Month Gone By – Markets (period ended October 29, 2021)

Markets continued to scale upward in the initial period of the month with both indices touching alltime

high levels in the middle of the month but failed to keep up the momentum ending largely flat.

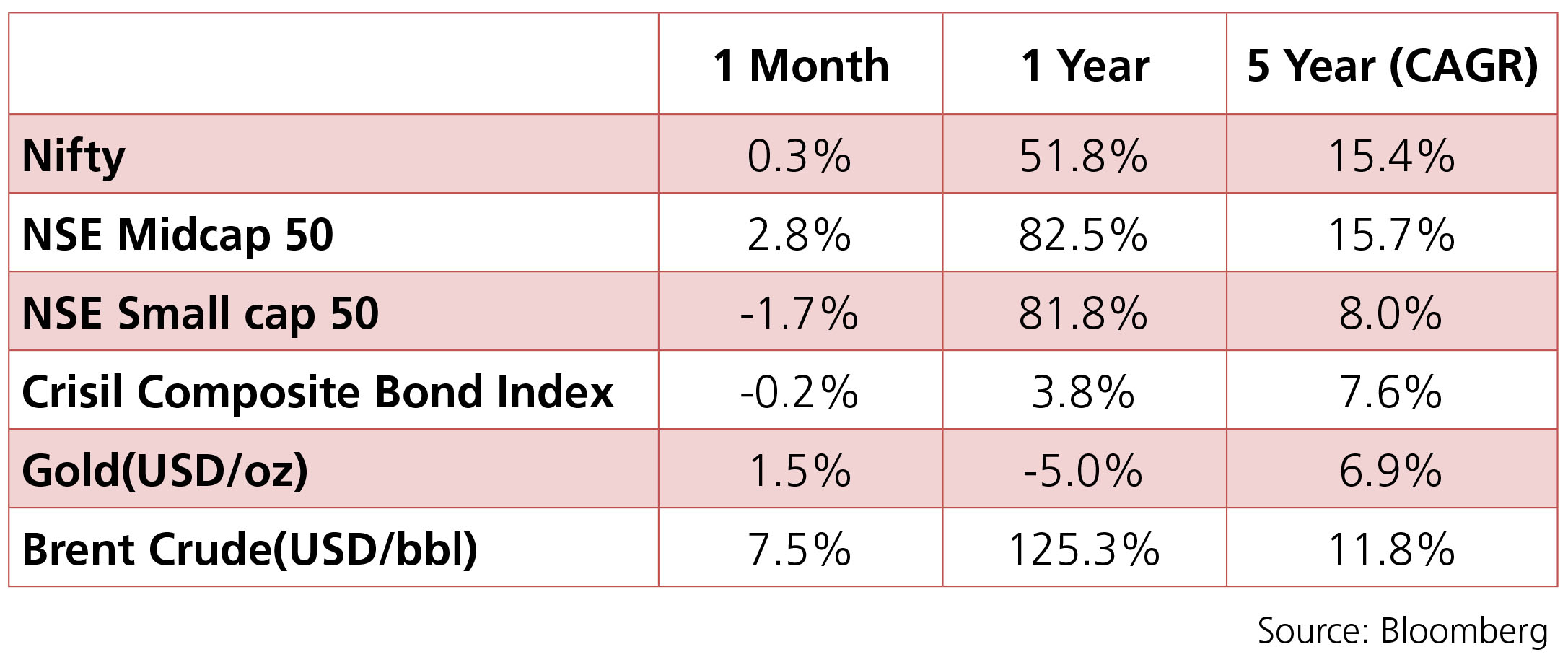

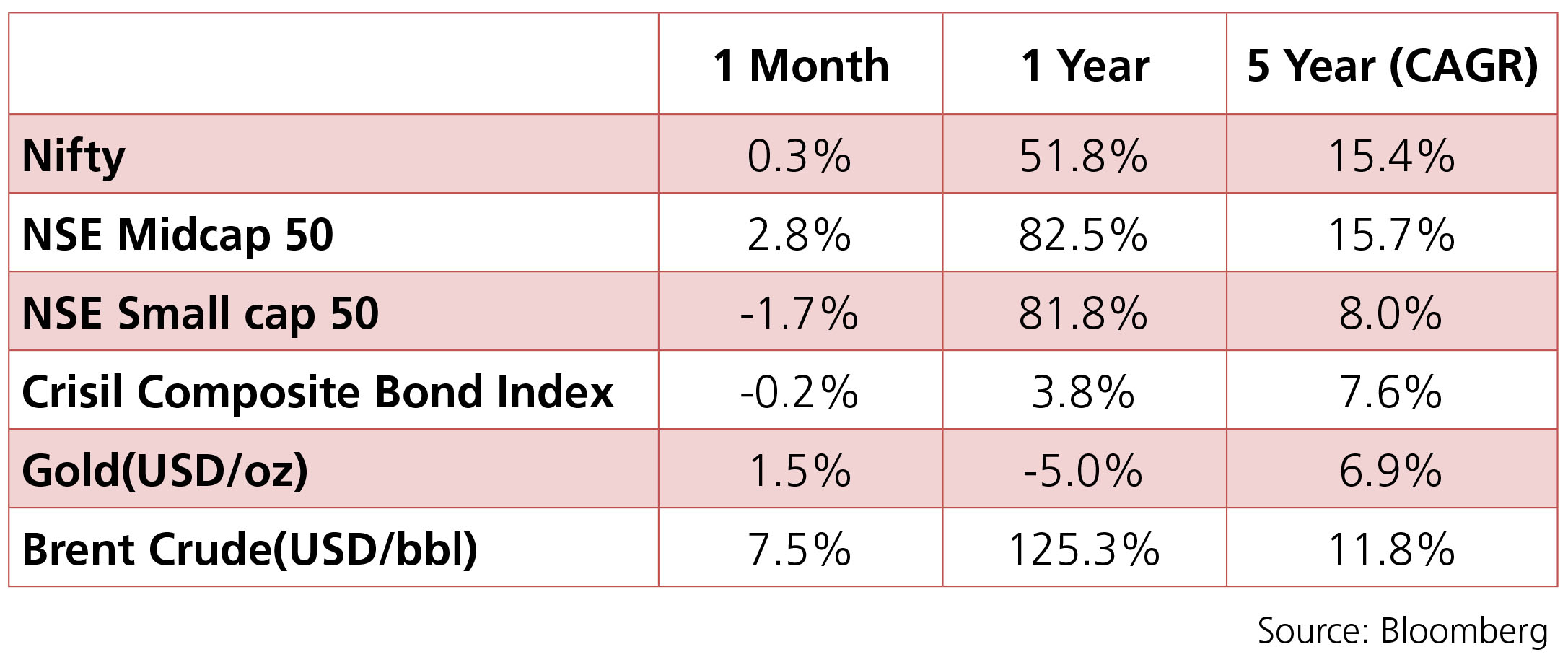

The Nifty index was up 0.3% for the month of October. Autos and Utilities have been the frontrunner

sectors while FMCG and Pharma have. been the laggards. The INR has been fairly stable averaging

around 75.00 with a monthly best and worst of 74.10 and 75.50 respectvely. Yields have been on an

upward trajectory with the 10y benchmark trading in a range of 6.23%-6.43% and eventually ending

the month 17bps higher m-o-m at 6.39%. The 10y benchmark averaged 6.33% over the month of

October.

The RBI MPC meeting was a major event for the month. Even though the market was not anticipating a rate action at this meeting, but there were some differing opinions on the path to liquidity normalization. Most of the opinions, however, incorporated some degree of tapering in the G-SAP calendar for Q3FY22. The RBI surprised one and all by winding down Government Securities Acquisition Programme (G-SAP) completely but at the same time reiterating that it stands ready to act as and when required. The RBI also announced augmentation of its Variable Rate Reverse Repo (VRRR) programme in a phased manner from INR 4tn to INR 6tn over the next two months. It was also mentioned that it may consider 28-day VRRR auctions to complent the 14-day VRRR auctions if required. Thus, the focus of this meeting, as can be inferred, was clearly on liquidity normalization.

The FOMC Minutes released this month of the September FOMC Meeting indicate that the commencement of tapering is virtually a certainty. The Fed would reduce the current USD 120bn per month pace of asset purchases by USD 15bn per month – USD 10bn for Treasuries and USD 5bn for MBS. However, the timing of the commencement of tapering is still an uncertainty that will most likely be addressed in the upcming FOMC Meeting in November. Market expetctaions are for tapering to commence in either mid-November or mid-December. That would be in line with Fed Chair Jerome Powell’s comments that Fed officials favor ending asset purchases by around mid-2022.

In commodities, brent crude averaged USD 83.6/bbl as energy prices continued to rise over the month. Brent crude was up 7.5% on a m-o-m basis. Gold edged higher by 1.5% over the month with not much appetite for safe haven assets.

The RBI MPC meeting was a major event for the month. Even though the market was not anticipating a rate action at this meeting, but there were some differing opinions on the path to liquidity normalization. Most of the opinions, however, incorporated some degree of tapering in the G-SAP calendar for Q3FY22. The RBI surprised one and all by winding down Government Securities Acquisition Programme (G-SAP) completely but at the same time reiterating that it stands ready to act as and when required. The RBI also announced augmentation of its Variable Rate Reverse Repo (VRRR) programme in a phased manner from INR 4tn to INR 6tn over the next two months. It was also mentioned that it may consider 28-day VRRR auctions to complent the 14-day VRRR auctions if required. Thus, the focus of this meeting, as can be inferred, was clearly on liquidity normalization.

The FOMC Minutes released this month of the September FOMC Meeting indicate that the commencement of tapering is virtually a certainty. The Fed would reduce the current USD 120bn per month pace of asset purchases by USD 15bn per month – USD 10bn for Treasuries and USD 5bn for MBS. However, the timing of the commencement of tapering is still an uncertainty that will most likely be addressed in the upcming FOMC Meeting in November. Market expetctaions are for tapering to commence in either mid-November or mid-December. That would be in line with Fed Chair Jerome Powell’s comments that Fed officials favor ending asset purchases by around mid-2022.

In commodities, brent crude averaged USD 83.6/bbl as energy prices continued to rise over the month. Brent crude was up 7.5% on a m-o-m basis. Gold edged higher by 1.5% over the month with not much appetite for safe haven assets.

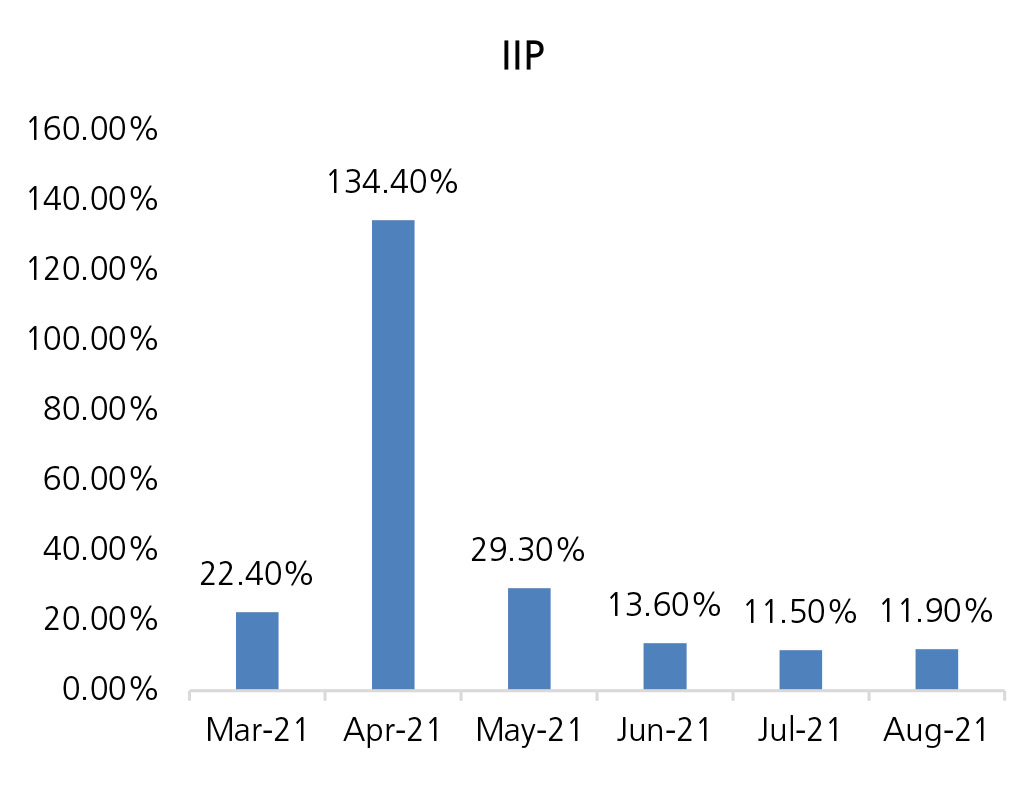

IIP: IIP was up 11.9% YoY in August as against 11.5% YoY in July. The marginal uptick was on

account of strong growth in all major components, led by a low base: manufacturing activity (IIP

weightage: 78%) grew 9.7% YoY, mining activity (IIP weightage: 14.4%) grew 23.6% YoY, and

power generation grew 16% YoY in August. All three were led by very low bases of -7.6%, -8.7%,

and -1.8% YoY, respectively, in August 2020. According to the use-based classification, only primary

and consumer goods grew 17% and 6.3% YoY respectively in August from 12.4% and 5.6% YoY

respectively in July. On the other hand, production of capital goods and intermediate goods, and

infrastructure/construction activity grew slower in August as compared to July.

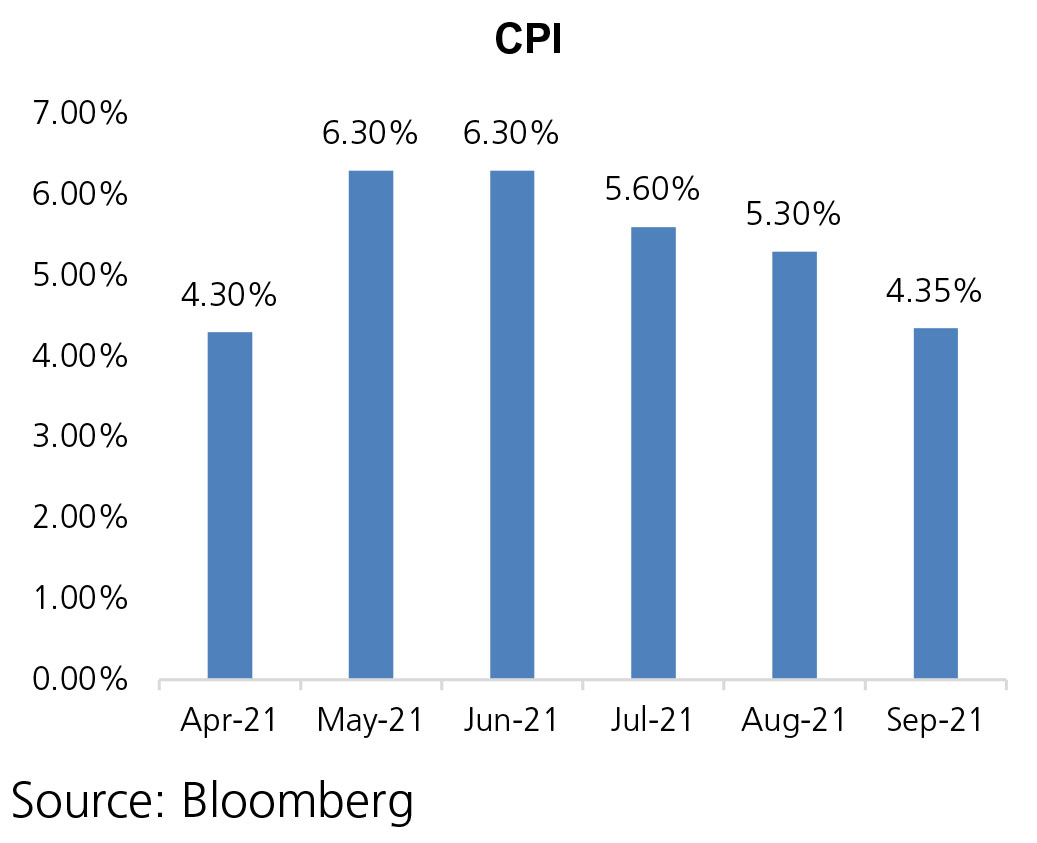

CPI: CPI-based retail inflation came in at a five-month low of 4.35% YoY in September as against 5.3% YoY in August. With this, CPI inflation in Q2FY22 stood at 5.1% YoY v/s 5.6% YoY in Q1FY22. Food inflation (CPI weightage: 39.1%) came in at a 30-month low of 0.7% YoY in September as compared to 3.1% YoY in August. Vegetables, one of the most seasonal food items, exhibited a deep deflation of 22.5%. CPI, excluding vegetables, came in higher at 6.7% YoY in September as compared to 6.6% YoY in August. Inflation in core items stood at 5.8% YoY in September from 5.9% YoY in August. Within miscellaneous items, all items except ‘recreation and amusements’ and ‘personal care and effects’ exhibited lower inflation in September as compared to August.

Trade Deficit: Trade deficit in September increased sharply to USD 22.9bn (August: USD 13.8 bn) and USD 78.4bn in H1FY22 (USD 25.9bn in H1FY21 and USD 88.9bn in H1FY20). Exports in September increased 21.3% to USD 33.4bn, growing sequentially by 0.5% (July: USD 33.3 bn). Non-oil exports at USD 28.5bn increased 18.7% but declined by 0.2% sequentially. Imports in August rose sharply by 84.7% to USD 56.3bn while increasing sequentially by 19.7% (July: USD 46.4bn). Non-oil imports grew 57.8% to USD 38.9bn (9.9% sequentially). The sharp rise in imports was due to oil imports at USD 17.4bn (50% sequentially) and electronics imports at USD 6.9bn (16.4% sequentially).

Fiscal Deficit: The fiscal deficit stood at 35% of the Budget Estimates, as compared to 114.8% in the same period last year. In absolute terms, the fiscal deficit was at Rs 5,26,851 crore at the end of September. The main contributors to the lower fiscal deficit were higher net tax revenues at 60% of BE vs 28% in the corresponding period previous year and non-tax revenues at 66% vs 24% in the same period last year. At the same time, total expenditure was marginally lower at 46.7% for the period vs 47.8% in the same period last year.

CPI: CPI-based retail inflation came in at a five-month low of 4.35% YoY in September as against 5.3% YoY in August. With this, CPI inflation in Q2FY22 stood at 5.1% YoY v/s 5.6% YoY in Q1FY22. Food inflation (CPI weightage: 39.1%) came in at a 30-month low of 0.7% YoY in September as compared to 3.1% YoY in August. Vegetables, one of the most seasonal food items, exhibited a deep deflation of 22.5%. CPI, excluding vegetables, came in higher at 6.7% YoY in September as compared to 6.6% YoY in August. Inflation in core items stood at 5.8% YoY in September from 5.9% YoY in August. Within miscellaneous items, all items except ‘recreation and amusements’ and ‘personal care and effects’ exhibited lower inflation in September as compared to August.

Trade Deficit: Trade deficit in September increased sharply to USD 22.9bn (August: USD 13.8 bn) and USD 78.4bn in H1FY22 (USD 25.9bn in H1FY21 and USD 88.9bn in H1FY20). Exports in September increased 21.3% to USD 33.4bn, growing sequentially by 0.5% (July: USD 33.3 bn). Non-oil exports at USD 28.5bn increased 18.7% but declined by 0.2% sequentially. Imports in August rose sharply by 84.7% to USD 56.3bn while increasing sequentially by 19.7% (July: USD 46.4bn). Non-oil imports grew 57.8% to USD 38.9bn (9.9% sequentially). The sharp rise in imports was due to oil imports at USD 17.4bn (50% sequentially) and electronics imports at USD 6.9bn (16.4% sequentially).

Fiscal Deficit: The fiscal deficit stood at 35% of the Budget Estimates, as compared to 114.8% in the same period last year. In absolute terms, the fiscal deficit was at Rs 5,26,851 crore at the end of September. The main contributors to the lower fiscal deficit were higher net tax revenues at 60% of BE vs 28% in the corresponding period previous year and non-tax revenues at 66% vs 24% in the same period last year. At the same time, total expenditure was marginally lower at 46.7% for the period vs 47.8% in the same period last year.

Deal flow moderated further in October with just 6 deals worth USD 1.4bn executed (vs

16 deals worth USD 2.2bn in September). Key deals included Aditya Birla AMC’s IPO (USD

370mn) and Axa’s stake sale in ICICI Lombard (USD 360mn).

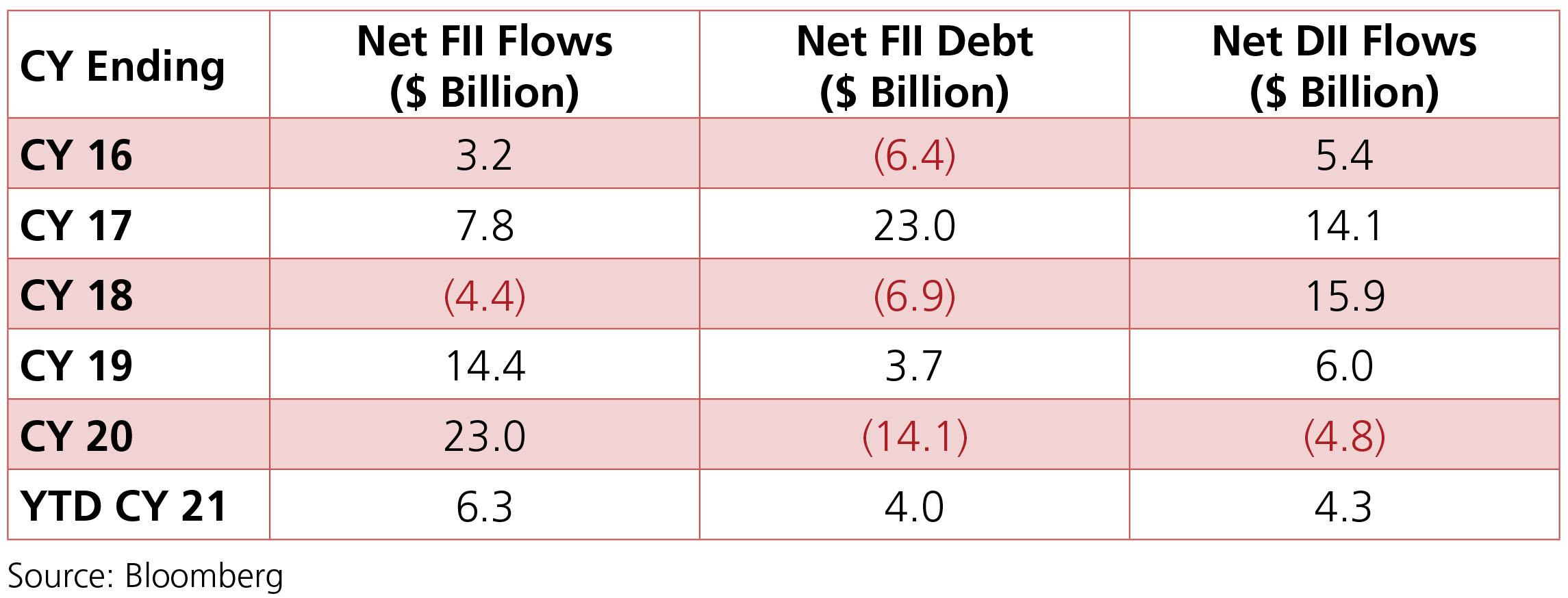

FIIs turned net sellers to the tune of –USD 2.2bn in October (YTD +USD 6.3bn), bulk of it being back-ended (sold USD 2.7bn on last 8 days) while DII buying was at +USD 0.6bn (YTD +USD 4.3bn) driven by both MFs (+USD 0.2bn) and insurance companies (+USD 0.4bn).

FIIs turned net sellers to the tune of –USD 2.2bn in October (YTD +USD 6.3bn), bulk of it being back-ended (sold USD 2.7bn on last 8 days) while DII buying was at +USD 0.6bn (YTD +USD 4.3bn) driven by both MFs (+USD 0.2bn) and insurance companies (+USD 0.4bn).