●Strong GDP Growth: India’s real GDP grew 7.6% YoY in 2QFY24 vs. 6.2% in 2QFY23. Overall, GDP growth remained robust driven by government capital expendisture also aided by higher domestic demand. Overall, India’s GDP growth remains extremely strong, at 7.7% real growth in 1H, we believe the full-year growth will be revised upward once again.

●Corporate earnings review: The corporate earnings during 2QFY24 remained strong with a widespread outperformance driven by margin tailwinds. Domestic cyclicals such as Automobiles, BFSI and Cement drove the earnings. O&G profits jumped with OMC’s profitability soaring due to strong marketing margins. Real Estate is another sector which is seeing strong demand trends sustaining: All companies are seeing record sales and with interest rate hikes now coming to a pause, the demand trends and continue to remain strong. All companies are also guiding for strong pre-sales numbers going ahead.

●Fed’s stance to remain hawkish: Despite the sharp rate hike, US economic indicators continue to remain strong and better than the Fed’s expectations, hampering its target of achieving sustainable inflation rate of 2%. Fed continued to hold interest rates of 5.25% to 5.5%, but remains hawkish if resilience in the US economy continues. The possibility of interest rates remaining ‘higher for longer’ cannot to be ruled out.

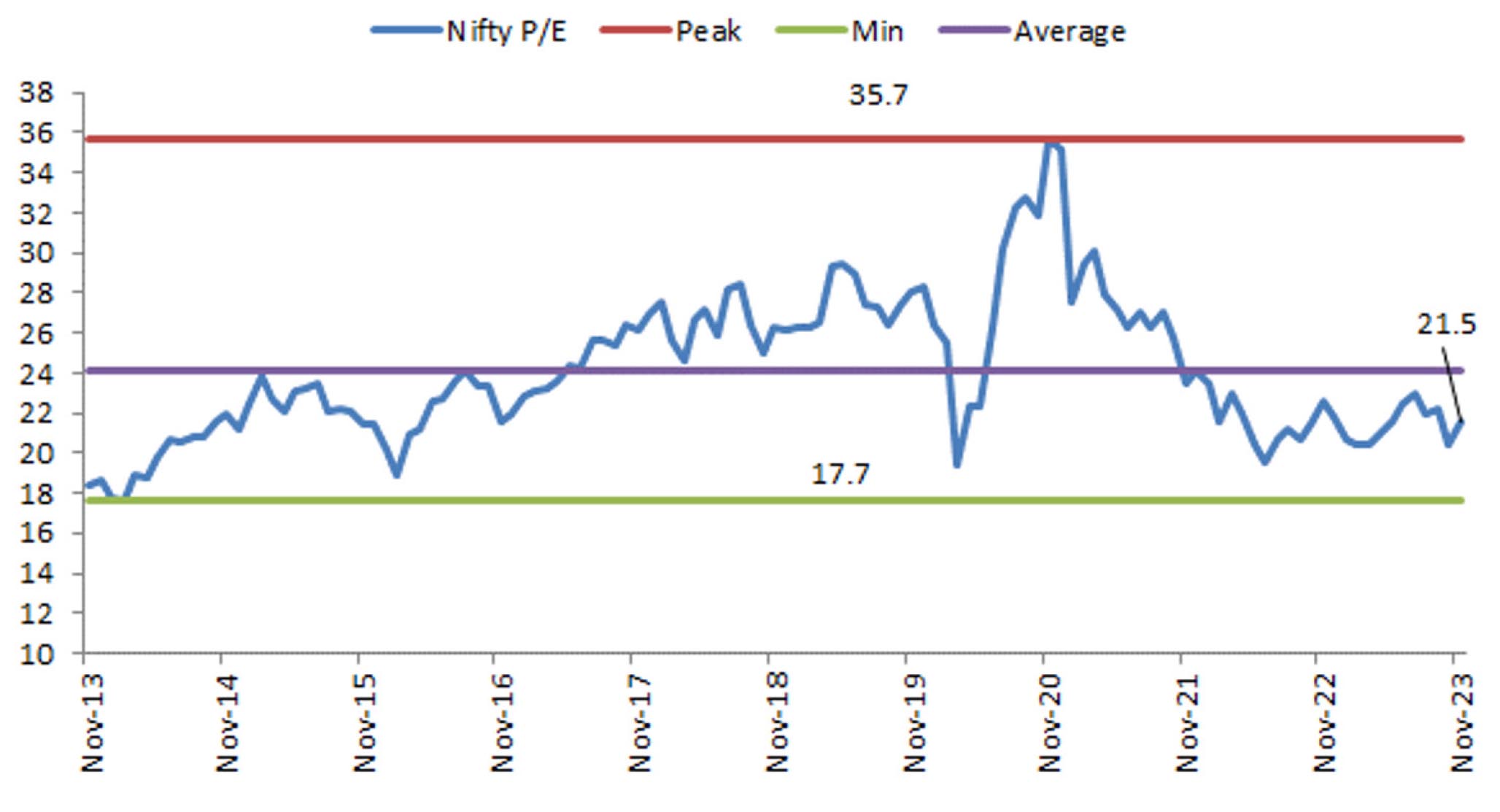

●Outlook: Buoyant corporate earnings, and economic activities, declining input costs, strong private and govt. infrastructure spends, strong DII inflows with near all time high SIP flows, cool off in US bond yield reaffirms positive outlook on the medium to long term horizon. Geopolitical developments, Fed’s hawkish stance, volatility in crude oil prices, weak rural demand and volatility led by investors pre-empting the outcome of 2024 elections will be the key near term challenges to watch out for.