Month Gone By – Markets (period ended January 31, 2022)

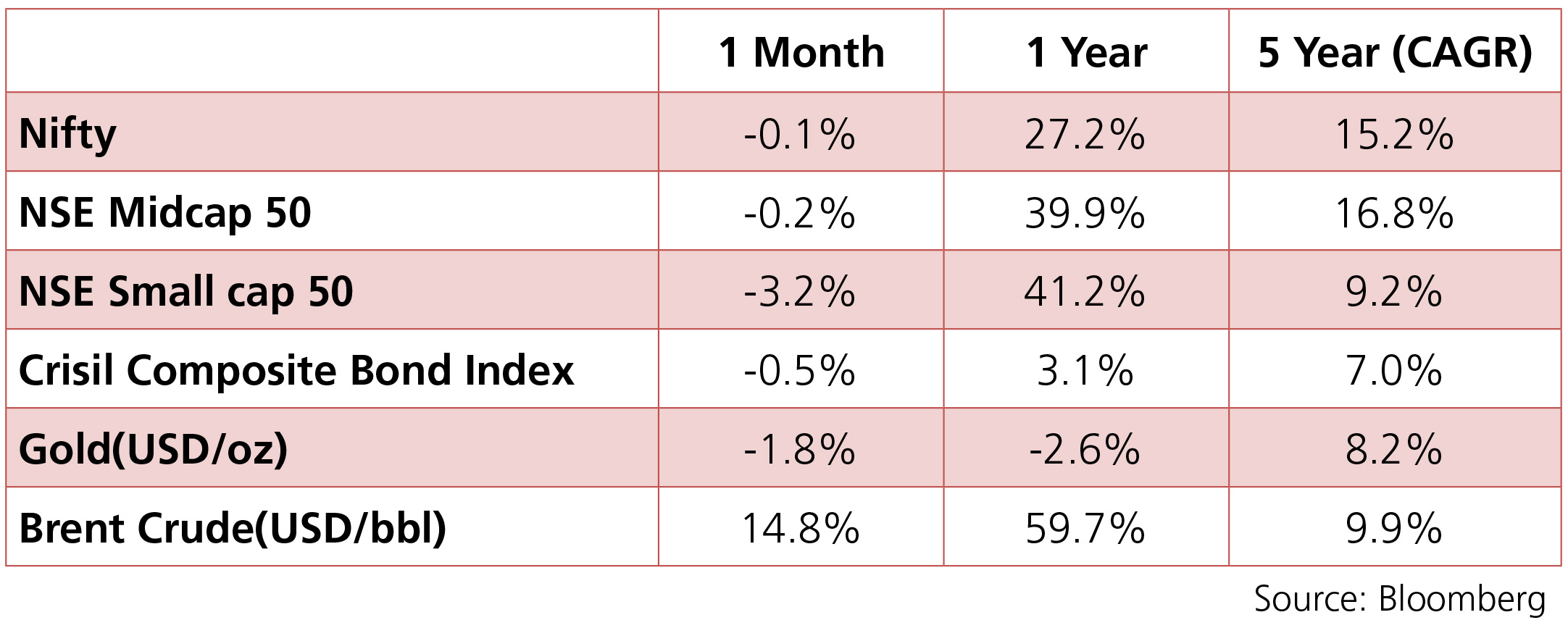

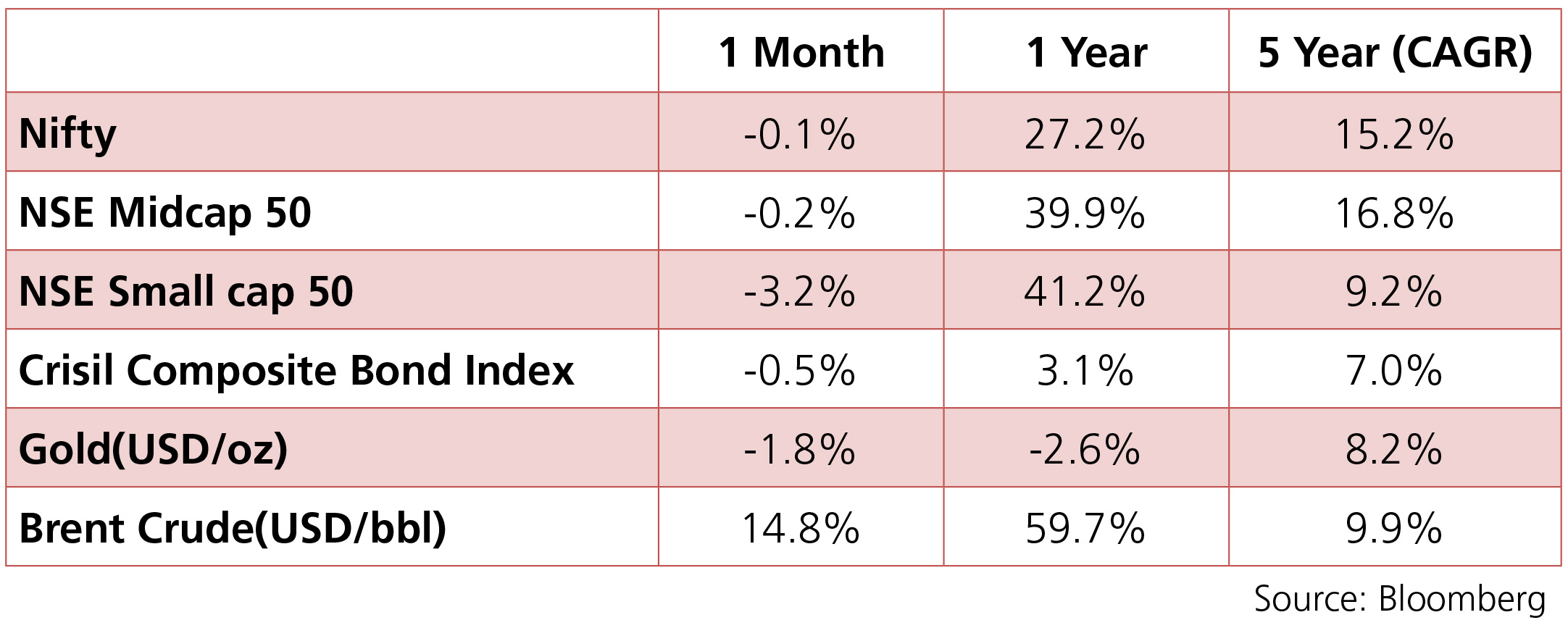

Markets were slightly jittery last month as surging cases of omicron, rising inflation, and a

hawkish tone by the global central banks weighed on sentiments. The Nifty index closed

0.1% lower for the month of January. Utilities, Energy, Consumer Discretionary and Financials

ended the month in the green while IT, Consumer Staples and Healthcare were key laggards.

The INR was down 0.5%MoM, closing at ~74.65/USD in January. Yields continued on an

upward trajectory with the 10y benchmark trading in a range of 6.46%-6.75% and eventually

ending the month 23 bps higher m-o-m at 6.68%. The 10y benchmark averaged 6.60% over

the month of January. Bond yields however fell sharply on January 31 after the government

switched government securities and oil bonds worth Rs1.2 tn with the RBI, with around Rs636

bn maturing in FY2023.

In terms of global developments, against the backdrop of high inflation and a tight labor market, the Fed pointed out that it will soon be appropriate to raise the policy rate—confirming widespread expectations for a March liftoff. The FOMC also announced that tapering of asset purchases will end in early March. In addition, Chair Powell’s remarks in the press conference seemed quite hawkish when he mentioned that the economic conditions presently are very different than during the post-GFC hiking cycle, with the economy and the labor market stronger than they were then and inflation running well above the Fed’s 2% target.

On the domestic front, the RBI continued to deploy variable rate reverse repo (VRRR) as its primary liquidity management tool, nudging the overnight rates higher. In fact, in one of the weeks, owing to larger than anticipated collections under the goods and services tax (GST), tightening in system liquidity pushed the overnight rates comfortably above 4%, prompting the RBI to announce variable rate repo auctions. Meanwhile, the RBI continued its OMO sales in January, although the quantum moderated significantly towards the end of the month.

In commodities, oil prices continued their momentum from previous month, gaining 17.4% in January. Brent crude averaged USD85.48/bbl over the month. Gold prices ended the month 1.6% lower than December close.

In terms of global developments, against the backdrop of high inflation and a tight labor market, the Fed pointed out that it will soon be appropriate to raise the policy rate—confirming widespread expectations for a March liftoff. The FOMC also announced that tapering of asset purchases will end in early March. In addition, Chair Powell’s remarks in the press conference seemed quite hawkish when he mentioned that the economic conditions presently are very different than during the post-GFC hiking cycle, with the economy and the labor market stronger than they were then and inflation running well above the Fed’s 2% target.

On the domestic front, the RBI continued to deploy variable rate reverse repo (VRRR) as its primary liquidity management tool, nudging the overnight rates higher. In fact, in one of the weeks, owing to larger than anticipated collections under the goods and services tax (GST), tightening in system liquidity pushed the overnight rates comfortably above 4%, prompting the RBI to announce variable rate repo auctions. Meanwhile, the RBI continued its OMO sales in January, although the quantum moderated significantly towards the end of the month.

In commodities, oil prices continued their momentum from previous month, gaining 17.4% in January. Brent crude averaged USD85.48/bbl over the month. Gold prices ended the month 1.6% lower than December close.

Source: Bloomberg

Source: Bloomberg

GDP: The NSO estimates FY2022 real GDP growth at 9.2%. With 1HFY22 GDP growth at

13.7%, the implied 2HFY22 GDP growth is at 5.6%. The key driver of 2HFY22 growth is

expected to be government at 13.9% growth (1% in 1HFY22) and GFCF growth at 6.1% in

2HFY22 (28.3% in 1HFY22). Private consumption growth is pegged to remain relatively weak at

1.8% in 2HFY22 (13.5% in 1HFY22). Exports growth in 2HFY22 is estimated at 6.4% (28.2%

in 1HFY22) and imports at 15% (49% in 1HFY22). Nominal GDP growth has been pegged at

17.6% implying a GDP deflator of around 7.7%. In absolute terms, it is pegged at Rs232 tn.

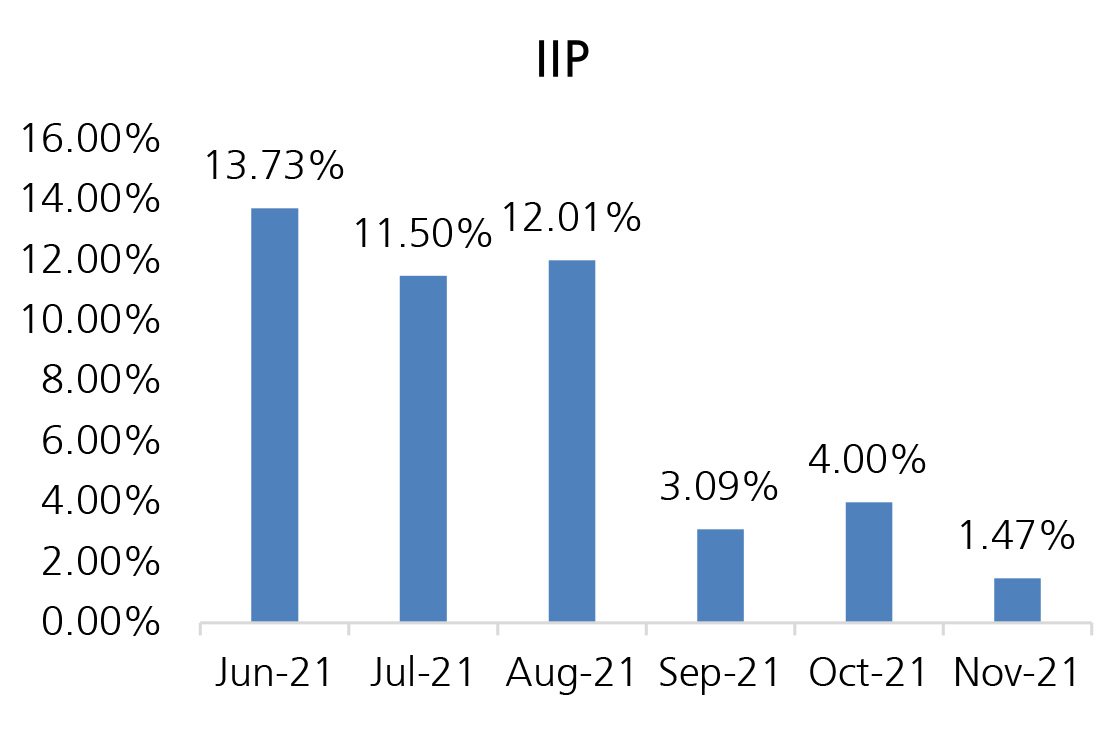

IIP: November IIP growth moderated to 1.47% (October: 4%), declining sequentially by 4.7% as the festive season impact faded. Compared to November 2019, IIP was marginally lower by 0.2%. On a sectoral basis, mining activity grew by 5% (October: 11.5%), electricity production by 2.1% (October: 3.1%), and manufacturing by 0.9% (3.1%). As per the use-based classification, infrastructure/construction goods grew by 3.8% followed by primary goods by 3.5%, and intermediate goods by 2.5%, and consumer non-durables by 0.8%. On the other hand, capital goods production contracted by 3.7% and consumer durables contracted by 5.6%.

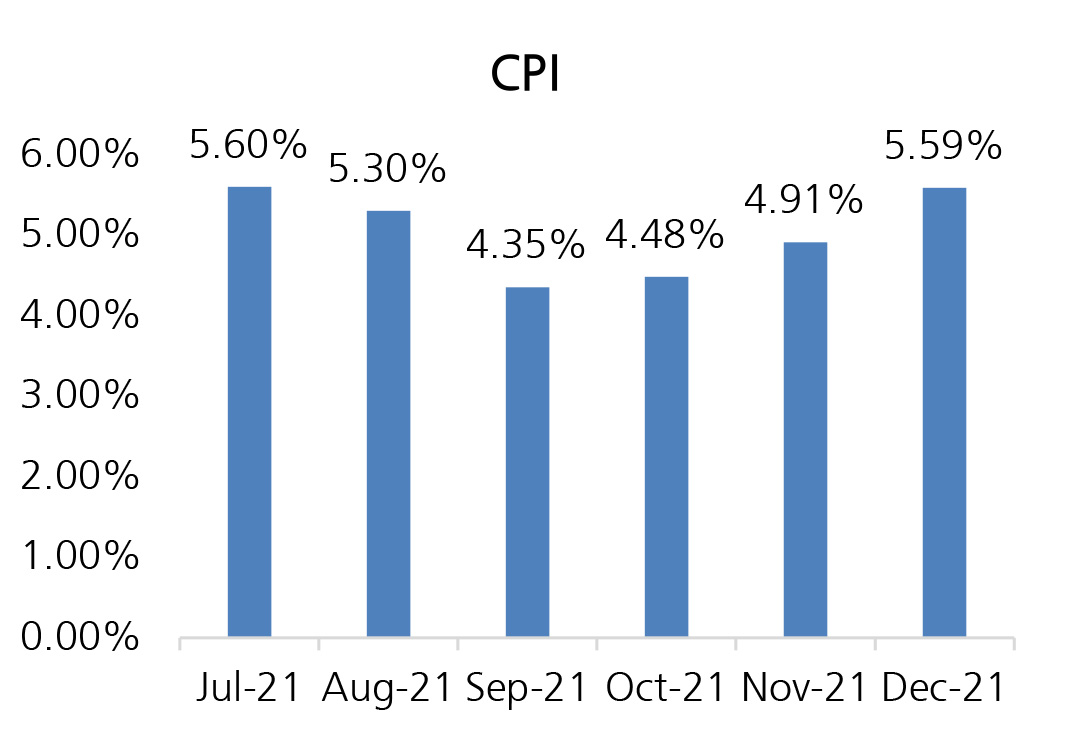

CPI: December CPI inflation shot up to 5.59% as against 4.91% in November. Sequentially, headline CPI fell by 0.4% (+0.7% mom in November), led by a 1.2% mom decline in food prices (+1.3% mom in November). Food inflation increased to 4% yoy (November: 1.9%) due to adverse base effects. Core inflation (CPI excluding food, fuel, pan and tobacco) moderated 10 bps to 6.2%, led by a softer sequential pickup of 0.1% (0.4% mom in November). Prices increased across all categories led by transport, clothing and footwear, and recreation. On a sequential basis, only housing prices declined by 0.5% (seasonal impact).

Trade Deficit: The merchandise trade deficit narrowed to USD17.9 bn in January from USD21.7 bn in December, reflecting sequential weakness in both exports and imports. Export growth moderated to 23.7% from 38.9% in December. Import growth fell to 23.7% from 38.6% in December. January trade data reflected the impact of the Omicron wave and capture the lagged effects of lower oil prices; both have now reversed. However, the impact of the third wave outside the transportation sector appears to have been limited; sequential momentum in core imports remained flat. Top export contributors included engineering goods, textiles, electronic goods and plastic & linoleum, while top import contributors were electronic goods, chemicals, coal, vegetable oils and non-ferrous metals, reflecting the dual role of higher commodity prices and volumes.

Fiscal deficit: The fiscal deficit stood at 50.4% of the Budget Estimates, as compared to 145.5% in the same period last year. In absolute terms, the fiscal deficit was at Rs7,59,366 crore at the end of December. The main contributors to the lower fiscal deficit were higher net tax revenues at 95.4% of BE vs 58.8% in the corresponding period previous year and non-tax revenues at 106.7% vs 32.8% in the same period last year. At the same time, total expenditure was marginally lower at 72.4% for the period vs 75% in the same period last year.

IIP: November IIP growth moderated to 1.47% (October: 4%), declining sequentially by 4.7% as the festive season impact faded. Compared to November 2019, IIP was marginally lower by 0.2%. On a sectoral basis, mining activity grew by 5% (October: 11.5%), electricity production by 2.1% (October: 3.1%), and manufacturing by 0.9% (3.1%). As per the use-based classification, infrastructure/construction goods grew by 3.8% followed by primary goods by 3.5%, and intermediate goods by 2.5%, and consumer non-durables by 0.8%. On the other hand, capital goods production contracted by 3.7% and consumer durables contracted by 5.6%.

CPI: December CPI inflation shot up to 5.59% as against 4.91% in November. Sequentially, headline CPI fell by 0.4% (+0.7% mom in November), led by a 1.2% mom decline in food prices (+1.3% mom in November). Food inflation increased to 4% yoy (November: 1.9%) due to adverse base effects. Core inflation (CPI excluding food, fuel, pan and tobacco) moderated 10 bps to 6.2%, led by a softer sequential pickup of 0.1% (0.4% mom in November). Prices increased across all categories led by transport, clothing and footwear, and recreation. On a sequential basis, only housing prices declined by 0.5% (seasonal impact).

Trade Deficit: The merchandise trade deficit narrowed to USD17.9 bn in January from USD21.7 bn in December, reflecting sequential weakness in both exports and imports. Export growth moderated to 23.7% from 38.9% in December. Import growth fell to 23.7% from 38.6% in December. January trade data reflected the impact of the Omicron wave and capture the lagged effects of lower oil prices; both have now reversed. However, the impact of the third wave outside the transportation sector appears to have been limited; sequential momentum in core imports remained flat. Top export contributors included engineering goods, textiles, electronic goods and plastic & linoleum, while top import contributors were electronic goods, chemicals, coal, vegetable oils and non-ferrous metals, reflecting the dual role of higher commodity prices and volumes.

Fiscal deficit: The fiscal deficit stood at 50.4% of the Budget Estimates, as compared to 145.5% in the same period last year. In absolute terms, the fiscal deficit was at Rs7,59,366 crore at the end of December. The main contributors to the lower fiscal deficit were higher net tax revenues at 95.4% of BE vs 58.8% in the corresponding period previous year and non-tax revenues at 106.7% vs 32.8% in the same period last year. At the same time, total expenditure was marginally lower at 72.4% for the period vs 75% in the same period last year.

Deal flow was tepid in January with 13 deals worth ~$0.54bn executed (vs 18 deals worth

~$2.2bn in Dec). Key deals included IPO of AGSTRA ($91mn.

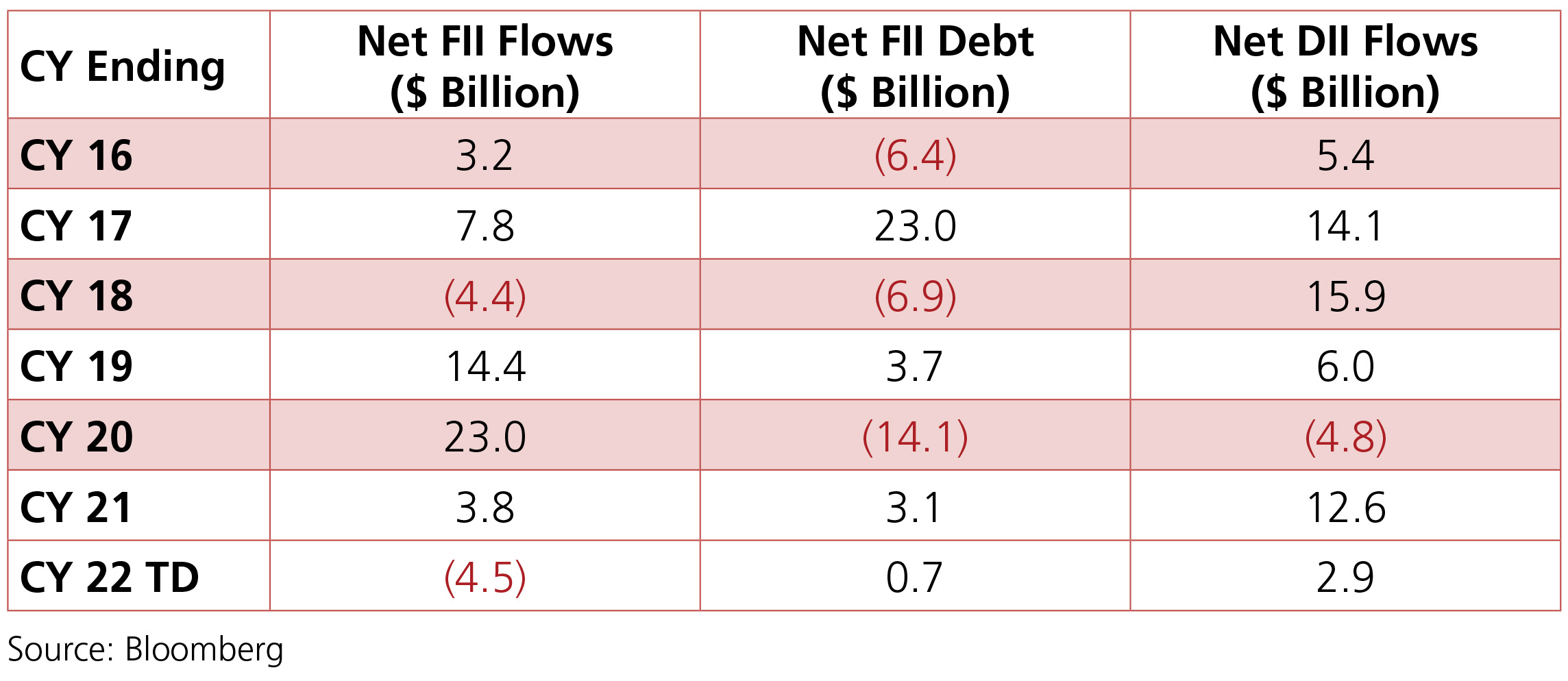

FIIs continued being net sellers in the month of January 2022 and were net sellers to the tune of -$4.5bn even as DII buying continued +$2.9bn, driven by both MFs +$1.4bn and Insurance +$1.6bn.

FIIs continued being net sellers in the month of January 2022 and were net sellers to the tune of -$4.5bn even as DII buying continued +$2.9bn, driven by both MFs +$1.4bn and Insurance +$1.6bn.