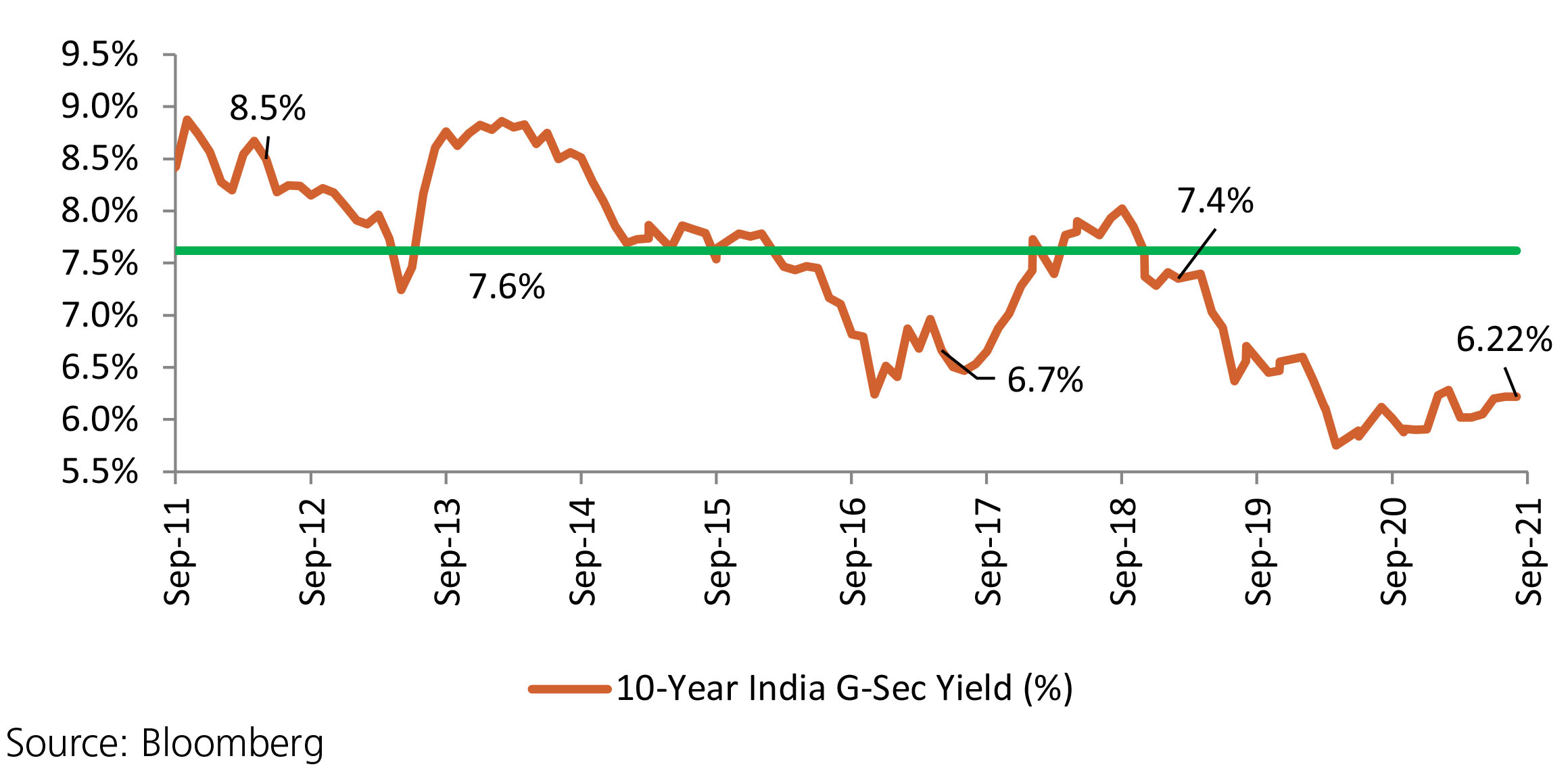

It was a tale of two different halves of the month as the fist half saw G-Sec yields start strongly as system liquidity remained well on the surplus side. With CPI also moderating and coming in much lower than expectation coupled with repeated guidance from governor and MPC member on slow pace of accommodation withdrawal, yields came off by 10bps by mid-month. The second half of the month saw some of the rally being reversed with most benchmark bonds closing unchanged for the month except for very short end where yields were higher by 10-15bps. In an indication of RBI’s plan for withdrawal of lqiudity, the remaining GSAPs were announced in the form of a twist instead of outright purchase indicating no intention of infusing additonal liquidity. In another indication of RBI attempting to nomrlaize the liquidity in the market, the RBI has been mopping up systemic lqiduity by conducting a series of Variable Rate Reverse Repo (VRRR) auction of varying tenors. This has exerted upward pressure on short-end yields. Surging oil prices breaching USD 80/bbl mark and uptick in USTs were the other factors contributing to the reversal of yields in second half. The H2FY22 G-Sec borrowing calendar came in line with market expectations with no incremental borrowing for shortfall in GST compensation cess. This, however, has not helped market recoup losses given the uncertainty around liquidity absorption.