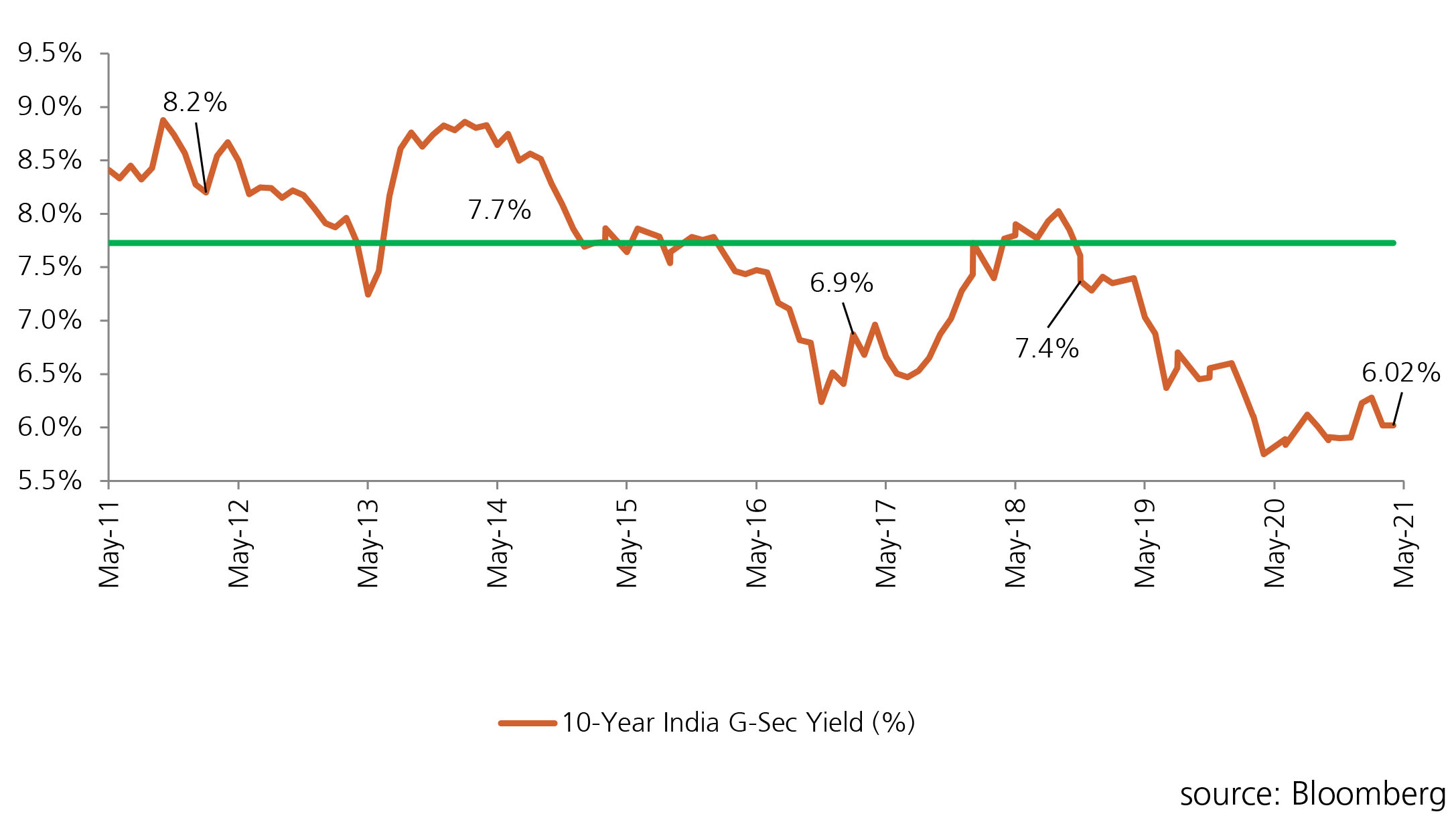

The 10Y Benchmark closed at 6.02% on April 30th and traded in a close range of 5.97% to 6.02% during the month, closing at 6.02%. The month was quite eventful with RBI declaring a surplus transfer of Rs. 991 Billion vs Rs. 535 Billion budgeted, the Central Government proposing an additional borrowing of Rs 1.58 Trillion to meet the GST compensation to States, moderation in inflation and GDP beating the -8% estimates by 0.7%. However, the auctions saw persistent weak demand in the 10Y Benchmark with unplaced borrowing in the paper amounting to Rs. 210 Billion as RBI sought to curtail any movement beyond 6.00% in the paper. The yields also witnessed a spike of 15 bps in the longer end of the curve.

RBI Monetary Policy outome is due on June 4th. While no rate action is expected, other measures to support the economy still reeling under turbulent waves of Covid may be announced which may include emergency credit line for microfinance institutions, liquidity support to NABARD, SIDBI, NHB and partial credit guarantee schemes to the affected sectors. A GSAP 2.0 announcement to the tune of Rs. 1.25 Trillion to support likely additional borrowing by the central government is also expected. Hence, with this as a backdrop the yields are expected to trade in the range of 5.95 – 6.05 for the month of June 2021.