Group Fund

Kotak Group Floating Rate Fund

(ULGF-005-07/12/04-FLTRFND-107)

MONTHLY UPDATE JANUARY 2023

|

AS ON 31st December 2022 |

Returns will be in line with those of fixed interest instruments, and may provide little protection against unexpected inflation increases Will preserve

capital and minimize downside risk, with investment in debt and government instruments.

Date of Inception

07th December 2004

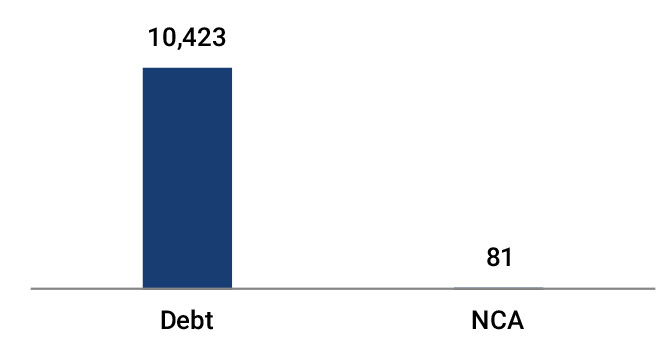

AUM (in Lakhs)

10,503.87

NAV

35.2760

Fund Manager

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 0% (NA)

Debt - 100% (CRISIL Liquid)

Debt - 100% (CRISIL Liquid)

Modified Duration

Debt & Money

Market Instruments : 0.77

Asset Allocation

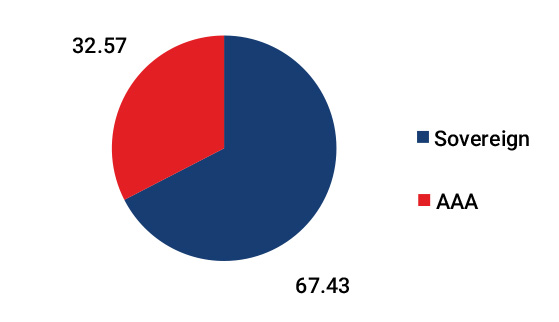

| Approved (%) | Actual (%) | |

| Gsec | 00 - 75 | 30 |

| Debt | 25 - 100 | 37 |

| MMI / Others | 00 - 40 | 33 |

Performance Meter

| Kotak Group Floating Rate Fund (%) | Benchmark (%) | |

| 1 month | 0.4 | 0.6 |

| 3 months | 1.4 | 1.6 |

| 6 months | 2.7 | 3.0 |

| 1 year | 3.5 | 5.1 |

| 2 years | 3.1 | 4.3 |

| 3 years | 4.3 | 4.4 |

| 4 years | 5.2 | 5.0 |

| 5 years | 5.4 | 5.5 |

| 6 years | 5.4 | 5.7 |

| 7 years | 5.9 | 6.0 |

| 10 years | 7.2 | 6.8 |

| Inception | 7.2 | 6.7 |

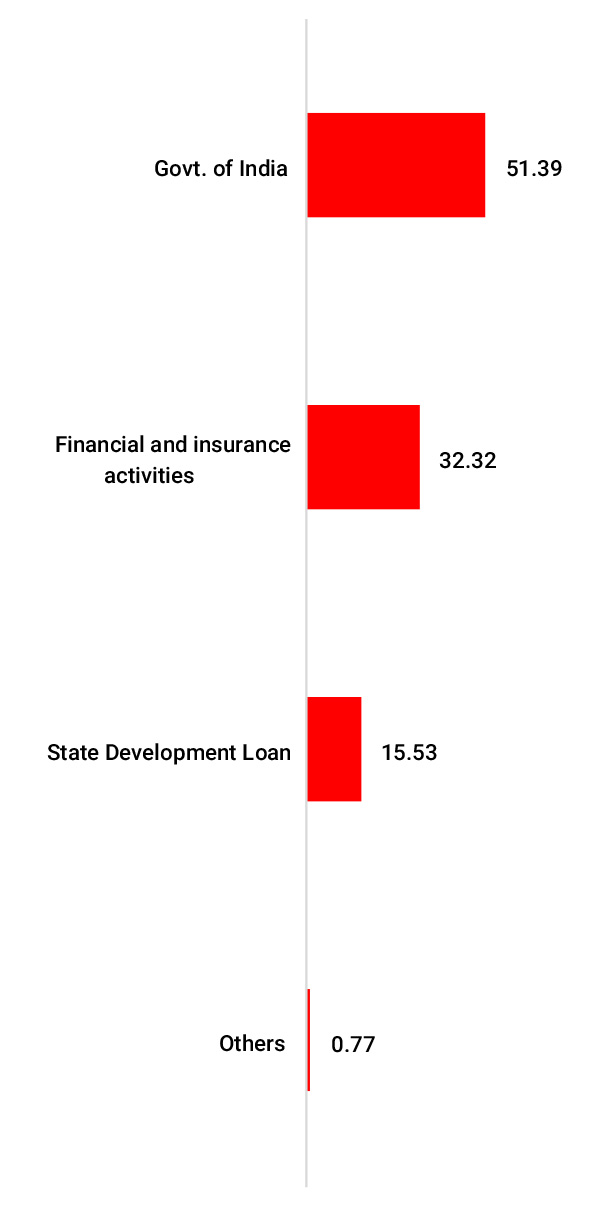

| Holdings | % to Fund |

| G-Sec | 30.33 |

| 7.38% GOI - 20.06.2027 | 11.97 |

| 9.37% MAH SDL - 04.12.2023 | 9.40 |

| 8.62% MAH SDL - 20.02.2023 | 1.91 |

| 8.84% PN SDL - 11.06.2024 | 1.78 |

| 8.30% Fertilizer Co GOI - 07.12.23 | 1.38 |

| 8.68% GJ SDL - 06.02.2023 | 1.01 |

| 8.28% GOI - 21.09.2027 | 0.99 |

| 9.25% HR SDL 09.10.2023 | 0.68 |

| 8.51% PN SDL - 10.04.2023 | 0.32 |

| 9.65% TN SDL - 12.03.2024 | 0.32 |

| Others | 0.58 |

| Corporate Debt | 36.59 |

| GOI FRB - 07.11.2024 | 29.51 |

| GOI FRB - 22.09.2033 | 7.08 |

| MMI | 32.32 |

| NCA | 0.77 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.