|  |

Individual Fund

Kotak Advantage Multiplier Fund II

(ULIF-026-21/04/06-ADVMULFND2-107)

|

AS ON 31ST DECEMBER 2025 |

Aims for a high level of capital growth by holding a significant portion in equities. May experience high levels of shorter term volatility (downside

risk).

Date of Inception

21st April 2006

AUM (in Lakhs)

0.48

NAV

21.5269

Fund Manager

Equity : Rohit Agarwal

Debt : Manoj Bharadwaj

Debt : Manoj Bharadwaj

Benchmark Details

Equity - 50% (Nifty);

Debt - 50% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 1.60

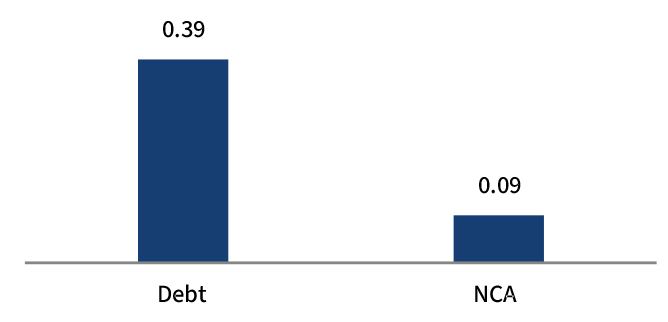

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 00 - 100 | 0 |

| Gsec / Debt | 00 - 100 | 81 |

| MMI / Others | 00 - 40 | 19 |

Performance Meter

| Kotak Advantage Multiplier Fund II (%) | Benchmark (%) | |

| 1 month | 0.1 | 0.001 |

| 3 months | 0.6 | 3.7 |

| 6 months | 0.8 | 2.2 |

| 1 year | 3.4 | 8.8 |

| 2 years | 3.4 | 9.0 |

| 3 years | 3.4 | 10.5 |

| 4 years | 2.1 | 8.8 |

| 5 years | 1.8 | 9.7 |

| 6 years | 2.0 | 10.6 |

| 7 years | 2.5 | 10.7 |

| 10 years | 2.6 | 10.4 |

| Inception | 4.0 | 9.6 |

| Holdings | % to Fund |

| G-Sec | 80.90 |

| 7.17% GOI - 08.01.2028 | 74.01 |

| 9.20% GOI - 30.09.2030 | 6.89 |

| MMI | 0.00 |

| NCA | 19.10 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.