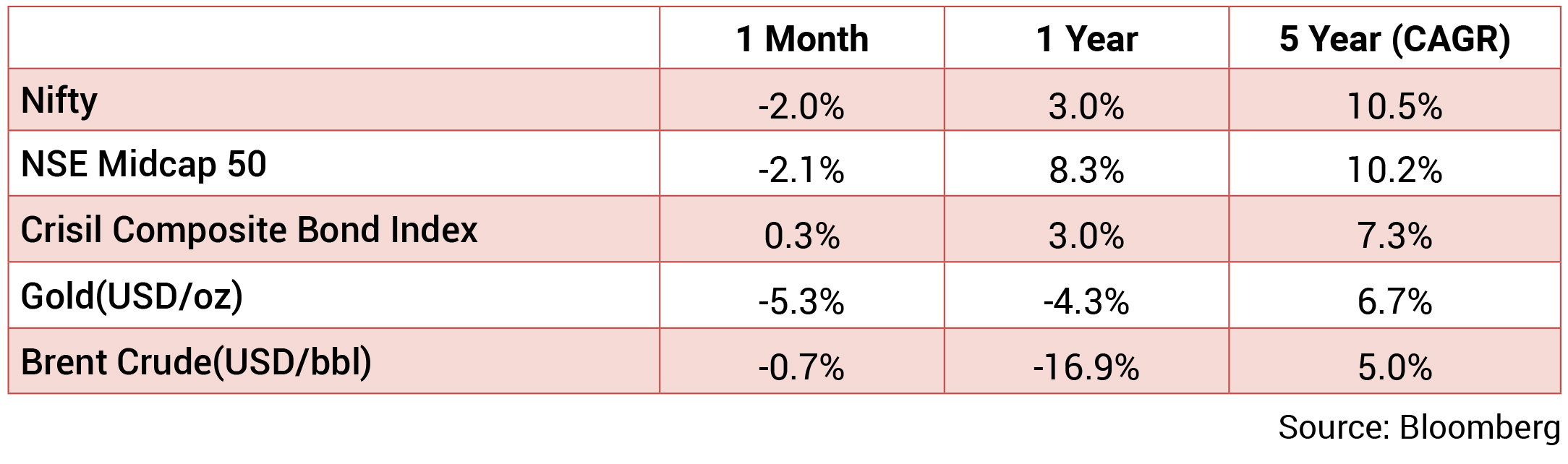

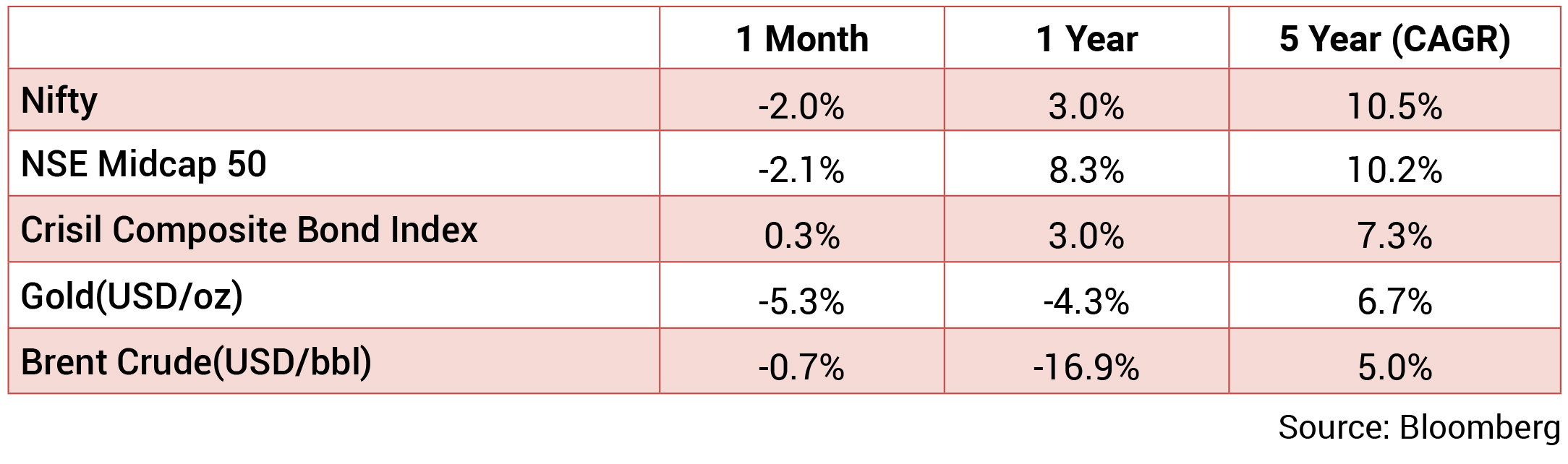

Markets declined by 2% amidst moderating institutional flow. With deposit rates picking up, opportunity

cost of investing in equities has increased and is weighing on domestic flows. Metal and Media have

been the laggards while FMCG & IT have been the frontrunner sectors. The INR depreciated against USD

in February after it had appreciated in the previous month. It averaged around 82.6 with a monthly best

and worst of 81.8 and 82.9 respectively. 10yr benchmark yields traded in the range of 7.28%-7.43% and

eventually ended the month 9bps higher sequentially at 7.43%. The 10y benchmark averaged 7.35% in

February.

At 6.4% yoy, US recorded its lowest inflation in 15 months but sequential inflation was recorded at 0.5%, which was the highest in last 3 months. Services-ex shelter, a leading indicator of US inflation as it represents services wage growth, increased by 0.3% sequentially while shelter, a component that represents a 3rd of the CPI basket, contributed to almost half of the inflation in January’23. While demand continues to hold in the US, the job market too remains tight as change in non-farm payroll was +519k, which was 1.6x higher than consensus’ expectations. There is rising expectations of 2 more 25bps rate hikes to be undertaken in March and May of 2023 as terminal rate has increased to ~5.4% EU and UK witnessed their inflation fall for the second month in a row but it remains at an elevated 8.6% & 10.1% respectively. ECB is expected to undertake a 50bps rate hike in March’23 while bank of England too may undertake a rate hike of at least 25bps in March or May. Cutting down on interest rates seem to have taken a back seat for now.

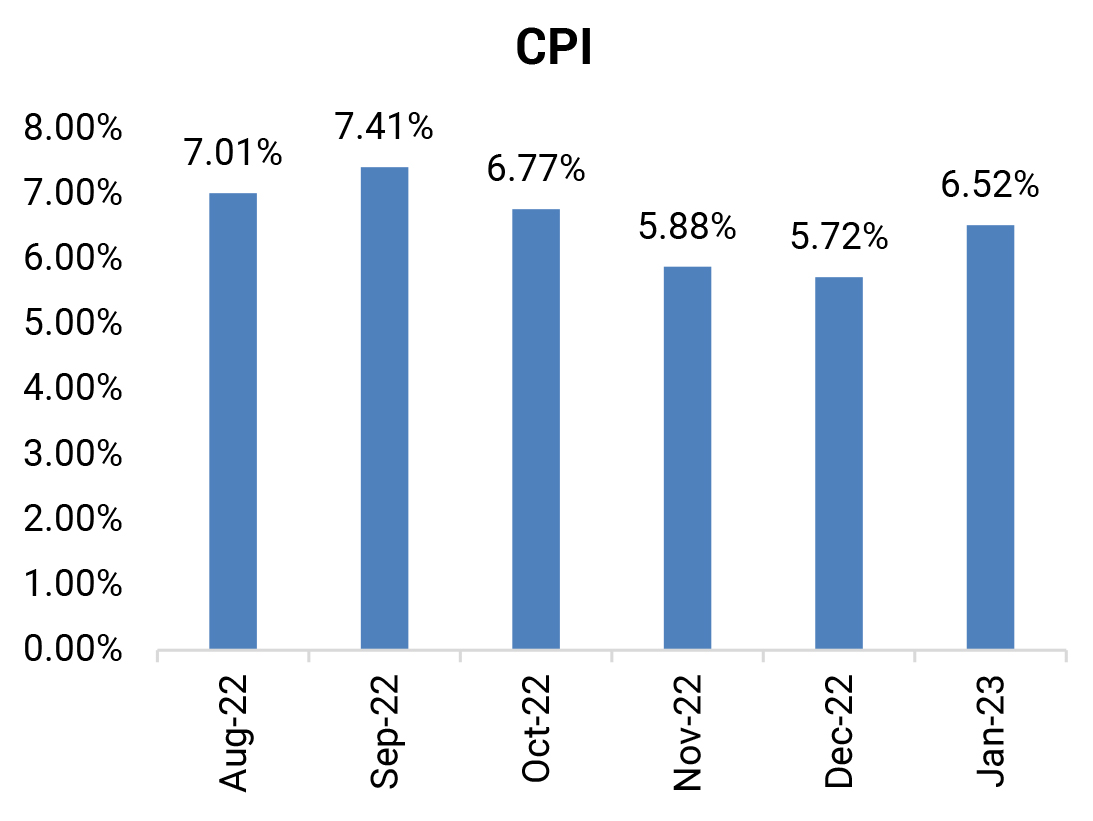

High frequency indicators suggest domestic consumption continues to remain resilient as represented by GST collections, e-way bill generation and strong consumer payments data. Manufacturing PMI fell for the second month in a row reflecting the impact of rising borrowing costs and global slowdown causing falling exports in the manufacturing sector, but remains in the expansion zone due to domestic demand. GDP in Q3FY23 grew by 4.4% driven by strong investment demand and services sector as government stuck by its projection of 7% growth in FY23. CPI increased to 6.5% YoY vs 5.7% in the previous month on account of rising food prices, especially cereals such as wheat and rice. Core inflation continued to remain sticky at 6.1%, which is higher than MPC’s inflation targeting upper tolerance limit of 6%. While RBI hiked the repo rate by 25bps in Feb’23, there are growing expectations that RBI would continue with further rate hikes to bring the sticky inflation under control. Government continued to rein in the fiscal deficit whilst it maintains strong capex numbers. By end January, government had already achieved 76% of its budgeted capex driven by railways and roads as both sectors have achieved 98% & 104% respectively of their initial budgeted capex. With 87% of tax revenues achieved, government’s fiscal deficit has been just 72% of the initial budgeted fiscal deficit.

In FY24, government is continuing with its 2 pronged approach of achieving fiscal consolidation and pushing infrastructure through greater allocation to road, railways and housing. Government is aiming to bring its fiscal deficit to 5.9% of the GDP in FY24 from 6.4% in FY23 by reining in its subsidies and several other revex components. Government has announced a massive Rs 10trn infrastructure led capex plan for FY24, of which ~Rs5trn would be spent on railways and roads. Discretionary consumption of the middle class should increase as government announced increase in the income tax exemption and rebate limit along with several other new tax regime related measures. It has set achievable nominal GDP growth target of 10.5% in FY24, which means real GDP would grow at 6-6.8% YoY.

Brent crude prices marginally decreased from an average of USD 84/bbl in January to USD 83.5/bbl in February. It traded between USD 83-86 per barrel for most of the month as China, the second largest crude oil consumer saw marginal recovery in its oil demand and Russia saw limited pressure on its supply of oil. Gold prices ended lower at USD 1,841/oz in February from USD 1,923/oz in January on account of stronger dollar and hawkish commentary of US Fed.

At 6.4% yoy, US recorded its lowest inflation in 15 months but sequential inflation was recorded at 0.5%, which was the highest in last 3 months. Services-ex shelter, a leading indicator of US inflation as it represents services wage growth, increased by 0.3% sequentially while shelter, a component that represents a 3rd of the CPI basket, contributed to almost half of the inflation in January’23. While demand continues to hold in the US, the job market too remains tight as change in non-farm payroll was +519k, which was 1.6x higher than consensus’ expectations. There is rising expectations of 2 more 25bps rate hikes to be undertaken in March and May of 2023 as terminal rate has increased to ~5.4% EU and UK witnessed their inflation fall for the second month in a row but it remains at an elevated 8.6% & 10.1% respectively. ECB is expected to undertake a 50bps rate hike in March’23 while bank of England too may undertake a rate hike of at least 25bps in March or May. Cutting down on interest rates seem to have taken a back seat for now.

High frequency indicators suggest domestic consumption continues to remain resilient as represented by GST collections, e-way bill generation and strong consumer payments data. Manufacturing PMI fell for the second month in a row reflecting the impact of rising borrowing costs and global slowdown causing falling exports in the manufacturing sector, but remains in the expansion zone due to domestic demand. GDP in Q3FY23 grew by 4.4% driven by strong investment demand and services sector as government stuck by its projection of 7% growth in FY23. CPI increased to 6.5% YoY vs 5.7% in the previous month on account of rising food prices, especially cereals such as wheat and rice. Core inflation continued to remain sticky at 6.1%, which is higher than MPC’s inflation targeting upper tolerance limit of 6%. While RBI hiked the repo rate by 25bps in Feb’23, there are growing expectations that RBI would continue with further rate hikes to bring the sticky inflation under control. Government continued to rein in the fiscal deficit whilst it maintains strong capex numbers. By end January, government had already achieved 76% of its budgeted capex driven by railways and roads as both sectors have achieved 98% & 104% respectively of their initial budgeted capex. With 87% of tax revenues achieved, government’s fiscal deficit has been just 72% of the initial budgeted fiscal deficit.

In FY24, government is continuing with its 2 pronged approach of achieving fiscal consolidation and pushing infrastructure through greater allocation to road, railways and housing. Government is aiming to bring its fiscal deficit to 5.9% of the GDP in FY24 from 6.4% in FY23 by reining in its subsidies and several other revex components. Government has announced a massive Rs 10trn infrastructure led capex plan for FY24, of which ~Rs5trn would be spent on railways and roads. Discretionary consumption of the middle class should increase as government announced increase in the income tax exemption and rebate limit along with several other new tax regime related measures. It has set achievable nominal GDP growth target of 10.5% in FY24, which means real GDP would grow at 6-6.8% YoY.

Brent crude prices marginally decreased from an average of USD 84/bbl in January to USD 83.5/bbl in February. It traded between USD 83-86 per barrel for most of the month as China, the second largest crude oil consumer saw marginal recovery in its oil demand and Russia saw limited pressure on its supply of oil. Gold prices ended lower at USD 1,841/oz in February from USD 1,923/oz in January on account of stronger dollar and hawkish commentary of US Fed.

Source: Bloomberg

Source: Bloomberg

Union Budget: The government in its FY24 union budget (1) prioritized fiscal consolidation and (2) focused

on capital expenditure to achieve higher medium-term GDP growth. It has targeted central GFD/GDP

at 5.9% in FY24BE (6.4% in FY2023RE), staying on course to reach the targeted 4.5% by FY2026. The

‘growth’ focus of the budget was visible in (1) high capital expenditure growth and (2) targeted increase

in allocations to affordable housing, rural employment, rural roads and drinking water. The government

has budgeted (1) 37% increase in direct capital expenditure to Rs 10tn (with Rs 1.3tn support to states

and 32% including spending of PSUs) and (2) 13% contraction in rural development. The budget has

targeted (1) tax revenues growth of 10% (10% for both direct and indirect taxes) and (2) overall expenditure

growth of 7.5% (1.2% for revenue expenditure). It has pegged divestment target at Rs 610bn (Rs 510bn of

divestment receipts and Rs 100bn as other receipts). Nominal GDP growth has been assumed at 10.5%

for FY24. The government has also rejigged the tax structures for personal income taxes and made them

increasingly attractive versus the old regime.

CPI: January CPI inflation increased by 6.52% (December: 5.72%), led mainly by a sequential rise in prices of cereals (2.6% mom compared to 1.1% in December) and eggs (2.3% mom compared to 4.9% mom). On the other hand, vegetable prices contracted, but the contraction was shallower than in December ((-)3.8% mom % versus (-)12.7% mom in December). January core inflation (CPI excluding food, fuel, pan, and tobacco) remained elevated and sticky at around 6.41% while increasing sequentially by 0.53% (December: 0.31% mom). Gold and silver prices, yet again, caused an increase in the personal care and effects category.

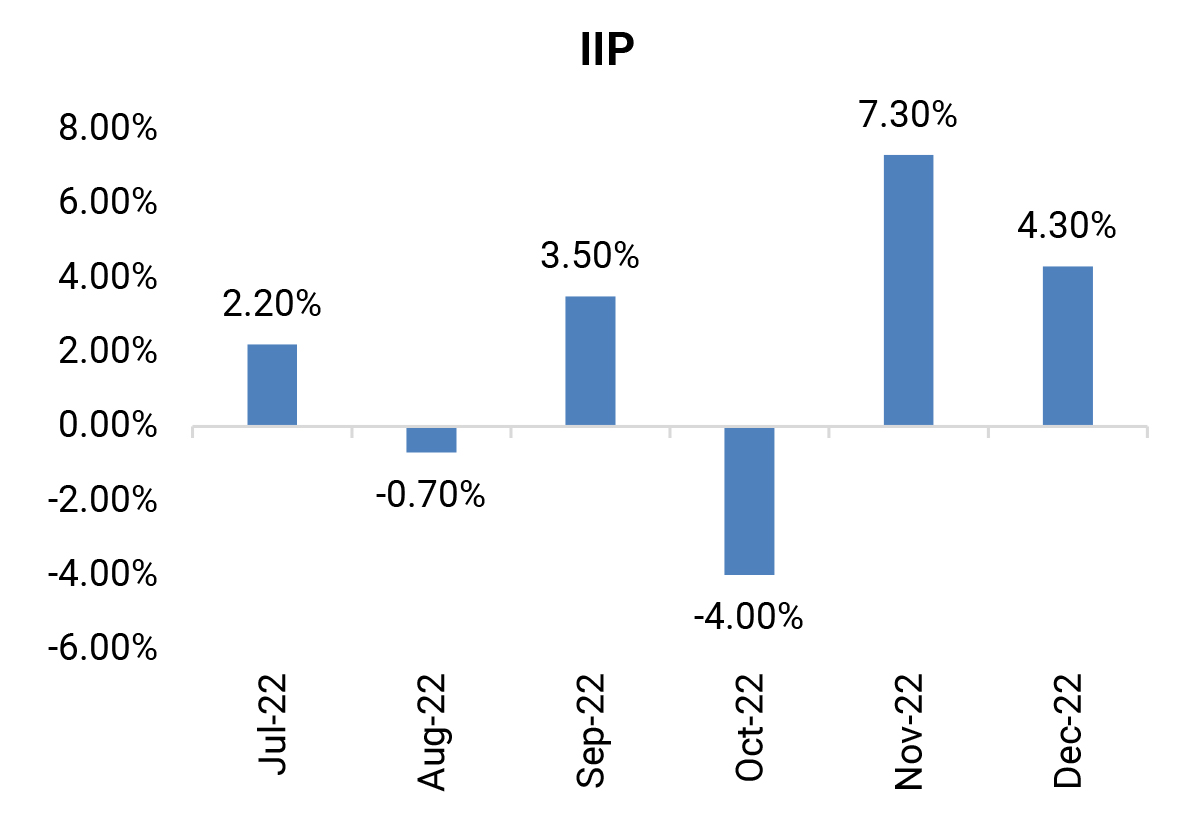

IIP: December IIP registered a growth of 4.3% yoy (November: 7.4%), mainly due to an unfavorable base effect. Sequentially, IIP increased 5.3%. On a sectoral basis, all components exhibited positive growth, led by electricity production growing 10.4% (November: 12.7%), and mining activity growing 9.8% (9.7%); the manufacturing sector grew at a muted 2.6% from 6.4% in November. According to the use-based classification, primary goods production grew the most by 8.3% (November: 4.8%), followed by construction goods at 8.2% (13.2%), and capital goods at 7.6% from 21.6% in November. On the other hand, consumer durables contracted the most, by 10.4% (November: +5.3%).

GDP: The NSO estimates FY23 real GDP growth at 7% against 8.7% in FY2022. With H1FY23 GDP growth at 9.7%, the implied H2FY23 GDP growth is at 4.5%. The key driver of H2FY23 growth is expected to be investments (GFCF) at 8.4% growth (15% in 1HFY23) and government expenditure growth at 7.2% ((- )1.3% in 1HFY23). Private consumption is expected to contract by 0.2% (+17.2% in 1HFY23). Exports are expected to grow by 11.9% in H2FY23 (13% in H1FY23) while import growth is expected to moderate sharply to 12.2% (30.9%). The NSO estimates FY23 real GVA growth at 6.7% against 8.1% in FY2022. With H1FY23 GVA growth at 9%, the implied H2FY23 growth is at 4.7%. Nominal GDP growth has been pegged at 15.4% implying a GDP deflator of around 7.9%.

GDP: Q3FY23 GDP growth stood at 4.4% (Q2FY23: 6.3%). Growth was led by GFCF growth of 8.3% (Q2FY23: 9.7%), while private consumption growth was weak at 2.1% (8.8%). Q3FY23 real GVA grew by 4.6%, led by services growth of 6.2% (Q2FY23: 9.4%) and agricultural sector growth of 3.7% (2.4%). Services growth was driven by contact-based services (trade, hotel, etc.) growth of 9.7% (Q2FY23: 15.6%). The NSO maintained its FY2023 GDP growth at 7% (same as the first advance estimates). Real GDP growth for FY2021-22 was revised up to (-)5.8% (earlier: (-)6.6%) and 9.1% (earlier: 8.7%).

Trade: January exports at USD 32.9bn (December: USD 38bn) fell by 6.6% yoy. Non-oil exports fell to USD 28bn (December: USD 29.7bn), while oil exports fell to USD 4.9bn (USD 8.4bn). Engineering goods fell to USD 8.4bn (December: USD 9.1bn). January imports were sharply lower at USD 50.7bn (December: USD 60.2bn). The sharp fall in imports was due to (1) non-oil imports falling, and (2) likely softening in domestic demand post-festive season. Consequently, the trade deficit in January narrowed to USD 17.7bn (December: USD 22.1bn) and was at USD 233.2bn in 10MFY23 (10MFY22: USD 153.8bn).

CPI: January CPI inflation increased by 6.52% (December: 5.72%), led mainly by a sequential rise in prices of cereals (2.6% mom compared to 1.1% in December) and eggs (2.3% mom compared to 4.9% mom). On the other hand, vegetable prices contracted, but the contraction was shallower than in December ((-)3.8% mom % versus (-)12.7% mom in December). January core inflation (CPI excluding food, fuel, pan, and tobacco) remained elevated and sticky at around 6.41% while increasing sequentially by 0.53% (December: 0.31% mom). Gold and silver prices, yet again, caused an increase in the personal care and effects category.

IIP: December IIP registered a growth of 4.3% yoy (November: 7.4%), mainly due to an unfavorable base effect. Sequentially, IIP increased 5.3%. On a sectoral basis, all components exhibited positive growth, led by electricity production growing 10.4% (November: 12.7%), and mining activity growing 9.8% (9.7%); the manufacturing sector grew at a muted 2.6% from 6.4% in November. According to the use-based classification, primary goods production grew the most by 8.3% (November: 4.8%), followed by construction goods at 8.2% (13.2%), and capital goods at 7.6% from 21.6% in November. On the other hand, consumer durables contracted the most, by 10.4% (November: +5.3%).

GDP: The NSO estimates FY23 real GDP growth at 7% against 8.7% in FY2022. With H1FY23 GDP growth at 9.7%, the implied H2FY23 GDP growth is at 4.5%. The key driver of H2FY23 growth is expected to be investments (GFCF) at 8.4% growth (15% in 1HFY23) and government expenditure growth at 7.2% ((- )1.3% in 1HFY23). Private consumption is expected to contract by 0.2% (+17.2% in 1HFY23). Exports are expected to grow by 11.9% in H2FY23 (13% in H1FY23) while import growth is expected to moderate sharply to 12.2% (30.9%). The NSO estimates FY23 real GVA growth at 6.7% against 8.1% in FY2022. With H1FY23 GVA growth at 9%, the implied H2FY23 growth is at 4.7%. Nominal GDP growth has been pegged at 15.4% implying a GDP deflator of around 7.9%.

GDP: Q3FY23 GDP growth stood at 4.4% (Q2FY23: 6.3%). Growth was led by GFCF growth of 8.3% (Q2FY23: 9.7%), while private consumption growth was weak at 2.1% (8.8%). Q3FY23 real GVA grew by 4.6%, led by services growth of 6.2% (Q2FY23: 9.4%) and agricultural sector growth of 3.7% (2.4%). Services growth was driven by contact-based services (trade, hotel, etc.) growth of 9.7% (Q2FY23: 15.6%). The NSO maintained its FY2023 GDP growth at 7% (same as the first advance estimates). Real GDP growth for FY2021-22 was revised up to (-)5.8% (earlier: (-)6.6%) and 9.1% (earlier: 8.7%).

Trade: January exports at USD 32.9bn (December: USD 38bn) fell by 6.6% yoy. Non-oil exports fell to USD 28bn (December: USD 29.7bn), while oil exports fell to USD 4.9bn (USD 8.4bn). Engineering goods fell to USD 8.4bn (December: USD 9.1bn). January imports were sharply lower at USD 50.7bn (December: USD 60.2bn). The sharp fall in imports was due to (1) non-oil imports falling, and (2) likely softening in domestic demand post-festive season. Consequently, the trade deficit in January narrowed to USD 17.7bn (December: USD 22.1bn) and was at USD 233.2bn in 10MFY23 (10MFY22: USD 153.8bn).

Deal flow picked in February with 30 deals worth USD 1.2bn executed. Key deals included Interglobe

Aviation (USD 355.6mn) and Syngene International Ltd (USD 273mn).

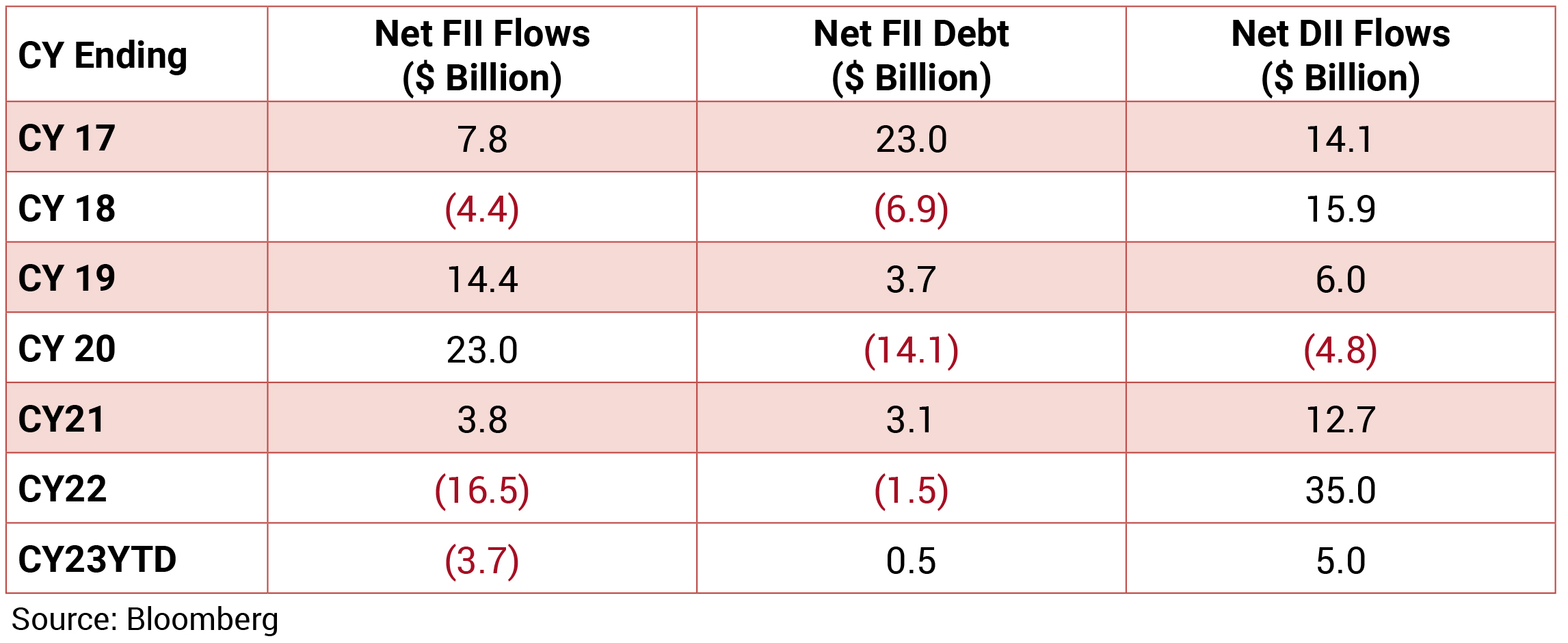

FIIs were net sellers in the month of February 2023 to the tune of USD 628mn and DIIs bought to the tune of USD 2.3bn.

FIIs were net sellers in the month of February 2023 to the tune of USD 628mn and DIIs bought to the tune of USD 2.3bn.