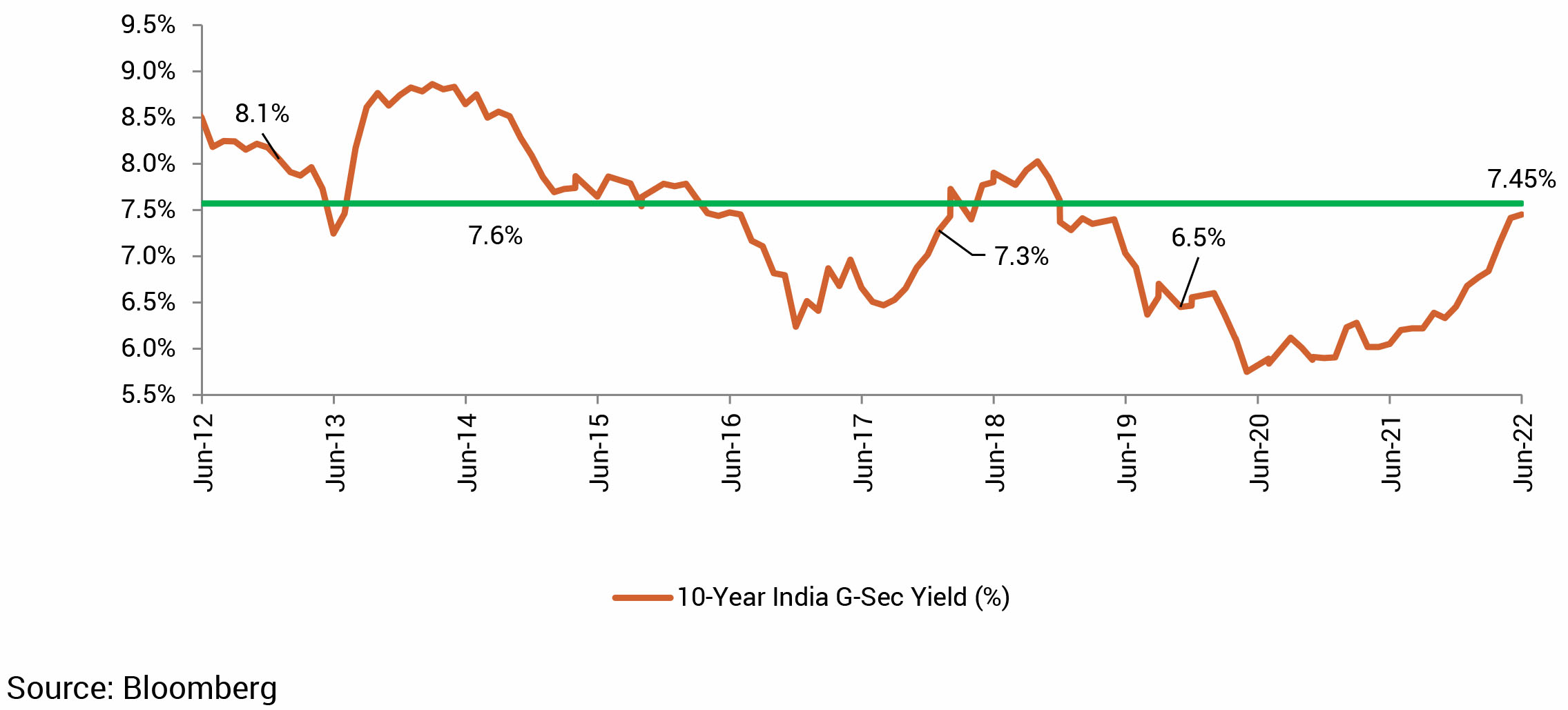

Yields were on a one-way move upward till the middle of the month as we saw a rise of 20bps from 7.42% at the start of the month till 7.62% mid-month. Elevated domestic and global inflation, crude prices perched at uncomfortable levels reluctant to edge lower, and unified tightening by global central banks pushed yields persistently higher.

However, post the middle of the month, clouds of global slowdown and recession fears started to appear in the skies leading to some respite for yields cooling off to eventually close the month at 7.45%. Going forward, expect yields to be caught in the tug-of-war between inflation and recession with trajectory decided by which narrative incremental data favours.