Group Fund

Kotak Group Short Term Bond Fund

(ULGF-018-18/12/13-SHTRMBND-107)

Monthly Update August 2021

|

AS ON 30th July 2021 |

Will generate stable returns through investments in a suitable mix of debt and money market instruments.

Date of Inception

19th October 2015

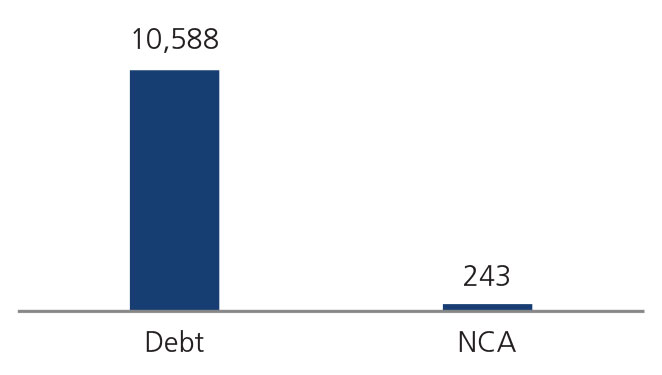

AUM (in Lakhs)

10,830.95

NAV

14.7829

Fund Manager

Debt : Gajendra Manavalan

Benchmark Details

100%-CRISIL Short Term Bond Fund Index

Modified Duration

Debt & Money

Market Instruments : 2.27

Asset Allocation

| Approved (%) | Actual (%) | |

| Gsec | 00 - 50 | 43 |

| Debt | 25 - 75 | 39 |

| MMI / Others | 10 - 75 | 18 |

Performance Meter

| Kotak Group Short Term Bond Fund (%) | Benchmark (%) | |

| 1 month | 0.6 | 0.7 |

| 3 months | 1.1 | 1.3 |

| 6 months | 1.4 | 2.6 |

| 1 year | 3.5 | 5.3 |

| 2 years | 6.3 | 8.2 |

| 3 years | 7.4 | 8.7 |

| 4 years | 6.5 | 7.7 |

| 5 years | 6.8 | 7.8 |

| 6 years | n.a | n.a |

| 7 years | n.a | n.a |

| 10 years | n.a | n.a |

| Inception | 7.0 | 8.0 |

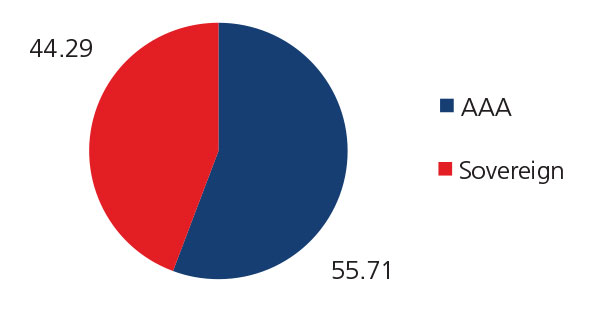

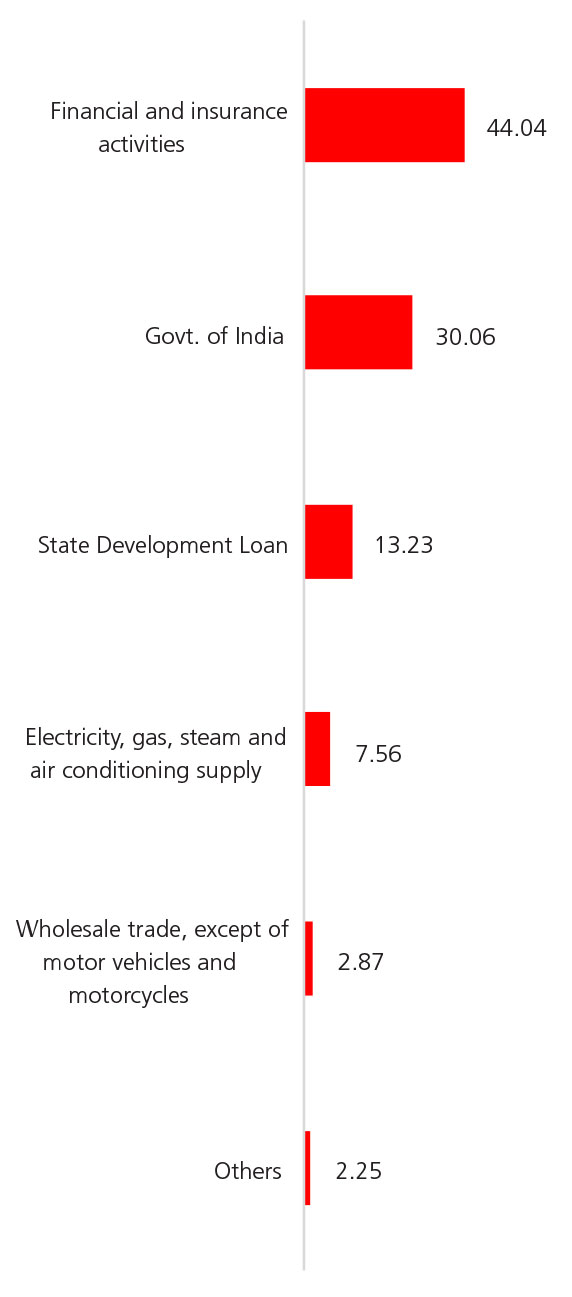

| Holdings | % to Fund |

| G-Sec | 43.29 |

| 6.18% GOI - 04.11.2024 | 11.46 |

| 7.20% MH SDL -09.08.2027 | 5.67 |

| 7.17% GOI - 08.01.2028 | 4.83 |

| 6.84% GOI - 19.12.2022 | 4.79 |

| 7.59% GOI - 11.01.2026 | 3.95 |

| 5.63% GOI - 12.04.2026 | 3.22 |

| 9.50% GJ SDL - 11.09.2023 | 2.02 |

| 6.65% Fertilizer Co GOI - 29.01.23 | 1.43 |

| 9.69% PN SDL - 12.02.2024 | 1.02 |

| 8.90% KA SDL - 19.12.2022 | 0.98 |

| Others | 3.91 |

| Corporate Debt | 39.00 |

| 7.35% Bajaj Finance Ltd - 10.11.2022 | 7.62 |

| 5.45% NTPC - 15.10.2025 | 7.44 |

| 9.05% HDFC - 20.11.2023 | 5.00 |

| 5.32% NHB - 01.09.2023 | 4.73 |

| 10.08% IOT Utkal Energy Services Limited - 20.03.2022 | 2.87 |

| 5.10% Sundaram Finance - 01.12.2023 | 2.79 |

| 5.78% HDFC - 25.11.2025 | 1.85 |

| 7.25% HDFC - 17.06.2030 | 1.65 |

| 9.25% LIC Housing Finance - 12.11.2022 | 1.17 |

| 7.70% REC - 10.12.2027 | 0.99 |

| Others | 2.90 |

| MMI | 15.46 |

| NCA | 2.25 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.