Individual Fund

Kotak Dynamic Growth Fund

(ULIF-012-27/06/03-DYGWTFND-107)

Monthly Update November 2021

|

AS ON 29th October 2021 |

Aims for a high level of capital growth by holding a significant portion in large sized company equities.

Date of Inception

27th June 2003

AUM (in Lakhs)

6,985.71

NAV

121.3996

Fund Manager

Equity : Rohit Agarwal

Debt :Gajendra Manavalan

Debt :Gajendra Manavalan

Benchmark Details

Equity - 80% (BSE 100);

Debt - 20% (Crisil Composite Bond)

Modified Duration

Debt & Money

Market Instruments : 4.45

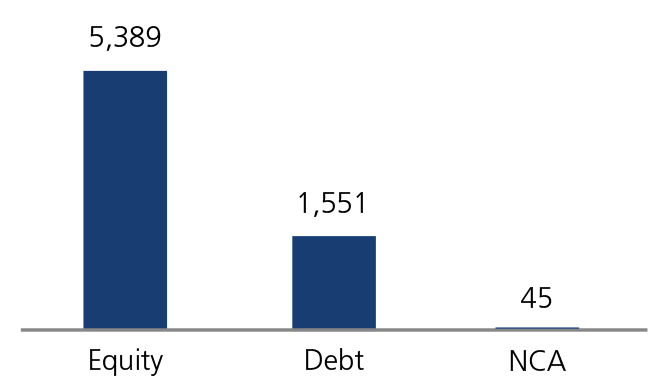

Asset Allocation

| Approved (%) | Actual (%) | |

| Equity | 40 - 80 | 77 |

| Gsec / Debt | 20 - 60 | 21 |

| MMI / Others | 00 - 40 | 2 |

Performance Meter

| Kotak Dynamic Growth Fund (%) | Benchmark (%) | |

| 1 month | 1.1 | 0.2 |

| 3 months | 8.7 | 9.3 |

| 6 months | 18.2 | 16.9 |

| 1 year | 42.3 | 41.8 |

| 2 years | 19.9 | 19.7 |

| 3 years | 18.4 | 17.4 |

| 4 years | 12.5 | 12.7 |

| 5 years | 13.0 | 13.7 |

| 6 years | 13.0 | 13.0 |

| 7 years | 12.2 | 11.2 |

| 10 years | 13.3 | 12.3 |

| Inception | 14.6 | 13.6 |

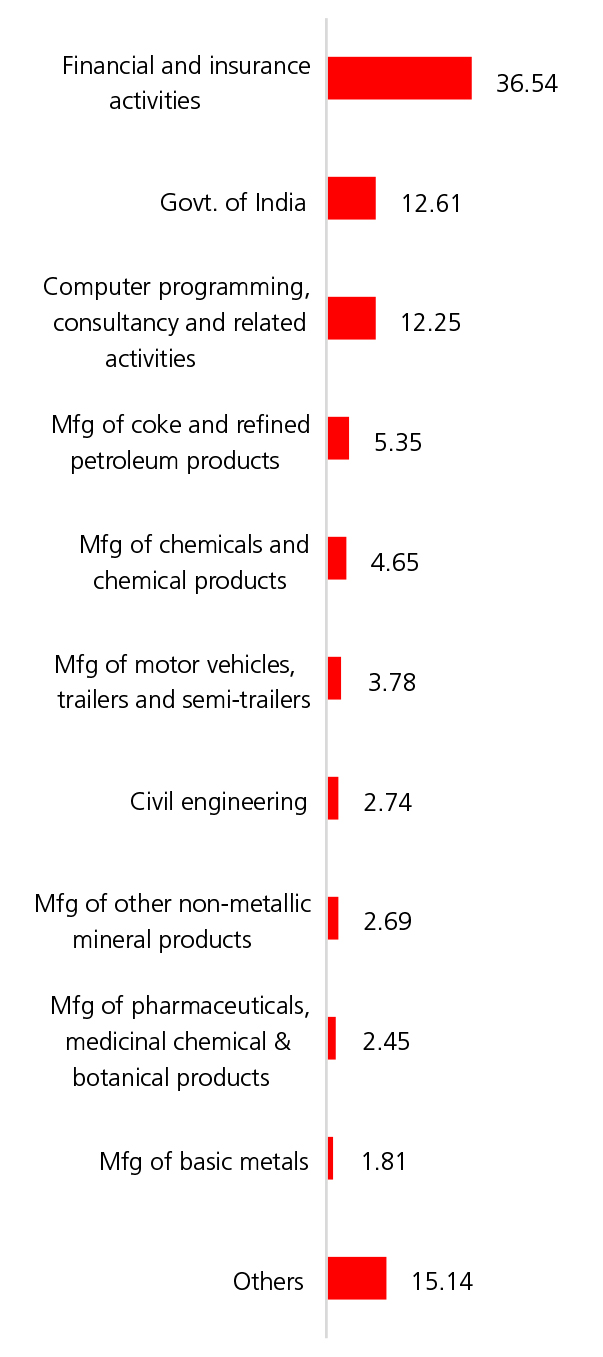

| Holdings | % to Fund |

| Equity | 77.15 |

| Infosys Ltd | 5.63 |

| ICICI Bank Ltd | 5.60 |

| Reliance Industries Ltd | 5.35 |

| Tata Consultancy Services Ltd | 3.78 |

| SBI ETF Nifty Bank | 3.28 |

| Kotak Banking ETF - Dividend Payout Option | 3.23 |

| ICICI Prudential Bank ETF Nifty Bank Index | 3.03 |

| Larsen And Toubro Ltd | 2.74 |

| HDFC Bank Ltd | 2.51 |

| State Bank of India | 2.37 |

| Axis Bank Ltd | 2.03 |

| S R F Ltd | 1.72 |

| Maruti Suzuki India Ltd | 1.72 |

| ICICI Prudential IT ETF | 1.63 |

| Mahindra & Mahindra Ltd | 1.57 |

| Bajaj Finance Ltd | 1.33 |

| UltraTech Cement Ltd | 1.25 |

| Housing Development Finance Corp. Ltd | 1.19 |

| Hindalco Industries Ltd | 1.16 |

| Brigade Enterprises Ltd | 1.05 |

| Others | 25.00 |

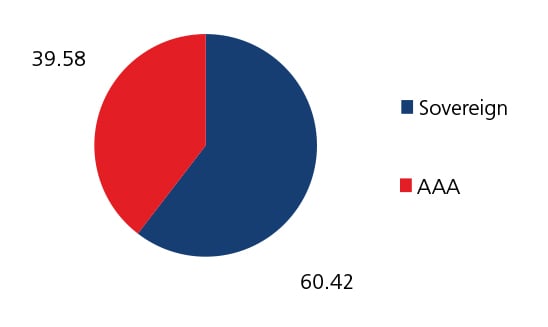

| G-Sec | 14.06 |

| 7.59% GOI - 11.01.2026 | 1.53 |

| 6.22% GOI - 16.03.2035 | 1.53 |

| 7.16% GOI - 20.09.2050 | 1.30 |

| 5.22% GOI - 15.06.2025 | 1.01 |

| 8.17% GOI - 01.12.2044 | 0.88 |

| 6.79% GOI - 15.05.2027 | 0.80 |

| 6.65% Fertilizer Co GOI - 29.01.23 | 0.73 |

| 5.63% GOI - 12.04.2026 | 0.71 |

| 8.30% GOI - 02.07.2040 | 0.65 |

| 8.70% REC - 28.09.2028 | 0.64 |

| Others | 4.28 |

| Corporate Debt | 6.78 |

| 7.20% HDFC - 13.04.2023 | 5.40 |

| 8.56% REC - 29.11.2028 | 0.48 |

| 8.65% PFC - 28.12.2024 | 0.47 |

| 9.02% REC - 19.11.2022 | 0.30 |

| 9.75% REC - 11.11.2021. | 0.14 |

| MMI | 1.36 |

| NCA | 0.65 |

**NIC 2008 - Industrial sector as defined under National Industrial Classification 2008.