Though minutes of August Monetary Policy Committee were percieved negatively by the market and saw yields shooting to highs of 6.20s on 10Y Benchmark from 5.94% on August 20th when the minutes were released, RBI’s actions to “Foster Orderly Market Conditions” on August 31st , saw yields crash to a close of 5.92% on September 1st.

As such, it is expected that RBI will play a saviour role for the debt markets as it demonstrates its ability to tightly control the yield levels through direct intervention i.e. consistent yield curve control through weekly OMOs, secondary market participation, tweaking HTM norms to accommodate additional supply of SLR securities, complete devolvement of 10Y benchmark auctions or declaring a very optimistic H2 2020-21 borrowing calendar. To also reduce the dependance of States on markets for borrowing, WMA limits for States have been increased from INR 515.6 bn to INR 1.25 tn.

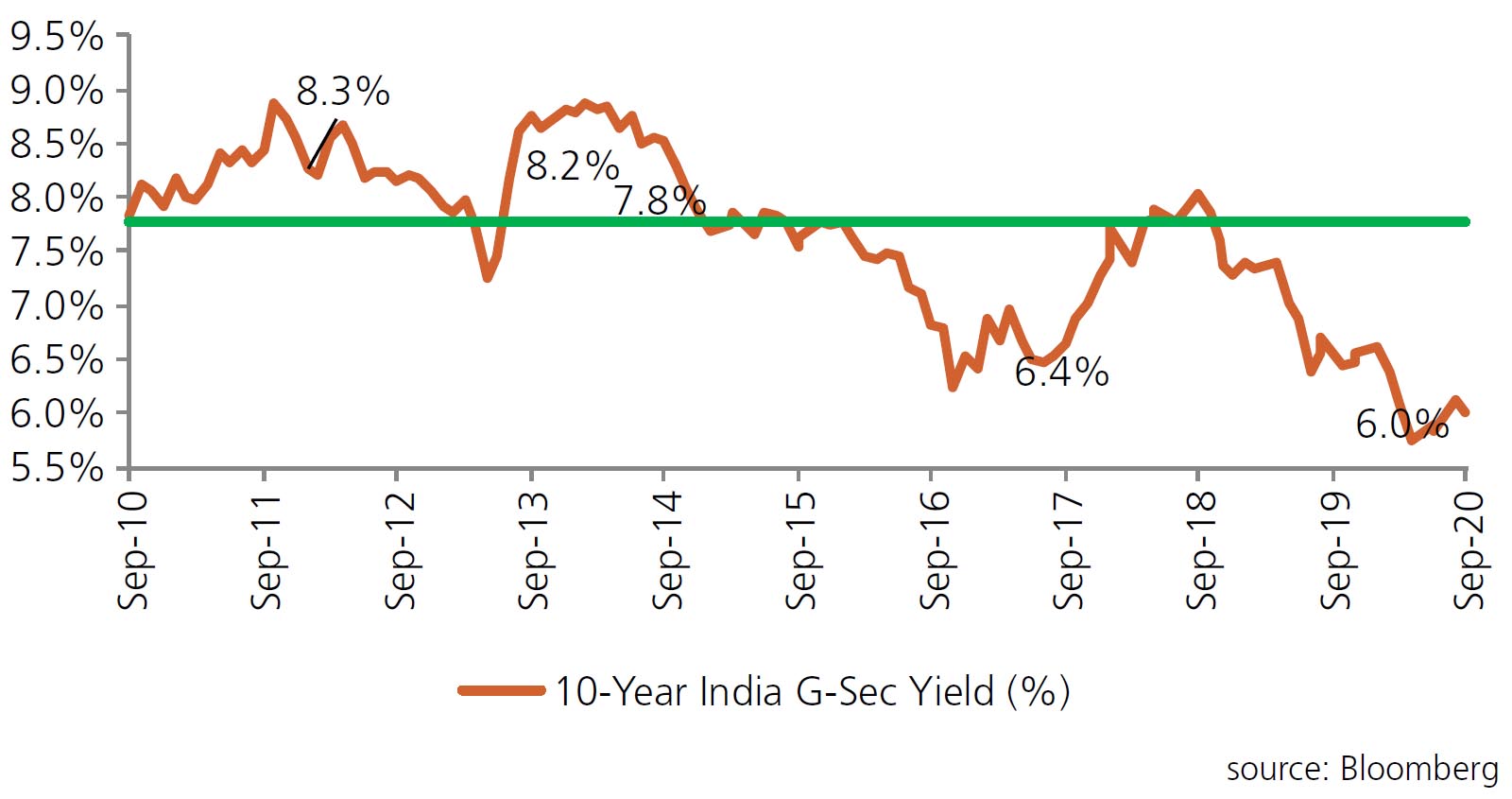

With economy recording a -23.9% growth in Q1 2020-21 and vital leading indicators yet to demonstrate a clear revival in the economy, an uncertain Covid scenario, US Presidential elections in November and Bihar elections on the domestic front, yields are expected to trade in a tight range of 5.95% - 6.05%.