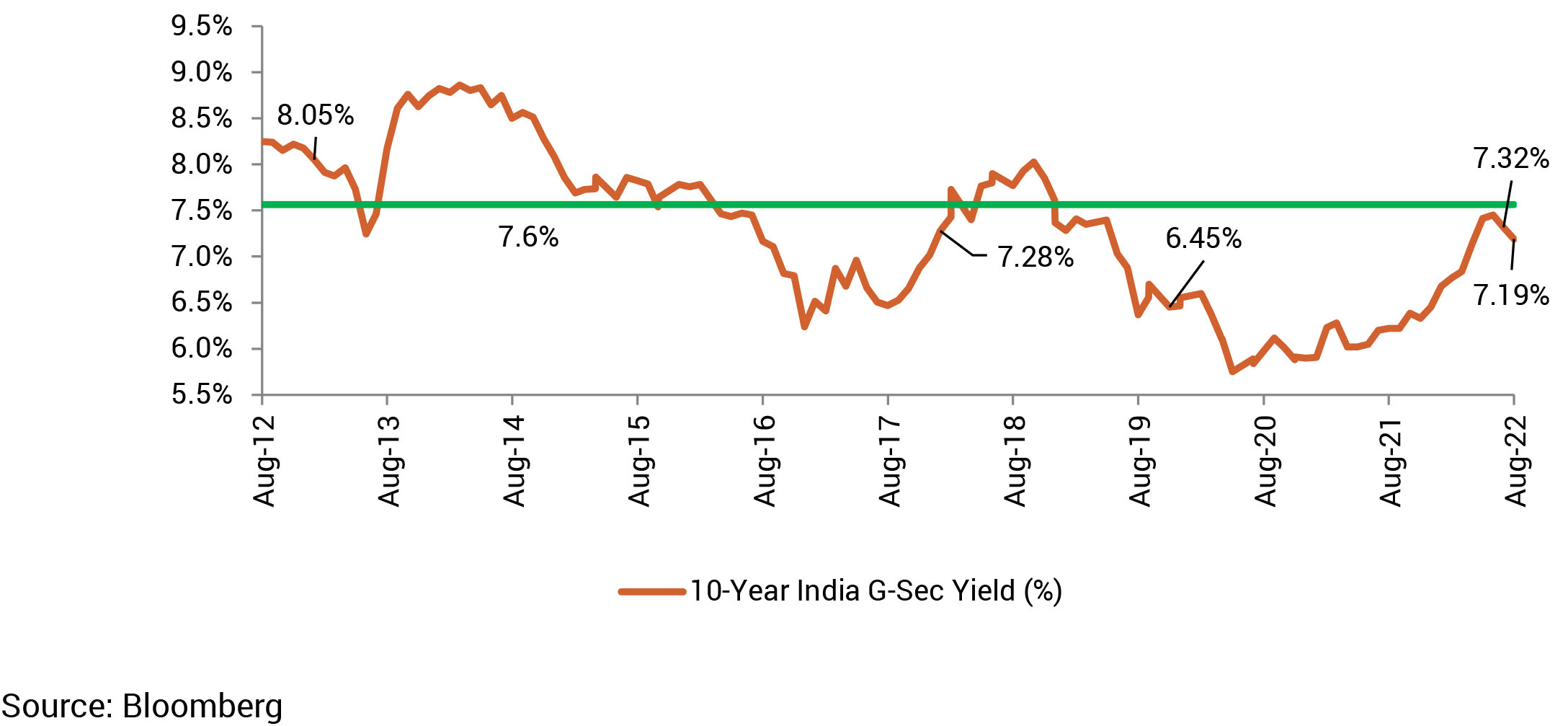

Markets were anticipating a less-hawkish RBI MPC heading into the August meeting reflected in yields moving lower at the start of the month. However, all such expectation and consequent positioning were quickly revised post the meeting as the RBI continued to focus on frontloaded inflation-targeting opting for a 50bps rate hike as against market expectations of a 35bps hike.

Post the disappointment in the MPC meeting, markets found some comfort from the CPI Inflation reading that came in lower signaling that inflation has perhaps peaked for this cycle. Sentiment was further helped by the familiar discussion at this time of the year around index inclusion. Amidst all this, market participants also had to cope with the hawkish actions/guidance of major global central banks and crude prices sustaining at elevated levels.

Going forward, the market will try to price in every news pertaining to index inclusion. Supply of SDL will also be a key monitorable as SDL auctions have vastly undershot the indicative calendar till now. In addition, the trajectory of crude prices and actions/commentary of major global central banks will also have a bearing on domestic yields.