● Rate cut would further support credit growth: The Monetary Policy Committee, in its bi-monthly review of December 2025, unanimously decided to reduce the policy repo rate by 25 bps to 5.25 per cent. The MPC also decided to maintain its neutral stance. The decisions were guided by the benign inflation outlook for both headline and core, which provided space for monetary policy to further support the growth momentum. The continuous rate cut is expected to further improve the system level credit growth.

● Inflation under control: demand improving: High-frequency indicators for November suggest that overall economic activity has held up with demand conditions improving. Headline CPI inflation edged up but continued to remain below the lower tolerance level. Financial conditions remained benign, and the flow of financial resources to the commercial sector remained robust.

● Rabi sowing: On the supply side, monsoon performance was excellent, ending the season 8.0% above normal (937.2mm vs 868.6mm), with 33 out of 36 sub-divisions recording normal or excess rainfall. Reservoir levels as of 18th December are very good at 83.0% of full capacity, well above the 10-year average. While extended rains pose a risk to vegetable crops, the overall surplus rainfall supports farm incomes, keeps food inflation contained, and reinforces rural demand.

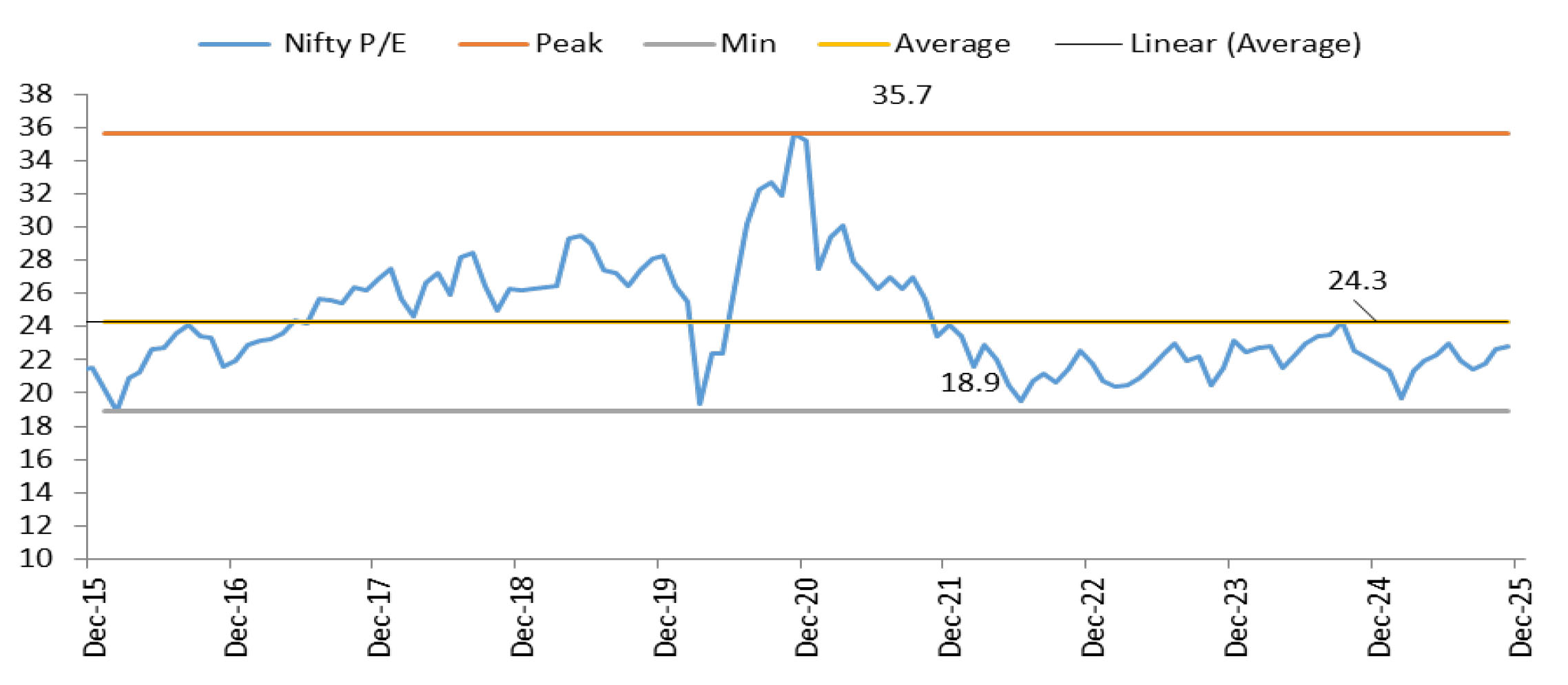

● Outlook: We continue to remain positive on equities as government support of rate cut, GST rate rationalisation and other policy measures have started to show positive momentum on the ground. Automobile sector was a key beneficiary of GST rate cut and we have started to see very strong sales data. We expect broad based recovery in consumption in next fiscal year.