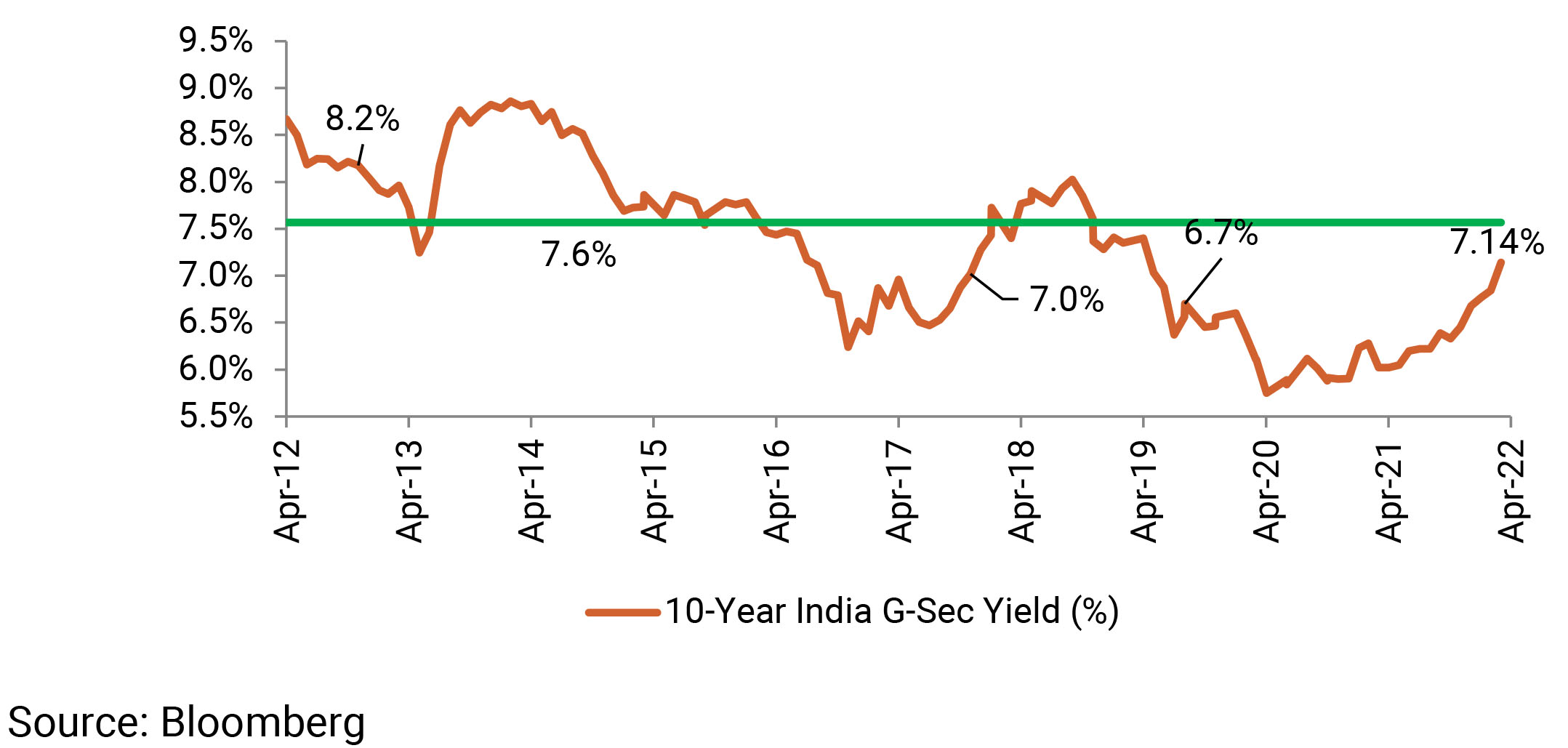

Yields have been on an upward trajectory through the month, up 30bps from 6.84% as of Mar-end to 7.14% as of Apr-end. An intra-month high of 7.22% registered in the middle of the month left market participants anticipating the extent to which yields could possibily rise. To their respite, yields cooled off slightly from there on and settled around 7.15%. The 10y avearged 7.08% over the month of April compared to 6.82% over the month of March.

The slight pullback in yields from the highs witnessed in the middle of the month by no way reassures that we have seen the maximum extent of weakness. A multitide of factors continue to linger on the minds’ of market participants such as overwhelming G-Sec supply, RBI pivot from accomodation/ ultra-loose monetary policy to withdrawal of accommodation/tightening due to inflation pressures, accelerated tightening by global Central Banks due to inflation pressures, continuing war in Ukraine, and crude prices entrenched over USD 100/bbl.

Market clearly expects the RBI to withdraw accommodation and act on rates in upcoming monetary policies. This should keep up the pressure on yields and any pullaback is likely to be shortlived. As such, we expect short duration and high accrual parts of the yield curve to perform better than the rest of the curve. The next cues for market will be largely drawn from the inflation readings in May and FOMC meeting also in May.