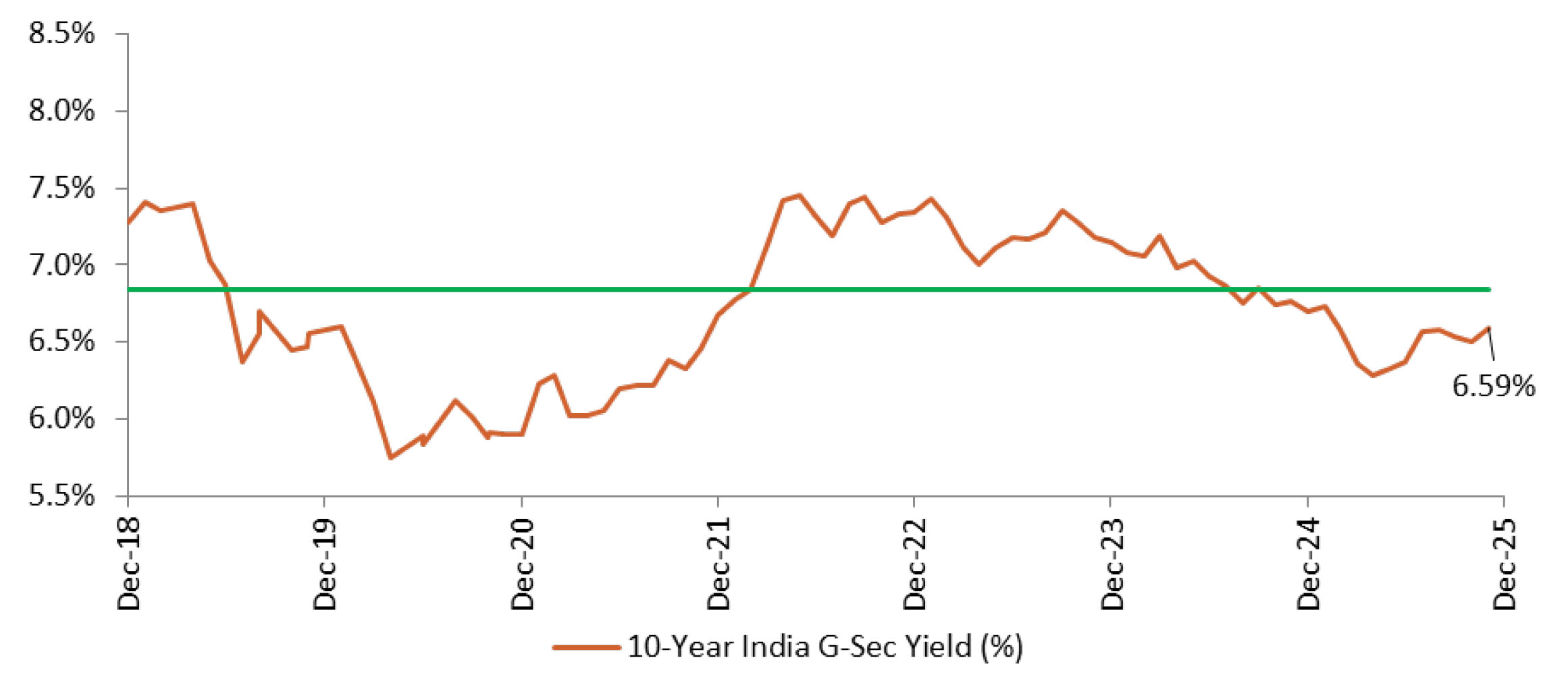

With inflation so far below target, the RBI likely has room to cut rates further in early 2026, which would support bonds. We expect at least one more 25 bps cut by Q1 2026, especially if inflation remains under 3%. However, the upcoming Union Budget (Feb 2026) is a key event – any significant fiscal expansion or higher borrowing could put upward pressure on yields. Conversely, a prudent budget could anchor yields around current levels. The RBI’s commitment to perform OMOs as needed provides a backstop. Progress on the US-India trade talks, the trajectory of crude oil prices and global central bank actions will be influential for India’s macro in 2026.