1.2 bn), (4) coal, coke, and briquettes (US$1 bn) and (5) fertilizers (US$ 0.7 bn). October trade deficit widened to US$31.5 bn (Sep: US$19.4 bn). Services surplus in October increased to US$14.4 bn with exports at US$28.7 bn and imports at US$14.3 bn.

Fiscal Deficit: The Center’s fiscal deficit in 1HFY24 remained in check at 39% of FY2024BE, aided by an improvement in direct tax collections. The pace of expenditure remained steady and buoyed by capex on roads and railways. We expect the Center to adhere to its FY2024BE GFD/GDP target of 5.9%, given robust tax collections, the RBI’s surplus transfer and manageable expenditure, so far.

Deal flow saw a pickup in November with reported 29 deals worth ~$3.4 billion executed. Key deals

included Zomato block ($400mn), Tata Tech IPO ($365mn) and Honasa IPO ($204mn).

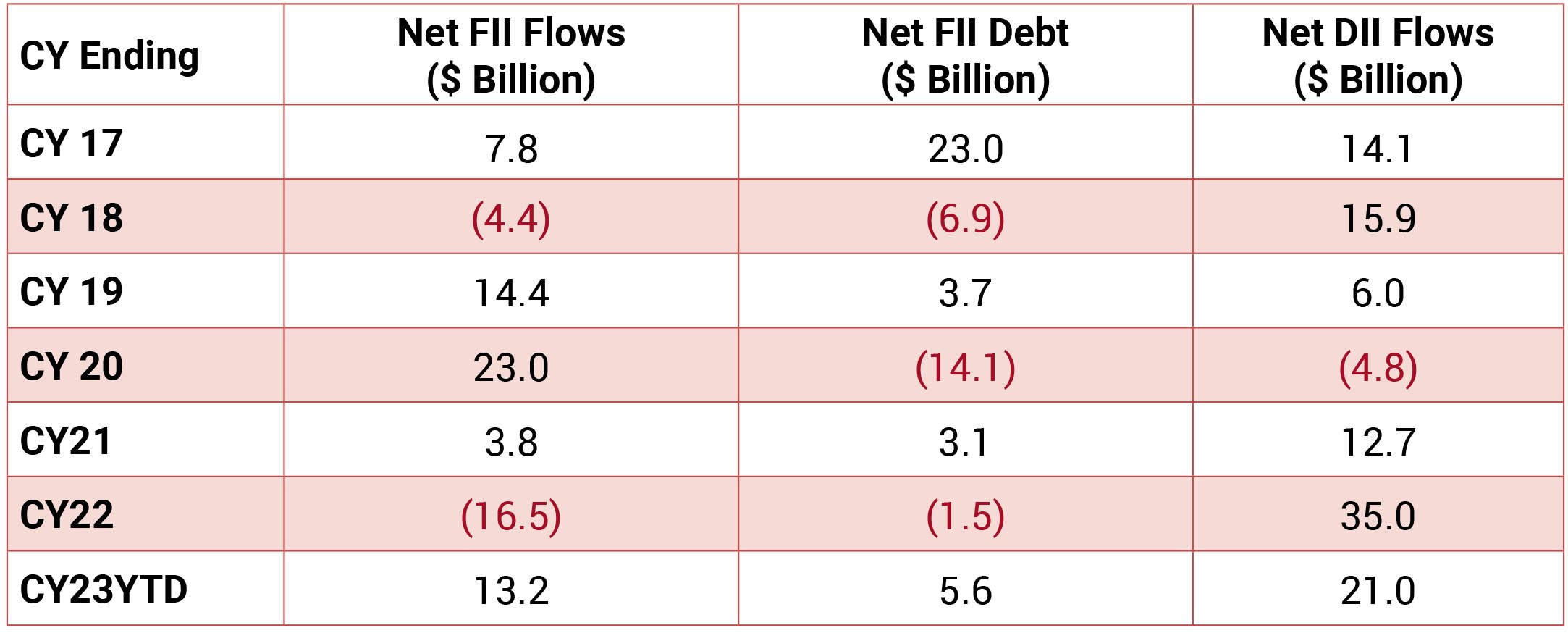

FIIs turned buyers in the month of November 2023 to the tune of $2.3bn and DIIs remained net buyers to the tune of $1.7bn.

FIIs turned buyers in the month of November 2023 to the tune of $2.3bn and DIIs remained net buyers to the tune of $1.7bn.