Month Gone By – Markets (period ended April 29, 2022)

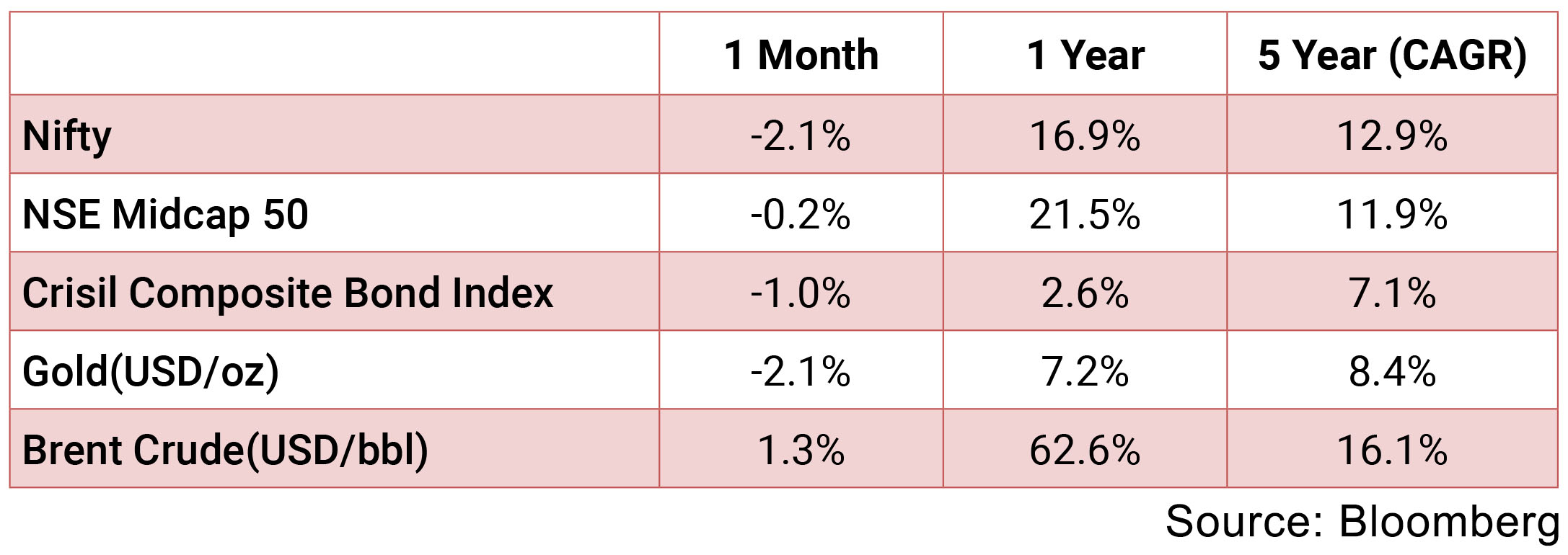

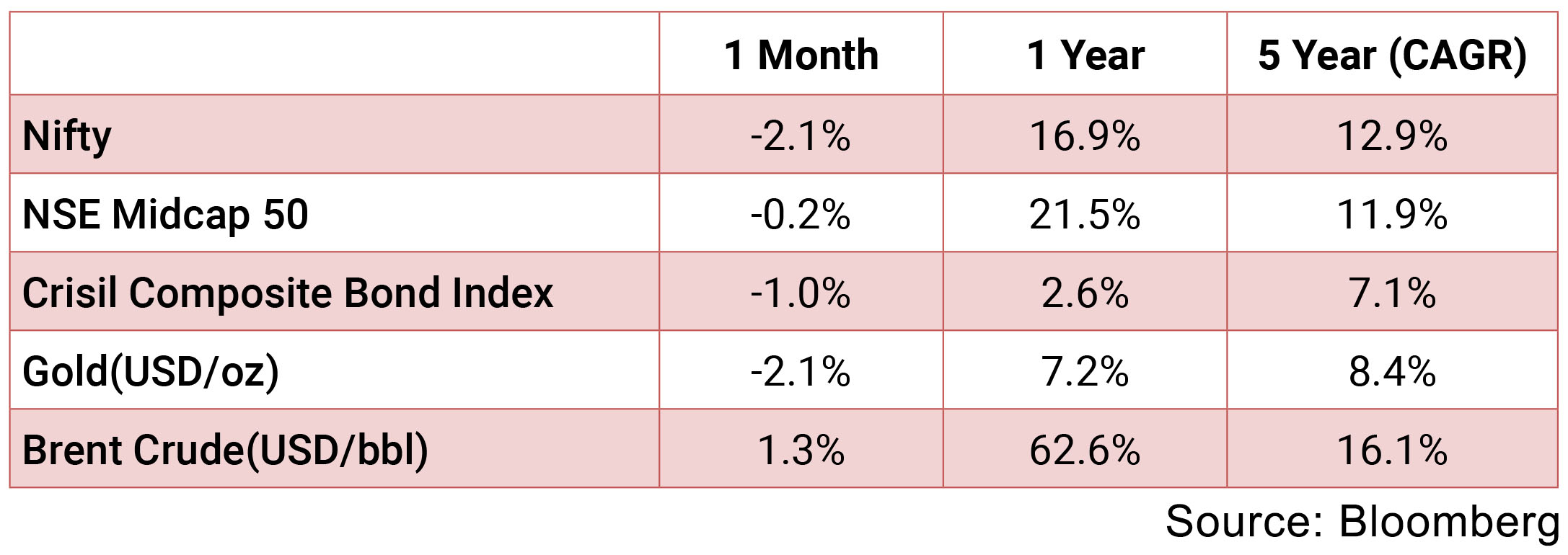

Markets declined 2.1% with continued concern over the ongoing Russia-Ukraine conflict and rising

Covid cases globally. Consumer staples and Energy sector have been the frontrunner sectors while

IT and Financials have been the laggards. The INR has been quite volatile tracking crude prices as

it averaged around 76.17 with a monthly best and worst of 75.33 and 76.70 respectively. Yields

continued on an upward trajectory with the 10y benchmark trading in a range of 6.90%-7.22% and

eventually ending the month 30bps higher m-o-m at 7.14%. The 10y benchmark averaged 7.08%

over the month of April.

While, Bank of England has already raised their interest rates successively in the last three meetings to attain 0.75%, FOMC raised the target range for the federal funds rate by 25 basis points (bps) in the last meeting. However, Fed chair in a recent IMF Spring Meeting debate suggested that it will be more appropriate to move more quickly and a 50bps hike in interest rate will be on the table in the upcoming May meeting. More details on the balance sheet normalization are also awaited. On the other hand, European Central Bank (ECB) stuck to the plan announced in the previous meeting of ending net asset purchases in the third quarter. ECB President re-iterated this stance during the IMF Spring meeting debate and mentioned that exact end date of Asset Purchase Programme (APP) and potential rate hike will be decided based on the data in the June meeting. IMF revised the global GDP growth downwards to 3.6% in 2022 and 2023 which is 0.8% and 0.2% points lower than projected in January due to the impact of Ukraine-Russia war.

On the domestic front, RBI at its policy meeting signaled a shift away from ultra-loose monetary policy stance as inflation pressures surface at home too and is no longer confined to developed economies. The RBI introduced the SDF (Standing Deposit Facility) window, an overnight window for banks to park funds with RBI without collateral, at 3.75%, effectively narrowing the policy corridor. RBI also lowered the FY23 GDP forecast to 7.2% from 7.8% estimated earlier and revised CPI expectations upwards to 5.7% in FY23 vs. 4.5% estimated earlier. The minutes released also highlighted that inflation concern was the key discussion point in the meeting. Annual macro data for FY22 was strong with 34% y-o-y growth in tax revenue collections and 43% y-o-y growth in merchandise exports.

Brent crude remain volatile, but moderated from an average USD 113/bbl in March to USD 106/ bbl in April due to the geo-political tensions and associated sanctions. Geopolitical risks remain the most significant variable driving crude prices at this point. Gold prices ended slightly lower at USD 1,938/oz in April from USD 1,954/oz in March.

While, Bank of England has already raised their interest rates successively in the last three meetings to attain 0.75%, FOMC raised the target range for the federal funds rate by 25 basis points (bps) in the last meeting. However, Fed chair in a recent IMF Spring Meeting debate suggested that it will be more appropriate to move more quickly and a 50bps hike in interest rate will be on the table in the upcoming May meeting. More details on the balance sheet normalization are also awaited. On the other hand, European Central Bank (ECB) stuck to the plan announced in the previous meeting of ending net asset purchases in the third quarter. ECB President re-iterated this stance during the IMF Spring meeting debate and mentioned that exact end date of Asset Purchase Programme (APP) and potential rate hike will be decided based on the data in the June meeting. IMF revised the global GDP growth downwards to 3.6% in 2022 and 2023 which is 0.8% and 0.2% points lower than projected in January due to the impact of Ukraine-Russia war.

On the domestic front, RBI at its policy meeting signaled a shift away from ultra-loose monetary policy stance as inflation pressures surface at home too and is no longer confined to developed economies. The RBI introduced the SDF (Standing Deposit Facility) window, an overnight window for banks to park funds with RBI without collateral, at 3.75%, effectively narrowing the policy corridor. RBI also lowered the FY23 GDP forecast to 7.2% from 7.8% estimated earlier and revised CPI expectations upwards to 5.7% in FY23 vs. 4.5% estimated earlier. The minutes released also highlighted that inflation concern was the key discussion point in the meeting. Annual macro data for FY22 was strong with 34% y-o-y growth in tax revenue collections and 43% y-o-y growth in merchandise exports.

Brent crude remain volatile, but moderated from an average USD 113/bbl in March to USD 106/ bbl in April due to the geo-political tensions and associated sanctions. Geopolitical risks remain the most significant variable driving crude prices at this point. Gold prices ended slightly lower at USD 1,938/oz in April from USD 1,954/oz in March.

Source: Bloomberg

Source: Bloomberg

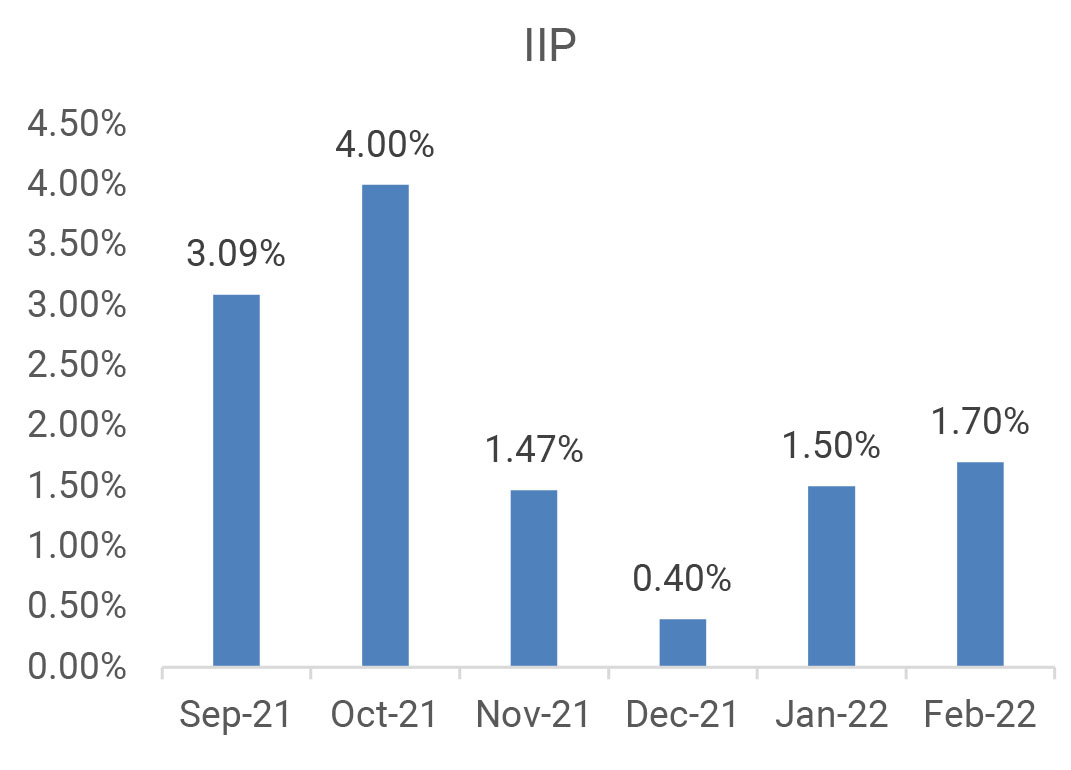

IIP: February IIP growth picked up marginally by 1.7% (January: 1.5%), declining sequentially by 4.7%.

Compared to pre-pandemic levels in February 2020, IIP was lower by 1.6%. On a sectoral basis, mining

activity and electricity production grew by 4.5% each (January: 2.8% and 0.9%, respectively) and

manufacturing by 0.8% (1.3%). As per the use-based classification, infrastructure/construction goods

grew 9.4% while consumer non-durable goods and durable goods production contracted by 5.5%

and 8.2%.

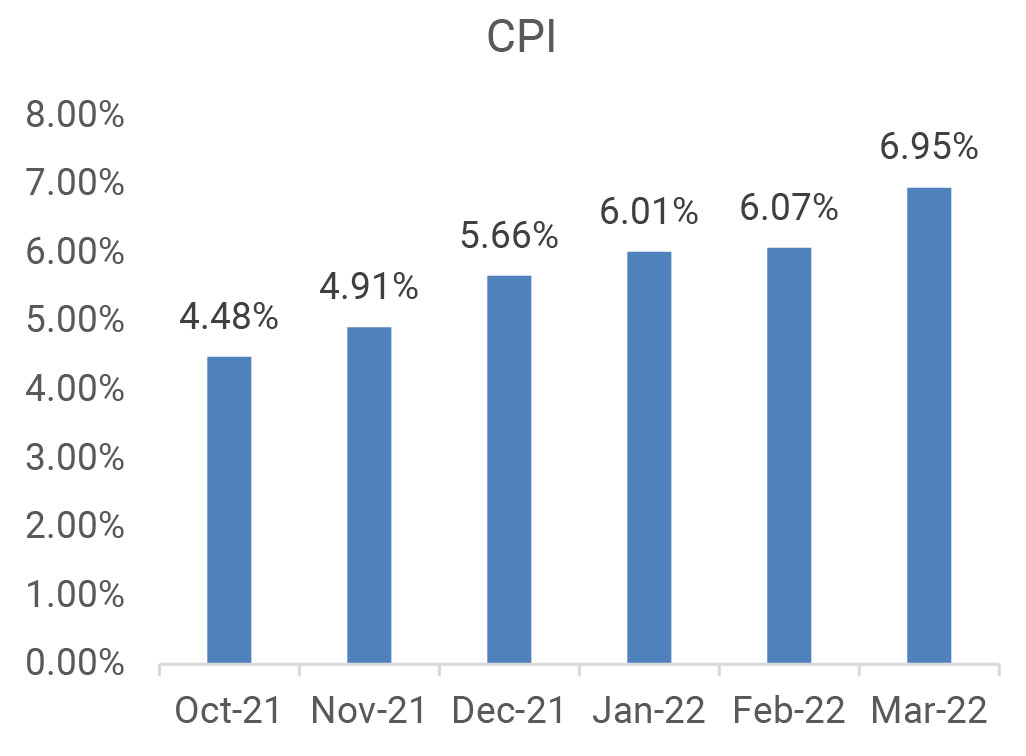

CPI: Headline inflation in March surged to 6.95% (February: 6.07%) with a 1% mom increase. Food inflation at 7.7% (February: 5.9%) contributed the bulk of inflation increase led by mom surge in oils and fats (5.3%), meat and fish (5%), fruits (2.5%) and cereals (0.8%). Urban inflation rose 30 bps to 6.1% (February: 5.8%) while rural inflation rose sharply to 7.7% (February: 6.4%). Core inflation (CPI excluding food, fuel, pan and tobacco) rose sharply by 60 bps to 6.6% while also increasing 0.6% mom (January: 0.5%). The mom increase was led by clothing and footwear along with personal care category reflecting the pass-through of rising input costs and gold prices. Rural core inflation rose sharply to 7.7% (February: 7%) and continued to remain higher than urban core inflation at 5.7% (February: 5.7%).

Trade Deficit: India’s merchandise exports reached a monthly historic high level of USD 40.4bn in March 2022, reaching USD 417.8bn for the whole year. Buoyant external demand for petroleum products, engineering goods and chemicals bolstered export growth. Merchandise imports at USD 59.1bn in March 2022 remained above USD 50bn for the seventh consecutive month and registered a growth of more than 20%. Import growth was broad-based and driven by higher demand for petroleum products, coal and electronic goods. Oil imports nearly doubled in March compared to a year ago. Overall, India’s trade deficit widened to USD 18.7bn in March 2022 from USD 13.1bn in March 2021; however, it moderated on a sequential basis. On an annual basis, the merchandise trade deficit recorded an all-time high of US$192.4 bn during FY2022 as against US$102.6 bn a year ago.

RBI Policy Meeting: While maintaining repo rate and accommodative stance, the MPC guided towards withdrawal of the accommodative stance, shifting the guidance decisively towards being hawkish in contrast to a very dovish February policy. The MPC introduced the Standing Deposit Facility (SDF) and set it as the floor for the LAF corridor at 3.75%. The policy corridor now has been restored to pre-pandemic width of 50 bps. The MPC noted global risks emanating from (1) increasing geopolitical tensions, (2) hardening of commodity prices, (3) persistent supply-chain disruptions, (4) disruptions in trade and capital flows, (5) divergent monetary policy responses, and (6) volatility in global financial markets. The MPC revised up its headline inflation forecasts from its benign forecasts in the February meeting. FY2023 headline CPI inflation has been revised up sharply to 5.7% (earlier: 4.5%), while FY2023 real GDP growth was revised down to 7.2% (earlier: 7.8%).

CPI: Headline inflation in March surged to 6.95% (February: 6.07%) with a 1% mom increase. Food inflation at 7.7% (February: 5.9%) contributed the bulk of inflation increase led by mom surge in oils and fats (5.3%), meat and fish (5%), fruits (2.5%) and cereals (0.8%). Urban inflation rose 30 bps to 6.1% (February: 5.8%) while rural inflation rose sharply to 7.7% (February: 6.4%). Core inflation (CPI excluding food, fuel, pan and tobacco) rose sharply by 60 bps to 6.6% while also increasing 0.6% mom (January: 0.5%). The mom increase was led by clothing and footwear along with personal care category reflecting the pass-through of rising input costs and gold prices. Rural core inflation rose sharply to 7.7% (February: 7%) and continued to remain higher than urban core inflation at 5.7% (February: 5.7%).

Trade Deficit: India’s merchandise exports reached a monthly historic high level of USD 40.4bn in March 2022, reaching USD 417.8bn for the whole year. Buoyant external demand for petroleum products, engineering goods and chemicals bolstered export growth. Merchandise imports at USD 59.1bn in March 2022 remained above USD 50bn for the seventh consecutive month and registered a growth of more than 20%. Import growth was broad-based and driven by higher demand for petroleum products, coal and electronic goods. Oil imports nearly doubled in March compared to a year ago. Overall, India’s trade deficit widened to USD 18.7bn in March 2022 from USD 13.1bn in March 2021; however, it moderated on a sequential basis. On an annual basis, the merchandise trade deficit recorded an all-time high of US$192.4 bn during FY2022 as against US$102.6 bn a year ago.

RBI Policy Meeting: While maintaining repo rate and accommodative stance, the MPC guided towards withdrawal of the accommodative stance, shifting the guidance decisively towards being hawkish in contrast to a very dovish February policy. The MPC introduced the Standing Deposit Facility (SDF) and set it as the floor for the LAF corridor at 3.75%. The policy corridor now has been restored to pre-pandemic width of 50 bps. The MPC noted global risks emanating from (1) increasing geopolitical tensions, (2) hardening of commodity prices, (3) persistent supply-chain disruptions, (4) disruptions in trade and capital flows, (5) divergent monetary policy responses, and (6) volatility in global financial markets. The MPC revised up its headline inflation forecasts from its benign forecasts in the February meeting. FY2023 headline CPI inflation has been revised up sharply to 5.7% (earlier: 4.5%), while FY2023 real GDP growth was revised down to 7.2% (earlier: 7.8%).

Deal flow was slow in April with 15 deals worth ~USD 816mn executed. Key deals included SBI Cards

and Payments (~USD 329mn) and Gland Pharma Ltd (~USD 225mn).

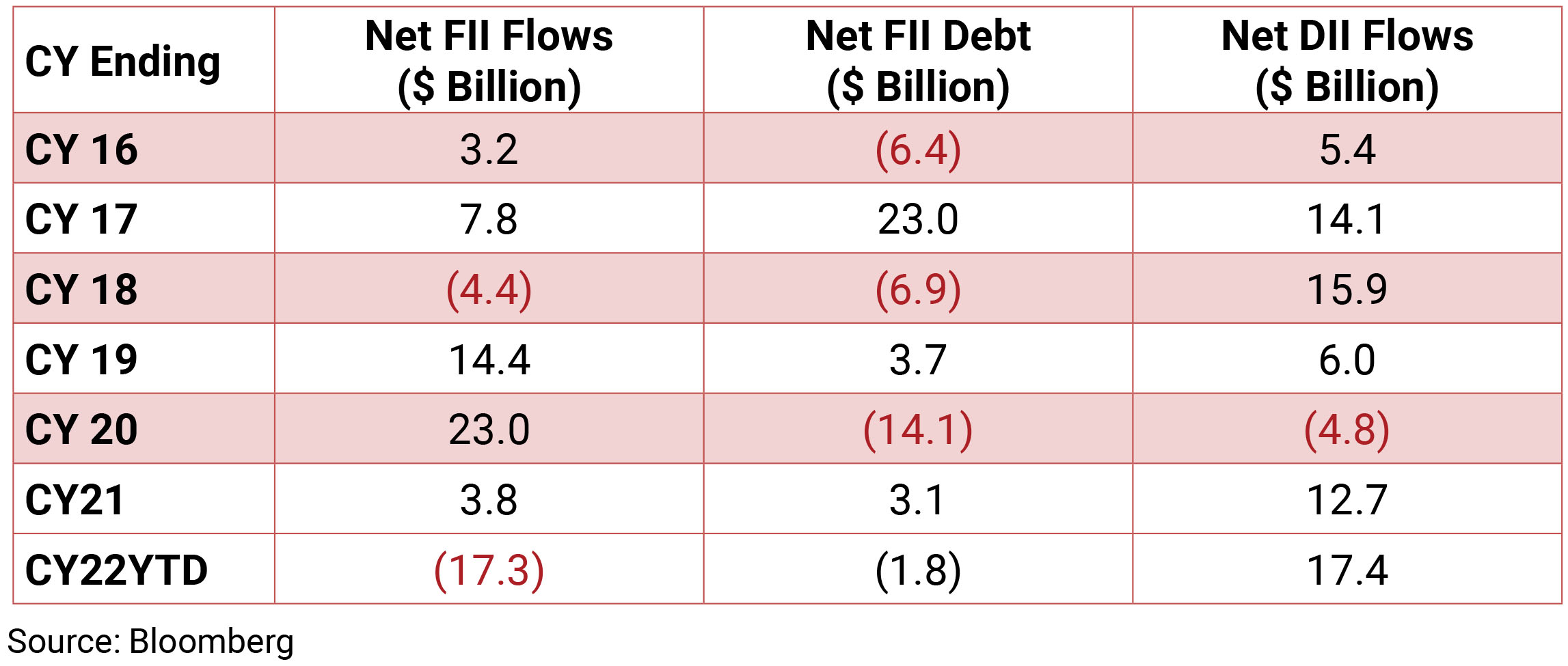

FIIs continued being net sellers in the month of April 2022 and were net sellers to the tune of –USD 3.8bn even as DII buying continued +USD 4.0bn. MFs had put in +USD 2.8bn till 27th April 2022.

FIIs continued being net sellers in the month of April 2022 and were net sellers to the tune of –USD 3.8bn even as DII buying continued +USD 4.0bn. MFs had put in +USD 2.8bn till 27th April 2022.