Global Equities: Equity markets extended their rally in September, with global equities rising roughly 3% for the month on easing

rate expectations. U.S. indices led the charge – the S&P 500 gained 3.5%, and the tech-heavy Nasdaq jumped 5.6%, marking their

best September in 15 years. Japan’s market was another standout: the Nikkei 225 surged about 6.5% to fresh multi-decade highs,

buoyed by a weaker yen and strong earnings. European stocks also advanced (Euro Stoxx 50 +2.8%), while Emerging Markets

saw solid gains (e.g. Hong Kong’s Hang Seng +4%). The rally was driven by growing risk appetite as the Fed delivered a rate

cut and investors cheered an ongoing AI-led tech boom. Despite persistent trade tensions, equity sentiment remained positive,

underscored by expectations of further monetary easing and only limited economic fallout so far from new tariffs.

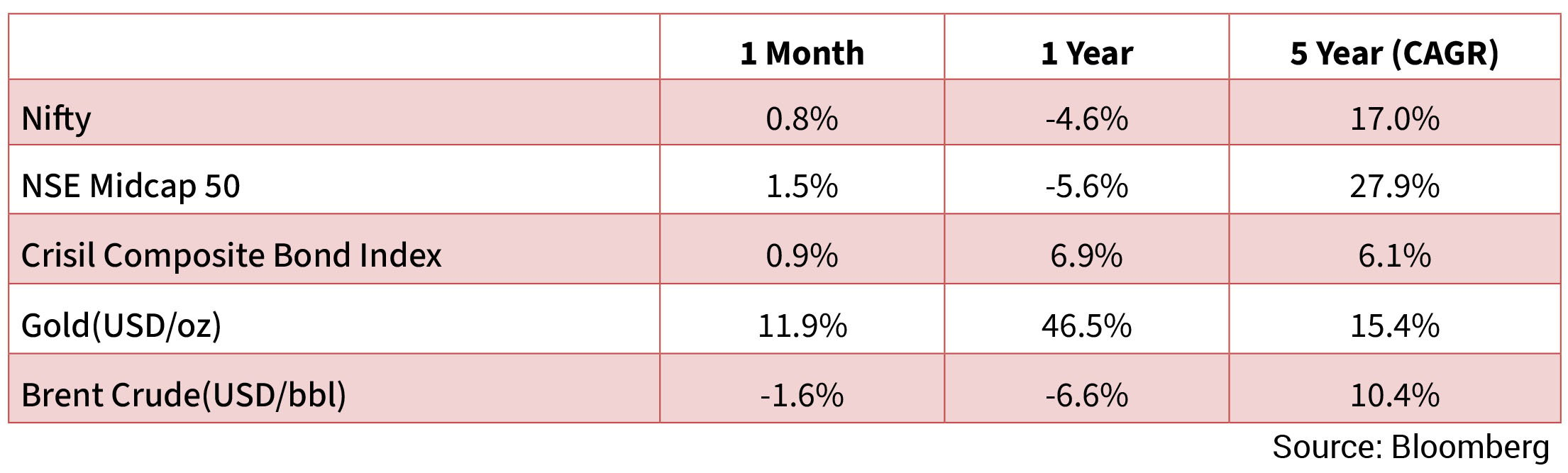

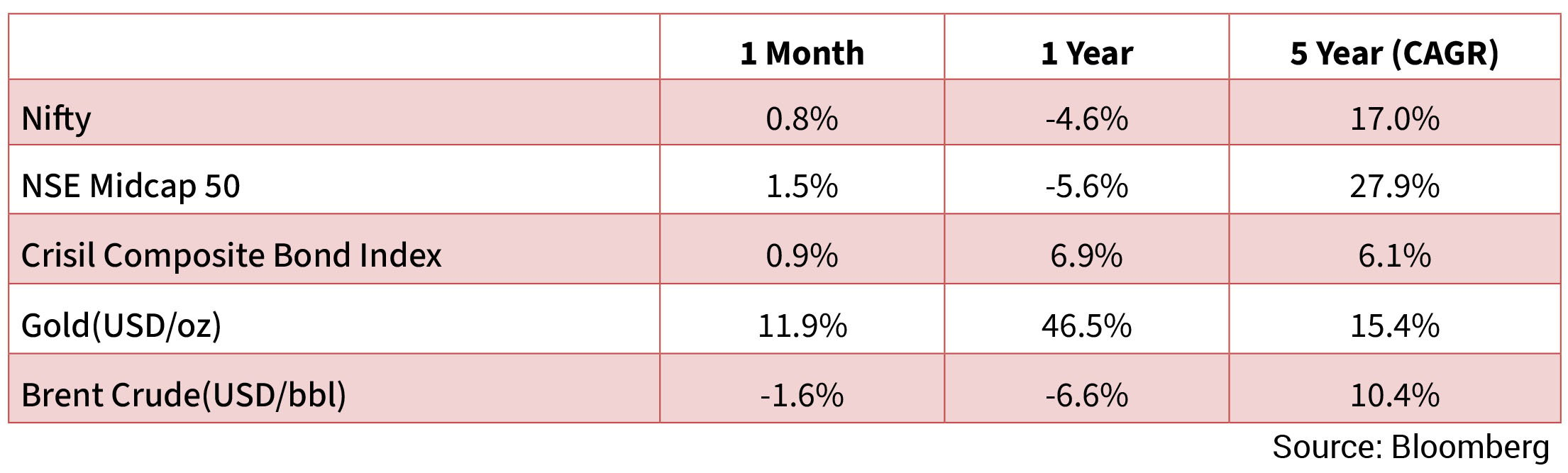

Indian Equities: Indian stocks underperformed global peers for a second month. The Nifty 50 index edged up marginally in September, ending around 24,610 (vs. 24,427 in August) – a muted rebound after the prior month’s drop. Large-cap indices managed a slight gain of ~0.5–1%, outpacing mid-caps and small-caps which were flat to modestly negative. Investor caution lingered amid continued foreign selling and macro concerns. Sectorally, performance was mixed: IT and bank stocks showed relative strength (Bank Nifty outperformed toward month-end), but Real Estate and Utilities remained under pressure. Notably, the consumer-oriented sectors that had outperformed in August (e.g. auto, consumer durables/FMCG) gave up some gains in September. Most other sectors saw tepid moves in either direction. Financials – which were among the worst performers in August – stabilized in late September as some buyers emerged at lower valuations, but realty and power/utilities stocks continued to lag on higher interest rate sensitivity and persistent FII outflows. Overall, Indian equities’ recovery was lackluster, held back by global trade headwinds and domestic liquidity drags, even as global markets rallied.

Currency Movements: The Indian rupee (INR) sank to all-time lows in September, pressured by capital outflows and the trade spat. The rupee depreciated about 0.7–0.8% during the month, sliding from ~₹88.1 per USD to ₹88.79/USD by September 30. It briefly hit a record intraday low of ₹88.89 before the RBI likely intervened modestly. This marked the fifth straight monthly decline for the INR, as persistent FII equity selling and tariff worries fueled dollar demand. In contrast, the U.S. dollar index (DXY) was roughly flat after August’s pullback – ticking up slightly and ending around 97.8–98.0. Early in the month the dollar softened on the Fed rate cut, but renewed safe-haven bids (amid looming U.S. fiscal risks) left DXY essentially unchanged overall.

Bond Yields: Indian government bond yields were range-bound to slightly higher in September. The 10-year benchmark yield averaged around 6.5%, up from 6.47% in August, and closed the month near 6.55%. This was essentially flat to 2 bps lower than end-August (6.57%), as late-month buying trimmed an early rise. Yields had initially firmed up on oil price gains and rupee weakness (foreign selling), briefly approaching 6.60%, before stabilizing ahead of the RBI policy meeting. In the U.S., Treasury yields eased amid the Fed’s dovish turn – the 10-year yield dipped to about 4.14% by month-end, a ~9 basis point decline from August’s 4.23%. Mid-month, the U.S. 10Y even touched lows near 4.0% after the Fed cut rates, though strong economic data later nudged yields back up.

Commodities: Oil prices reversed August’s slide, rising on the back of extended supply curbs. Brent crude gained about +3.5% in September, climbing from ~$67 to about $70 per barrel. Early in the month, OPEC+ announced an extension of production cuts into year-end, which, along with persistent demand, helped lift prices despite ample global inventories. Brent settled near $69.8 on September 30. Gold prices, meanwhile, surged to new record highs. The yellow metal jumped roughly 10–11% for the month, breaking above the $3,800/oz mark. Gold ended September around $3,870/oz – an all-time high – after spiking on the back of the Fed rate cut and heightened geopolitical risks. Investors piled into gold as real yields fell and the U.S. dollar’s summer strength ebbed, seeking a hedge against uncertainty.

Global Macro Developments: September saw a delicate balance of easing monetary policy and geopolitical uncertainty. In the United States, the Federal Reserve cut its policy rate by 25 basis points at the Sep 16–17 FOMC meeting – the first cut since 2024 – bringing the target range to 4.00–4.25%. Fed Chair Jerome Powell cited a “softening” labor market and contained inflation as justification, and signaled this mid-cycle adjustment could be followed by another cut later in the year if disinflation persists. Markets, which had largely priced in two year-end cuts, adjusted to guidance of perhaps one more move as the Fed struck a cautious tone. Attention turned to Washington as a potential U.S. government shutdown hovered at month-end; indeed, Congress went down to the wire on funding, introducing a late headwind to sentiment. In Europe, the ECB kept its deposit rate at 2.00% in September, after its July hike, and adopted a wait-and-see approach. ECB President Lagarde emphasized that policy is in a “good place” for now and that clear evidence of weakening inflation is needed before considering cuts.

India Macro Developments: India’s economic fundamentals remained strong in September, even as it navigates external headwinds. GDP growth for the April–June quarter (Q1 FY2025-26) came in at 7.8% YoY, beating market expectations and marking an acceleration from 6.1% in the previous quarter. This robust print was driven by a convergence of high nominal GDP growth with easing inflation, as well as exceptional performance in services. In particular, services output surged (India’s Services PMI hit 62.9 in Aug, a 15-year high), and government capital spending was front-loaded in the fiscal year, providing a boost to demand. Manufacturing activity also picked up: August factory output (IPI) jumped to a 17-year high growth rate, despite the U.S. tariff overhang. On the inflation front, price pressures are currently benign. Headline CPI inflation fell to 2.6% in August, rebounding slightly from July’s 1.5% (a multi-year low) but still near the lower bound of the RBI’s 2–6% target range. Core inflation has trended down, aided by softer food prices (vegetable costs normalized) and the RBI’s past tightening.

Indian Equities: Indian stocks underperformed global peers for a second month. The Nifty 50 index edged up marginally in September, ending around 24,610 (vs. 24,427 in August) – a muted rebound after the prior month’s drop. Large-cap indices managed a slight gain of ~0.5–1%, outpacing mid-caps and small-caps which were flat to modestly negative. Investor caution lingered amid continued foreign selling and macro concerns. Sectorally, performance was mixed: IT and bank stocks showed relative strength (Bank Nifty outperformed toward month-end), but Real Estate and Utilities remained under pressure. Notably, the consumer-oriented sectors that had outperformed in August (e.g. auto, consumer durables/FMCG) gave up some gains in September. Most other sectors saw tepid moves in either direction. Financials – which were among the worst performers in August – stabilized in late September as some buyers emerged at lower valuations, but realty and power/utilities stocks continued to lag on higher interest rate sensitivity and persistent FII outflows. Overall, Indian equities’ recovery was lackluster, held back by global trade headwinds and domestic liquidity drags, even as global markets rallied.

Currency Movements: The Indian rupee (INR) sank to all-time lows in September, pressured by capital outflows and the trade spat. The rupee depreciated about 0.7–0.8% during the month, sliding from ~₹88.1 per USD to ₹88.79/USD by September 30. It briefly hit a record intraday low of ₹88.89 before the RBI likely intervened modestly. This marked the fifth straight monthly decline for the INR, as persistent FII equity selling and tariff worries fueled dollar demand. In contrast, the U.S. dollar index (DXY) was roughly flat after August’s pullback – ticking up slightly and ending around 97.8–98.0. Early in the month the dollar softened on the Fed rate cut, but renewed safe-haven bids (amid looming U.S. fiscal risks) left DXY essentially unchanged overall.

Bond Yields: Indian government bond yields were range-bound to slightly higher in September. The 10-year benchmark yield averaged around 6.5%, up from 6.47% in August, and closed the month near 6.55%. This was essentially flat to 2 bps lower than end-August (6.57%), as late-month buying trimmed an early rise. Yields had initially firmed up on oil price gains and rupee weakness (foreign selling), briefly approaching 6.60%, before stabilizing ahead of the RBI policy meeting. In the U.S., Treasury yields eased amid the Fed’s dovish turn – the 10-year yield dipped to about 4.14% by month-end, a ~9 basis point decline from August’s 4.23%. Mid-month, the U.S. 10Y even touched lows near 4.0% after the Fed cut rates, though strong economic data later nudged yields back up.

Commodities: Oil prices reversed August’s slide, rising on the back of extended supply curbs. Brent crude gained about +3.5% in September, climbing from ~$67 to about $70 per barrel. Early in the month, OPEC+ announced an extension of production cuts into year-end, which, along with persistent demand, helped lift prices despite ample global inventories. Brent settled near $69.8 on September 30. Gold prices, meanwhile, surged to new record highs. The yellow metal jumped roughly 10–11% for the month, breaking above the $3,800/oz mark. Gold ended September around $3,870/oz – an all-time high – after spiking on the back of the Fed rate cut and heightened geopolitical risks. Investors piled into gold as real yields fell and the U.S. dollar’s summer strength ebbed, seeking a hedge against uncertainty.

Global Macro Developments: September saw a delicate balance of easing monetary policy and geopolitical uncertainty. In the United States, the Federal Reserve cut its policy rate by 25 basis points at the Sep 16–17 FOMC meeting – the first cut since 2024 – bringing the target range to 4.00–4.25%. Fed Chair Jerome Powell cited a “softening” labor market and contained inflation as justification, and signaled this mid-cycle adjustment could be followed by another cut later in the year if disinflation persists. Markets, which had largely priced in two year-end cuts, adjusted to guidance of perhaps one more move as the Fed struck a cautious tone. Attention turned to Washington as a potential U.S. government shutdown hovered at month-end; indeed, Congress went down to the wire on funding, introducing a late headwind to sentiment. In Europe, the ECB kept its deposit rate at 2.00% in September, after its July hike, and adopted a wait-and-see approach. ECB President Lagarde emphasized that policy is in a “good place” for now and that clear evidence of weakening inflation is needed before considering cuts.

India Macro Developments: India’s economic fundamentals remained strong in September, even as it navigates external headwinds. GDP growth for the April–June quarter (Q1 FY2025-26) came in at 7.8% YoY, beating market expectations and marking an acceleration from 6.1% in the previous quarter. This robust print was driven by a convergence of high nominal GDP growth with easing inflation, as well as exceptional performance in services. In particular, services output surged (India’s Services PMI hit 62.9 in Aug, a 15-year high), and government capital spending was front-loaded in the fiscal year, providing a boost to demand. Manufacturing activity also picked up: August factory output (IPI) jumped to a 17-year high growth rate, despite the U.S. tariff overhang. On the inflation front, price pressures are currently benign. Headline CPI inflation fell to 2.6% in August, rebounding slightly from July’s 1.5% (a multi-year low) but still near the lower bound of the RBI’s 2–6% target range. Core inflation has trended down, aided by softer food prices (vegetable costs normalized) and the RBI’s past tightening.

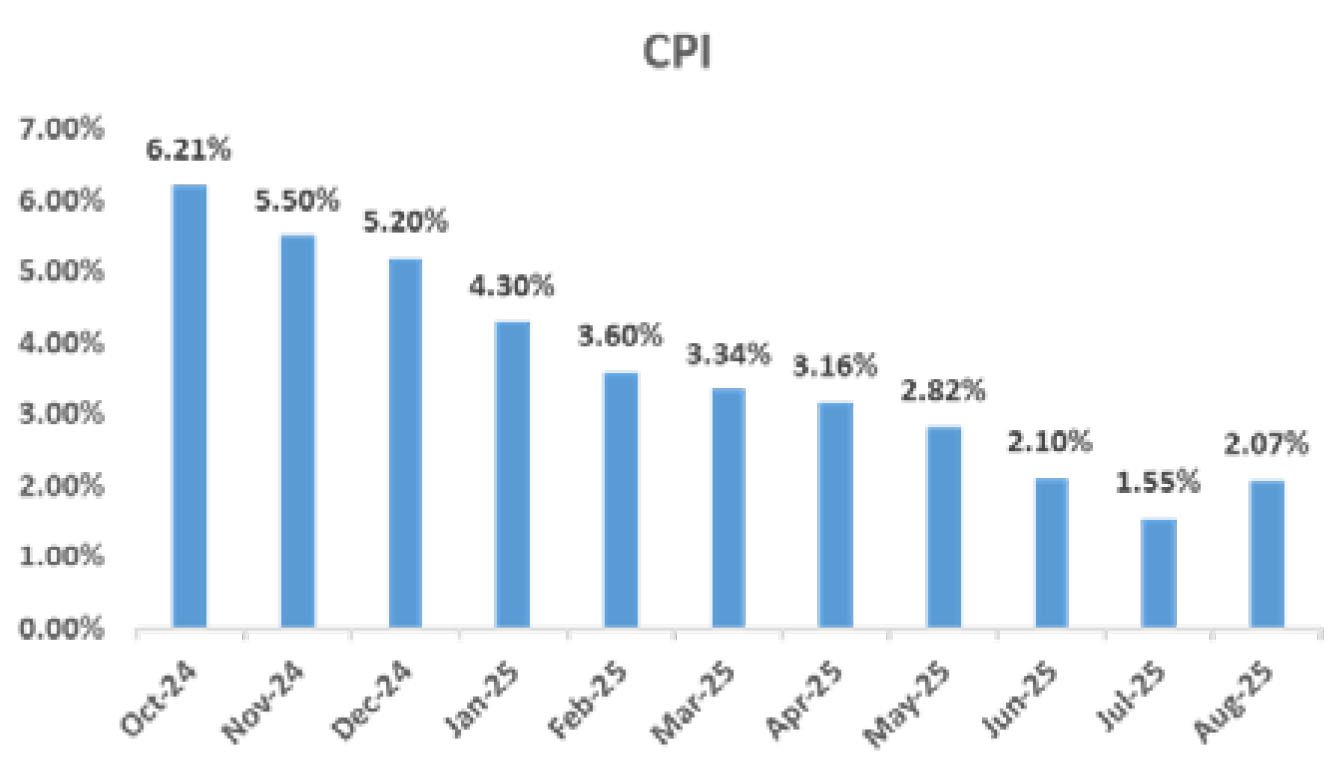

CPI: August CPI inflation inched up to 2.1% (Consensus: 2.1%; July: 1.6%) due to a broad-based marginal

uptick across categories barring food inflation, which contracted by 0.7%, led by a sharp decline in prices

of vegetables, pulses and spices. Sequentially, CPI rose by 0.5%, led by a 0.6% mom rise in food prices,

led by prices of vegetables, oil & fats and sugar. Core inflation (CPI excluding food, beverages and fuel)

remained steady at 4.1% (July: 4.1%). Core inflation increased 0.4% mom, driven by a sharp increase in

personal effects inflation led by gold and silver prices increasing by 2% and 4%, respectively, in August.

The prices of gold and silver have continued to move upwards in September.

Trade: India’s goods trade deficit narrowed to US$26.5 bn in August, driven by higher exports compared with July levels. Exports to the US have contracted 14% mom, amid normalization after frontloaded trade. The services trade surplus improved slightly to US$16.6 bn. Goods exports in August increased 6.7% yoy to US$35.1 bn (July: US$37.2 bn), driven by identical growth in oil and non-oil exports. Non-oil exports (down 6.9% mom) increased 6.7% yoy due to engineering goods, electronics, pharma products and gems and jewelry. Goods imports in August decreased 10% yoy to US$61.6 bn (July: US$64.6 bn), led by a 14.3% yoy decline in non-oil imports. Sequentially, oil and non-oil imports moderated.

Borrowing: The central government has decided to borrow Rs6.77 tn in 2HFY26 (1HFY25 gross borrowing was at Rs7.95 tn). The 2HFY26 gross borrowing is marginally higher by 2.4% yoy. The net issuance for 2HFY26, at Rs4.88 tn, is expected to be lower than 1HFY26 at Rs5.93 tn and 2HFY25 at Rs4.95 tn. The weekly dated securities auction size will be in tranches of Rs280-330bn (Rs220-390 bn in 1HFY26), spread across 22 weeks. The share of the 10-year segment alone remains highest at 28.4% (higher than 24.8% in 2HFY25 and 1HFY26 at 26.4%). Supply in the near end of the curve (3-5 years segments) rose to 19.9% (from 16.6% in 1HFY26). Meanwhile, supply in the far end of the curve (30-50 years segments) fell sharply to 29.4% (from 34.6% in 1HFY26). The issuance in the belly of the curve (7-15 years segments) is expected at 50.7% of the total supply (as compared with around 48.8% in 1HFY26).

Trade: India’s goods trade deficit narrowed to US$26.5 bn in August, driven by higher exports compared with July levels. Exports to the US have contracted 14% mom, amid normalization after frontloaded trade. The services trade surplus improved slightly to US$16.6 bn. Goods exports in August increased 6.7% yoy to US$35.1 bn (July: US$37.2 bn), driven by identical growth in oil and non-oil exports. Non-oil exports (down 6.9% mom) increased 6.7% yoy due to engineering goods, electronics, pharma products and gems and jewelry. Goods imports in August decreased 10% yoy to US$61.6 bn (July: US$64.6 bn), led by a 14.3% yoy decline in non-oil imports. Sequentially, oil and non-oil imports moderated.

Borrowing: The central government has decided to borrow Rs6.77 tn in 2HFY26 (1HFY25 gross borrowing was at Rs7.95 tn). The 2HFY26 gross borrowing is marginally higher by 2.4% yoy. The net issuance for 2HFY26, at Rs4.88 tn, is expected to be lower than 1HFY26 at Rs5.93 tn and 2HFY25 at Rs4.95 tn. The weekly dated securities auction size will be in tranches of Rs280-330bn (Rs220-390 bn in 1HFY26), spread across 22 weeks. The share of the 10-year segment alone remains highest at 28.4% (higher than 24.8% in 2HFY25 and 1HFY26 at 26.4%). Supply in the near end of the curve (3-5 years segments) rose to 19.9% (from 16.6% in 1HFY26). Meanwhile, supply in the far end of the curve (30-50 years segments) fell sharply to 29.4% (from 34.6% in 1HFY26). The issuance in the belly of the curve (7-15 years segments) is expected at 50.7% of the total supply (as compared with around 48.8% in 1HFY26).

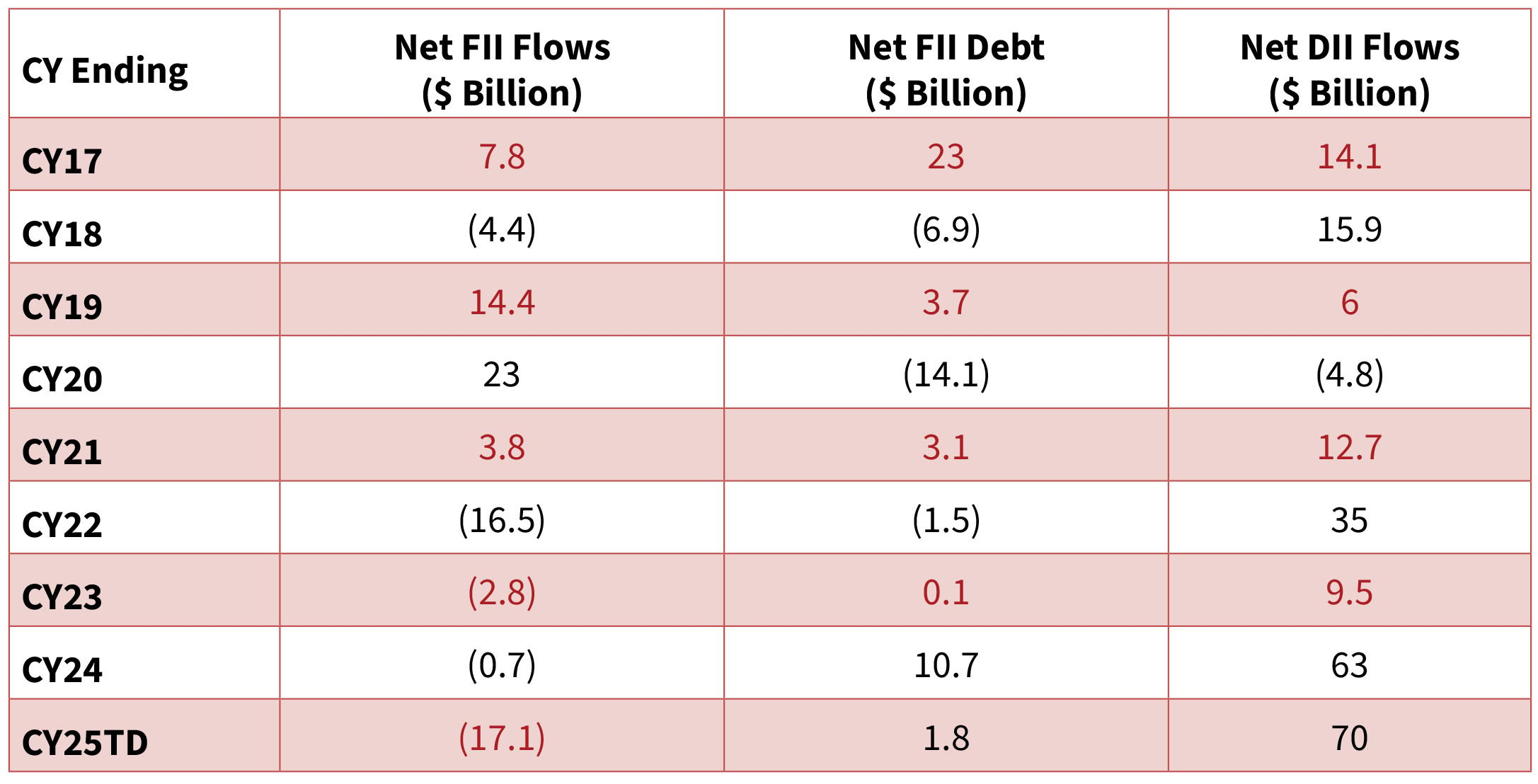

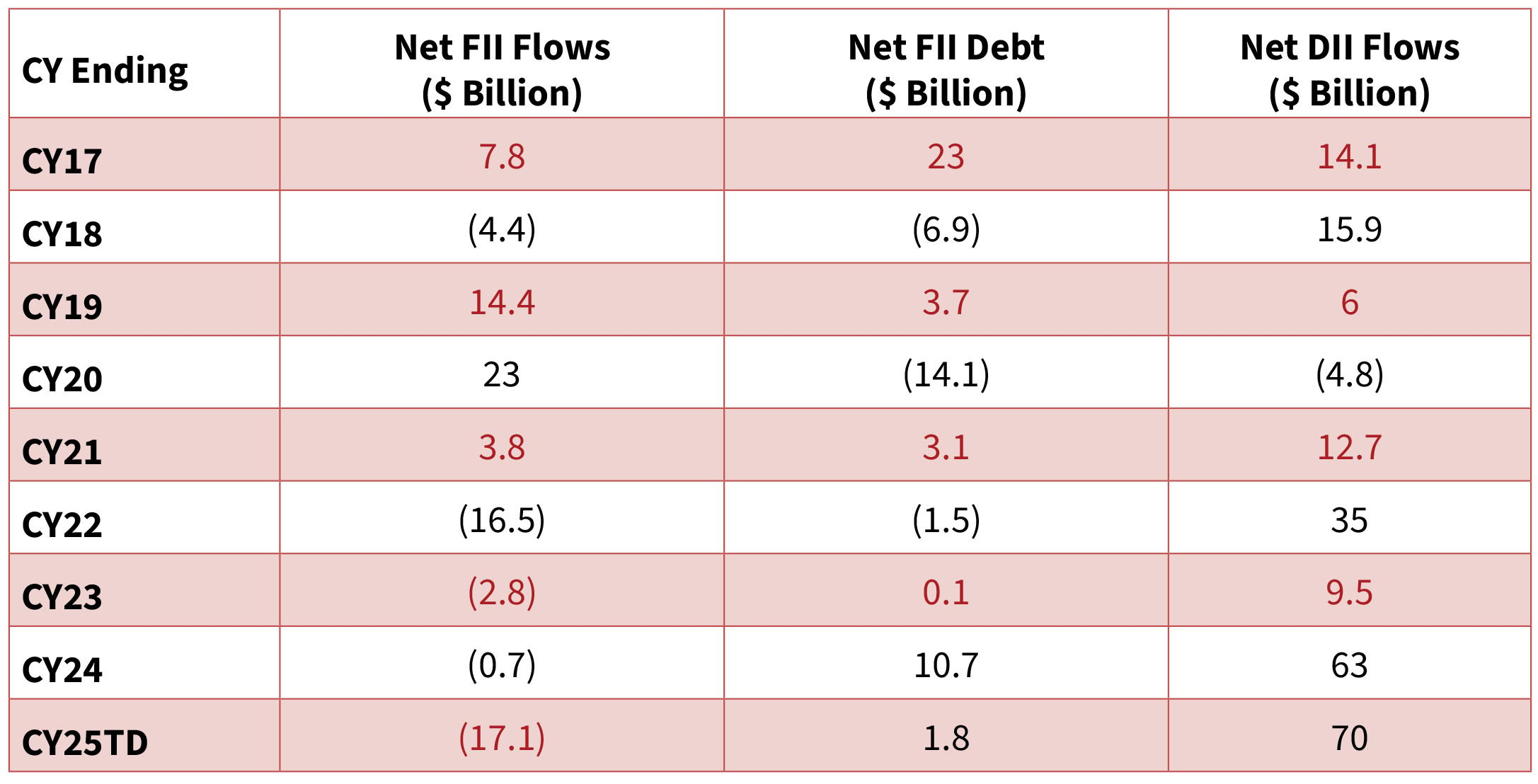

FIIs remained cautious in September, continuing their equity sell-off but at a slower pace. There was

a net outflow of ~$2.7 billion from Indian equities in September, compared to the larger outflows

of $3.3 billion in August and $2.9 billion in July. On a positive note, FIIs continued buying in Indian

bonds – registering an inflow of roughly $0.4 billion into debt markets in September (albeit lower

than August’s $1.5 billion inflow and the marginal $0.1 billion in July). This reflects some rotation

by FIIs into high-yield Indian debt, encouraged by India’s sovereign rating upgrade and prospects

of index inclusion for Indian G-secs. DIIs stepped up aggressively, marking their 26th consecutive

month of net equity buying. This massive buying by DIIs provided crucial support to the market,

easily absorbing FII selling.