Month Gone By – Markets (period ended July 30, 2021)

The S&P 500 closed the month of July at 4395.26, delivering a staggering 2.3% return for the

month (18% for the calendar year), bolstered by better than expected earnings, lesser probability

of imposition of lockdown like measures, moderation in US Yields and continued expectations of

growth.

The US Yields moderated from 1.47 to 1.23 as the Federal Reserve, in testimony to the U.S. House of Representatives Financial Services Committee, pledged support to the US Economy towards its recovery from the pandemic and only views the current inflation as transitory.

The Bloomberg Commodity Index closed the month 96.27 vs 94.54 on June 30th. The biggest contributor to the spike in index was Energy which grew by 3.8% and constitutes 19% of the index, along with Metals growing at 2.6% while constituting 40% of the index.

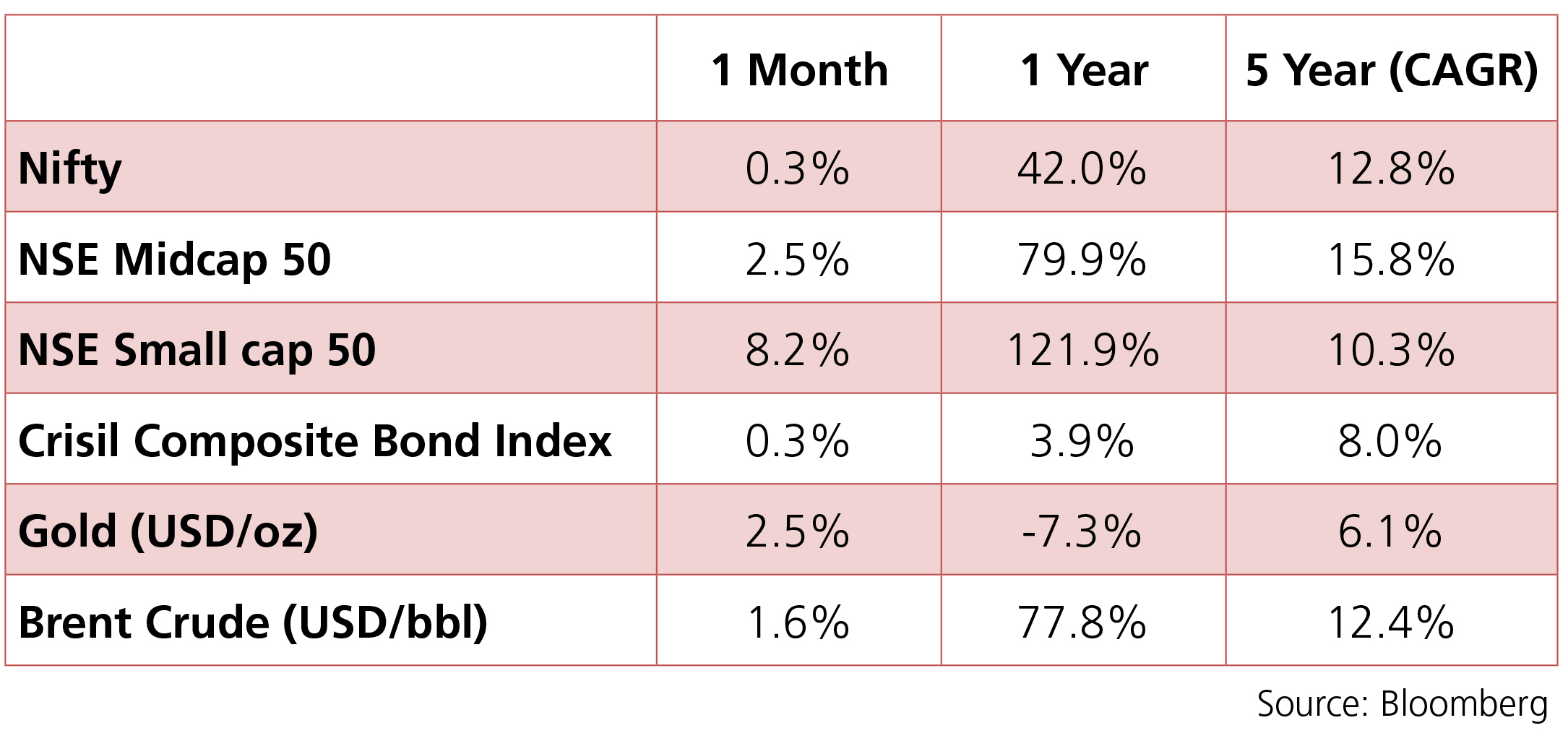

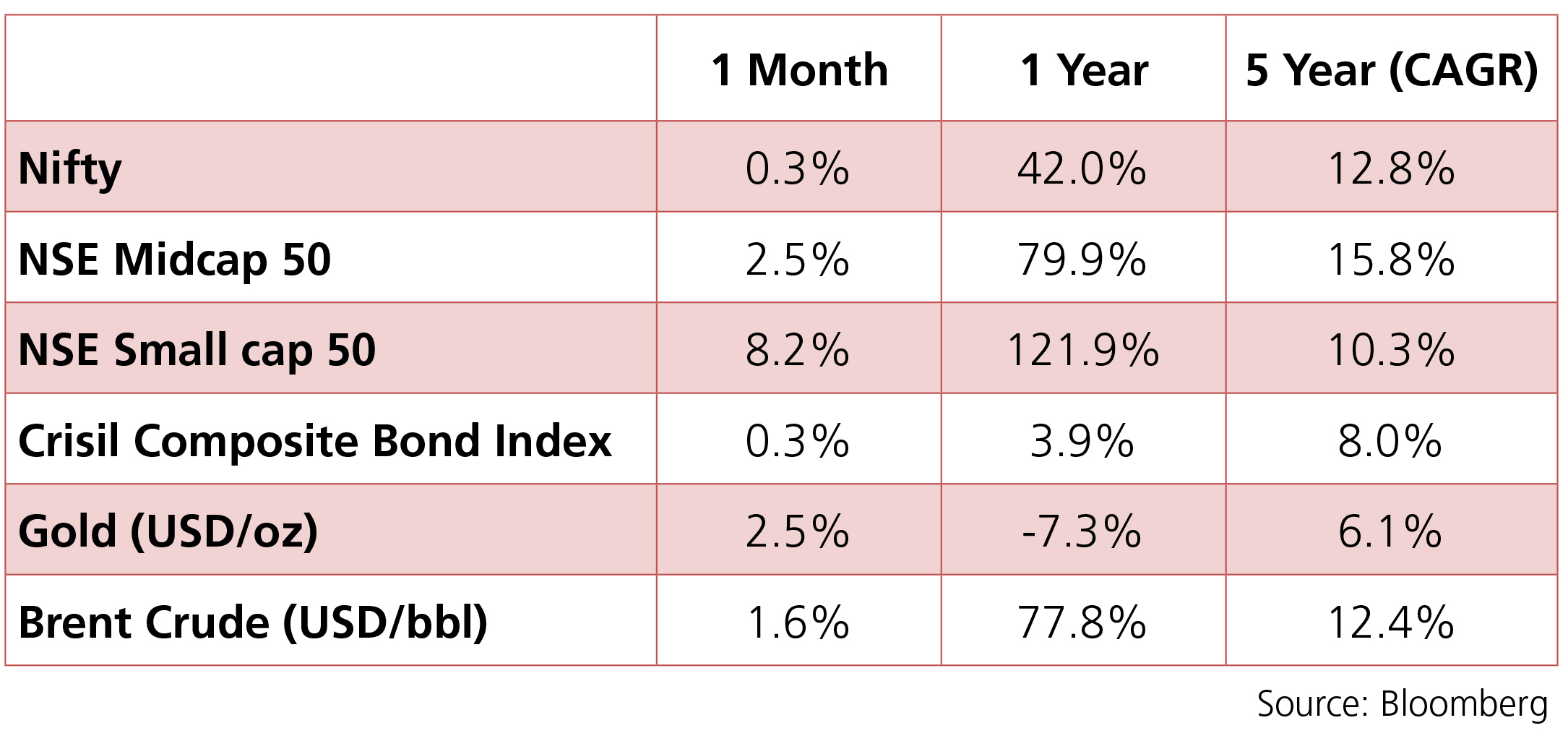

On the domestic front, the Sensex and Nifty-50 Index ended the roller-coaster ride of the month almost flat – at 0.2% and 0.3% m-o-m respectively. The small rally in the stock indices was lead by Realty (BSE Realty 16.1% m-o-m), followed by Metals (BSE Metals 12.6% m-o-m), while Auto Sector (BSE Auto 5.4% m-o-m) along with Energy (BSE Power 5.0% m-o-m) lead to the overall moderation in the indices. The INR traded in a rangebound manner, within a range of 74.24 to 74.85

The US Yields moderated from 1.47 to 1.23 as the Federal Reserve, in testimony to the U.S. House of Representatives Financial Services Committee, pledged support to the US Economy towards its recovery from the pandemic and only views the current inflation as transitory.

The Bloomberg Commodity Index closed the month 96.27 vs 94.54 on June 30th. The biggest contributor to the spike in index was Energy which grew by 3.8% and constitutes 19% of the index, along with Metals growing at 2.6% while constituting 40% of the index.

On the domestic front, the Sensex and Nifty-50 Index ended the roller-coaster ride of the month almost flat – at 0.2% and 0.3% m-o-m respectively. The small rally in the stock indices was lead by Realty (BSE Realty 16.1% m-o-m), followed by Metals (BSE Metals 12.6% m-o-m), while Auto Sector (BSE Auto 5.4% m-o-m) along with Energy (BSE Power 5.0% m-o-m) lead to the overall moderation in the indices. The INR traded in a rangebound manner, within a range of 74.24 to 74.85

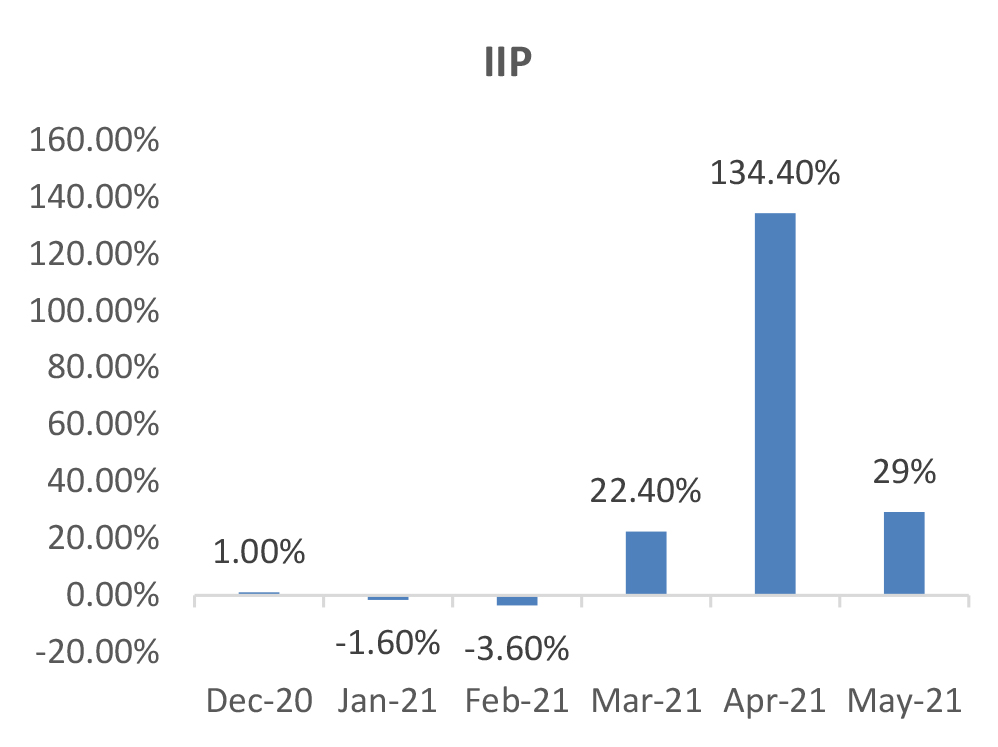

IIP: The country’s index of industrial production (IIP) surged by 29.3% y-o-y to 121.7 in

the month of May 2021 primarily due to a low base in May 2020. Manufacturing which

contributes to 77.6% of the basket grew by 34.5%, while Mining and Elctricity grew by

23.3% and 7.5% respectively.

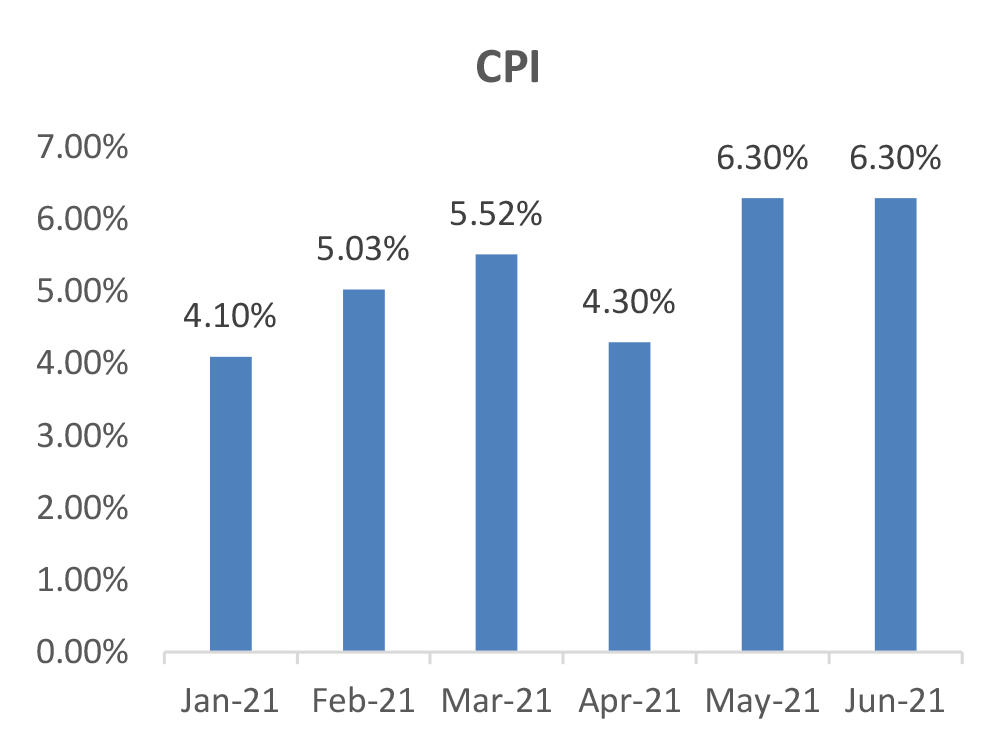

CPI: The CPI at 6.26% came in as a pleasant surprise against a market consensus of 6.7%. Though still above the RBI’s comfort range of 2%-6%, the CPI is expected to moderate below 6% for the remainder of the year. The Consumer Food Price Index rose 5.6% y-o-y vs 5.2% in the previous month. Fuel and Light at 12.7% y-o-y along with Transport and Communication at 11.6% were the main drivers of inflation along with food prices.

Trade Deficit: The trade deficit for the month aggregated to $11.2 Bn vs a deficit of $9.4 Bn in the previous month. The trade deficit in July 2020 was $5.3 Bn. The country’s exports came in at $35.2 Bn vs 23.9 Bn in July 2020. Imports for the month increased by 60% over July 2020 to US$46.4 Bn due to lower base effect. Oil imports for the month rose to $6.4 Bn, as compared to $3.2 Bn in July 2020.

Fiscal Deficit: The fiscal deficit stood at 18.2% of the Budget Estimates, as compared to 83.2% in the same period last year. In absolute terms, the fiscal deficit was at Rs 2,74,245 crore at the end of June. The main contributors to the lower fiscal deficit were higher tax revenues at 26.7% of BE vs 8.2% in the corresponding period previous year and net non tax revenues at 52.4% vs 3.2% in the same period last year. Similarly, even total expenditure 23.6% for the period vs 26.8% in the past period.

CPI: The CPI at 6.26% came in as a pleasant surprise against a market consensus of 6.7%. Though still above the RBI’s comfort range of 2%-6%, the CPI is expected to moderate below 6% for the remainder of the year. The Consumer Food Price Index rose 5.6% y-o-y vs 5.2% in the previous month. Fuel and Light at 12.7% y-o-y along with Transport and Communication at 11.6% were the main drivers of inflation along with food prices.

Trade Deficit: The trade deficit for the month aggregated to $11.2 Bn vs a deficit of $9.4 Bn in the previous month. The trade deficit in July 2020 was $5.3 Bn. The country’s exports came in at $35.2 Bn vs 23.9 Bn in July 2020. Imports for the month increased by 60% over July 2020 to US$46.4 Bn due to lower base effect. Oil imports for the month rose to $6.4 Bn, as compared to $3.2 Bn in July 2020.

Fiscal Deficit: The fiscal deficit stood at 18.2% of the Budget Estimates, as compared to 83.2% in the same period last year. In absolute terms, the fiscal deficit was at Rs 2,74,245 crore at the end of June. The main contributors to the lower fiscal deficit were higher tax revenues at 26.7% of BE vs 8.2% in the corresponding period previous year and net non tax revenues at 52.4% vs 3.2% in the same period last year. Similarly, even total expenditure 23.6% for the period vs 26.8% in the past period.

Deal flow moderated a bit in July with 11 deals worth $1.9 Bn executed (vs 13 deals

worth ~$4bn in June). Key deals included a string of IPOs - Zomato ($1.3 Bn), Clean

Science (~$0.2 Bn), GR Infraprojects ($0.13 Bn) among others.

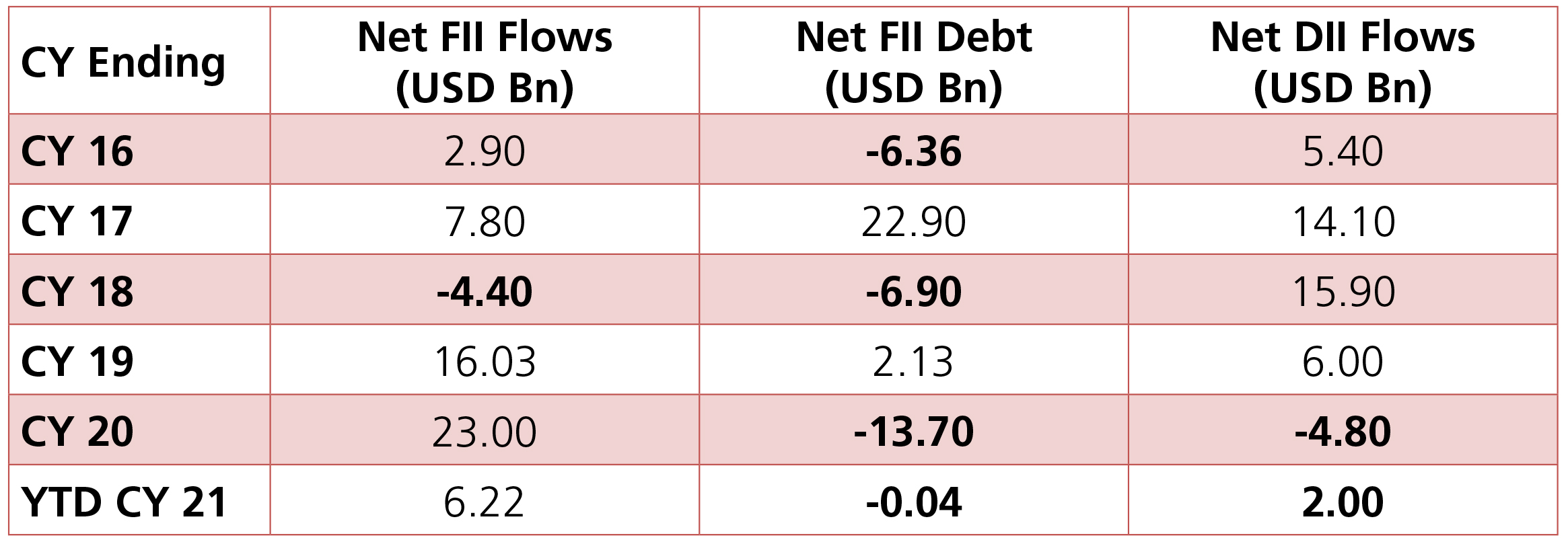

After two months of inflows, FIIs again turned net sellers in July (-$1.9 Bn, YTD +$6.2 Bn) vs +$1.5 Bn in June whereas DIIs ramped up buying (+$2.5bn in July) turning net buyers YTD (+$2 Bn) as well. Bulk of this DII buying seemed to be driven by Domestic MFs buying who bought net +$1.9 Bn (till July 28th), their highest single monthly deployment since Mar’20

After two months of inflows, FIIs again turned net sellers in July (-$1.9 Bn, YTD +$6.2 Bn) vs +$1.5 Bn in June whereas DIIs ramped up buying (+$2.5bn in July) turning net buyers YTD (+$2 Bn) as well. Bulk of this DII buying seemed to be driven by Domestic MFs buying who bought net +$1.9 Bn (till July 28th), their highest single monthly deployment since Mar’20