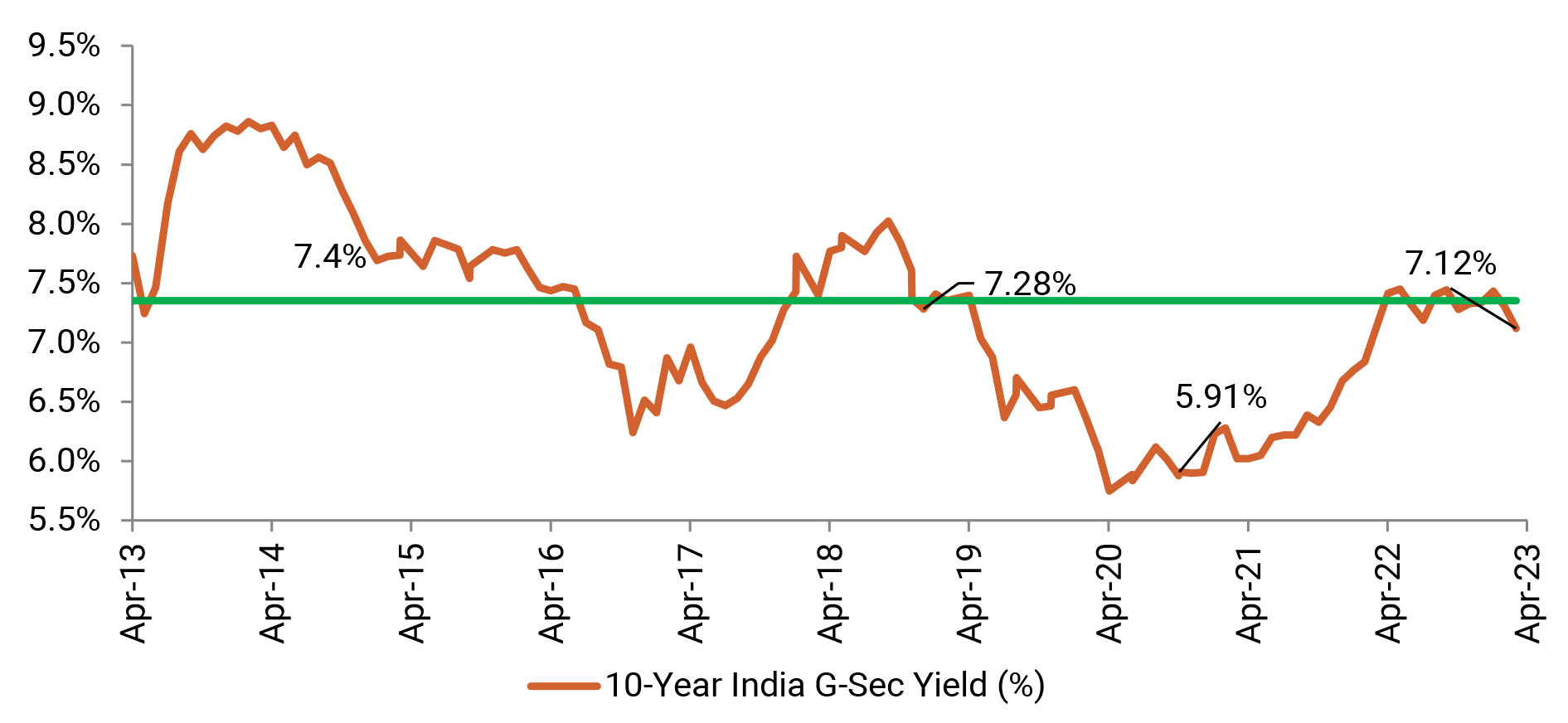

April was a relatively stable month compared to March, with price action considerably less volatile. US data in the first half was neutral with NFP number largely in line with market expectations and US CPI inflation lower than expected (0.1% MoM vs 0.2% MoM expected) which sparked some speculation on whether data had peaked. Nevertheless, strong manufacturing data in the second half of the month suggested otherwise. US rates traded a 20bp range throughout April. The RBI unexpectedly paused in its bi-monthly MPC meeting (market consensus was a hike of 25bps) which sparked a rally in G-Sec. While the Governor emphasized that the action was a pause and not a pivot, the rally only continued throughout the month supported by strong investor demand for G-Sec in the weekly auctions.

G-Sec yields moved lower during April thanks in part both to a dovish MPC and very strong investor demand. The benchmark 10y bond rallied by 20bps while the shorter end of the curve rallied around 15bps. The strength of the market meant that even on days when US Treasuries sold off by 8-10bps, IGBs would only move by 2-3bps. Auction demand was very evident in the strong cutoffs over the course of the month.

With CD issuances reducing post the FY year end as well as a reduction in SDL supply, one would have expected that credit spreads would have reasonably narrowed, but the broader AAA segment moved more or less in tandem with IGBs.