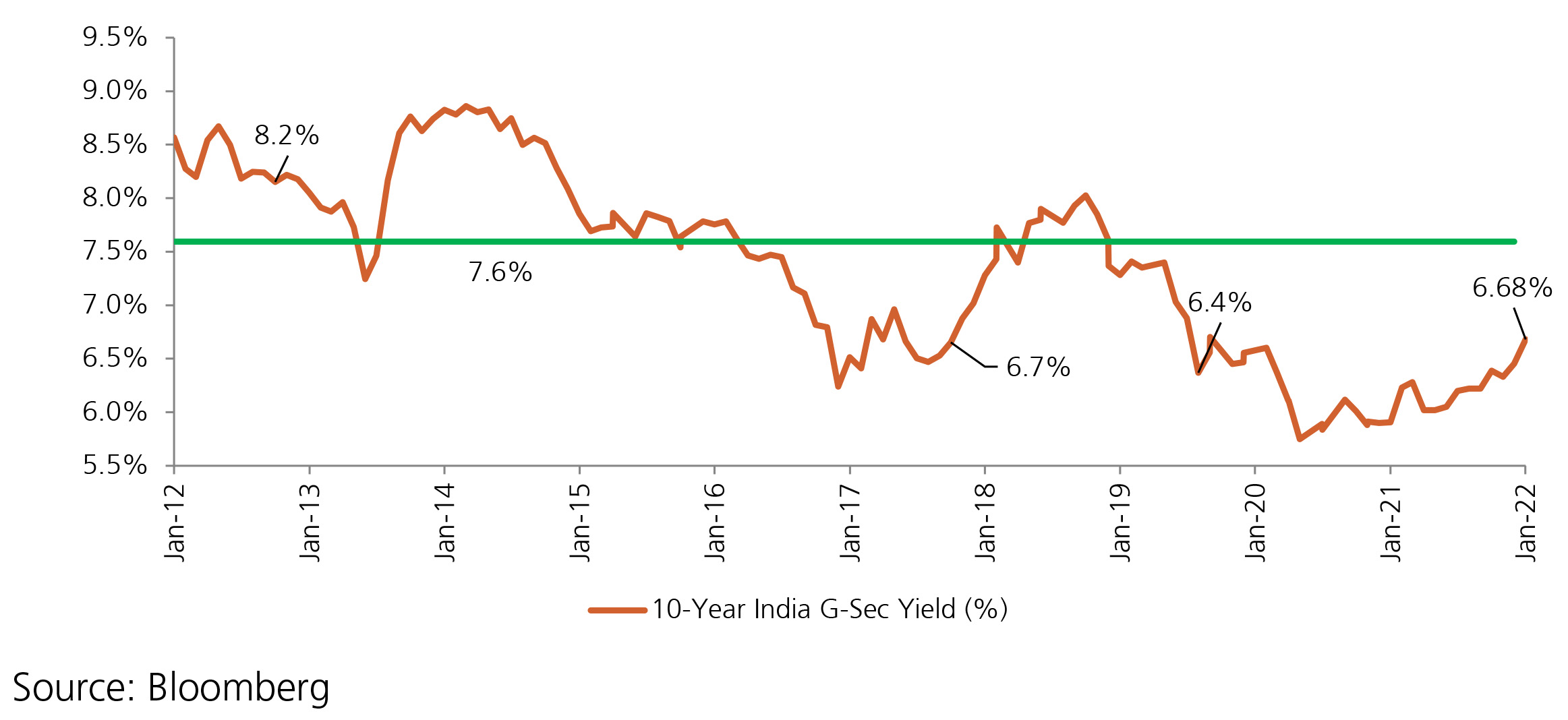

Domestic government bond yields continued their uptrend in January amidst disappointing auction results, fiscal concerns, higher oil prices and tightening in global finanical conditions. With the Fed shifting its focus from tolerating inflation to addressing inflation, the US Treasury yields made a strong move, with the 10 year ending January 26 bps higher at 1.77%. Oil prices also moved higher amidst geopolitical tensions, and limited economic impact of Omicron variant. Domestically, the coupon for the new 10-year benchmark was set at 6.54%, but demand for dated papers remained muted. Discomfort with higher yields pushed RBI to devolve, although that had limited impact in arresting the sell-off, especially since the RBI continued its OMO sales (even though the quantum has moderated recently).

Bond markets, however, ended January on a slighly optimistic note when the government switched government securities and oil bonds worth Rs1.2 tn with the RBI, with around Rs636 bn maturing in FY2023. This led to a build-up in expectation that the government may keep the overall gross borrowing for FY2023 at a somewhat manageable level, with the 10-year rallying by 9 bps on January 31, 2022. Despite this, the 10 year bond yield ended the month 23 bps higher at 6.68% compared to 6.45% in December. The 10y benchmark averaged 6.60% over the month of January.The Union Budget is the next big event and bulk of the recent sell off in the the market is in anticipation of a large borrowing quantum for FY2023. Markets also await further clarity on the progress made towards bond-index inclusion. In addition, markets will watch out for the MPC policy outcome due on February 9, and wait for further signals towards policy normalization.