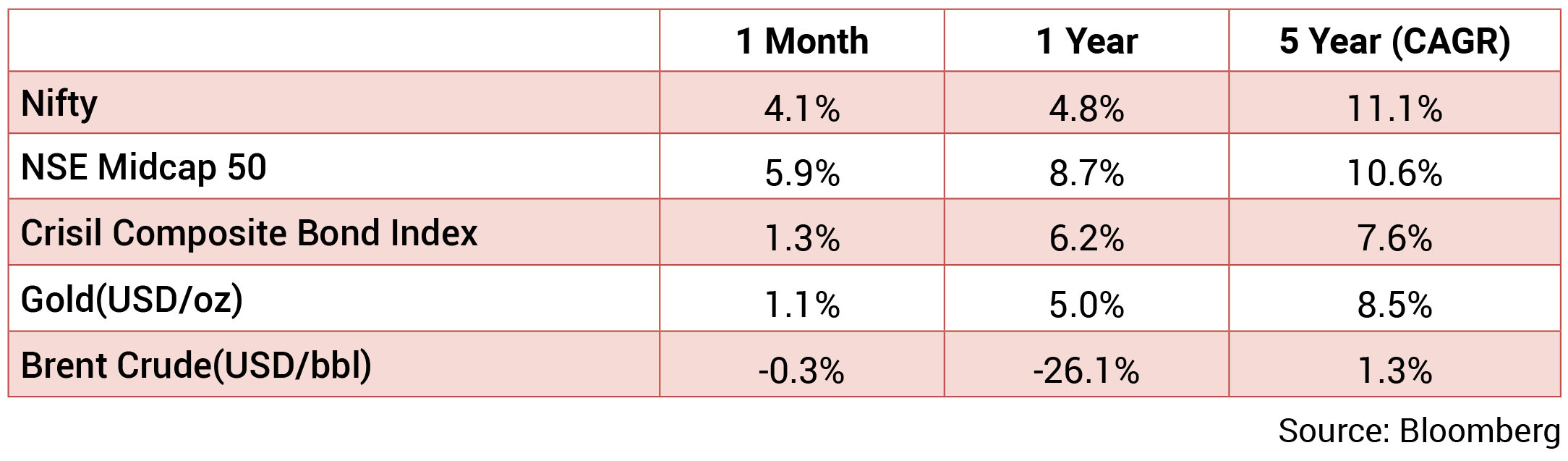

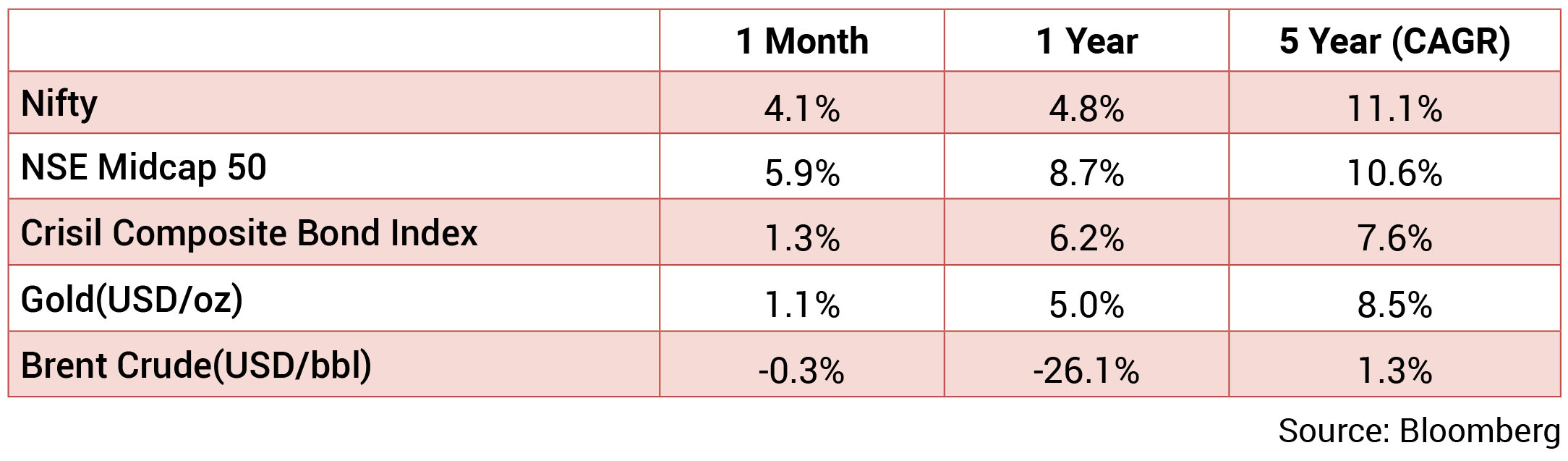

Market was up 4.1% primarily driven by FIIs buying, favorable macros and earnings. Discretionary,

Industrials and Communication Service sector have been the frontrunner sectors while Material and IT

have been the laggards. The INR continued appreciation against USD for the second successive month in

April. It averaged around 82 with a monthly best and worst of 81.8 and 82.3 respectively. 10yr benchmark

yields traded in the range of 7.10%-7.31% and eventually ended the month 19bps lower sequentially at

7.12%. The 10y benchmark averaged 7.19% in April.

With stress in banking sector last month cooling down, at least temporarily and economic data still holding up, Fed is expected to continue to fight inflation. Fed minutes also suggested the same and some members even considered a 50bps hike if there was no banking turmoil in the March meeting. With the current conditions, Fed staff expected mild recession starting later this year, with recovery over subsequent two years. US to witness tighter credit conditions due to rising interest rates and impact of banking turmoil. US inflation rate slowed for the ninth successive month to 5% YoY in March from the highs of 9.1% in June 2022 while US core PCE price index (Federal Reserve’s preferred gauge of inflation) eased to 4.6% YoY from 4.7% in the previous month. Looking at the employment scenario, US economy created 236k jobs in March, indicating slight slowdown in hiring, but still a strong labor market. EU inflation rate slowed over the months to 6.9% in March. Markets are also looking ahead to global central bank monetary policies lined up in May as inflation rate is still well above the 2% target amidst collapse of First Republic Bank and JP Morgan acquiring the bank.

Meanwhile, against wide consensus, RBI left policy rates unchanged unanimously; marginally lowered FY24 inflation projection to 5.2% (-10bps) and raised GDP growth projection for FY24 to 6.5% (+10bps). To keep the long-term inflation expectation anchored, RBI governor stated that the decision was only to ‘pause and not a pivot’, and that future decision will be data dependent. However, CPI reading for March released a week after the MPC meeting came in as a positive surprise. Owing to favorable base and moderation in price rise, CPI dipped to 5.7% YoY in March vs. 6.4% in the last month with core CPI slowing to 19-month low of 5.9% YoY. March inflation print also saw softening in sequential price pressures for fuel & light, clothing & footwear and services while housing prices remained flat. Easing inflation should drive RBI to stay on a prolonged pause. El-Nino, deviation from normal monsoon and distribution pattern is currently key risk factors that could impact food prices. However, IMD expects normal monsoon this year. High frequency indicators suggest resilience in domestic demand with highest ever GST collections and significantly strong PMI. Both manufacturing and services PMI registered higher activity with service sector leading the growth. While government fiscal accounts for FY23 is to be released later in May, direct tax revenue for FY23 has surpassed the revised target set in the budget.

Brent crude prices increased from an average of USD79.2/bbl in March to USD83.4/bbl in April as it ranged between USD78-USD87/bbl. OPEC+ had announced plans to cut crude oil production which led to increase in prices while towards the end of April the increase was reversed due to expectations of further rate hike and economic slowdown. Gold price saw slight increase as it ended at USD 1,999/oz in April from USD 1,969/oz in March. Steel price trended lower as HRC prices ended the month at US1,070 compared to USD1,164 in March.

With stress in banking sector last month cooling down, at least temporarily and economic data still holding up, Fed is expected to continue to fight inflation. Fed minutes also suggested the same and some members even considered a 50bps hike if there was no banking turmoil in the March meeting. With the current conditions, Fed staff expected mild recession starting later this year, with recovery over subsequent two years. US to witness tighter credit conditions due to rising interest rates and impact of banking turmoil. US inflation rate slowed for the ninth successive month to 5% YoY in March from the highs of 9.1% in June 2022 while US core PCE price index (Federal Reserve’s preferred gauge of inflation) eased to 4.6% YoY from 4.7% in the previous month. Looking at the employment scenario, US economy created 236k jobs in March, indicating slight slowdown in hiring, but still a strong labor market. EU inflation rate slowed over the months to 6.9% in March. Markets are also looking ahead to global central bank monetary policies lined up in May as inflation rate is still well above the 2% target amidst collapse of First Republic Bank and JP Morgan acquiring the bank.

Meanwhile, against wide consensus, RBI left policy rates unchanged unanimously; marginally lowered FY24 inflation projection to 5.2% (-10bps) and raised GDP growth projection for FY24 to 6.5% (+10bps). To keep the long-term inflation expectation anchored, RBI governor stated that the decision was only to ‘pause and not a pivot’, and that future decision will be data dependent. However, CPI reading for March released a week after the MPC meeting came in as a positive surprise. Owing to favorable base and moderation in price rise, CPI dipped to 5.7% YoY in March vs. 6.4% in the last month with core CPI slowing to 19-month low of 5.9% YoY. March inflation print also saw softening in sequential price pressures for fuel & light, clothing & footwear and services while housing prices remained flat. Easing inflation should drive RBI to stay on a prolonged pause. El-Nino, deviation from normal monsoon and distribution pattern is currently key risk factors that could impact food prices. However, IMD expects normal monsoon this year. High frequency indicators suggest resilience in domestic demand with highest ever GST collections and significantly strong PMI. Both manufacturing and services PMI registered higher activity with service sector leading the growth. While government fiscal accounts for FY23 is to be released later in May, direct tax revenue for FY23 has surpassed the revised target set in the budget.

Brent crude prices increased from an average of USD79.2/bbl in March to USD83.4/bbl in April as it ranged between USD78-USD87/bbl. OPEC+ had announced plans to cut crude oil production which led to increase in prices while towards the end of April the increase was reversed due to expectations of further rate hike and economic slowdown. Gold price saw slight increase as it ended at USD 1,999/oz in April from USD 1,969/oz in March. Steel price trended lower as HRC prices ended the month at US1,070 compared to USD1,164 in March.

Source: Bloomberg

Source: Bloomberg

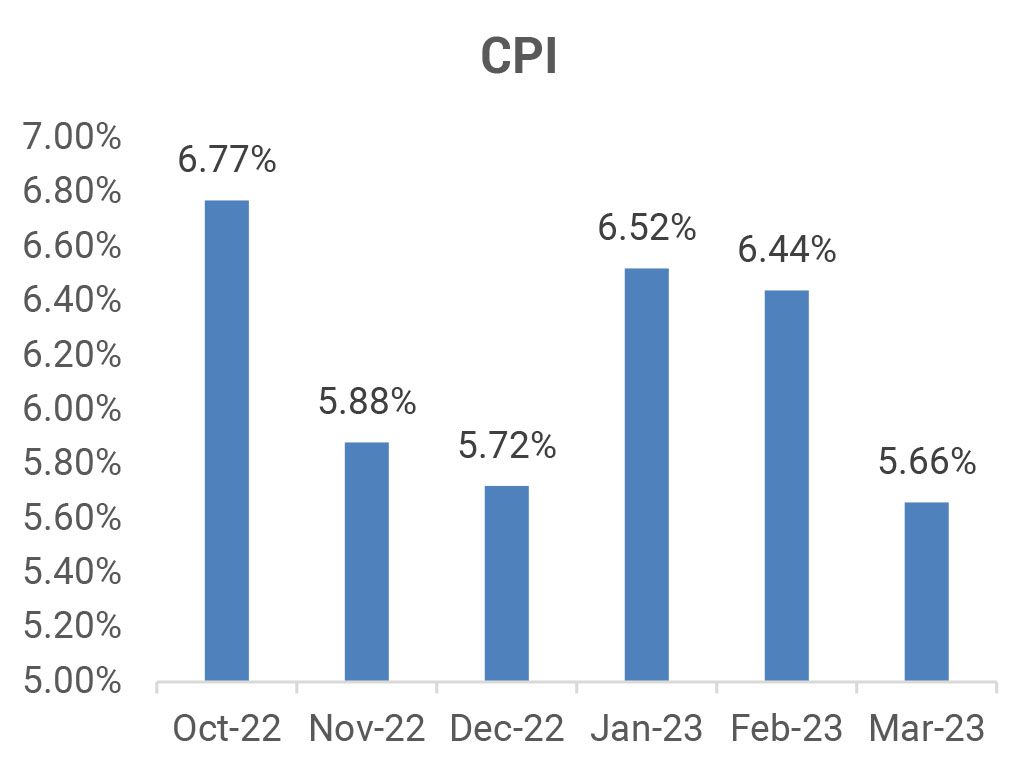

CPI: March CPI inflation moderated to 5.66% (February: 6.44%), led by a favorable base effect and broad

easing across food & beverages and core inflation. Sequentially, headline inflation increased 0.2% (broadly

the same pace as in February). The contribution of cereals to food & beverages inflation, though positive,

moderated in March; vegetables, oils & fats and meat & fish pulled it down. sharply to 5.5% (February:

6.7%). March core inflation (CPI, excluding food and fuel) moderated sharply 38 bps to 5.74% from 6.12%

in February (0.26% mom compared with 0.41% mom in February). Personal care and effects rose the most

by 8.3%, led mainly by gold prices, followed by clothing and footwear at 8.2%, though both moderated from

February levels. Rural and urban core inflation, while elevated, moderated to 6.2% and 5.8%, respectively

(from 6.7% and 6.0% in February.

WPI: March WPI inflation moderated sharply to 1.3% (February: 3.9%) while remaining flat on a sequential basis from February. Fuel and power inflation moderated to 9% (February: 14.8%), primary articles inflation came in at 2.4% (3.3%), and food inflation came in at 2.3% (2.8%). On the other hand, manufactured products inflation contracted by 0.8% (February: +1.9%). Core WPI inflation contracted by 0.4% (February: +2.1%).

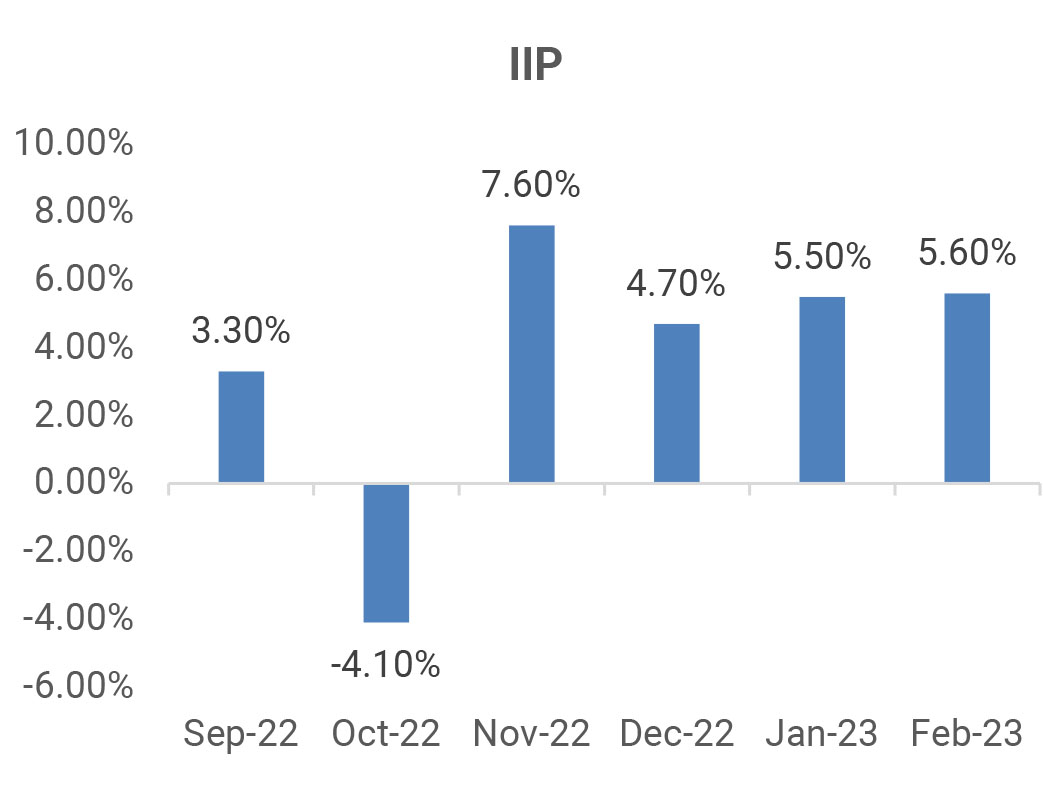

IIP: February IIP grew softer than our expectations at 5.5% (January: 5.5%), despite a strong favorable base effect. Sequentially, IIP contracted 5.6% (January: +1.1% mom), mainly due to declining manufacturing activity. According to the use-based classification, sequential momentum contracted across categories, even as a favorable base aided headline growth.

RBI MPC: The RBI MPC, in a surprise move, voted unanimously to maintain status quo on the repo rate at 6.5%. The MPC also voted to remain focused on withdrawal of accommodation with 5-1 majority (Dr Varma expressed reservations on this part). Further, the MPC also surprised with a downward revision to its FY2024 average inflation estimate to 5.2% (from 5.3% earlier). This took into account downsides from (1) record rabi production, and (2) easing cost conditions, which moderate the pace of output price increases. However, they also highlighted upside risks to inflation from (1) global financial market volatility increasing risks of imported inflation, (2) uncertainty in crude oil prices, (3) adverse weather patterns domestically, (4) elevated core inflation from lagged pass-through of input costs, and (5) sticky milk prices due to high input costs and seasonal factors. On the other hand, the MPC revised up its real GDP growth for FY2024 to 6.5% (from 6.4% earlier), despite global slowdown concerns amid (1) strengthening rural demand from good rabi production, and (2) support to manufacturing and investment activity from the central government’s focus on capital expenditure, improving capacity utilization, robust credit growth, and moderation in commodity prices. On the other hand, they also flagged downside risks from faltering external demand, ongoing geopolitical tensions, and tight financial conditions and financial market volatility globally.

Trade: Exports in March fell by 13.9% yoy to USD 38.4bn (February: USD 37bn) while imports fell by 7.9% yoy to USD 58.1bn (February: USD 53.2bn). Consequently, March trade deficit widened to USD 19.7bn (February: USD 16.2bn). In FY2023, exports and imports reached their record highs at USD 447.5bn (FY2022: USD 422bn) and USD 714.2bn (USD 613.1bn) causing the trade deficit to widen to record highs of USD 267bn (USD 191bn). Services trade surplus increased to USD 13.7bn in March (February: USD 13.1bn). In FY2023, services trade surplus reached record high of USD 142.2bn (FY2022: USD 107.5bn).

WPI: March WPI inflation moderated sharply to 1.3% (February: 3.9%) while remaining flat on a sequential basis from February. Fuel and power inflation moderated to 9% (February: 14.8%), primary articles inflation came in at 2.4% (3.3%), and food inflation came in at 2.3% (2.8%). On the other hand, manufactured products inflation contracted by 0.8% (February: +1.9%). Core WPI inflation contracted by 0.4% (February: +2.1%).

IIP: February IIP grew softer than our expectations at 5.5% (January: 5.5%), despite a strong favorable base effect. Sequentially, IIP contracted 5.6% (January: +1.1% mom), mainly due to declining manufacturing activity. According to the use-based classification, sequential momentum contracted across categories, even as a favorable base aided headline growth.

RBI MPC: The RBI MPC, in a surprise move, voted unanimously to maintain status quo on the repo rate at 6.5%. The MPC also voted to remain focused on withdrawal of accommodation with 5-1 majority (Dr Varma expressed reservations on this part). Further, the MPC also surprised with a downward revision to its FY2024 average inflation estimate to 5.2% (from 5.3% earlier). This took into account downsides from (1) record rabi production, and (2) easing cost conditions, which moderate the pace of output price increases. However, they also highlighted upside risks to inflation from (1) global financial market volatility increasing risks of imported inflation, (2) uncertainty in crude oil prices, (3) adverse weather patterns domestically, (4) elevated core inflation from lagged pass-through of input costs, and (5) sticky milk prices due to high input costs and seasonal factors. On the other hand, the MPC revised up its real GDP growth for FY2024 to 6.5% (from 6.4% earlier), despite global slowdown concerns amid (1) strengthening rural demand from good rabi production, and (2) support to manufacturing and investment activity from the central government’s focus on capital expenditure, improving capacity utilization, robust credit growth, and moderation in commodity prices. On the other hand, they also flagged downside risks from faltering external demand, ongoing geopolitical tensions, and tight financial conditions and financial market volatility globally.

Trade: Exports in March fell by 13.9% yoy to USD 38.4bn (February: USD 37bn) while imports fell by 7.9% yoy to USD 58.1bn (February: USD 53.2bn). Consequently, March trade deficit widened to USD 19.7bn (February: USD 16.2bn). In FY2023, exports and imports reached their record highs at USD 447.5bn (FY2022: USD 422bn) and USD 714.2bn (USD 613.1bn) causing the trade deficit to widen to record highs of USD 267bn (USD 191bn). Services trade surplus increased to USD 13.7bn in March (February: USD 13.1bn). In FY2023, services trade surplus reached record high of USD 142.2bn (FY2022: USD 107.5bn).

Key deal in April was the Mankind Pharma IPO (USD 530mn).

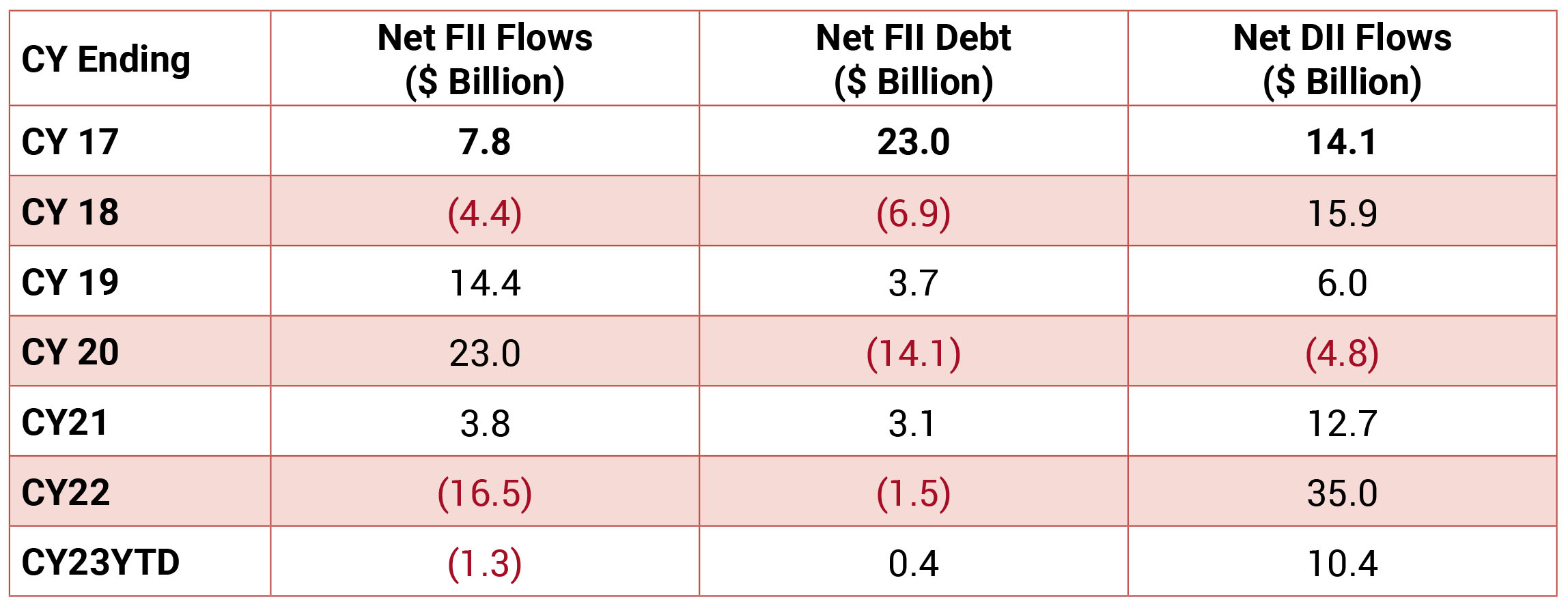

FIIs were net sellers in the month of April 2023 to the tune of USD 1.5bn and DIIs bought to the tune of USD 302mn.

FIIs were net sellers in the month of April 2023 to the tune of USD 1.5bn and DIIs bought to the tune of USD 302mn.