Month Gone By – Markets (period ended August 30, 2022)

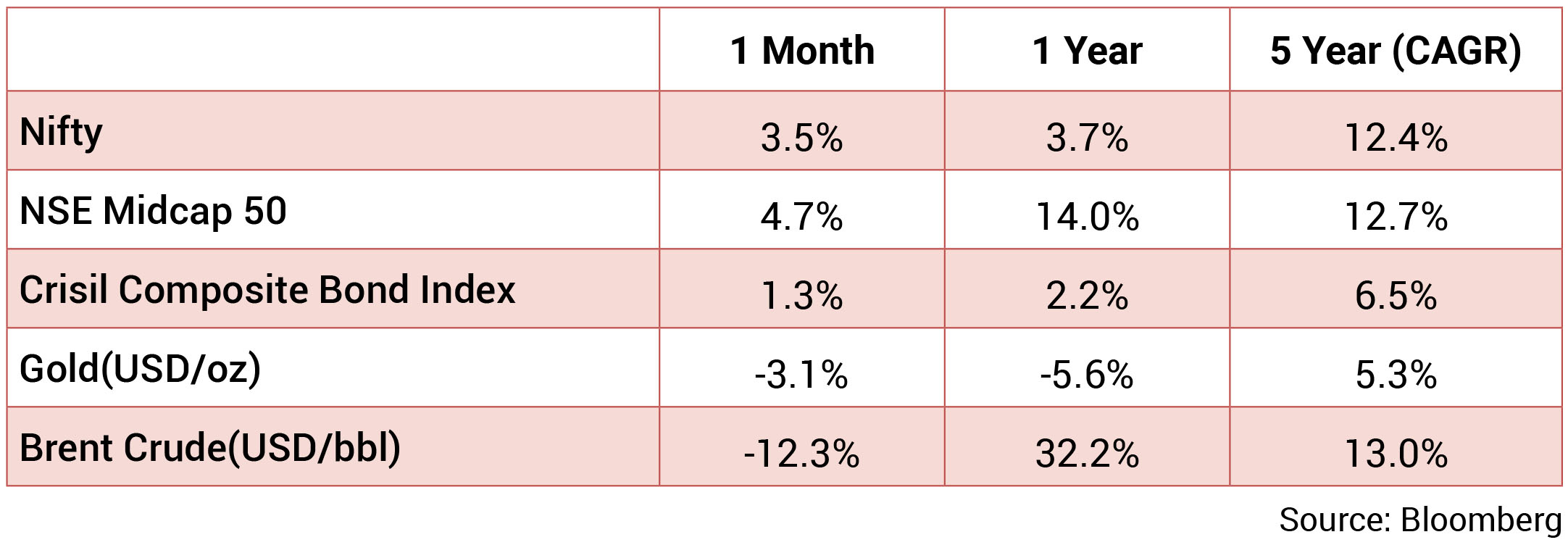

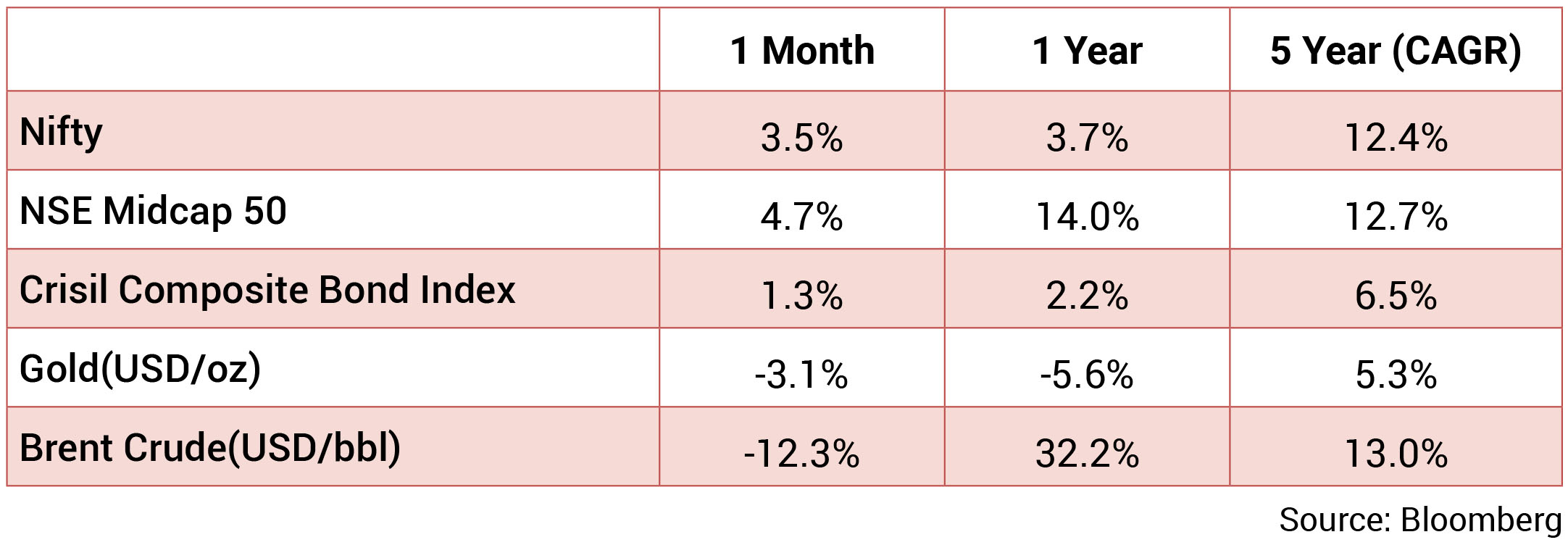

Markets increased by 3.5% m-o-m tracking global cues and robust earnings, but ended the month

on a downward trajectory due to Federal Reserve Chair Jerome Powell’s comments at the Jackson

Hole symposium. All sectors barring Healthcare and IT ended the month in the green. Utilities and

Industrials were the best-performing sectors. The INR continued to depreciate against the USD

due to aggressive rate hikes in the US as well as volatile crude prices. INR depreciated by 0.2%

m-o-m, reaching ~79.46/USD in August. Yields fell, with the 10y benchmark trading in a range of

7.16%-7.35% and eventually ending the month 13bps lower m-o-m at 7.19%. The 10y benchmark

averaged 7.25% in August.

Inflation in US and UK remained elevated at 8.5% and 8.8% respectively in July, while EU registered 9.1% inflation in August. With monetary policy meetings coming up in September, all eyes were on the Federal Reserve’s annual symposium of central banks at Jackson Hole, Wyoming. Fed Chair Jerome Powell affirmed that higher interest rates will likely persist “for some time…the historical record cautions strongly against prematurely loosening policy.” This was interpreted as an extremely hawkish signal by markets, which promptly sold off in the US and elsewhere globally. Expectations of 75bps hikes by the Fed, ECB and BOE in September are quite high.

On the domestic front, the RBI raised rates by 50bps at its August meeting, with the repo rate now at 5.40%. The RBI’s growth and inflation forecasts for FY23 remain unchanged, while it also provided its forecast for Q1FY24 (CPI inflation – 5.0%, GDP growth – 6.7%). Q1FY23 GDP growth came in at 13.5% YoY, led by a recovery in the services sector and helped by a favourable base effect.

Brent crude remained volatile, although it ended the month at USD 93/bbl – it also went as high as USD 105/bbl during the month, with sharp movements throughout this period. Volatility is expected to continue due to tight supply, as well as the potential for higher demand in the coming months as Europe’s gas shortages force countries to turn to diesel for heating. Gold ended August lower at USD 1,702/oz compared to USD 1,766/oz at the end of July.

Inflation in US and UK remained elevated at 8.5% and 8.8% respectively in July, while EU registered 9.1% inflation in August. With monetary policy meetings coming up in September, all eyes were on the Federal Reserve’s annual symposium of central banks at Jackson Hole, Wyoming. Fed Chair Jerome Powell affirmed that higher interest rates will likely persist “for some time…the historical record cautions strongly against prematurely loosening policy.” This was interpreted as an extremely hawkish signal by markets, which promptly sold off in the US and elsewhere globally. Expectations of 75bps hikes by the Fed, ECB and BOE in September are quite high.

On the domestic front, the RBI raised rates by 50bps at its August meeting, with the repo rate now at 5.40%. The RBI’s growth and inflation forecasts for FY23 remain unchanged, while it also provided its forecast for Q1FY24 (CPI inflation – 5.0%, GDP growth – 6.7%). Q1FY23 GDP growth came in at 13.5% YoY, led by a recovery in the services sector and helped by a favourable base effect.

Brent crude remained volatile, although it ended the month at USD 93/bbl – it also went as high as USD 105/bbl during the month, with sharp movements throughout this period. Volatility is expected to continue due to tight supply, as well as the potential for higher demand in the coming months as Europe’s gas shortages force countries to turn to diesel for heating. Gold ended August lower at USD 1,702/oz compared to USD 1,766/oz at the end of July.

Source: Bloomberg

Source: Bloomberg

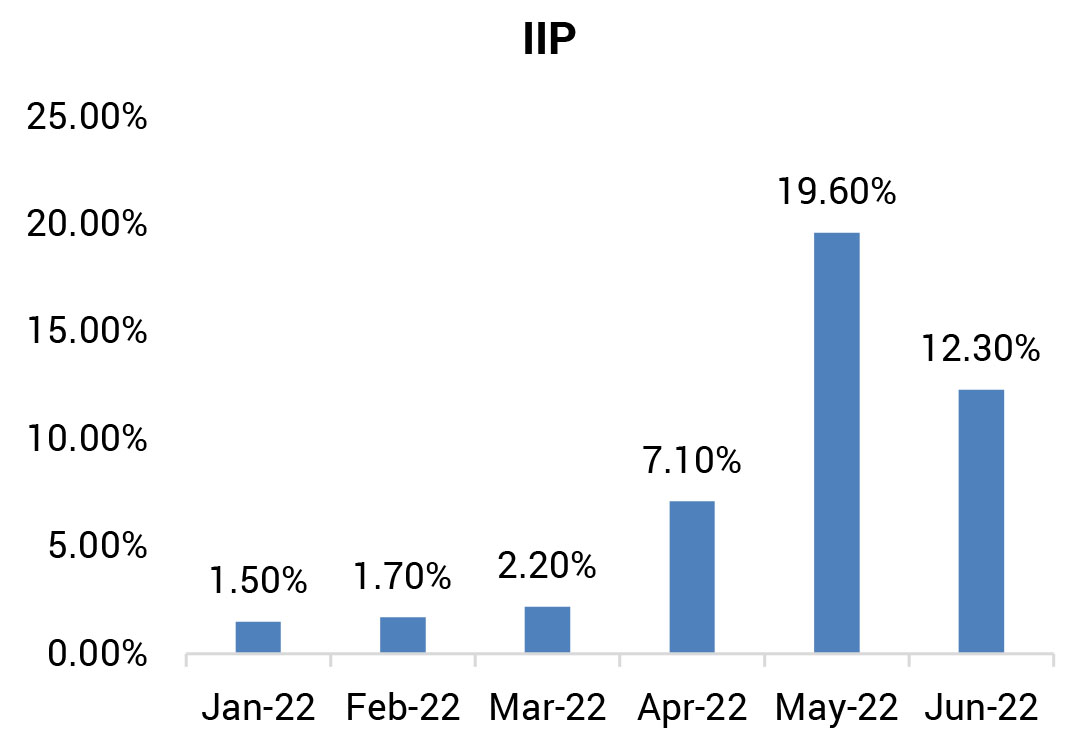

IIP: June IIP registered a growth of 12.3% yoy (May: 19.6%), with a slightly unfavourable base

effect, but with some sequential momentum. Sequentially, IIP rose by 0.1%. On a sectoral basis,

all components exhibited positive growth (over June 2021) led by electricity production growing

by 16.4% (May: 23.5%), manufacturing by 12.5% (20.6%), and mining activity by 7.5% (11.2%). As

per the use-based classification, capital goods production grew the most by 26.1% (over June

2021) (May: 54.4%), followed by consumer durables by 23.8% (58.4%), primary goods by 13.7%

(17.8%), intermediate goods by 11.0% (17.5%), infrastructure/construction goods by 8.0% (18.1%)

and consumer non-durables growth at 2.9% (1.0%).

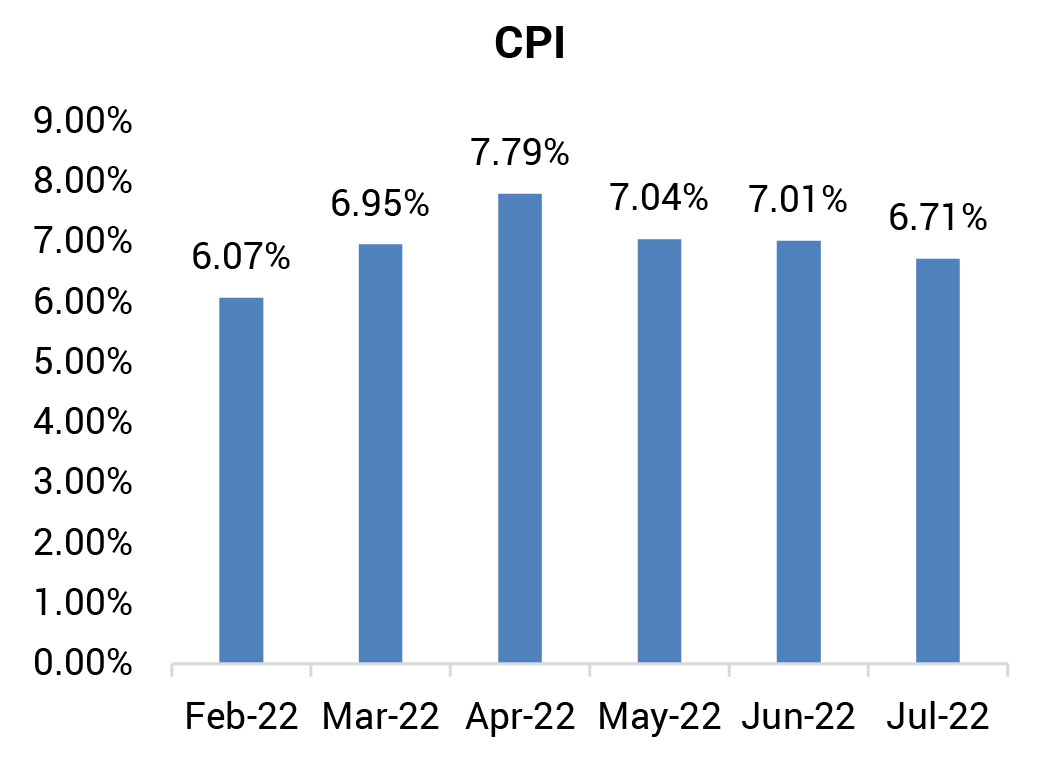

CPI: Headline CPI inflation in July dropped to 6.71% compared to 7.01% in June supported by easing food inflation. Food inflation at 6.8% (June: 7.7%) was the main contributor to headline inflation, with sequential easing in meat and fish (-2.9%), oils and fats (-2.5%) and vegetables (-0.1%). However, fruit prices rose by 2.8% sequentially. July core inflation (CPI excluding food, fuel, pan and tobacco) was virtually unchanged at 6.2% (June: 6.3%), with a pick-up in the sequential momentum of 0.7% (0.1% mom in June). Most components declined sequentially; however, education (0.5% mom in July) and clothing and footwear (0.4%) were significant contributors. T&C cost reduction (-1.4% mom) reflected the impact of lower pump prices following excise duty cuts.

Trade Deficit: Trade deficit widened once again to a record USD 31.0bn in July 2022, with exports (-12.2% MoM) and imports (-0.1% MoM) declining sequentially. Core imports rose by 1.2% MoM, while non-oil exports declined by 5.3% MoM, showing weakness in external demand as well as resilient domestic demand. While oil deficit rose materially, coal and gold imports declined sequentially; however, majority of the top 10 major commodity exports have witnessed a decline on both sequential and YoY basis.

Fiscal deficit: Fiscal deficit for Apr-July 2022 came in at 4.0% of GDP vs BE of 6.4%. The cumulative deficit in INR for the first four months of this fiscal year is 20.5% of the total budgeted deficit for the full year, which is the lowest ratio (at this point in the fiscal year) in the last 21 years. Direct taxes grew 43% FYTD yoy, while indirect taxes grew at 11% FYTD yoy (GST growing by 29% FYTD yoy). Total expenditure contracted to INR 1.8tn in July from INR 3.6tn in June, with a decrease in capital expenditure to INR 0.3tn (from INR 0.7tn in June) and revenue expenditure to INR 1.5tn (from INR 2.9tn in June), mainly due to lower spending in roads and rural ministries.

GDP: Q1FY23 GDP growth expectedly rebounded to 13.5%, led by recovery in the services sector. Despite sequential contraction, the strong YoY growth partly reflects a favorable base effect, as Q1FY22 growth was severely impacted by the Covid Delta wave. On the production front, GVA growth at 12.7% (3.9% in Q4FY22) was led by Services growing 17.6%, with the industrial sector also rising, to 8.6%. Growth disappointed in Manufacturing, partly owing to sequential easing in corporate profitability led by rising input costs and supply shortages. Construction rose 16.8%, while electricity demand remained resilient. Services depicted the impact of full normalization, especially in contact-intensive services, led by trade hotels and T&C. Public Services rose 26.3%, possibly also supported by the ‘others’ category, which includes sectors like education, etc. Agriculture grew 4.5%, but uneven distribution of the monsoon may pose a mild downside risk for Q2FY23. Private GVA growth remained steady at 12.2%. Growth remains tepid on a 3-year CAGR basis, with real GDP only having a CAGR of 1.3% over Q1FY20.

CPI: Headline CPI inflation in July dropped to 6.71% compared to 7.01% in June supported by easing food inflation. Food inflation at 6.8% (June: 7.7%) was the main contributor to headline inflation, with sequential easing in meat and fish (-2.9%), oils and fats (-2.5%) and vegetables (-0.1%). However, fruit prices rose by 2.8% sequentially. July core inflation (CPI excluding food, fuel, pan and tobacco) was virtually unchanged at 6.2% (June: 6.3%), with a pick-up in the sequential momentum of 0.7% (0.1% mom in June). Most components declined sequentially; however, education (0.5% mom in July) and clothing and footwear (0.4%) were significant contributors. T&C cost reduction (-1.4% mom) reflected the impact of lower pump prices following excise duty cuts.

Trade Deficit: Trade deficit widened once again to a record USD 31.0bn in July 2022, with exports (-12.2% MoM) and imports (-0.1% MoM) declining sequentially. Core imports rose by 1.2% MoM, while non-oil exports declined by 5.3% MoM, showing weakness in external demand as well as resilient domestic demand. While oil deficit rose materially, coal and gold imports declined sequentially; however, majority of the top 10 major commodity exports have witnessed a decline on both sequential and YoY basis.

Fiscal deficit: Fiscal deficit for Apr-July 2022 came in at 4.0% of GDP vs BE of 6.4%. The cumulative deficit in INR for the first four months of this fiscal year is 20.5% of the total budgeted deficit for the full year, which is the lowest ratio (at this point in the fiscal year) in the last 21 years. Direct taxes grew 43% FYTD yoy, while indirect taxes grew at 11% FYTD yoy (GST growing by 29% FYTD yoy). Total expenditure contracted to INR 1.8tn in July from INR 3.6tn in June, with a decrease in capital expenditure to INR 0.3tn (from INR 0.7tn in June) and revenue expenditure to INR 1.5tn (from INR 2.9tn in June), mainly due to lower spending in roads and rural ministries.

GDP: Q1FY23 GDP growth expectedly rebounded to 13.5%, led by recovery in the services sector. Despite sequential contraction, the strong YoY growth partly reflects a favorable base effect, as Q1FY22 growth was severely impacted by the Covid Delta wave. On the production front, GVA growth at 12.7% (3.9% in Q4FY22) was led by Services growing 17.6%, with the industrial sector also rising, to 8.6%. Growth disappointed in Manufacturing, partly owing to sequential easing in corporate profitability led by rising input costs and supply shortages. Construction rose 16.8%, while electricity demand remained resilient. Services depicted the impact of full normalization, especially in contact-intensive services, led by trade hotels and T&C. Public Services rose 26.3%, possibly also supported by the ‘others’ category, which includes sectors like education, etc. Agriculture grew 4.5%, but uneven distribution of the monsoon may pose a mild downside risk for Q2FY23. Private GVA growth remained steady at 12.2%. Growth remains tepid on a 3-year CAGR basis, with real GDP only having a CAGR of 1.3% over Q1FY20.

Deal flow picked up in August with 13 deals worth ~$2bn executed. Key deals included Max

Health Care ($1.15bn) and Zomato ($390mn).

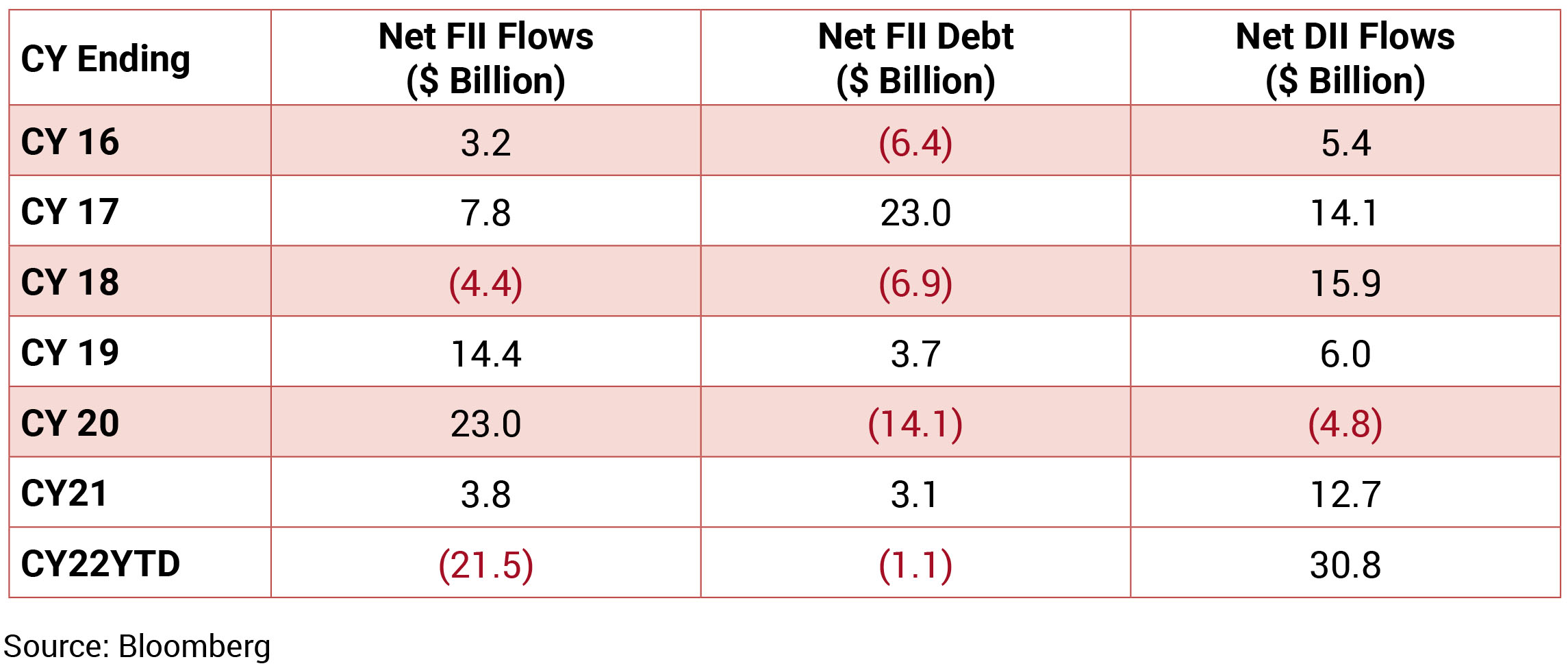

FIIs were net buyers in the month of August 2022 to the tune of $6.8bn while DIIs turned sellers at $890M.

FIIs were net buyers in the month of August 2022 to the tune of $6.8bn while DIIs turned sellers at $890M.