Individual Fund

Kotak Aggressive Growth Fund

(ULIF-018-13/09/04-AGRGWTFND-107)

MONTHLY UPDATE SEPTEMBER 2022

|

AS ON 30th August 2022 |

Aims for a high level of capital growth by holding a significant portion in large sized company equities.

Date of Inception

13th September 2004

AUM (in Lakhs)

28,891.93

NAV

130.2271

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 100% (BSE 100)

Modified Duration

Debt & Money

Market Instruments : 0.01

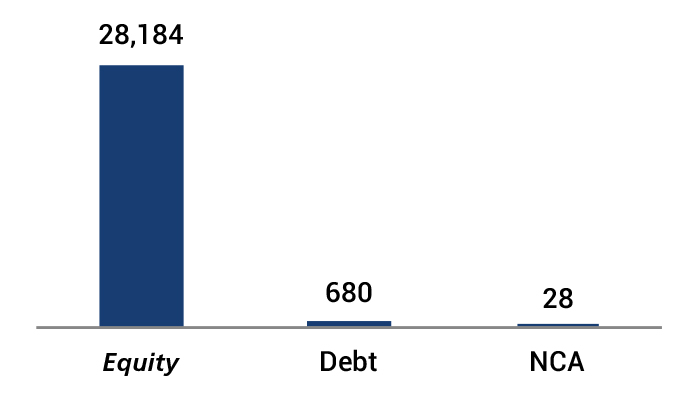

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 60 - 100 | 98 |

| Gsec / Debt | 00 - 40 | 0 |

| MMI / Others | 00 - 40 | 2 |

Performance Meter

| Aggressive Growth Fund (%) | Benchmark (%) | |

| 1 month | 3.8 | 3.9 |

| 3 months | 9.2 | 7.9 |

| 6 months | 6.6 | 6.9 |

| 1 year | 4.4 | 4.9 |

| 2 years | 25.9 | 26.0 |

| 3 years | 18.4 | 17.8 |

| 4 years | 11.2 | 11.0 |

| 5 years | 11.8 | 12.1 |

| 6 years | 11.9 | 12.4 |

| 7 years | 12.2 | 12.2 |

| 10 years | 14.6 | 13.2 |

| Inception | 15.4 | 13.3 |

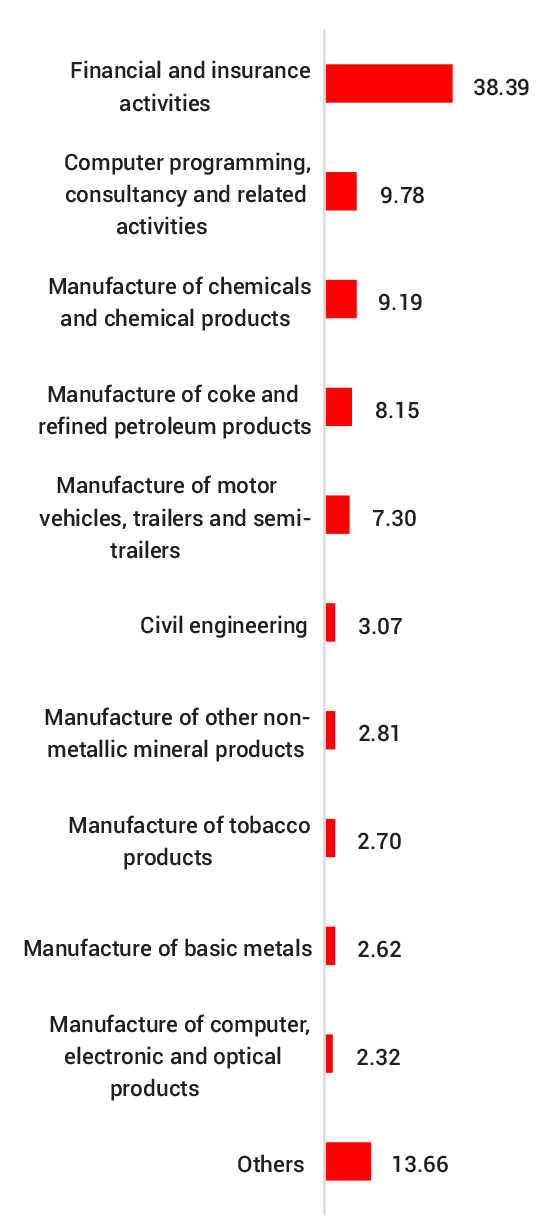

| Holdings | % to Fund |

| Equity | 97.55 |

| ICICI Bank Ltd | 8.76 |

| Reliance Industries Ltd | 8.15 |

| Infosys Ltd | 6.24 |

| Kotak Banking ETF - Dividend Payout Option | 4.01 |

| Axis Bank Ltd | 3.92 |

| State Bank of India | 3.52 |

| Maruti Suzuki India Ltd | 3.38 |

| Larsen And Toubro Ltd | 3.07 |

| Hindustan Unilever Ltd | 3.03 |

| ICICI Prudential Bank ETF Nifty Bank Index | 2.98 |

| SBI ETF Nifty Bank | 2.97 |

| I T C Ltd | 2.70 |

| Mahindra & Mahindra Ltd | 2.67 |

| HDFC Bank Ltd | 2.53 |

| Tata Consultancy Services Ltd | 2.24 |

| Bajaj Finance Ltd | 2.22 |

| Housing Development Finance Corp. Ltd | 2.17 |

| UltraTech Cement Ltd | 2.10 |

| S R F Ltd | 2.07 |

| SBI Life Insurance Company Ltd | 2.00 |

| Others | 26.83 |

| MMI | 2.35 |

| NCA | 0.10 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.