Global Macro Developments: In December, the U.S. Federal Reserve cut its policy rate by 0.25% at the Dec 10 FOMC meeting, bringing the target range to 3.50%–3.75%. Notably, the decision saw three dissents, reflecting debate over inflation risks. In Europe, the European Central Bank (ECB) kept rates unchanged at its Dec 18 meeting (deposit rate steady at 2.15%). The Bank of England (BoE) delivered a widely expected “Christmas cut” of 25 bps on Dec 18, lowering Bank Rate to 3.75%. Globally, monetary policy turned decisively dovish by year-end, contributing to easier financial conditions.

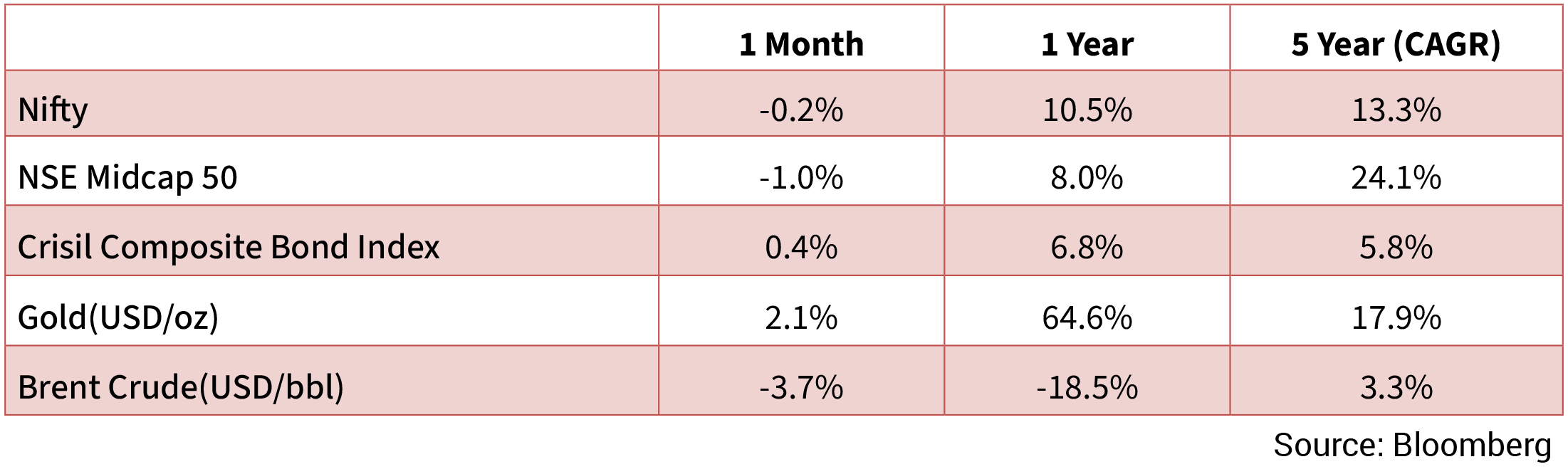

Global Equities: Equity markets worldwide extended their rally in December. In the U.S., major indices hit fresh records during the holiday-shortened week of Christmas. The S&P 500 notched a new all-time closing high on Dec 23, propelled by robust Q3 GDP growth (+4.3% annualized) and cooling inflation. Although stocks gave back some gains in the final sessions of the year. European equities also rallied into year-end. The pan-European STOXX 600 climbed in December, aided by the ECB’s pause and hopes of fiscal support. Germany’s DAX and France’s CAC 40 each approached record levels.

Commodities: Crude oil prices remained range-bound to soft in December. Brent crude hovered around the low $60s per barrel, slightly down from ~$64 in late November. Notably, OPEC+ confirmed it would extend its production pause (no further output increases) into early 2026. This announcement in late December provided a floor under prices. Still, Brent fell about –4% in Dec, finishing 2025 with approximately a –17% yearly decline. U.S. WTI crude similarly ended around $57–58, reflecting concerns that a record projected surplus in 2026 could suppress prices further. Gold prices skyrocketed in December, extending an already strong year-long uptrend. Spot gold surged through December, reaching an all-time high around $4,330/oz by year-end. Silver followed suit, bolstered by both its precious-metal status and industrial prospects (for electronics and solar), but it too saw speculative flows. By late December, CME margin hikes tried to cool the rally; indeed, gold and silver did pull back slightly from their mid-month peak levels.

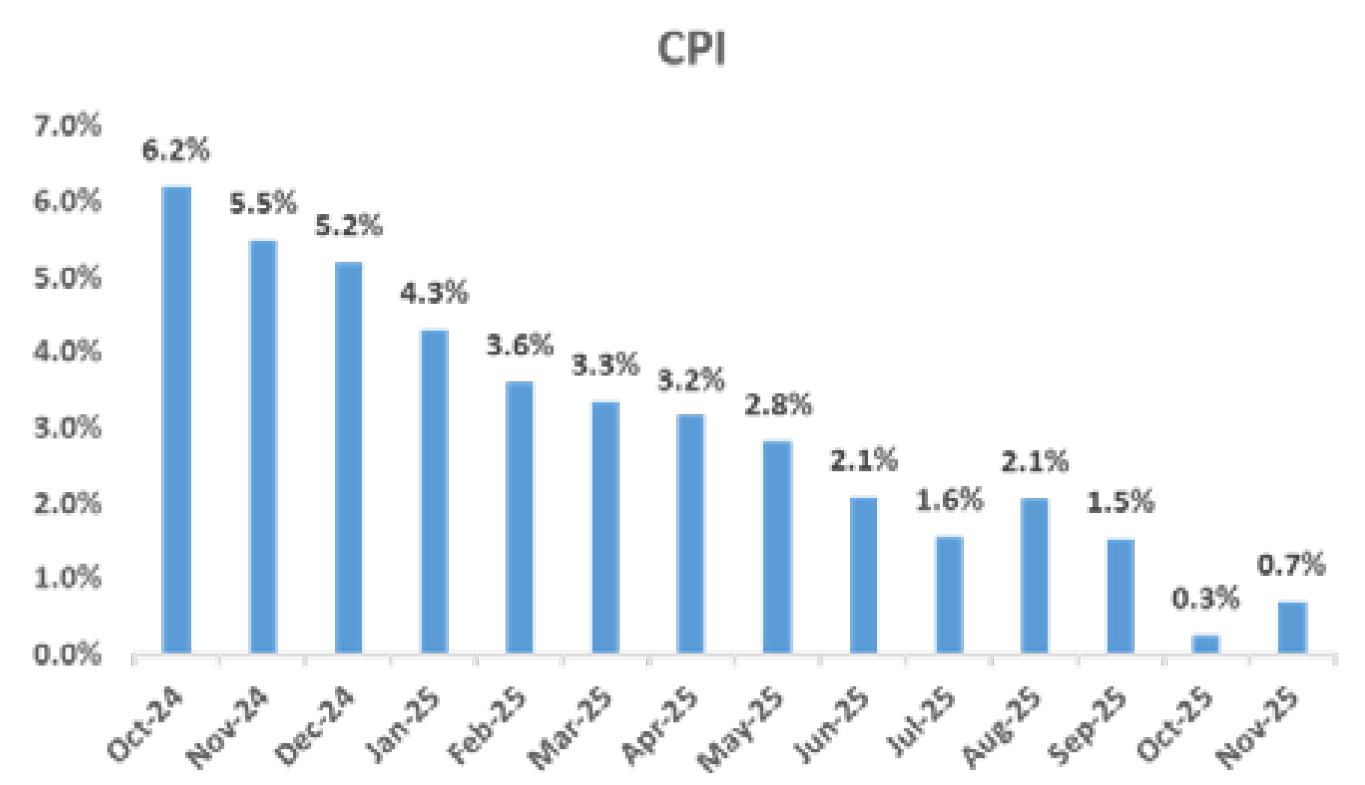

India Macro Developments: India’s economy continued its strong momentum through year-end. High-frequency indicators remained resilient in December. The HSBC India Services PMI stayed very elevated at 59.1, after hitting 59.8 in November. Services activity got a continued boost from festive demand and policy tailwinds, especially in finance and consumer services. The Manufacturing PMI moderated slightly, the December PMI slipped to 55.0 from 56.6 in Nov, its lowest in two years. Even so, a 55 PMI indicates solid expansion. The slight cooling was attributed to weaker domestic demand and slower new orders growth in certain sectors. With inflation at multi-year lows, the Reserve Bank of India (RBI) pivoted to growth support. At its December 5 policy meeting, the RBI’s Monetary Policy Committee cut the repo rate by 25 bps to 5.25%, the fourth cut in 2025 for a cumulative 125 bps easing since February. The RBI maintained a “neutral” stance, signaling flexibility for future decisions. Importantly, the central bank sharply revised down its inflation forecasts (FY26 CPI projection cut to 2.0% from 2.6%) and nudged up its GDP growth forecast (FY26 GDP to 7.3% from 6.8%), reflecting confidence in benign price dynamics and strong activity. To ensure ample liquidity, the RBI also announced a $5 billion FX swap and ₹1 trillion of open market bond purchases in Dec, steps that injected durable liquidity into the banking system. These moves kept overnight rates below repo and supported credit conditions. India’s inflation stayed extraordinarily low. Headline CPI for November 2025 came in at just +0.71% YoY, up slightly from the record low +0.25% in October.

Indian Equities: In December 2025, the Nifty 50 showed a cautious but stable performance, reflecting mixed investor sentiment toward the end of the year. The index moved within a narrow range of roughly 25,900 to 26,300, facing intermittent volatility due to profit booking, global market cues, and year-end positioning by investors. Mid-month weakness briefly pushed the index lower, but buying interest in heavyweight stocks helped it recover in the later sessions. As a result, Nifty 50 closed the month near 26,130, registering modest gains of about 0.5–1%. Overall, December capped a positive year for the market, with Nifty delivering annual returns of around 10–11% in 2025, signaling resilience despite periodic uncertainties.

Currency Movements: In December 2025, the USD–INR exchange rate reflected sustained pressure on the Indian rupee amid global and domestic factors. The rupee began the month around ₹89.5–₹89.7 per US dollar but gradually weakened as demand for the dollar increased due to persistent US monetary tightness, foreign portfolio outflows, and higher global uncertainty. Mid-month, the exchange rate briefly crossed ₹90.5 and touched levels close to ₹91, signaling heightened volatility. However, intermittent support from the Reserve Bank of India and month-end exporter dollar inflows helped prevent a sharper depreciation. By the end of December, the rupee stabilized near ₹89.9–₹90 per dollar, resulting in an average monthly rate of about ₹90. Overall, December 2025 highlighted a fragile but managed rupee, closing the year on a weaker footing against the US dollar.

Bond Yields: Indian government bond yields experienced considerable volatility in the final quarter of 2025. During December, the 10-year yield initially fell after the RBI’s rate cut, then spiked to multi-month highs, and finally eased back down after central bank intervention. Following the RBI’s 25 bps rate cut on Dec 5, bond yields rallied. The 10-year yield dipped to around 6.3–6.4% by mid-December, the lowest in over two months, as traders priced in the start of an easing cycle and abundant liquidity. In the week before Christmas, yields abruptly shot up. By Dec 23, the 10-year yield surged to 6.70%, a nine-month high. Thin holiday trading conditions exaggerated the move. The RBI stepped in to calm the bond market. On Dec 24, RBI announced a massive ₹2 lakh crore open market bond purchase program (OMOs). This “Christmas bonanza” triggered a powerful rally: the 10-year yield fell ~9 bps to 6.54% that day. By the final trading sessions of the year, the benchmark yield settled around 6.59%.

CPI: In November 2025, India’s CPI inflation rose modestly to 0.71% year-on-year, up from a record low of 0.25% in October

2025. The increase was largely driven by a slower decline in food prices, particularly vegetables, pulses, and some cereals,

along with minor upticks in fuel and transport costs. Core inflation, which excludes volatile items like food and fuel,

remained higher at above 4%, indicating that underlying price pressures in services, housing, and manufactured goods were

more persistent despite the overall subdued headline inflation. The combination of very low headline CPI and relatively

steady core inflation reflects disinflationary pressures in food and energy, but underlying demand-driven inflation remained

moderate, suggesting that the economy was stable without significant cost-push pressures.

Trade: In November 2025, India’s trade performance showed a clear improvement compared with earlier months. Merchandise exports grew by approximately 15-19% year-on-year, reaching nearly USD 74 billion, boosted by strong shipments of engineering goods, electronics, chemicals, and pharmaceutical products. On the import side, total merchandise imports stood at around USD 80.6 billion, slightly lower than the previous month, due in part to reduced purchases of gold, crude oil, and coal. As a result, India’s trade deficit narrowed to about USD 6.6 billion for November, the lowest in five months, compared with a wider deficit of USD 7.8 billion in October 2025. Year-to-date (April–November 2025), cumulative exports rose roughly 5.4%, while imports increased about 5%, leaving the cumulative trade deficit near USD 89 billion. The narrowing of the deficit in November reflected both strong external demand for Indian goods and government measures to promote exports and rationalize import costs, signaling a healthier external sector as India approached the end of 2025.

Trade: In November 2025, India’s trade performance showed a clear improvement compared with earlier months. Merchandise exports grew by approximately 15-19% year-on-year, reaching nearly USD 74 billion, boosted by strong shipments of engineering goods, electronics, chemicals, and pharmaceutical products. On the import side, total merchandise imports stood at around USD 80.6 billion, slightly lower than the previous month, due in part to reduced purchases of gold, crude oil, and coal. As a result, India’s trade deficit narrowed to about USD 6.6 billion for November, the lowest in five months, compared with a wider deficit of USD 7.8 billion in October 2025. Year-to-date (April–November 2025), cumulative exports rose roughly 5.4%, while imports increased about 5%, leaving the cumulative trade deficit near USD 89 billion. The narrowing of the deficit in November reflected both strong external demand for Indian goods and government measures to promote exports and rationalize import costs, signaling a healthier external sector as India approached the end of 2025.

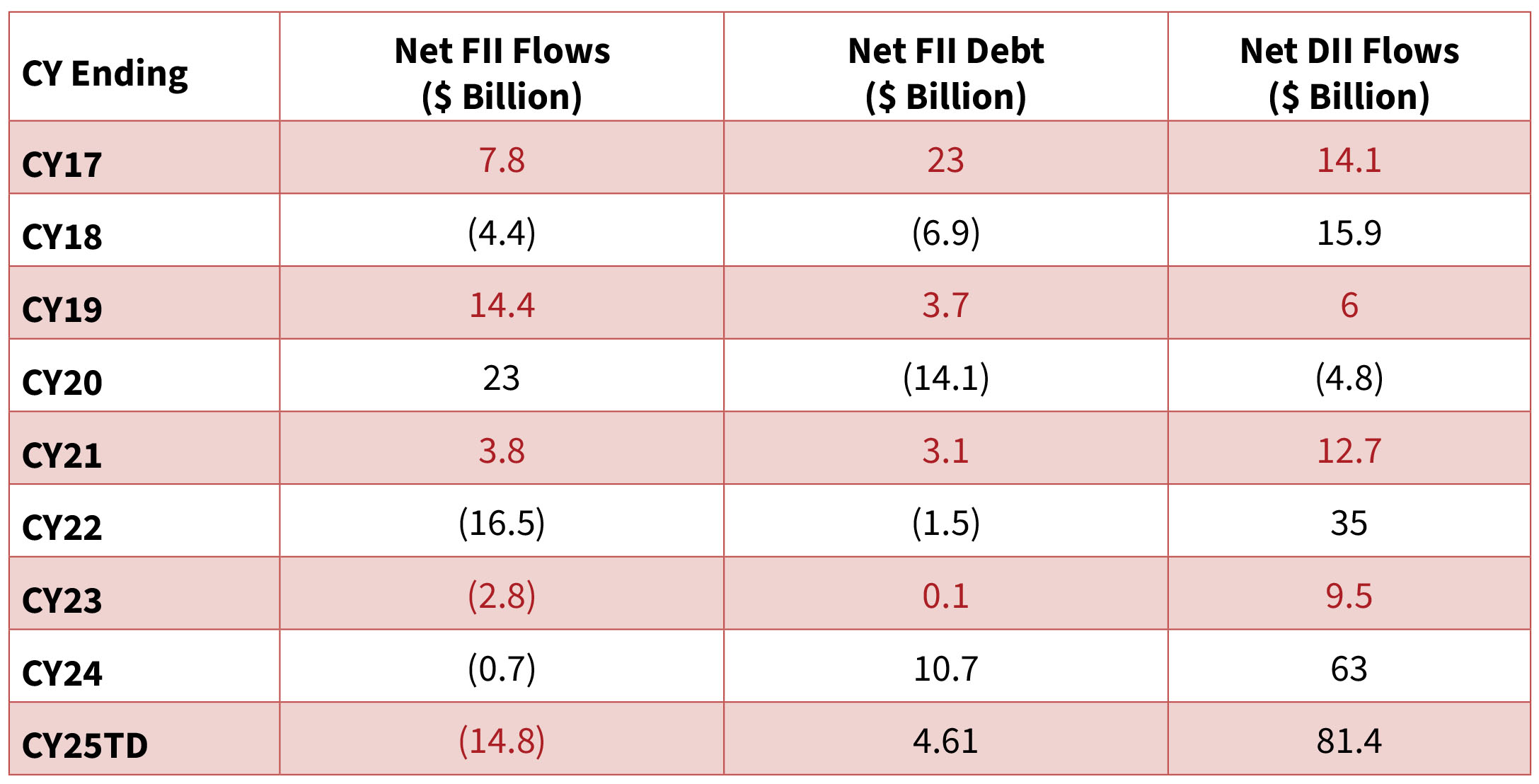

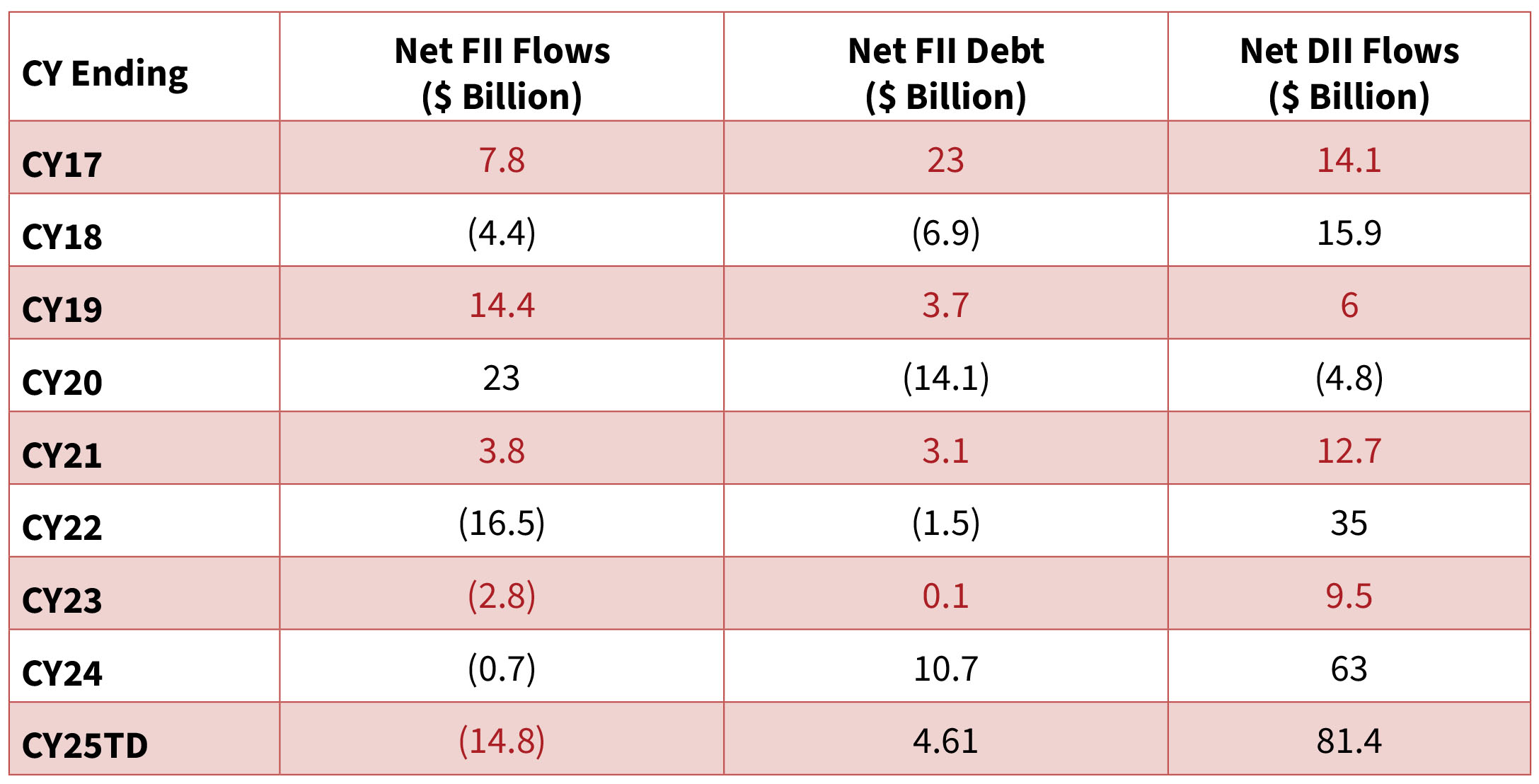

FIIs (Foreign Institutional Investors) were net sellers, withdrawing about ₹17,955 crore from Indian equities in the first half of

December (Dec 1–12) as part of ongoing foreign selling pressure in 2025. DIIs (Domestic Institutional Investors) continued to

be strong net buyers, with gross purchases ~₹3.37 lakh crore and gross sales ~₹2.65 lakh crore, leading to a net equity inflow

of ~₹72,860 crore in December. In the debt segment, FIIs were also net sellers early in the month, with data showing net

debt outflows of about ₹310 crore under the general limit during early December. Some FII debt activity also included small

inflows (~₹151 crore) through voluntary retention route schemes, but overall sentiment in debt leaned cautious.