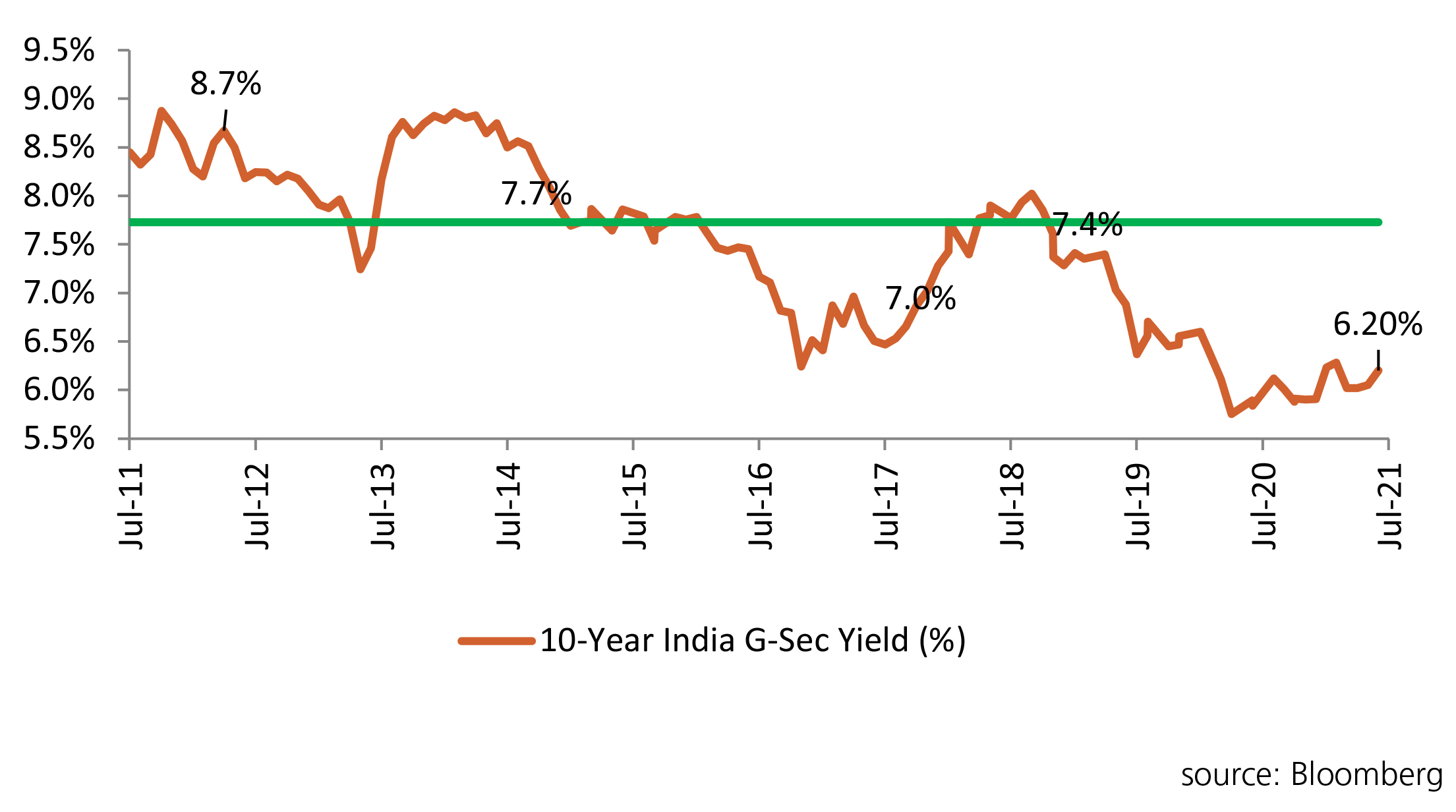

The 10Y Benchmark started the month at 6.04%. The new 10 year benchmark issued on July 09th at a coupon of 6.10%, eventually closed at 6.20%. The month was quite eventful with the change in auction methodology – with upto 14Y and FRBs issued at uniform pricing and 30Y and 40Y benchmarks issued at multiple price basis. The choice of GSAP papers from liquid on the run papers to illiquid papers added to the mirage of RBI eventually letting go control of the yield curve. The Monetary Policy Committee slated to be held from August 4th to 6th is also expected to be a non-event with an expectated mark-up in the inflation curve from 5.10 to 5.60 for the FY 2021-22. The voting pattern and minutes of the meeting will be keenly watched for any further guidance from the central bank. The yields for the month of August are expected to trade in the range of 6.15% – 6.25%.