Month Gone By – Markets (period ended June 30, 2022)

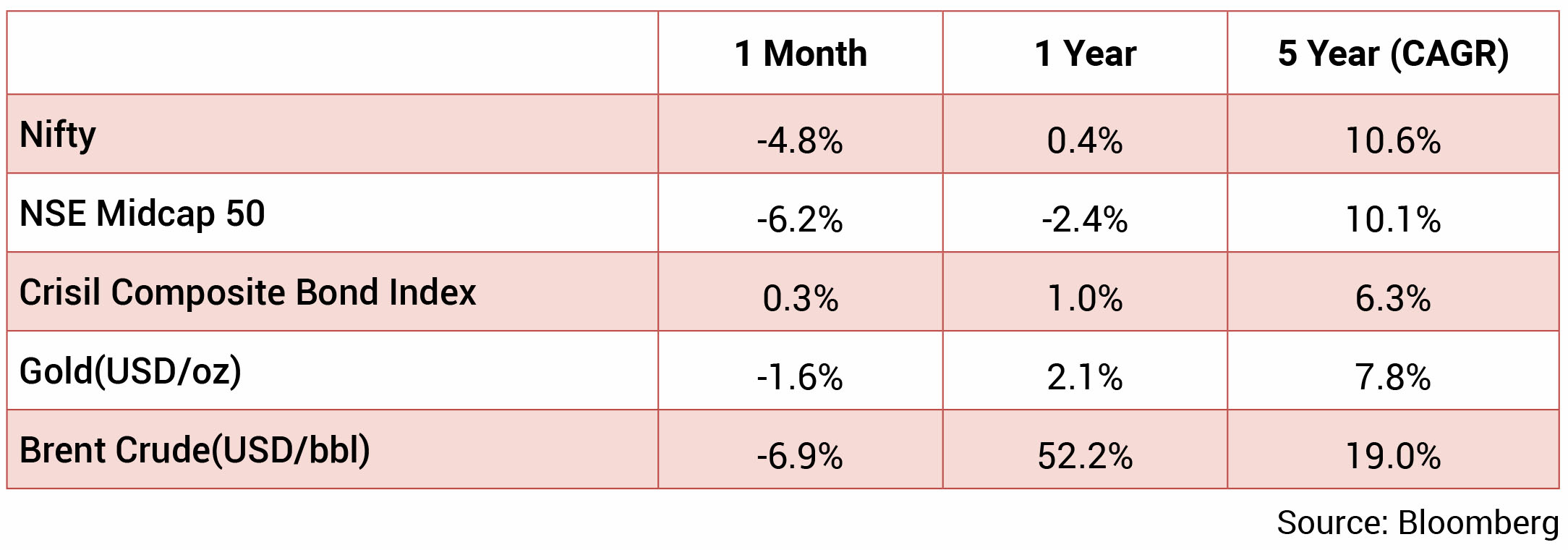

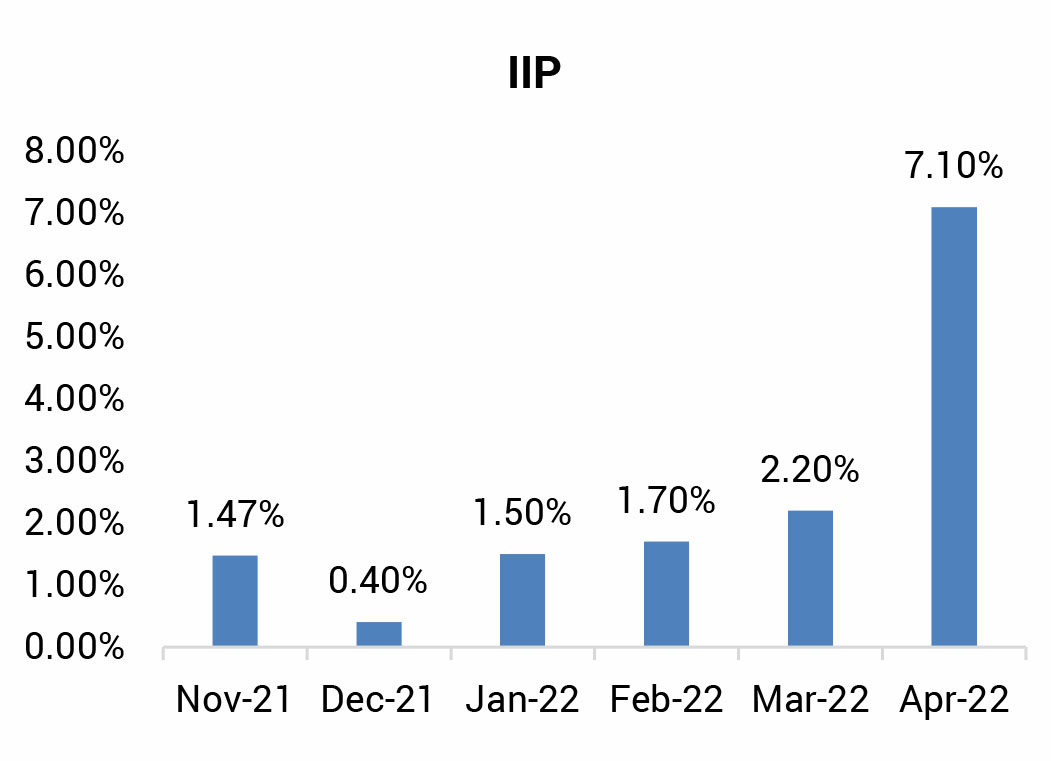

Markets declined 4.8% m-o-m primarily dragged down by inflationary pressure, RBI rate hike and continued FIIs

selling. Nearly all the sectors in the S&P BSE index have underperformed in June except Auto. The INR depreciated

against USD for the fifth straight month due to volatile crude prices and expectation of aggressive US rate hikes.

INR averaged around 77.9 with a monthly best and worst of 77.5 and 78.3 respectively. Yields continued to ascend

with the 10y benchmark trading in a range of 7.40%-7.62% and eventually ending the month 3bps higher m-o-m at

7.45%. The 10y benchmark averaged 7.49% in June.

Inflation in US and UK remained elevated at 8.6% and 9.1% respectively in May while EU registered 8.6% inflation in June. With sustenance of inflation pressures, FOMC raised the federal funds rate further by 75bps in the last meeting in June post the 50bps/25bps increase in April/March. The minutes of the meeting released thereafter indicated that taming inflation is the utmost priority and signaled a similar 50bps or 75 bps hike in the next meeting in July. FOMC members also supported the plan for reducing balance sheet from 1st June with a monthly cap of USD 47.5bn in the first three months and thereafter to be increased to USD 95bn. Bank of England raised their interest rates further by 25bps to attain 1.25% in June. ECB raised its inflation expectation to 6.8% in 2022 and 3.5% in 2023 in its June policy meeting, higher than March projections. In aligning with global central banks, the ECB is expected to raise key interest rates by 25 bps in its July monetary policy meeting.

On the domestic front, FY22 GDP/GVA registered 8.7%/8.1% growth, slightly lower than the earlier advanced estimates. However, Q4FY22 GDP was better than market expectation. Positively, Indian fiscal deficit for FY22 was tamed at 6.7% of GDP vs. 6.9% expected according to the revised estimates supported to healthy tax collections. To tackle the inflationary concerns, RBI opted for an intermittent meeting in the first week of May and raised policy repo rate by 40bps and CRR by 50bps. In its June meeting, the RBI again raised policy rate by 50bps to 4.9% and minutes of the meeting released a fortnight later also indicate heightened pressure from inflation, thereby, indicating further rate hikes. Government’s fiscal account for FY23 is currently under pressure due to excise duty cut and additional food & fuel subsidy. On the contrary, the recent hike in export duty on domestically produced crude oil might aid the government balance this out. Most of the high frequency data including GST collections for June indicate robustness in economic activity.

Brent crude remained volatile and elevated to average USD 123/bbl in June from USD 113/ bbl in May due to continued geopolitical tensions - reports on EU’s partial ban on Russian oil and other geo-political concerns. Inability of OPEC to comply with announcements on increase in output and geo-political issues is likely to keep the pressure on crude prices. Gold prices ended lower at USD 1,834/oz in June from USD 1,848/oz in May.

Inflation in US and UK remained elevated at 8.6% and 9.1% respectively in May while EU registered 8.6% inflation in June. With sustenance of inflation pressures, FOMC raised the federal funds rate further by 75bps in the last meeting in June post the 50bps/25bps increase in April/March. The minutes of the meeting released thereafter indicated that taming inflation is the utmost priority and signaled a similar 50bps or 75 bps hike in the next meeting in July. FOMC members also supported the plan for reducing balance sheet from 1st June with a monthly cap of USD 47.5bn in the first three months and thereafter to be increased to USD 95bn. Bank of England raised their interest rates further by 25bps to attain 1.25% in June. ECB raised its inflation expectation to 6.8% in 2022 and 3.5% in 2023 in its June policy meeting, higher than March projections. In aligning with global central banks, the ECB is expected to raise key interest rates by 25 bps in its July monetary policy meeting.

On the domestic front, FY22 GDP/GVA registered 8.7%/8.1% growth, slightly lower than the earlier advanced estimates. However, Q4FY22 GDP was better than market expectation. Positively, Indian fiscal deficit for FY22 was tamed at 6.7% of GDP vs. 6.9% expected according to the revised estimates supported to healthy tax collections. To tackle the inflationary concerns, RBI opted for an intermittent meeting in the first week of May and raised policy repo rate by 40bps and CRR by 50bps. In its June meeting, the RBI again raised policy rate by 50bps to 4.9% and minutes of the meeting released a fortnight later also indicate heightened pressure from inflation, thereby, indicating further rate hikes. Government’s fiscal account for FY23 is currently under pressure due to excise duty cut and additional food & fuel subsidy. On the contrary, the recent hike in export duty on domestically produced crude oil might aid the government balance this out. Most of the high frequency data including GST collections for June indicate robustness in economic activity.

Brent crude remained volatile and elevated to average USD 123/bbl in June from USD 113/ bbl in May due to continued geopolitical tensions - reports on EU’s partial ban on Russian oil and other geo-political concerns. Inability of OPEC to comply with announcements on increase in output and geo-political issues is likely to keep the pressure on crude prices. Gold prices ended lower at USD 1,834/oz in June from USD 1,848/oz in May.

Source: Bloomberg

Source: Bloomberg

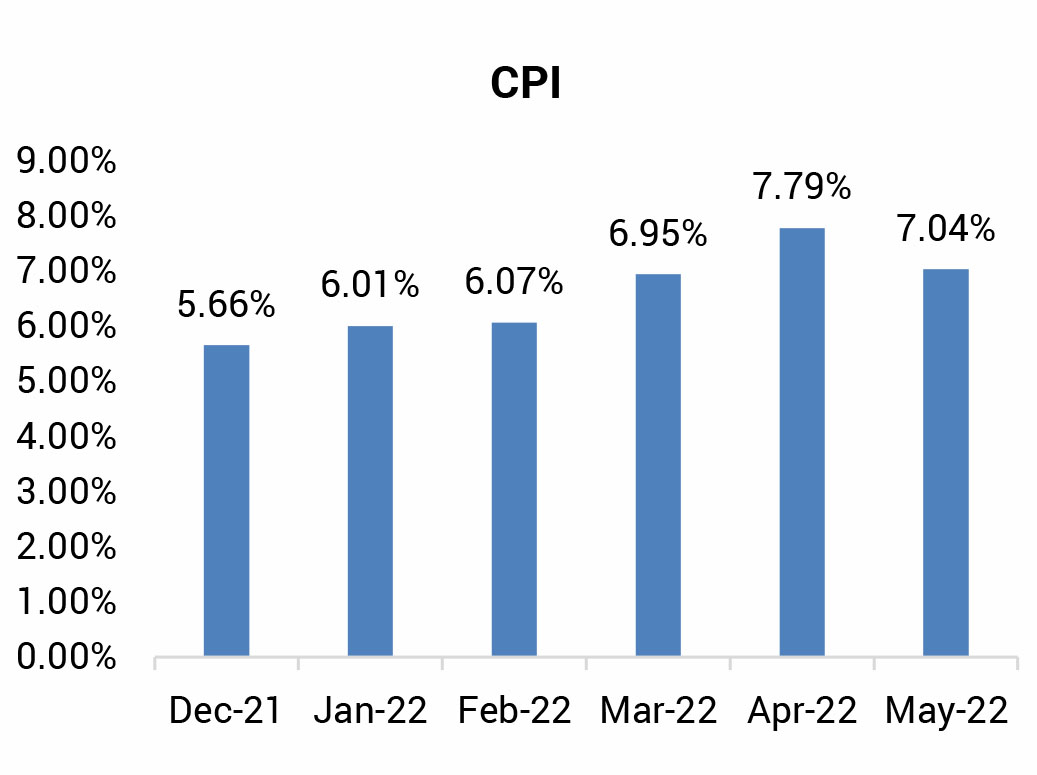

IIP: April IIP registered a growth of 7.1% yoy (March: 2.2%) led primarily by a favorable base. Sequentially, IIP fell

sharply by 8.9%. On a sectoral basis, all components exhibited positive growth (over April 2021) led by electricity

production growing by 11.8% (March: 6.1%), mining activity by 7.8% (4%), and manufacturing by 6.3% (0.9%). As

per the use-based classification, capital goods production grew the most by 14.7% (over April 2021) (March: 2%),

followed by primary goods by 10.1% (5.7%), consumer durables by 8.5% ((-)2.6%), intermediate goods by 7.6%

(1.8%), and consumer non-durables growth at 0.3% ((-) 4.6%).

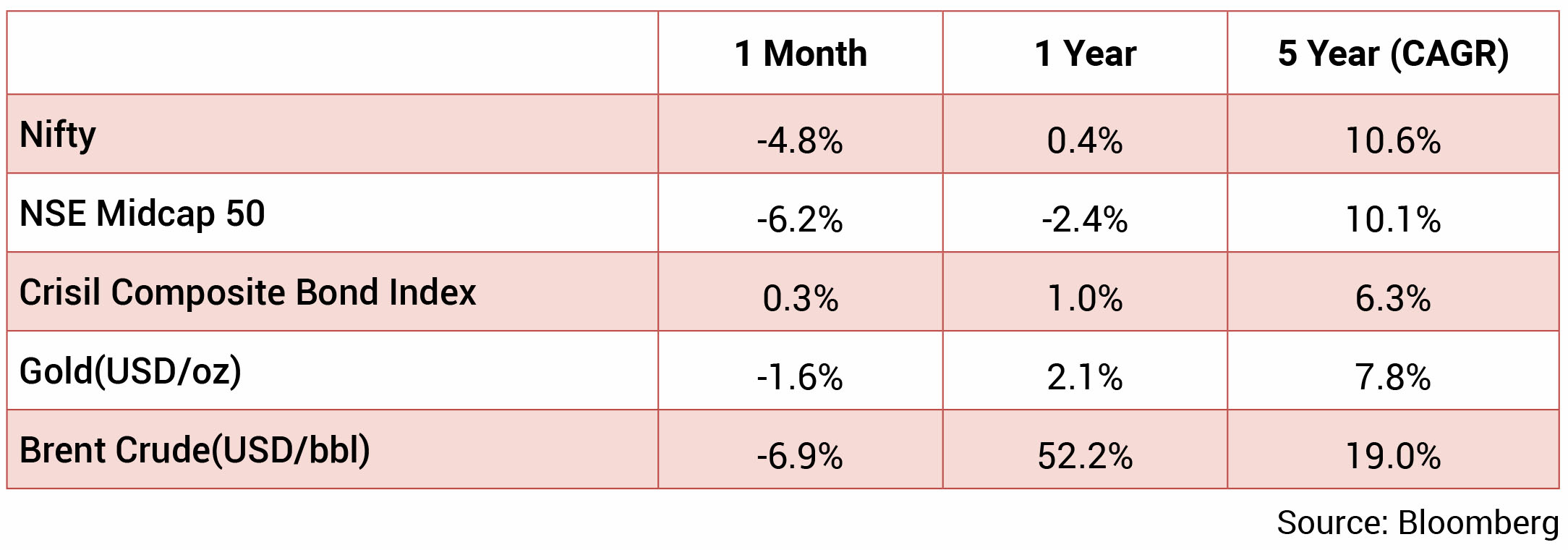

CPI: Headline CPI inflation in May dropped to 7.04% compared to 7.79% in April led by a favorable base effect and moderation in sequential momentum (0.9% in May compared to 1.4% in April). Food inflation at 8% (April: 8.3%) was the main contributor to headline inflation led by a sequential surge in vegetables (5.2%), meat and fish (2.5%), spices (2%), and oils and fats (1.5%). May core inflation (CPI excluding food, fuel, pan and tobacco) moderated sharply to 6.2% (April: 7.4%), with a moderation in the sequential momentum of 0.4% (1.3% mom in April). While most components registered a moderate increase, personal care category contracted by 0.2% mom reflecting the impact of moderation in gold and silver prices. Transport and communication category registered a 0.3% sequential increase (compared to 3% in April) reflecting a partial impact of excise duty cuts.

Trade Deficit: India’s merchandise exports grew by 20.6% in May 2022, a moderation over the previous month. Exports recorded contraction on a sequential basis across all major exporting segments, reflecting the rising uncertainty due to the escalation of the Russia-Ukraine war and aggravating supply chain disruptions. Merchandise imports at USD 63.2bn remained above USD 60bn mark for the third consecutive month, reflecting strong domestic demand as well as the impact of higher commodity prices. Imports registered a robust growth of 62.8%yoy and witnessed sequential growth of 5.0 per cent. India’s trade deficit at USD 24.3bn increased to its highest monthly level in May 2022. Around 70% of the increase in the trade deficit was on account of petroleum and its products; and gems and jewellery.

BoP: Q4FY22 current account deficit narrowed to USD 13.4bn (1.5% of GDP), compared to USD 22.2bn in Q3FY22. This was due to moderation in the trade deficit to USD 54.5bn (Q3FY22: USD 59.7bn) and lower net outflow of primary income. Imports increased to USD 173bn (Q3FY22: USD 169bn) and exports increased to USD 118bn (Q3FY22: USD 109bn). Q4FY222 capital account moderated sharply to -USD 2bn (Q3FY22: USD 22bn) due to high FPI outflows of USD 15bn (3QFY22: -USD 6bn and banking capital outflows of USD 6bn (Q3FY22: +USD 8bn). FDI inflows increased to USD 14bn (Q3FY22: USD 5bn) while ECBs flows increased to USD 3bn (Q3FY22: -USD 0.3bn). Overall, the BOP was at –USD 16bn in Q4FY22 after 12 quarters of BOP surplus.

Current account reverted to deficit in FY2022 (1.2% of GDP) after a registering a surplus (0.9% of GDP) in FY2021. The deficit was led by higher trade deficit of USD 189bn (FY2021: -USD 102 bn) offsetting the invisibles surplus of USD 151bn (FY2021: USD 126bn). Both exports and imports hit record highs in FY2022 and widened the trade deficit to a 9-year high at USD 189bn. FY2022 capital account registered a surplus of USD 86bn (FY2021: USD 64bn) supported by short-term credit of USD 20bn (FY2021: -USD 4bn), and SDR allocation of USD 17.9bn from the IMF. BOP surplus moderated to USD 47.5bn (FY2021: USD 87.3bn).

Monetary Policy Meeting: The MPC unanimously voted to raise the repo rate by 50 bps to 4.9% while remaining focused on withdrawal of accommodation. Consequently, SDF rate and MSF rate increased to 4.65% and 5.15%, respectively. Importantly, the phrase ‘remain accommodative’ was dropped from the stance, removing any ambiguity regarding the way forward. The MPC noted the global risks emanating from (1) multi-decadal high inflation and slowing growth, (2) persistence of geopolitical tensions, (3) elevated commodity prices, especially crude oil, and (4) lingering Covid-19 related supply-chain bottlenecks. The MPC revised up its FY2023 CPI inflation forecast by 100 bps to 6.7% (earlier: 5.7%, Kotak: 6.5%) with assumption of a normal monsoon and crude oil price average of USD 105/bbl. On the growth front, the MPC retained its FY2023 GDP growth forecast at 7.2% (Kotak: 7.3%), which takes into account (1) pickup in rural consumption following likely normal south-west monsoon, (2) rebound in contact-intensive services aiding urban consumption, (3) pickup in investment activity supported by improvement in capacity utilization, government’s capex push, and bank credit growth, and (4) buoyancy in merchandise exports. However, downside risks to growth remain from persistence of supply bottlenecks and tightening global financial conditions.

CPI: Headline CPI inflation in May dropped to 7.04% compared to 7.79% in April led by a favorable base effect and moderation in sequential momentum (0.9% in May compared to 1.4% in April). Food inflation at 8% (April: 8.3%) was the main contributor to headline inflation led by a sequential surge in vegetables (5.2%), meat and fish (2.5%), spices (2%), and oils and fats (1.5%). May core inflation (CPI excluding food, fuel, pan and tobacco) moderated sharply to 6.2% (April: 7.4%), with a moderation in the sequential momentum of 0.4% (1.3% mom in April). While most components registered a moderate increase, personal care category contracted by 0.2% mom reflecting the impact of moderation in gold and silver prices. Transport and communication category registered a 0.3% sequential increase (compared to 3% in April) reflecting a partial impact of excise duty cuts.

Trade Deficit: India’s merchandise exports grew by 20.6% in May 2022, a moderation over the previous month. Exports recorded contraction on a sequential basis across all major exporting segments, reflecting the rising uncertainty due to the escalation of the Russia-Ukraine war and aggravating supply chain disruptions. Merchandise imports at USD 63.2bn remained above USD 60bn mark for the third consecutive month, reflecting strong domestic demand as well as the impact of higher commodity prices. Imports registered a robust growth of 62.8%yoy and witnessed sequential growth of 5.0 per cent. India’s trade deficit at USD 24.3bn increased to its highest monthly level in May 2022. Around 70% of the increase in the trade deficit was on account of petroleum and its products; and gems and jewellery.

BoP: Q4FY22 current account deficit narrowed to USD 13.4bn (1.5% of GDP), compared to USD 22.2bn in Q3FY22. This was due to moderation in the trade deficit to USD 54.5bn (Q3FY22: USD 59.7bn) and lower net outflow of primary income. Imports increased to USD 173bn (Q3FY22: USD 169bn) and exports increased to USD 118bn (Q3FY22: USD 109bn). Q4FY222 capital account moderated sharply to -USD 2bn (Q3FY22: USD 22bn) due to high FPI outflows of USD 15bn (3QFY22: -USD 6bn and banking capital outflows of USD 6bn (Q3FY22: +USD 8bn). FDI inflows increased to USD 14bn (Q3FY22: USD 5bn) while ECBs flows increased to USD 3bn (Q3FY22: -USD 0.3bn). Overall, the BOP was at –USD 16bn in Q4FY22 after 12 quarters of BOP surplus.

Current account reverted to deficit in FY2022 (1.2% of GDP) after a registering a surplus (0.9% of GDP) in FY2021. The deficit was led by higher trade deficit of USD 189bn (FY2021: -USD 102 bn) offsetting the invisibles surplus of USD 151bn (FY2021: USD 126bn). Both exports and imports hit record highs in FY2022 and widened the trade deficit to a 9-year high at USD 189bn. FY2022 capital account registered a surplus of USD 86bn (FY2021: USD 64bn) supported by short-term credit of USD 20bn (FY2021: -USD 4bn), and SDR allocation of USD 17.9bn from the IMF. BOP surplus moderated to USD 47.5bn (FY2021: USD 87.3bn).

Monetary Policy Meeting: The MPC unanimously voted to raise the repo rate by 50 bps to 4.9% while remaining focused on withdrawal of accommodation. Consequently, SDF rate and MSF rate increased to 4.65% and 5.15%, respectively. Importantly, the phrase ‘remain accommodative’ was dropped from the stance, removing any ambiguity regarding the way forward. The MPC noted the global risks emanating from (1) multi-decadal high inflation and slowing growth, (2) persistence of geopolitical tensions, (3) elevated commodity prices, especially crude oil, and (4) lingering Covid-19 related supply-chain bottlenecks. The MPC revised up its FY2023 CPI inflation forecast by 100 bps to 6.7% (earlier: 5.7%, Kotak: 6.5%) with assumption of a normal monsoon and crude oil price average of USD 105/bbl. On the growth front, the MPC retained its FY2023 GDP growth forecast at 7.2% (Kotak: 7.3%), which takes into account (1) pickup in rural consumption following likely normal south-west monsoon, (2) rebound in contact-intensive services aiding urban consumption, (3) pickup in investment activity supported by improvement in capacity utilization, government’s capex push, and bank credit growth, and (4) buoyancy in merchandise exports. However, downside risks to growth remain from persistence of supply bottlenecks and tightening global financial conditions.

Deal flow slowed materially in June with 17 deals worth ~USD 191mn executed. Key deals included Bata (~USD

86.3mn) and PB Fintech (~USD 29.61mn).

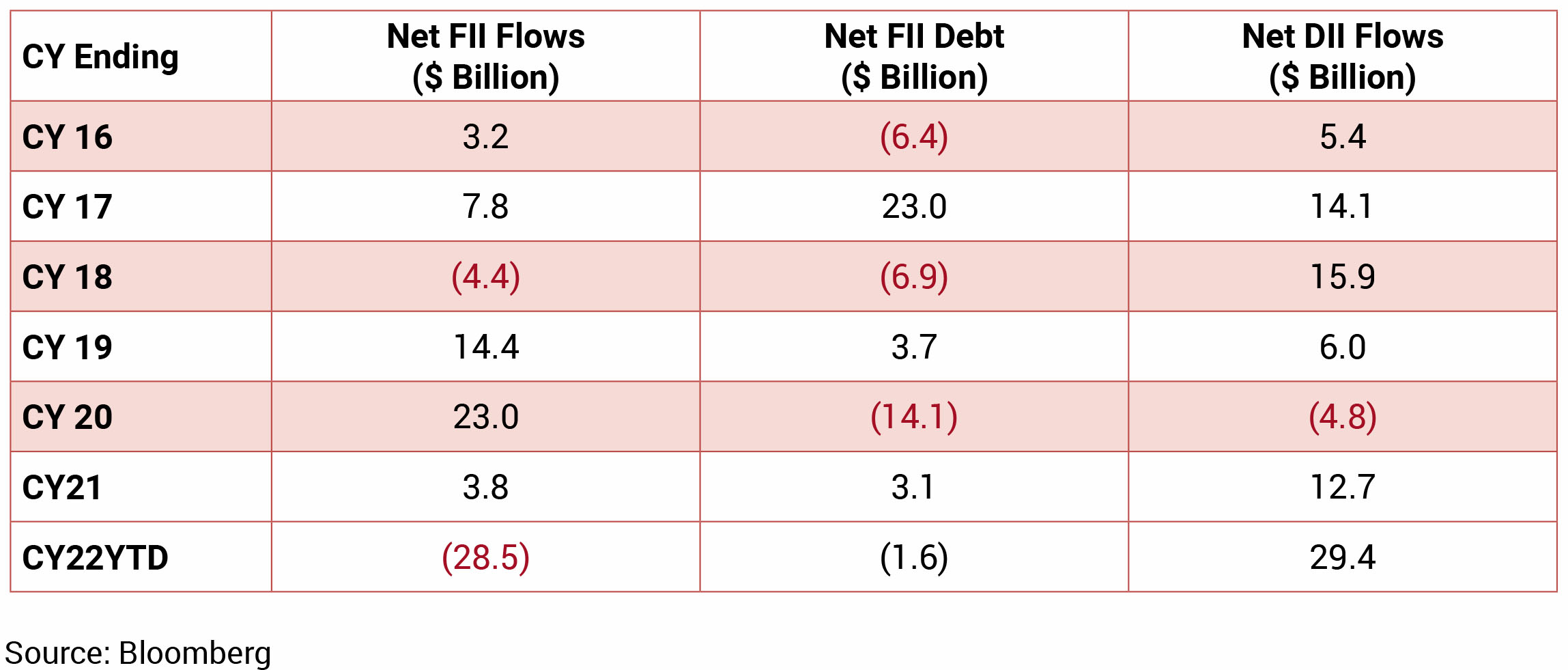

FIIs continued being net sellers in the month of June 2022 and were net sellers to the tune of -USD 6.4bn even as DII buying continued at +USD 5.9bn.

FIIs continued being net sellers in the month of June 2022 and were net sellers to the tune of -USD 6.4bn even as DII buying continued at +USD 5.9bn.