Month Gone By – Markets (period ended May 31, 2021)

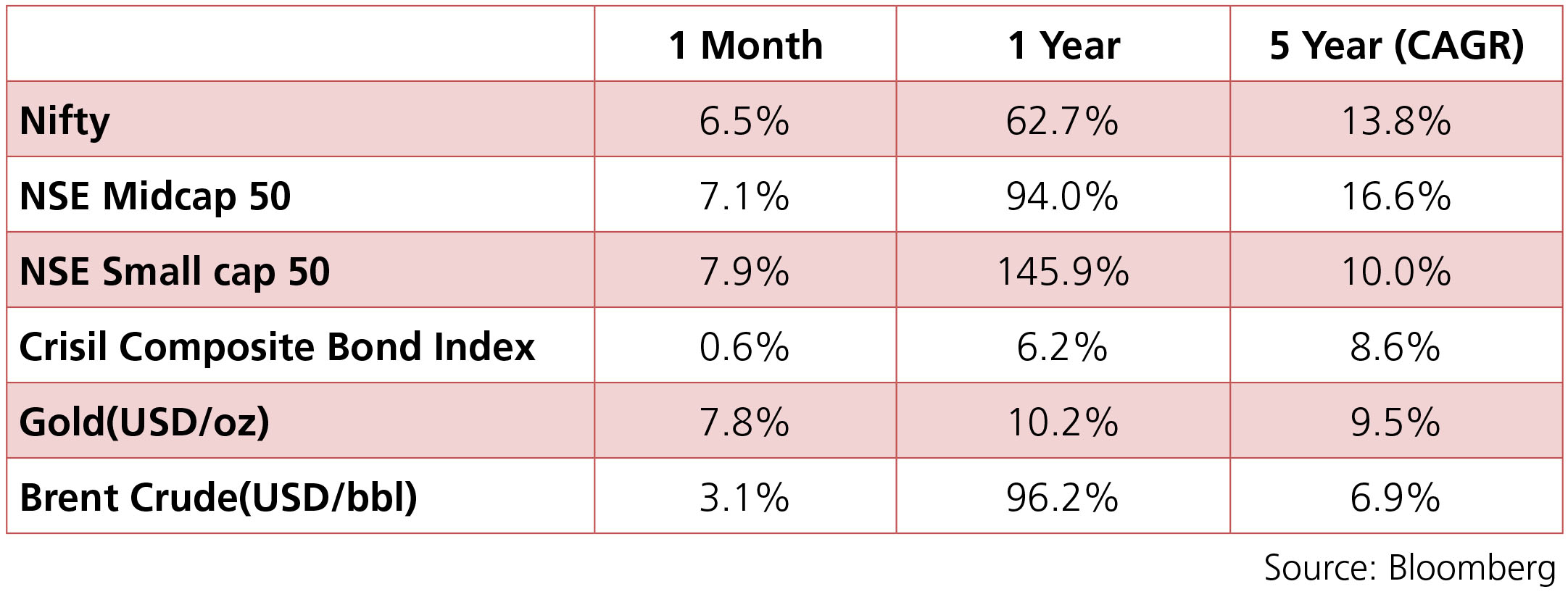

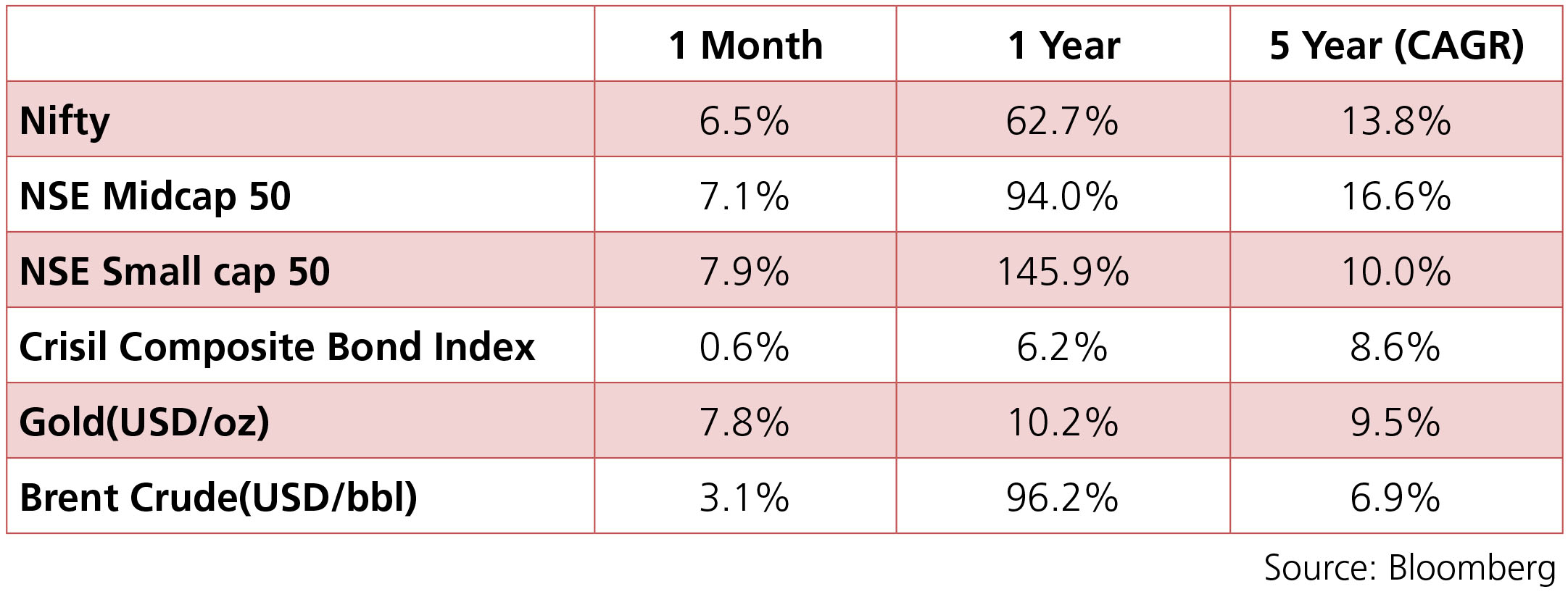

S&P 500 recorded a close of 4204 on May 28th witnessing a m-o-m increase of 0.54%. The

jobs growth data was a huge disappointment with hardly 2,66,000 jobs added against a broad

consensus of 1,000,000. Following the development, the S&P 500 plummeted from 4232.6 to

4063.04 in a matter of three trading sessions before the markets finally started inching upwards.

The U.S. Department of Commerce’s 2nd estimate for Q1’21 GDP (the broadest measure of

goods and services produced across the economy) was unchanged from the advance estimate

of 6.4%.With the inflation coming in at 4.2% vs 2.6% in the previous month, investor concerns

could be seen be rolling into yields with spikes uto 1.70% before closing the month at 1.60%,

Gold increasing by $100/oz. thereon to close the month at $1906/oz. Also, the comments in

FOMC minutes released on May 19th hinting towards tapering of asset purchase program as the

economy progresses lead to a spike in yields before closing for the month at 1.60%.

The Bloomberg Commodity Index which records an increase across various commodities recorded an increase from 90.36 on April 30th to 94.14 on May 31st, reflecting an increase in prices of crude and various industrial metals.

The cryptocurrencies witnessed the roughest month with value of Bitcoin and other cryptos freefalling to over 40% of monthly highs on the back of negative comments by Elon Musk, crackdown by China and profit booking by traders.

The INR moderated from 74.05 on April 30th to 72.51 on May 31st as DXY (the index which measures dollar strength against a basket of currencies) fell from 91.28 on April-end to 89.81 on May 31st indicating a weakening in the greenback.

The Bloomberg Commodity Index which records an increase across various commodities recorded an increase from 90.36 on April 30th to 94.14 on May 31st, reflecting an increase in prices of crude and various industrial metals.

The cryptocurrencies witnessed the roughest month with value of Bitcoin and other cryptos freefalling to over 40% of monthly highs on the back of negative comments by Elon Musk, crackdown by China and profit booking by traders.

The INR moderated from 74.05 on April 30th to 72.51 on May 31st as DXY (the index which measures dollar strength against a basket of currencies) fell from 91.28 on April-end to 89.81 on May 31st indicating a weakening in the greenback.

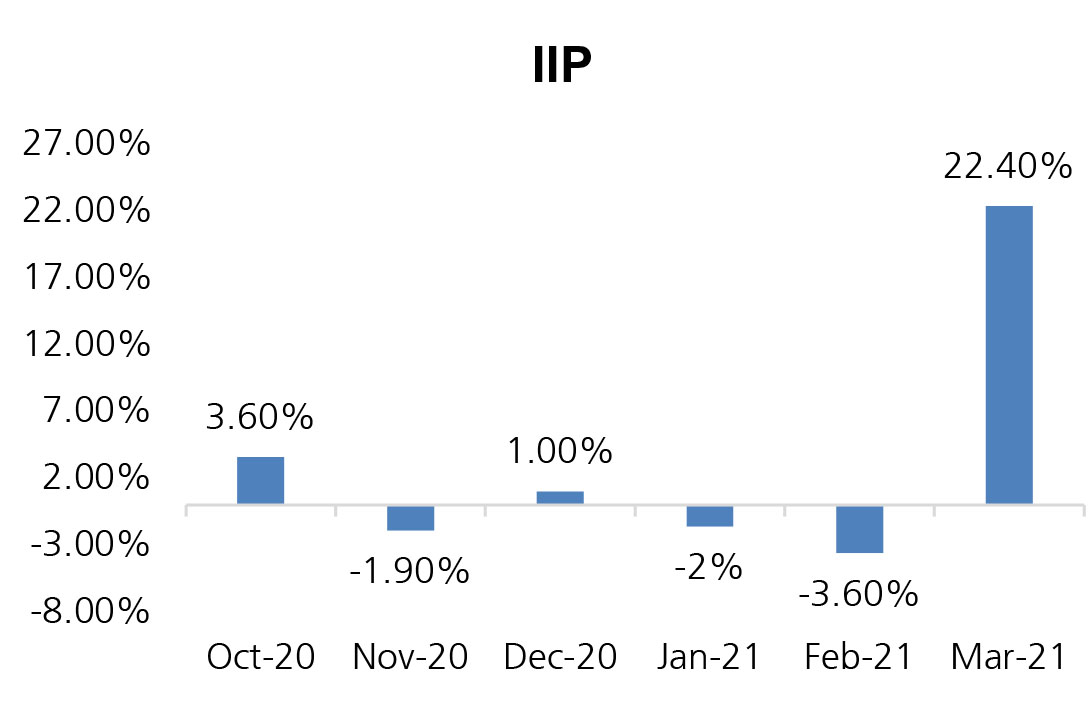

IIP: The IIP y-o-y for the month of March 2021 recorded an increase 22.4%, the average IIP for

the year 2020-21 compared to 2019-20 recorded a dip of 8.6%. While Manufacturing y-o-y

recorded a spike of 25.8% for the month, the year average vs previous year witnessed a dip

of 9.8%. The uptrend in Manufacturing and overall IIP needs to be taken with a pinch of salt

as localised lockdowns due to second wave of covid seriously disrupted trade across the nation

in the month of April.

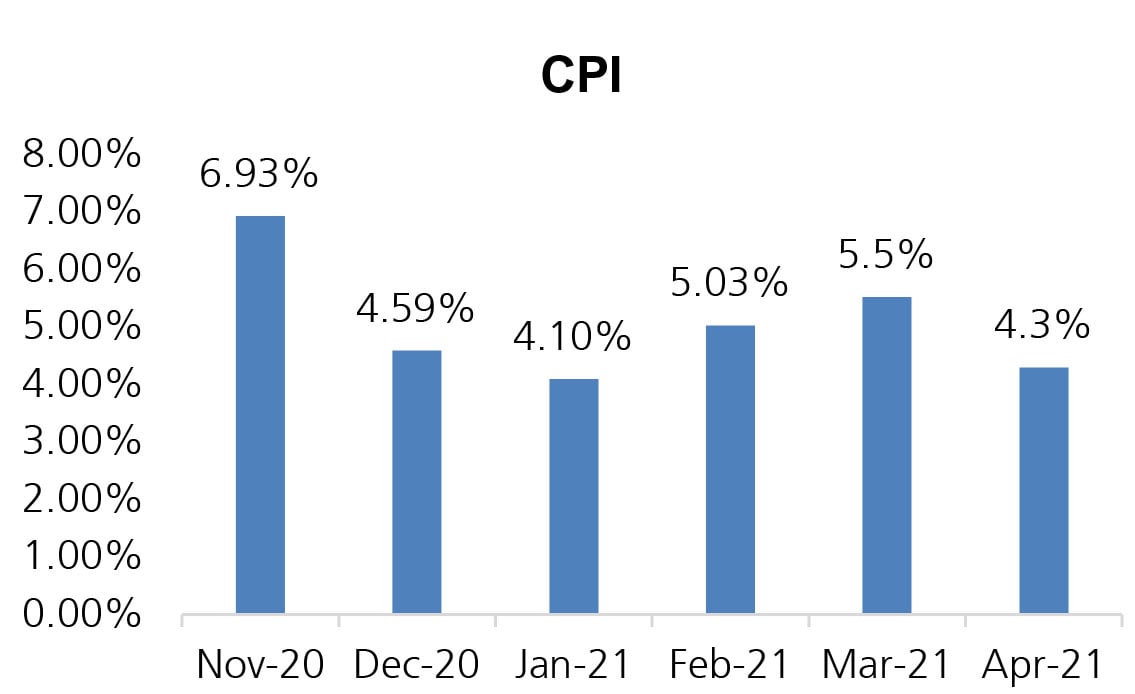

CPI: The month of April 2021 witnessed a softening in the headline at 4.3% vs 5.6% for the previous month. The moderation in inflation was largely a result of softening of food prices. Consumer Food Price Inflation stood at 2%, down from 4.9% for the month of March 2021. Transport and Communication also recorded a y-o-y increase of 11% on the back of surging crude prices and lack of public travel infrastructre.

Trade Deficit: India witnessed a trade deficit of $6.3 Billion, against $15.2Billion in the previous month. Exports rose to $32.2 Billion for the month vs $30 Billion in the previous month $19.24 billion a year earlier, while imports dropped to $38.5 Billion from $45.5 Billion in April 2021. The biggest contributor to the fall in trade deficit was fall in imports of Gold & Precious stones by $5.8 Billion over previous month.

Fiscal Deficit: India recorded a fiscal deficit of Rs. 18.2 Trillion against a revised budgeted figure of Rs. 18.48 Trillion. In percentage terms, the fiscal stood at 9.3% against the budgeted 9.5%. The slightly better than budgeted fiscal deficit has been account of revenue beating the estimates by Rs. 880 Billion as against expenses recording an increase by Rs. 610 Billion beyond the budgeted estimates.

GDP: While the Q4 2020-21 GDP saw a narrow expansion of 1.6%, the overall GDP for the fiscal contracted by 7.3%. Across the components of GDP – Agriculture recorded an y-o-y increase of 3.6%, while Industry witnessed a fall of 7% and Services recorded a fall of 8.4% y-o-y.

CPI: The month of April 2021 witnessed a softening in the headline at 4.3% vs 5.6% for the previous month. The moderation in inflation was largely a result of softening of food prices. Consumer Food Price Inflation stood at 2%, down from 4.9% for the month of March 2021. Transport and Communication also recorded a y-o-y increase of 11% on the back of surging crude prices and lack of public travel infrastructre.

Trade Deficit: India witnessed a trade deficit of $6.3 Billion, against $15.2Billion in the previous month. Exports rose to $32.2 Billion for the month vs $30 Billion in the previous month $19.24 billion a year earlier, while imports dropped to $38.5 Billion from $45.5 Billion in April 2021. The biggest contributor to the fall in trade deficit was fall in imports of Gold & Precious stones by $5.8 Billion over previous month.

Fiscal Deficit: India recorded a fiscal deficit of Rs. 18.2 Trillion against a revised budgeted figure of Rs. 18.48 Trillion. In percentage terms, the fiscal stood at 9.3% against the budgeted 9.5%. The slightly better than budgeted fiscal deficit has been account of revenue beating the estimates by Rs. 880 Billion as against expenses recording an increase by Rs. 610 Billion beyond the budgeted estimates.

GDP: While the Q4 2020-21 GDP saw a narrow expansion of 1.6%, the overall GDP for the fiscal contracted by 7.3%. Across the components of GDP – Agriculture recorded an y-o-y increase of 3.6%, while Industry witnessed a fall of 7% and Services recorded a fall of 8.4% y-o-y.

Deal activity moderated further with 8 deals of ~$2.2bn executed in May(vs 12 deals worth

~$2.8bn in April) notable ones being PowerGrid’s InvIT (~$1bn), PE Stake sale in SBI Life

(~$0.5bn) and PNB’s QIP (~$0.2bn).

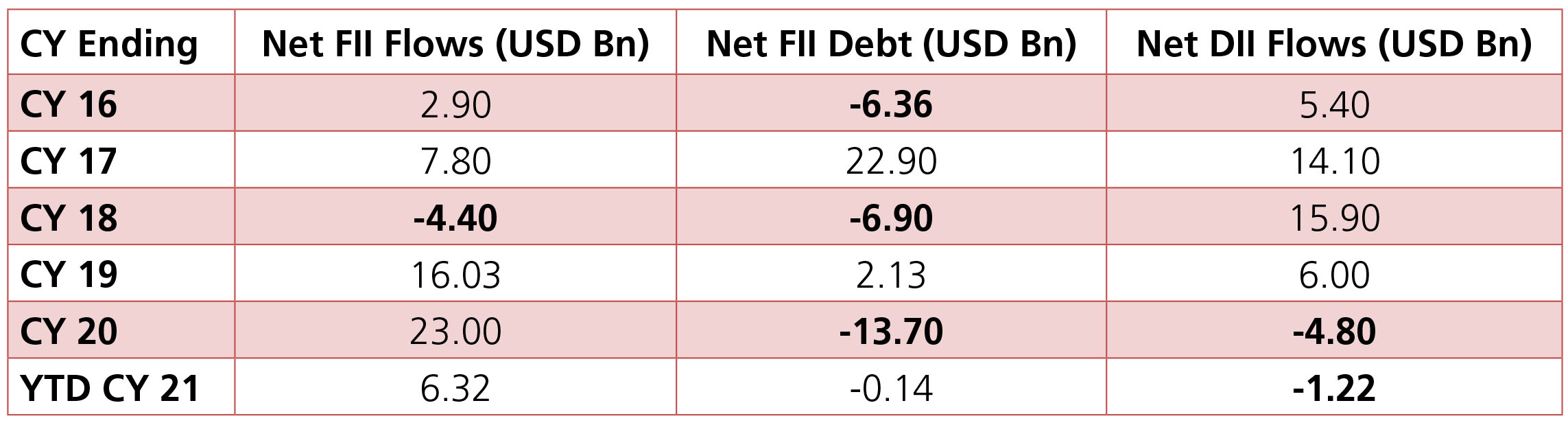

FIIs turned net buyers again in May at +$370mn (vs-$1.5bn in April) while DII buying (+$283mn vs +$1.5bn in April) moderated, taking their respective YTD flows to +$6.2bn / -$1.4bn respectively. Deal activity moderated in April with 12 deals worth ~$2.8 Billion (vs 27 deals worth ~$4.9 Billion in March) key deals being IDFC First Bank’s QIP (~$0.4 Billion), Macrotech Developers’ IPO (~$0.3 Billion) and Indigrid’s Rights Issue (~$0.2 Billion).

FIIs turned net buyers again in May at +$370mn (vs-$1.5bn in April) while DII buying (+$283mn vs +$1.5bn in April) moderated, taking their respective YTD flows to +$6.2bn / -$1.4bn respectively. Deal activity moderated in April with 12 deals worth ~$2.8 Billion (vs 27 deals worth ~$4.9 Billion in March) key deals being IDFC First Bank’s QIP (~$0.4 Billion), Macrotech Developers’ IPO (~$0.3 Billion) and Indigrid’s Rights Issue (~$0.2 Billion).