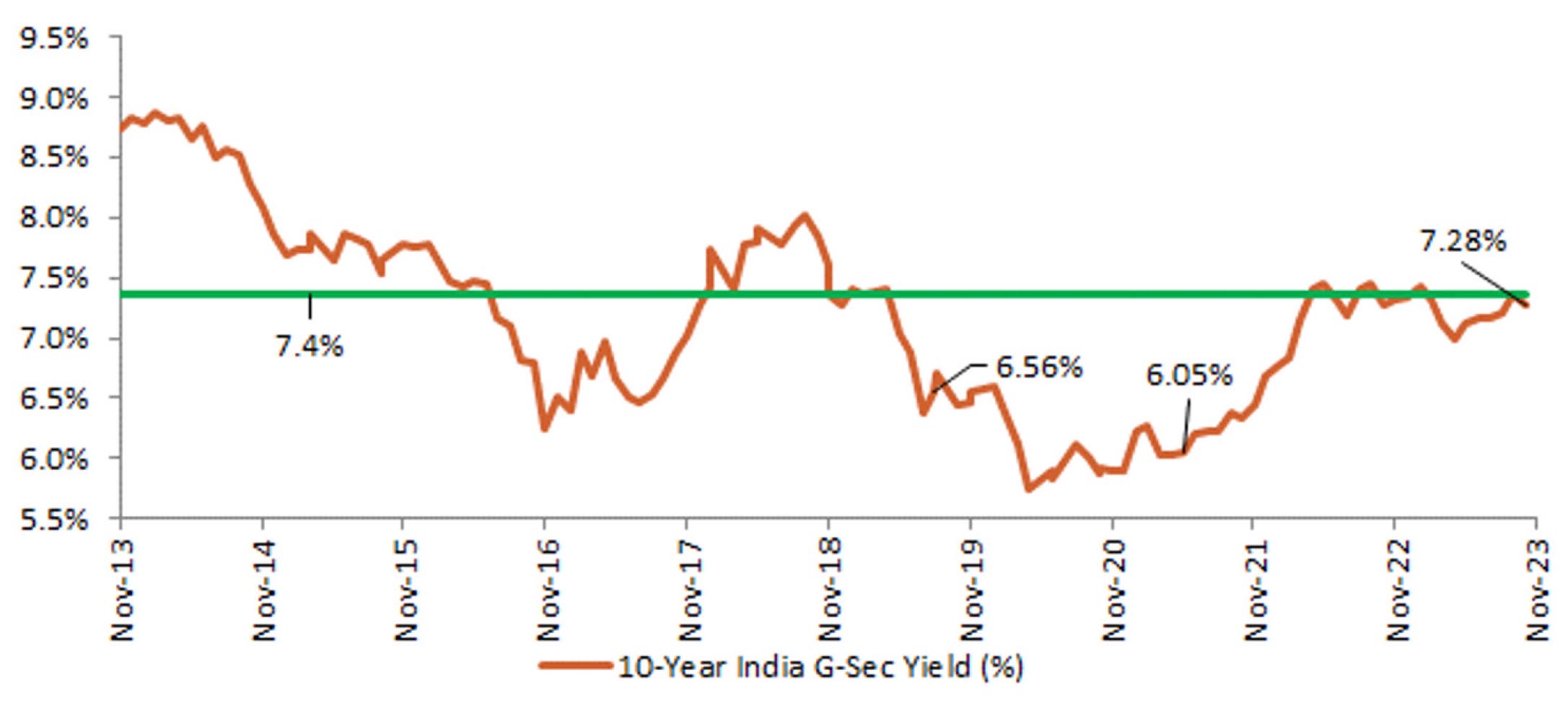

The 10yr benchmark yields traded in the range of 7.22%-7.36% in Nov-23 and eventually ended the month 7bps lower sequentially at 7.28%. The 10y benchmark averaged 7.28% in November.

The longer end spread of 30yr and 40yr widened due to muted investor demand. Market has been struggling ever sincee SDL supply and corporate bond supply has gone up over the month. US rates have been falling quite sharply and this has meant market has remained stable instead of selling off. Domestic investors have used the rallies to book profits. India’s GDP surprised positively and inflation is likely to stay above 6% for next 2 months which means there is little hope that RBI will ease liquidity in upcoming MPC meeting. However, it is likely that they may acknowledge that there is no immediate need to do OMO sales. They haven’t been selling any bonds in secondary market for last few weeks as liquidity conditions have tightened post Diwali. On a medium term basis there is not much demand supply mismatch in India G-secs as FPIs will buy INR 2tn of G-secs next year but one has to be patient for yields to go lower in Dec- Mar quarter when non G-sec supply will weigh on market. One last caveat regarding the 10y G-sec which is going to see a much larger supply in December due to increased auction size (INR 160 bn vs INR 130 bn weekly). Further we can see a new 10yr G-sec being announced in January. This may mean that 7.18 2033 may underperform relative to rest of the market.